Calling Graduate Students Of The 1980’s…

I found this Bloomberg article about the exhaustion of pandemic-benefits-related savings of interest and the coming consumption crash of interest.

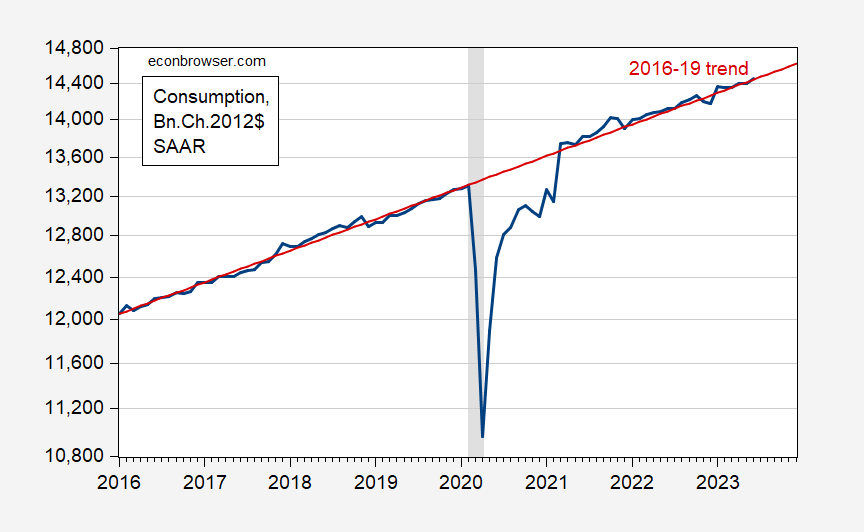

First, it fits into a general commentary regarding American consumer’s behavior. See Jan Groen‘s recent assessment of excess savings. The return of consumption to pre-pandemic trend was enabled by transfers, in this interpretation.

Figure 1: Total consumption, in bn.Ch.2012$ SAAR (blue), and 2016-19 deterministic trend line (red). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

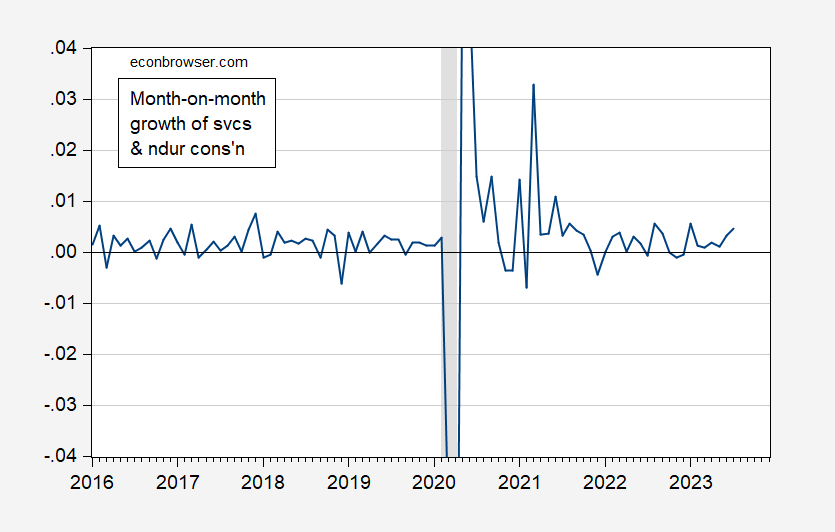

Second, the idea that excess savings would be decumulated within a few years is at variance with the consumption follows a random walk thesis. Remember, risk neutral (or at least certainty equivalence) consumers unencumbered by liquidity constraints should spend only a fraction of a temporary windfall. Consumption flow (different from consumption expenditures) should then follow roughly a random walk. Here’s the first log differences of the sum of services and nondurables consumption expenditure.

Figure 2: First difference of log of sum of services and nondurables consumption, in bn.Ch.2012$ SAAR (blue). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Of course, services consumption was impeded by the pandemic, and the shift to tradables understandable; and changes in interest rates should affect consumption growth too (although usually measured changes are too small).

What is interesting is that consumption doesn’t seem to be a random walk in recent months.

Technically, one can’t reject first differences over the last two years are white noise, although 24 observations means that it’s a pretty low powered test.

In any case, exhaustion of “excess savings” is inconsistent with this simple model.

My preferred explanation is rule-of-thumb consumers (a la Mankiw-Romer). The presence of liquidity-constrained consumers is also a possible explanation. However, liquidity constraints do not explain why the excess savings are being spent down (as liquidity constrained agents should be able to save).

In any case, we seem to be away from the Euler equation/consumption follows a random walk model we learned in 1980’s grad school…

As an aside, if we think consumption follows a random walk is true, the recent rise in consumption suggests that agents have revised upwards their views of future income…

More By This Author:

How Much Have (Ex Ante) Real Rates Risen?Recession Probabilities (Using Data Through End-2022)

The Recession Of 2022H1 – Rec Vehicles, But No Spam