The Bank Of Canada Is Now Behind The Curve As The Unemployment Rate Rises

Image Source: Pexels

Unlike the Federal Reserve, the Bank of Canada (BoC) does not have a dual mandate to seek price stability and promote maximum employment. Central to Canada’s monetary policy is the familiar 2% inflation target. Specifically, that target guides all the BoC’s decisions regarding setting its policy interest rate. Unemployment does not play any upfront role in how the BoC adjusts monetary policy, affecting all aspects of the economy. To be fair, the BoC considers job market developments when it looks at the economy’s relative performance to its potential, but that remains a secondary consideration to the inflation target. What does the Bank do when unemployment rises and there is no reduction in the rate of inflation?

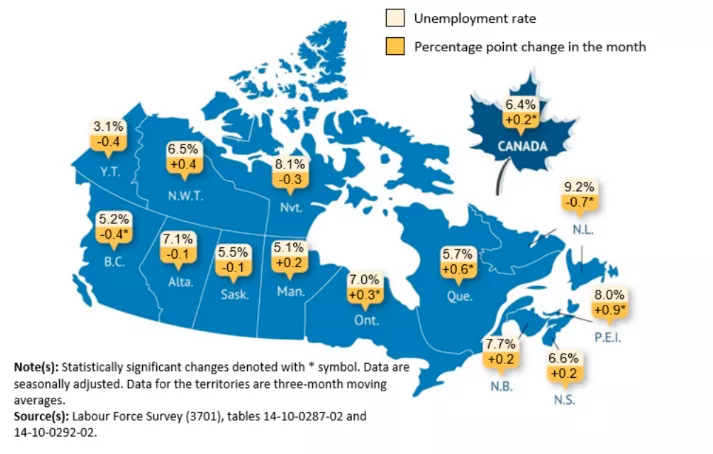

The June employment report in Canada reveals a worrisome picture. Nationally, the overall unemployment hit 6.4%. Of greater concern is that Ontario, the largest province, the rate is 7%; Alberta, 7.1% and eastern Canada, averaging over 7.5%. In other words, no broad areas of the country are spared the rise in unemployment. Canada’s national unemployment rate has risen 1.3 percentage points since April of last year.

Over the same period, the CPI barely moved from 2.9% to 2.7% annually. The inflation target of 2% remains elusive, while the unemployment remains unacceptably high.

The job market has failed to keep up with Canada’s rather explosive population growth for the past few years. Consequently, in June alone, there was no net increase in jobs, despite the population surging by 100,000. Labour economists note that Canada’s workforce is steadily losing jobs in the high-wage industries, such as manufacturing and skilled office workers. Welcoming as is it that the low-wage sectors, such as food and hospitality are expanding, the overall impact this wage sector shift reduces the nation’s economic growth rate. As a consequence, per capita GDP has turned negative and is at the bottom of the ranking amongst the industrial nations.

Clearly, the BoC can no longer argue that labour markets remain tight and, as a result, wage pressures will continue to keep inflation above its target rate. Jobs growth needs to be moved up the rank of policy considerations, even above hitting the inflation target in the short term. When the BoC meets on July 24 to assess its policy stance, it is long overdue to adopt a more aggressive posture of rate cuts to help the job market recover.

More By This Author:

The Nexus Between Immigration Flows And Employment Growth In Canada

Canada Now Needs to Develop Pro-Growth Policies

The Bank Of Canada Is First Of The Gate In Lowering Its Policy Rate