Businesses Are Warning The Bank Of Canada That Stagnation Is Just Beginning

Image Source: Pexels

The Bank of Canada relies heavily on what the business community expects in the near term to judge the success of its rate policy. The optimism of 2022 has given way to a significant degree of pessimism. The source of this pessimism should feed directly into Bank rate decisions going forward. The business survey captures the outlook for capital investment, growth in sales, and inflation. Canadian corporations are anticipating economic weakness in the coming 12-month period that will test the wisdom of the Bank rate policy. The question remains what should the Bank’s policy be in such an unfavourable environment?

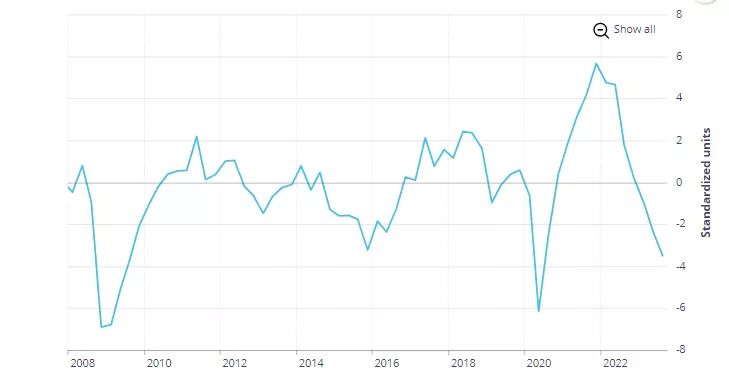

Overall, the business indicator is unmistakably heading south. The recovery from the hit to the economy during the pandemic has now dissipated. In fact, the negative reading is barely above that experienced during the pandemic shutdown of 2020-21. The survey reveals the decline in business is across all regions and in most industrial sectors. Capacity constraints and labour shortages have eased considerably over the past 12 months. No longer can firms claim that sales are withheld because of supply constraints; that excuse cannot be an explanation away declining sales.

Business Outlook Indicator

(Click on image to enlarge)

Source: Bank of Canada

One-third of the firms expect a full-blown recession in the coming 12 months. Firms believe that recent rate hikes have yet to be fully felt by businesses and consumers. Knowing that interest rate changes have long and variable lags, it is entirely plausible to anticipate that we are not finished with adjusting to a new rate environment. Making the Bank of Canada’s life more difficult is that the corporate sector expects price increases to remain above the 2% target through to 2025. Granted, inflation has moderated considerably, firms continue to deal with cost pressures that will ultimately be passed onto consumers. Related surveys of consumers reveal that nearly 40% feel they are worse off than a year ago. An equal number of homeowners are concerned that mortgage payments are close to the maximum they can tolerate. In somewhat of an inconsistency, though, more than half of the firms expect to hire more workers in the coming years; why they are needed when sales are falling doesn’t square with a weakening economy.

So, where does this leave the Bank of Canada in this current rate cycle? The survey results clearly point to stagnation, something that the Bank needs to take very seriously into account before it decides to squeeze the economy further with subsequent rate increases.

More By This Author:

Time To Assess The Damage From Rate Hikes

If Global Monetary Tightening Is Over, What Lies Ahead?

An Old-Fashion Credit Crunch Is In The Making As Money Supply Contracts