Canada Now Needs To Develop Pro-Growth Policies

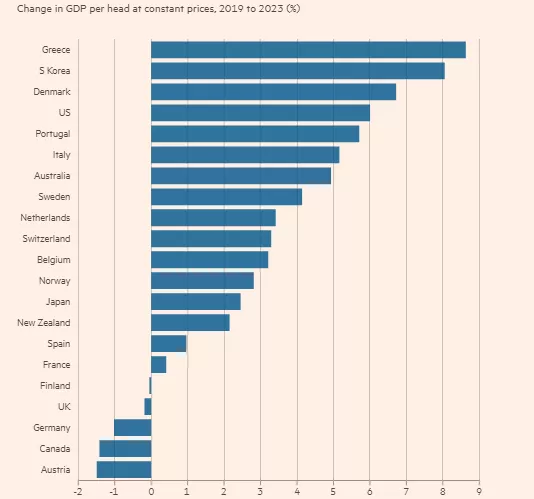

Now that the Bank of Canada has started to unwind its restrictive monetary policy, it has to begin to focus on how monetary policy can best promote economic growth. The struggle to bring down inflation in pursuit of an arbitrary 2% target should no longer be the focus of monetary policy. Canada’s growth performance, as measured by GDP per head, has been running at a negative pace for the period of 2019-2023. More importantly, its GDP per head is now the lowest of the major industrialized nations. IMF figures reveal that Canada’s GDP per head has declined by 1.4% during the past four years. By comparison, the US grew by 6%, Sweden by 4%, and Australia by 5%.

To be fair, Canada has had the highest population growth rate of any of these nations. In 2023 over 97% of Canada’s population growth came from international migration, resulting in an overall increase of 3.2% last year. However, at the same time, Canada’s growth performance was spotty and never really equalled, or let alone, surpass the growth in population. The only indication that the economy was expanding derived from absorbing more immigrants, and even that amount of growth was insufficient to keep Canadians from slipping further behind.

Source: Statistics Canada

What lies at the base of Canada’s stagnation is a huge topic in itself and one that elicits considerable debate amongst economists. Unmistakably, Canadian productivity growth has been faltering for several years. The factors that go into generating higher levels of output per worker involve education, technological adaptation, and deepening of capital investment in both private and public sectors. Business investment has been weak for more than a decade. In survey after survey, the business community cites a variety of reasons that retard private capital formation.

Here, the Bank of Canada has a vital role to play by ensuring that monetary policy is no longer restrictive. Following a path of steadily cutting its policy rate would do a tremendous amount of good in encouraging private investment in residential and non-residential activities. Right now, the Canadian banks are holding down credit expansion in response to a rising level of loan losses provisions. Credit restrictions, either by high interest rates or by the availability of funds, continues to hold back economic performance. The Bank of Canada must not go slowly in cutting rates.

More By This Author:

The Bank Of Canada Is First Of The Gate In Lowering Its Policy RateCanadian Banks Put Aside More For Loan Losses As The Economy Continues To Deteriorate

Canada’s Trade Performance Is A Drag On The Economy