The Bank Of Canada’s Anti-Growth Policies Are Coming To Fruition

Photo by Michelle Spollen on Unsplash

When the Bank of Canada embarked on its relentless upward march in setting the bank rate, it took the stance that economic growth was excessive, beyond what the economy could tolerate. The economy had to be slowed down to wrestle inflation to the ground. The Bank focussed on the relatively low unemployment rate and the narrowness of the output gap, i.e., there was no daylight between supply and demand. More likely, according to the Bank, there was a persistent excess of demand over supply that was and continues to be the source of inflation. Furthermore, the Bank’s growth forecasts optimistically called for continued robust growth, something Bank officials felt needed to tamed.

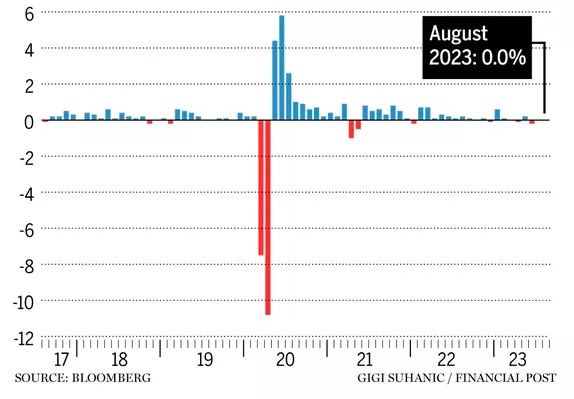

As it turned out, the Bank consistently had to scale back its economic forecasts every time fresh data became available. It simply misread the state of affairs upon which it then was conjured up in its crystal ball. These mistakes are now becoming apparent with today’s preliminary (annualized) estimates for Q3 of -0.1%, following a further contraction in Q2 of -0.2%.

Figure 1 Canadian GDP Growth

As recently as yesterday, the Bank continues to argue that demand and supply are not yet in balance. Among the reasons supporting this claim are higher global energy prices. In addition, the housing market, much to the dismay of the Bank, continues to hold up well, principally because Canada does not build sufficient housing to absorb the growth in population. Domestic interest policies cannot influence world energy prices. Higher mortgage rates only deter the expansion of the housing stock. Yet, the Bank clings to these two big sectors as major culprits in headline inflation. The Bank anticipates that the pressures from higher energy costs and higher domestic shelter costs will keep inflation to about 3.5% through to the middle of 2024.

Meanwhile, while the Canadian economy has (un)officially entered into a recession, the Bank continues to anticipate positive economic growth in 2024 (1%) and in 2025 (2%). Just how we move from the most recent economic decline to positive growth is not spelled out in the Bank statements. After all, the Bank does not even hint that rates will have to come down to stimulate economic activities. Rate cuts seem to be in another universe. Strangely, the Bank continues to threaten that it will be forced to raise its policy rate in the event of an uptick in inflation. Canadians be forewarned.

Consequently, the Bank does not even entertain the possibility that rate cuts are needed in the face of the current weakness. Bankers are a stubborn lot, yet it takes considerable effort to ignore clear signs that, if not a recession, then at least zero growth lies ahead. They anti-growth policy continues.

More By This Author:

Canadian Dollar Weakens As The Economy Slides Into RecessionBusinesses Are Warning The Bank Of Canada That Stagnation Is Just Beginning

Time To Assess The Damage From Rate Hikes