What Underlies The Pessimism Regarding The Outlook In Canada

Image Source: Pexels

It is little wonder that the Liberal government’s fortune languishes with each new political poll. All that is needed to understand this decline is an appreciation of the changing attitudes regarding the short-term outlook for the economy. Quarterly, the Bank of Canada publishes surveys probing how businesses and consumer attitudes shift over time to help guide interest rate decisions. The most recent report for the second quarter of 2024 reveals an over weakness from both sectors that, unmistakably, reveal that Canadians simply are not optimistic about any aspect of the economy.

Take the results from the business surveys to wit:

- Businesses relying mostly on discretionary consumer spending report very weak sales expectations; it is discretionary spending that gives an uplift to overall economic growth;

- The majority of firms cite high interest rates, the high of cost of new machinery and equipment as a major impediment to business expansion;

- On the positive side, firms, by and large, see inflation declining in the next 12 months; but that is not sufficient to turn their attention to boost investment;

- Across all sectors, respondents cited that labour shortages had lessened considerably due to weakening sales and the increase in supply related to immigration.

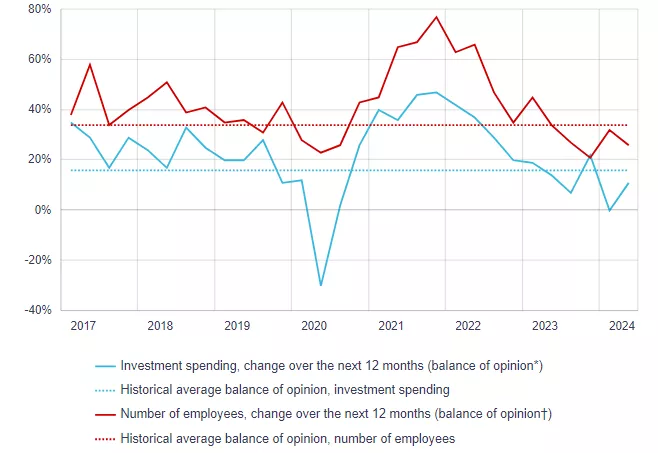

The accompanying chart indicates that the balance of businesses expects investment spending and new hiring to fall well below historical averages.

Weak Demand Holding BusinessInvestment and Hiring

Turning to the consumer, the Bank’s survey of consumer expectations holds the key to what greatly influences business investment decisions. Overall, consumers point to

- Domestic factors cause the high rate of inflation; no longer can the argument be made that overseas supply constraints are pushing up prices;

- High interest rates and high inflation are stressing consumers, leading to spending cuts;

- Private sector jobs are scarce, while public sector employment continues to grow;

- Majority of respondents remain under stress and await further interest rate cuts to ease consumer debt payments

Consumers and businesses cite identical factors giving rise to an overall malaise. The Bank of Canada cannot afford to focus just on whether inflation is trending sufficiently towards its 2% target. There is a lot more at stake than hitting an arbitrary inflation number. Business expansion, job creation, and overall economic growth need to be the focus. It remains to be seen whether the Bank of Canada will pivot in that direction.

More By This Author:

The Bank Of Canada Is Now Behind The Curve As The Unemployment Rate Rises

The Nexus Between Immigration Flows And Employment Growth In Canada

Canada Now Needs to Develop Pro-Growth Policies