Thoughts For Thursday: Market Pops Back, But Oil Stocks Head Down

Yesterday the stock marked snapped back from Tuesday's tumble, but that does not mean it will be sustained today. As oil prices retreated, sector stocks did as well.

Wednesday the S&P 500 closed at 4,264 up 34 points, the Dow closed at 33,130 up 127 points and the Nasdaq Composite closed at 13,236, up 177 points.

Chart: The New York Times

Top losers for the day were all Oil sector related. Leading the pack was Devon Energy (DVN), down 5.2%, followed by Marathon Oil (MRO), down 5% and Schlumberger (SLB), down 4.7%.

Chart: The New York Times

In morning futures action, S&P 500 market futures are trading down 20 points, Dow market futures are trading down 144 points and Nasdaq 100 market futures are trading down 66 points.

In an "In The Spotlight" column entitled Yield Relief, TalkMarkets contributor Stephen Innes highlights some of the moves behind yesterday's upwards movement in the market.

"US stocks rebounded on Wednesday as the recent sell-off in Treasuries, which had driven yields to multiyear highs, temporarily abated.

The yield on the 10-year Treasury note declined by 0.07 to 4.73 percent during the day after reaching a recent peak of 4.88 percent.

The proximate causes appear to be a wickedly timely 5 % slide in oil prices complimented by the below-expectations ISM non-manufacturing survey and ADP employment estimate underscoring a well-defined post-pandemic trend: good news is bad news (and vice versa), as markets navigate the remainder of the year and contemplate the Fed's path from here...

The modern-day history book says that when yields move lower, it is generally bullish for mega-cap tech Stocks. So, it is no surprise to see shares of major tech companies, known as the "Magnificent Seven," all posting gains.

But seriously, given all the market uncertainty, is it unsurprising to see this level of stock market resilience and its ability to bounce at the index level?...

Demand destruction always plays a crucial role in eventually easing price pressures.

Oil futures extended their losses during the midday on Wednesday in response to a U.S. Energy Information Administration report that revealed a larger-than-expected increase in domestic gasoline inventories during the last week of September, suggesting that demand had dropped to the second-lowest level of the year...

The recent dramatic move higher in benchmark US Treasury yields, particularly in the 10-year Treasury, is indeed a significant macroeconomic event...

One of the specific concerns is the recurring issue of raising the debt limit, which has become contentious and politically charged in recent years...The perception that partisan intransigence and ideological divisions may persist and lead to further political standoffs could contribute to investor unease. These concerns highlight the importance of addressing political gridlock and finding constructive ways to manage fiscal and funding issues to maintain stability in financial markets and the broader economy."

See the full article for additional insights.

Contributor Lallalit Srijandorn writes WTI Holds Below $84.00 After The Biggest Sell-off In A Year, OPEC Leaves Policy Unchanged.

"Western Texas Intermediate (WTI), the US crude oil benchmark, is trading around $83.50 so far on Thursday. WTI trades in negative territory for the third consecutive week and hits the lowest level in two months as investors are concerned about the oil demand outlook...

At the OPEC Joint Ministerial Monitoring Committee (JMMC) online meeting on Wednesday, the group maintained the output policy unchanged. OPEC and its allies reiterated the joint Saudi-Russian vow to continue its voluntary supply cut of at least 1.3M barrels a day from the two nations' daily output through the end of the year...

Apart from this, oil traders turn cautious amid the higher-for-longer US rate narrative. The Federal Reserve is likely to raise interest rates one more time this year. This, in turn, exerts some selling pressure on WTI prices. It's worth noting that higher interest rates raise borrowing costs, which can slow the economy and diminish oil demand."

The new drop in 10 year Treasury yields aside, TM contributor Cullen Roche discusses how investors can still benefit from bond yields in Chart Of The Week: The Bond Market Sweet Spot.

"Yields have been surging in recent weeks as markets price in rising credit risk and the likelihood of the Fed remaining higher for longer. Our view on credit risk hasn’t changed this year – Fed tightening cycles are a risky time to take excessive credit risk as the Fed jacks up rates and forces future debt contracts to roll at higher interest rates...the good news in this story is that the relative risks are highly asymmetric and are now at a point where short-duration instruments look super attractive...

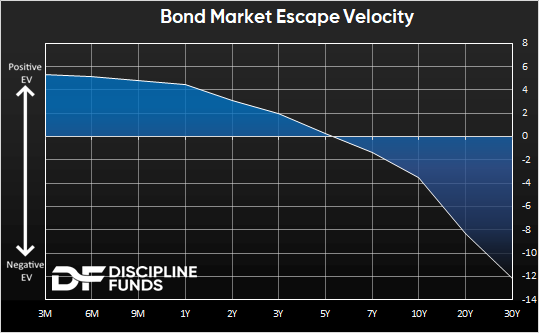

We discussed the concept of “escape velocity” a few weeks back, but without getting wonky it’s basically the point where current coupon payments offset the interest rate risk. So, for instance, if a bond with a duration of 5 also yields 5% then a 1% change in interest rates over a year will have no impact on the price because the yield that accrues over a one-year period will offset the decline in prices. I call it “escape velocity” because the new starting coupon allows the bond to “escape” its interest rate risk.

So where are we now and what is the “sweet spot” for US government bonds? The following chart shows the escape velocities across the US government yield curve. We would argue that the sweet spot at present is anything in that 0-5-year time horizon. That’s the point where you are clipping a high enough coupon that you can sleep well without worrying too much about principal risk. The further out you go the more principal risk you have. The current break-even point is at 5 years and as we go further out the escape velocity looks increasingly unattractive...

As I note in our Defined Duration strategy, the longer maturities can still serve an insurance-like aspect in your portfolio. Specifically, they will hedge your portfolio against deflation and a rapidly declining interest rate scenario. That’s most likely a situation where a recession or credit crisis of some sort is occurring and the Fed is shifting rates lower to combat the slowdown. Alternatively, buying longer-duration bonds could be a smart hedge against the bond market being wrong. In other words, if the Fed gradually reduces rates in the coming years investors who lock in 5% 10-year rates will not only clip a coupon for 10 years but also benefit from the increased principal if the Fed reduces rates over that period. However, that investor is exposing themselves to the short-term risk that inflation remains more entrenched than we think and that rates could go even higher.

It’s a great time to be a short-term saver. And for now, the sweet spot remains on the shorter end of the curve."

Caveat Emptor.

Rounding out the column for today we take a look at three contributors' takes on what is going on in Germany, India and Japan.

TalkMarkets contributor Carsten Brzeski notes German Exports Disappoint In August.

"There is no end to the German macro disappointments. Exports dropped again in August and there's a growing risk that the entire economy has fallen back into recession in the third quarter.

And another German macro morning to forget. German exports disappointed again and dropped by 1.2% month-on-month in August. Even worse, the July drop was revised downwards to -1.9% MoM, from an initial -0.9% MoM. August imports decreased by 0.4%, from -1.3% MoM in July. As a consequence, the trade balance widened to €16.6bn from €16.0bn in July. Don’t forget that this is in nominal terms and not corrected for high inflation.

Like the rest of the German economy, exports remain stuck in the twilight zone between recession and stagnation. Since the start of 2022, net exports have been a drag on the economy in four out of six quarters. Supply chain frictions, a more fragmented global economy and China increasingly being able to produce goods it previously bought from Germany, are all factors weighing on the German export sector...

With the drop in retail sales and today’s disappointing export data, the risk of the German economy of sliding back into recession in the third quarter remains high."

In an extensive article, briefly quoted here, contributor Shivam Kaushik asks Why Is The Reserve Bank Of India’s MPC Likely To Execute A Hawkish Pause This Week?

"The RBI is likely to maintain interest rates as is till the end of the year.

- Inflation has begun to ease in India but remains above the RBI's tolerance band.

- The Indian rupee is under pressure due to hawkish policy across leading central banks.

On October 4, the Reserve Bank of India commenced its six-member Monetary Policy Committee meeting.

The policy rate decision is to be announced on October 6.

Key concerns for the apex body to consider include domestic consumption, struggling urban unemployment, rural distress, retail inflation, global oil prices, the weakness of the rupee, and the hawkish narrative of leading central banks...

In recent months, domestic consumption has witnessed notable strength in urban areas, as well as higher retail lending, record vehicular sales, and robust domestic travel.

In the month of July, retail borrowing increased by nearly 32% YoY and is expected to remain healthy through the end of the year.

Data from the Society of Indian Automobile Manufacturers (SIAM) for August 2023 showed that sales of passenger vehicles reached a new high of nearly 360,000, a 9.4% YoY increase...

Despite these positive developments, downside risks do exist in the broader economy, with a mixed picture emerging particularly due to persistent rural distress and less-than-optimistic consumer surveys...

All-India unemployment witnessed an uptick to above 8% in August 2023, with urban areas being especially hard hit at 10.1%...

In the August CPI release, food inflation remained elevated at 10.4% YoY but is expected to moderate in the months ahead.

In addition, core inflation has begun to ease, falling below the 5% YoY level in August 2023, while encouragingly the Wholesale Price Index (WPI) has stayed in negative territory...

India, which has a high oil import bill could see rising energy costs, as well as a deterioration in the current account deficit which has reached 1.8% of GDP...

Globally, the hawkish narrative among major central banks, such as the Fed and ECB is likely to continue to weigh on emerging markets such as India, weakening domestic currencies and leading to additional portfolio outflows.

On a positive note, Indian government bonds are set to be integrated into JP Morgan’s Global Diversified Index, a benchmark index of emerging markets, from June 2024, which should support rupee demand...

Given the mix of positive and restraining factors on the economy, and the pressure that the rupee is under, the RBI is likely to execute a hawkish pause and maintain the current policy rate at 6.5%, despite inflation being presently above the tolerance band...

In terms of economic growth, the MPC is widely expected to retain full financial year GDP estimates at 6.5%"

Writing about the Japanese economy TalkMarkets contributor John Rubino is concerned about implosion writing Japan Is In That Box.

"People keep talking about the “box” in which profligate countries will someday find themselves, where the tools that used to work no longer do and everything falls apart.

Japan might be in that box. After years of soaring government debt and central bank “financial repression” to make that debt manageable, it now finds itself in the following situation:

The yen is plunging:

|

|

Interest rates are spiking:

|

|

And the Bank of Japan already owns about half of all outstanding government debt:

|

|

...Propping up a weak yen by buying the currency and retiring it while forcing interest rates down by buying bonds with newly-created yen is analogous to inflating and deflating a balloon at the same time. One thing negates the other and antagonizes everyone with a stake in the financial system. Here’s what Japan’s stock market thinks of the BoJ’s recent incoherence:

|

|

Add an equities bear market to the mix and the BoJ faces three simultaneous emerging crises: plunging currency, spiking interest rates, and falling stock prices. Are we about to see a three-pronged attack in which the BoJ simultaneously buys stocks, bonds, and yen with newly-created currency? Very possibly. The result? At least one and maybe all three markets implode, ending the experiment. Stay tuned."

That's a wrap for today.

Have a good one.

More By This Author:

Tuesday Talk: Shut-down Averted But Showdowns Loom!

Tuesday Talk: Up Monday Doesn't Preclude A Repeat Performance On Tuesday