Tuesday Talk: War, What Is It Good For? The Stock Market

It's true war is good for absolutely nothing, but yesterday the stock market closed in the green with top gainers all from the defense industry or oil industry. Amidst concerns that the war in the Middle East may widen and the sending of a U.S. carrier group to the immediate region of the conflict, as well as the need to increase supply of equipment and munitions to Israel, companies like Lockheed-Martin and General Dynamics registered strong grains.

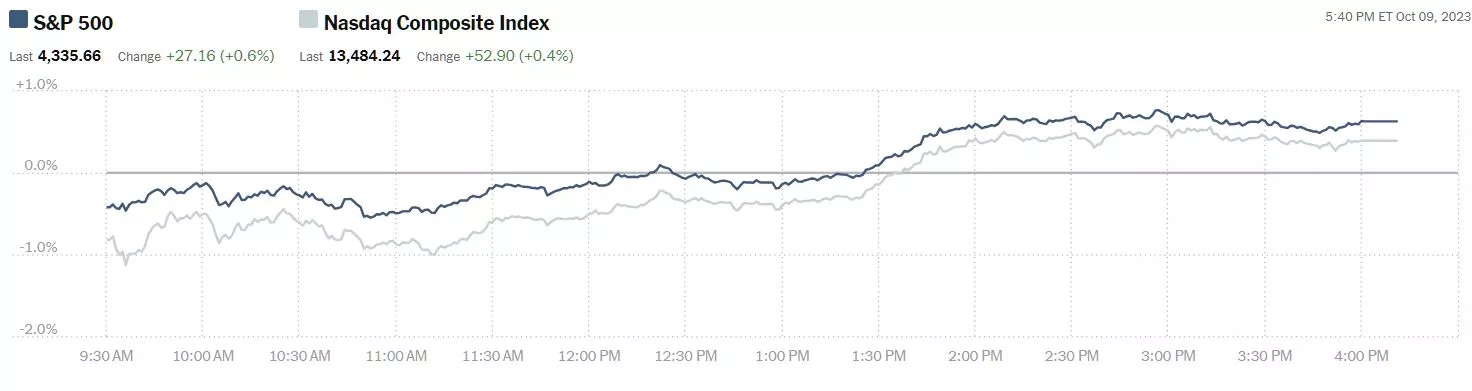

Yesterday, the bond market was closed for Indigenous Peoples’ Day (Columbus Day), but the stock market was open. The S&P 500 closed at 4,336, up 27 points, the Dow closed at 33,605, up 197 points, and the Nasdaq Composite closed at 13,484, up 53 points.

Chart: The New York Times

Top gainers on the day were led by Northrop Grumman (NOC), up 11.4%, followed by L3Harris (LHX), up 10.0%, and Huntington Ingalls (HII), up 9.3%.

Chart: The New York Times

In morning futures trading, S&P 500 market futures are trading up 8 points, Dow market futures are trading up 60 points, and Nasdaq 100 market futures are trading up 30 points.

While there is much global uncertainty weighing on markets, TM contributor Patrick Munnelly in his Daily Market Outlook - Tuesday, Oct. 10, reports that Asian markets had a largely good day on Monday.

"Asian equity markets opened the week on a mostly positive note as markets returned from the long weekend. This positive sentiment was influenced by the recovery seen on Wall Street, partly due to dovish-leaning comments from Federal Reserve officials. The Nikkei 225, returning from the holiday closure, outperformed. It had the chance to react to key market themes, including last week's US jobs data, the Israel-Hamas conflict, and recent Fed rhetoric.

In contrast, the Hang Seng and Shanghai Composite had mixed performances. Hong Kong's market was lifted by strength in the technology and property sectors, while the mainland market lagged. Concerns over holiday spending and lingering debt issues arose after Country Garden announced its inability to meet offshore obligations on time."

Contributors Warren Patterson and Ewa Manthey write in The Commodities Feed: Uncertainty Lingers:

"The oil market managed to hold onto gains yesterday after opening higher following the terrible events that took place in Israel over the weekend. ICE Brent settled 4.22% higher on the day, taking it back above US$88/bbl. It is still very early days and there are multiple ways in which the situation could play out. For now, oil markets are pricing in a risk premium given the uncertainty. If reports of Iran’s involvement turn out to be true, this would provide another boost to prices, as we would expect to see the US enforcing oil sanctions against Iran more strictly/ That would further tighten an already tight market. In addition, it would boost tensions in the region even further.

"The issue for the US government is that they are clearly worried about rising energy prices and one would expect that strictly enforcing these sanctions would provide more support to oil prices. This also comes at a time when there is growing noise around the ineffectiveness of the G-7 oil price cap for Russian oil. Russian oil continues to flow despite trading above the US$60/bbl cap. Russia has managed to largely get around the price cap by using its own fleet of vessels and insurance. However, what will be concerning to the US are reports that some of these flows are still being facilitated by Western services. The US Treasury Secretary, Janet Yellen, has said that the US is looking to enforce the cap more aggressively, however, doing so will not be an easy task.

"European gas prices jumped yesterday with TTF settling almost 15% higher. The gas market likely rallied on the back of developments in the oil market, but there have also been a number of supply risks that have popped up. These include Australian workers at Chevron’s LNG facilities giving notice that they would resume strike action from 19 October, as Chevron and workers have struggled to finalize a labor agreement. The Israeli government has also ordered Chevron to shut down the offshore Tamar gas field following the attacks over the weekend. The field produced 10.25 bcm of gas last year."

TalkMarkets contributor Tim Knight takes note of The Long-Standing Success Of Northrop:

"Designing, manufacturing, and selling for-profit devices that can maim, mutilate, and incinerate people is a long-standing American industry. I personally don’t believe in the classical Hell, but I suppose if there was one, the senior management of all “Defense” companies would be nice candidates.

"In any case, here is a multi-decade chart of Northrop, which had a grand old day and has, quite obviously, been a sensational stock for a very long time.

"What struck me during this War Is Awesome bullgasm was the trendline. This line, which dates back to the 2009 bottom, was tagged to the penny today. Absolutely amazing!

"I’ve been charting for decades, but I never cease to be amazed at the power of these simple support/resistance delineators."

Contributor Mish Schneider asks What We Will Use To Ascertain Market’s Next Moves:

"For consistency, here are the key go-to’s during an uncertain time in the market:

- The next direction of long bonds (TLT)

- The next direction of the small caps and retail sectors (IWM XRT)

- The next direction of commodities, all of them, but particularly the agricultural ones, oil and precious metals (DBA DBC).

There are other relationships to watch like our risk gauges (all still risk on).

And of course, there are stocks that will outperform like what we saw on Monday in defense companies (PLTR).

Overall, though, and to simplify the macro, these top 3 points should help a lot.

The first chart is the monthly charts of small caps and retail.

The 80-month moving average (green line) is a longer-term business cycle or about 6-7 years.

Besides the blip during covid, the Russell 2000 has not broke that 80-month MA since 2010. The SPDR S&P Retail ETF sits right above the 80-month.

To remain bullish, those lines must continue to hold."

TM contributor Tyler Durden reports Israel Orders Chevron To Close Tamar Gas Field As War Rages.

"Focusing on energy markets, Israel ordered the shutdown of the Chevron-operated (CVX) Tamar gas field in the Mediterranean Sea off the coast of Israel for fear Hamas rockets could strike offshore gas installations.

"Chevron Mediterranean Limited was instructed by Israel's Ministry of Energy to shut in production at the Tamar Production Platform," the company said in a statement, first cited by Reuters.

At the moment, NatGas is still flowing to customers in Israel and the region from the Leviathan platform, Chevron told Bloomberg in a statement, adding, "Our top priority is the safety of our personnel, the communities in which we operate, the environment and our facilities."

Tamar is located in Israel's exclusive economic zone, about 50 miles west of Haifa in waters. It produces about 7.1 million to 8.5 million cubic meters a day NatGas."

Closing out the column today, TalkMarkets contributor Bob Lang writes The 2023 Stock Market Is Not Higher:

"(2023) Economic data has been mixed. The job market is weakening but still quite strong. Prices are coming down, but not fast enough (and in some cases going up). And then there’s the 2023 stock market, which is not actually higher...

"A handful of stocks are having a great year. The FANG names, Tesla TSLA, Microsoft MSFT, and Nvidia NVDA are sporting huge gains. But everyone else is gasping for air. These mega-cap stocks are the reason that the Nasdaq 100 is showing a YTD gain of 33% and the S&P 500 is enjoying double digit returns. Both indices are skewed, because they are cap-weighted indices. As a result, the biggest names by market cap have the biggest influence.

"If you look at equal-weighted performance, the 2023 stock market is telling a much different story than the headlines.

"In an equal-weighted index, a name like Apple AAPL (with a massive market cap) has the same vote as the much smaller cap AirBnB ABNB. This method is ideal as it tells us how the overall market is doing.

"The RSP, or the equal-weighted S&P 500, is down about 2% on the year. The Russell 2K, which gives equal weight to a large sampling of small cap stocks, is also down 2% on the year. The Dow Industrials Index, which is a price-weighted index, is roughly flat in 2023.

"The only index showing a strong return on an equal-weighted basis is the Nasdaq. It is actually up 15%, not the 33% that is heralded in the financial media...

"Equal-weighted indices are a better representation of performance relative to what is happening in the economy and across various sectors. They also help us understand if the economy is doing well across groups or concentrated in a few areas...The 2023 stock market is mostly down – but there is time to recover. Watch the equal-weighted indices for clues as to what’s really happening."

Peace.

![]()

More By This Author:

Thoughts For Thursday: Market Pops Back, But Oil Stocks Head Down

Tuesday Talk: Shut-down Averted But Showdowns Loom!