Thoughts For Thursday: War Worries Rattle The Market

Perhaps it was partly credit availability and high rate worries, but more likely the market was jittery because POTUS was spending the day in a relatively dangerous war zone on Wednesday. In any event, it all made for a rather down day.

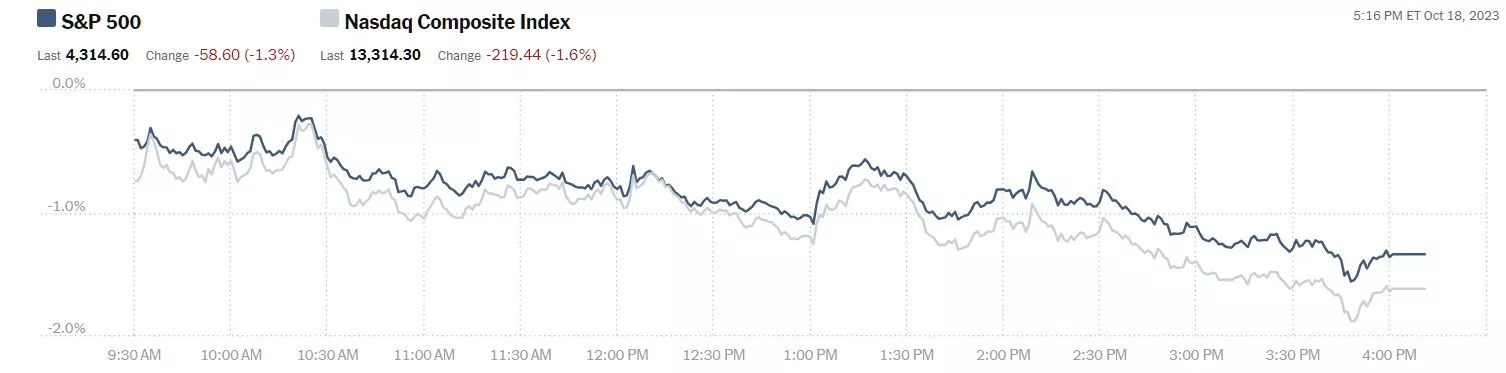

Wednesday the S&P 500 closed at 4,315, down 59 points, the Dow closed at 33,665, down 333 points and the Nasdaq Composite closed at 13,314, down 219 points.

Chart: The New York Times

Most actives were all big blue chips and all were down. Leading the list was Tesla (TSLA), down 4.8%, followed by Bank of America (BAC), down 1.1% and American Airlines (AAL), down 4.9%.

Chart: The New York Times

In morning futures action, S&P 500 market futures are trading down 4 points, Dow market futures are trading down 31 points and Nasdaq 100 market futures are trading up 10 points.

TM contributors Chris Turner, Frantisek Taborsky and Francesco Pesole weigh in on the equities markets while still expecting the dollar to come out on top in FX Daily: Defensive Positions Advised. Here is some of what they have to say:

"Equity markets are looking increasingly vulnerable as the risk-free rate rises and as businesses are finding their margins under pressure. A turn lower in core equity markets would like to keep the activity currencies under pressure and the dollar bid. The Japanese yen and Swiss franc could also win a few more friends.

Dominating global financial markets is the push in US 10-year Treasury yields very close to 5.00%. Arguably, the move could be a delayed reaction to some very strong US retail sales data earlier in the week. We note the incredible re-pricing in the two to three-year sector of the USD swaps curve. Investors now struggle to see 1m USD OIS swaps trading below 4.75% over the cycle.

However, the move in US Treasury yields does not wholly look like a function of a re-pricing of the medium-term Fed cycle. We note the US 10-year Treasury-OIS swap spread moving out to the widest levels in a couple of years near 40bp. This looks to embed some fiscal risk premium into Treasuries – perhaps not a surprise given rating agencies fears over an 'erosion of governance' and the startling developments in the US House of Representatives. Additionally, we note the continuous unwinding of US Treasury holdings by Chinese investors, whose holdings dropped by another $16 billion in August. China's holdings of US Treasuries have dropped by $235 billion since the start of 2022. At some point, there is a risk that the US Treasury yield to dollar correlation briefly flips from positive to negative. We are probably not there yet, however.

We are focusing on equities today not only because they are under pressure globally, but last night's release of the Fed's Beige Book warned:

Sales prices increased at a slower rate than input prices, as businesses struggled to pass along cost pressures because consumers had grown more sensitive to prices. As a result, firms struggled to maintain desired profit margins.

This pressure on profit margins plus the rise in the risk-free rate of 10-year Treasury yields warn that equities will come lower. The S&P 500 rally has recently stalled at an upside gap near 4400 and the index looks primed for a retest of the 4216 low seen at the start of the month.

FX correlations with the S&P 500 suggest the dollar will hold gains in a sell-off, largely at the expense of the commodity and activity currencies. GBP/USD actually has one of the highest positive correlations with the S&P 500. Even though we think the Australian dollar is exceptionally undervalued from a medium-term macro basis, it could prove a high-beta victim to an equity sell-off. Here, we see a cross rate like AUD/JPY coming substantially lower if equities do finally drop.

A risk-off tone should keep DXY bid towards the top of its 106-107 range. In terms of today's calendars, look out for a host of Federal Reserve speakers, with Fed Chair Jay Powell's as the main event at 6:00 pm CET. Also, see how the dollar fares with the release of the weekly jobless claims at 2:30 pm CET, which so far have shown no signs of any lay-offs."

See the full article for other daily currency updates.

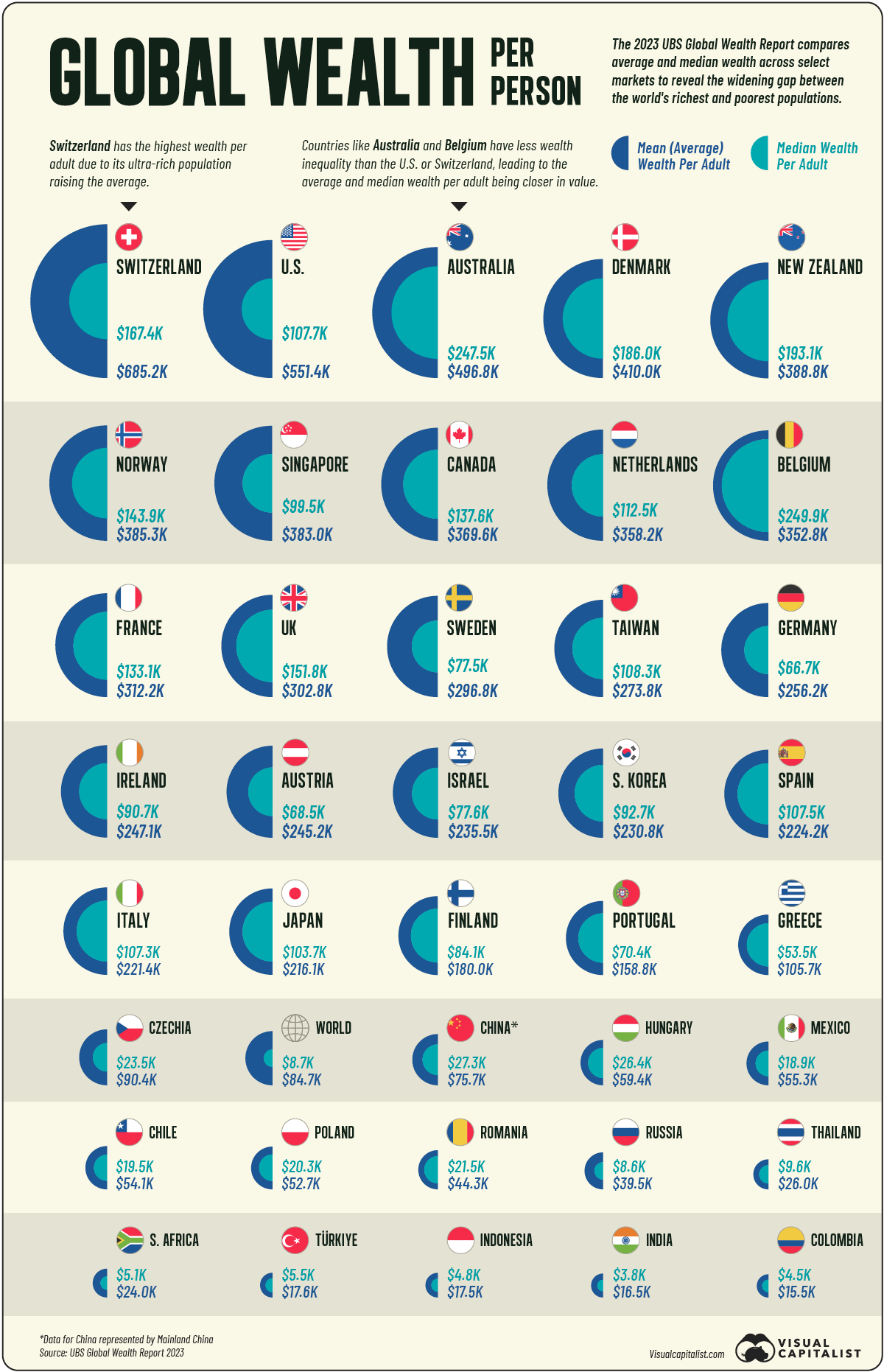

Contributor Tim Knight brings us an update of individual global wealth courtesy of another TalkMarkets contributor Jeff Desjardins in Swiss Don’t Miss.

"This information strikes me as odd, considering that half the people in the U.S. carry a high interest credit card balance, and that 57% of Americans don’t have a spare $1,000 for an emergency. So I really have trouble believing the average wealth per adult is $551,400. Something is seriously faulty with this data."

We have talked about the impact of a credit crunch due to higher interest rates and contributor Michael Kramer writes that it is Too Much To Handle For Stocks As Rates Continue To Rise.

"Stocks finished sharply lower as rates reached new cycle highs on the long end of the curve, and the yield curve steepened. This led to a drop of about 1.3% on the S&P 500, bringing the index down to around 4,315. This retraces about 50% from the rally following the Job report. For now, the index managed to find some support at 4,310, and a gap below that level tomorrow would probably suggest that the double top on the hourly chart has broken, which could lead to a decline back to the lows on October 6 around 4,220, and potentially lower."

"The spread between the 30-year Treasury and 3-month Treasury rose by seven bps to around -51 bps and is approaching what appears to be an important resistance region around -40 bps. A break above that -40 bps could result in a much bigger rise in the inversion, and one would think that it potentially heads back to 0%. I would think that most gains could be from the 30-year rate rising. Unless the Fed starts cutting rates, sending the 3-month sharply lower (which I don’t see happening anytime soon), the only way for the curve to steepen further is by the back of the curve rising to the front...

Biotech (XBI)

It is probably worth pointing out that today’s Biotech sector is almost back to October 2022 lows. This ETF rallied by 51% off the low, has fallen 25% since June, and is almost back where it started a year ago."

"Netflix (NFLX)

Netflix is trading higher by around 12% following what looked like really good results. Net streaming subscribers easily beat expectations, and what was impressive was that free cash flow rose by $1.9 billion in the quarter, much higher than the estimated $1.27 billion. Cash flow from operation was even stronger at nearly $2 billion, which means it hit a new high of $6.1 billion on a trailing twelve-month basis. If the price follows cash flow, the stock could go higher over the longer term.

However, the stock rose sharply for now, right to a big uptrend line, which is where the stock stopped. It seems pretty clear that the resistance level right now is around $390, which could limit the upside. "

See the article for additional charts.

Here's a bit of market insight from contributor Mish Schneider, who writes Market Has Stress Fractures But No Clear Breaks.

"Considering EVERYTHING:

- Yields and mortgage rates

- War

- Inflation and rising commodity prices

- Bank stocks falling

- Risk Gauges 2 out of 6 now risk-off

To name a few, why then is the S&P 500 (SPY) so strong?

Here are a few reasons:

- Fed members suggest rate hike pauses.

- Hope that the war lateralizes rather than escalates.

- Economy stats mixed with retail sales and labor strong.

- Sidelined cash in money markets could move into equities.

- Seasonally, Q4 and pre-election years are historically strong."

Closing us out in the "Where To Invest Department" contributor Lorimer Wilson, in an "In the Spotlight" column notes, US Exchange Listed Israeli Stocks Hit Hard.

"111 Israeli companies trade on U.S. stock exchanges of which only 15 have market capitalization of $2B or more. How have they performed since the Hamas-Israeli War began on October 7th? Let;s find out.

Of those 15 stocks only 3 have advanced and, on average, the 15 are down 4% as of yesterday (7 trading days). The details are as follows:

- SolarEdge Technologies (SEDG): UP 3.0%

- Playtika Holding Corp. (PLTK): UP 2.4%

- CyberArk Software (CYBR): UP 2.2%

- Check Point Software Technologies (CHKP): DOWN 1.1%

- Nice Ltd. (NICE): DOWN 2.6%

- Israel Chemicals (ICL): DOWN 4.7%

- Wix.Com Ltd. (WIX): DOWN 5.2%

- Camtek Ltd. (CAMT): DOWN 6.0%

- Nova Measuring Instruments (NVMI): DOWN 6.2%

- Elbit Systems (ESLT): DOWN 6.5%

- Teva Pharmaceutical Industries (TEVA): DOWN 8.1%

- monday.com Ltd. (MNDY): DOWN 8.8%

- Global-E Online Ltd. (GLBE): DOWN 10.2%

- Tower Semiconductor (TSEM): DOWN 10.3%

- Mobileye Global (MBLY): DOWN 11.8%"

That's a wrap for today.

Peace.

More By This Author:

TalkMarkets Image Library

Thoughts For Thursday: Market Expectation - No Change In Fed Funds Rate

Tuesday Talk: War, What Is It Good For? The Stock Market