The Nexus Between Immigration Flows And Employment Growth In Canada

Image Source: Pexels

Canada has had a long successful history in welcoming immigrants to build our economy. Often, we hear politicians referring to the country as a nation of immigration. And, this has been true for all of the post-WWII years. In very recent years, however, employment growth has failed to match the immigration growth, let alone exceed it so our standard of living continues to improve. In fact, per capita GDP has declined slightly over the past half-decade, largely because we have not generated sufficient economic output to absorb the growth in total population--- domestic plus immigration. At the same time, the Federal government is targeting the highest level of annual immigration in our history. A further twist concerns the issue of whether the country can provide sufficient housing, health, and educational services to satisfy the requirements of new immigrants.

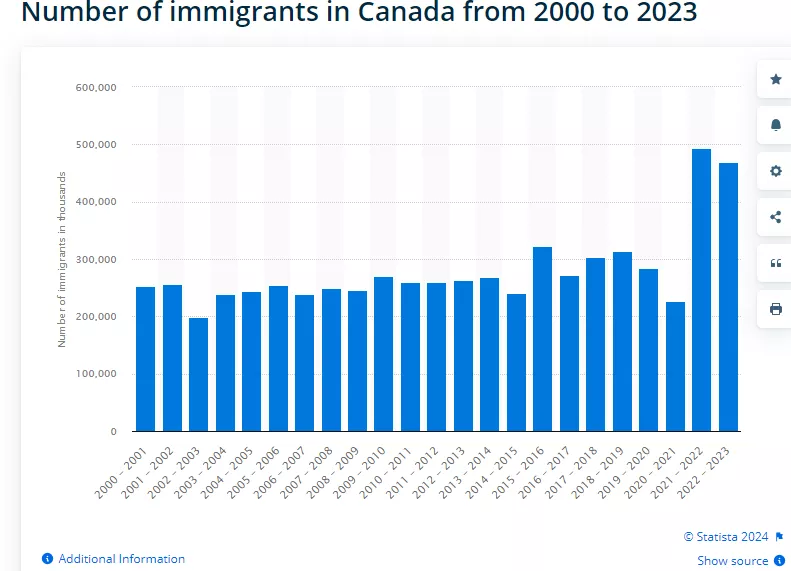

Let’s look at the immigration flows first. The accompanying chart makes a very clear statement. For the first 20 years of this century, Canadian immigration numbers averaged less than 300,000 annually, and became rather predictable for governments at all levels to plan for social services (e.g. health care, education) and necessary infrastructure (e.g. transportation). The COVID-19 pandemic hit in full force in 2020-21 and immigration levels fell off, but not so dramatically as one would have thought given the huge disruptions in all aspects of economic life. Post-COVID, immigration levels shot up dramatically reaching nearly 500,000 in 2022 and slightly less in 2023. Forecasts for 2024 anticipate immigration to reach 485,000 and 500,000 in 2025.

Clearly, there has been a departure in immigration from the average of the past two decades by a sizable degree. More than 1/3 of all newcomers settle in the Greater Toronto Area and this has added considerable stress to the housing industry to supply new housing units as fast as the immigrants arrive.

Explanations for the shift in immigration policy have not been adequately forthcoming to the wider public and are often buried within bureaucratic documentation. Be that as it may, the surge in immigration is now getting more attention than ever in light of the issues of housing, education, and health services arising out of this rapid influx.

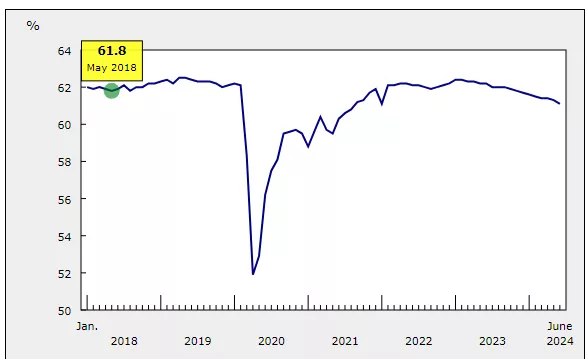

Let's turn our attention to the growth in employment during the past half-decade in relation to the immigration flows. Pre-COVID, nearly 62% of the working-age population was employed. The post-recovery period still does not return the employment levels to those experienced in 2018. Economists continue to study the longer-term effects of the pandemic on the nature of work and how both young and older workers have changed their respective attitudes to the job market. We still do not understand all the changes that are taking place.

Nonetheless, the percentage of individuals of working age (15-64 age) who are gainfully employed remains below the level experienced in 2018.

The latest employment numbers for June 2024 reveal a continuation of this nexus between immigration and employment. Nationally, employment did not grow in June. Yet the population expanded by 100,000. The result is that the unemployment rate increased to 6.4%, one of the highest in the industrial world.

While the Bank of Canada focuses on the inflation rate, they are missing out on the more important consideration, namely, the weakness in economic growth. A nation whose population is growing rapidly must generate economic growth to forestall a decline in living standards. Stalling employment growth at a time of rising immigration levels contributes to greater stresses in the provision of all types of public services. No doubt as we approach closer to an election, and possible political change, in Canada, we need to have a national debate on the impact of immigration in relation to economic growth.

More By This Author:

Canada Now Needs to Develop Pro-Growth Policies

The Bank Of Canada Is First Of The Gate In Lowering Its Policy Rate

Canadian Banks Put Aside More For Loan Losses As The Economy Continues To Deteriorate