The Bank Of Canada Has Entered The Realm Of Overkill

Central bankers have notoriously gone too far in either direction when it comes to setting interest rates. In the early 1980s, the Volcker Fed was highly criticized for excessive rate hikes that resulted in a surge in the unemployment rate and a major recession. Critics of post-2008 monetary policy argue that zero-bound interest rates set the stage for this recent surge of inflation worldwide. Too much or too little seems to be a dilemma facing all bankers. This ambivalence was clearly stated when the Bank of Canada announced that is set its overnight rate at 5%, yesterday. Governor Macklem admitted that:

“We are trying to balance the risks of under-and-over tightening monetary policy. If we do not do enough now, we will likely have to do even more later. If we do too much, we risk making economic conditions unnecessarily painful for everybody” (Bank Quandary)

In this writer’s view, the Bank chose to “do too much”. Let us look at some underlying conditions that should govern any decision regarding rate policy and how they relate to the recent rate hike.

To begin with, the Bank consistently argues that overall demand is “excessive” and must be curbed. Overall demand includes consumption, business investment and government outlays. While consumption growth continues to hold up, business investment is simply, abysmal. In an earlier blog, I argued that the decline in business investment and the accompanying decline in productivity growth are signs of a weakening economy (Business investment)

This weakness is now apparent to the Bank. Its own forecast anticipate that the economy will expand by 1.8% in 2023, shifting to a lower rate of 1.2% in 2024. These growth rates hardly smack of an economy that is overheated, especially in view that the Canadian population is expanding by 1% yearly, the highest in the G-7 community. Put differently, real per capita income growth is less than 1% a year. The Bank has chosen to go after inflation at a time when the economy is, at best, barely expanding. No wonder, there is the real concern that Bank policy will push us in a recession.

The Bank notes that a large accumulation of savings during the pandemic will provide a cushion for households to withstand higher debt-service costs. In other words, rate hikes can readily be absorbed, especially in the household sector. Nonetheless, servicing debt at the expense of consumption only re-enforces the view that economic growth will continue to remain low. The Bank does, however, acknowledge that the financial health in the household sector is at risk with higher rates. Again, this does not auger well for economic growth and avoiding recessionary conditions. No matter how one interprets the Bank’s analysis, it clearly remains that the economy will get weaker and weaker as these most recent rate hikes work their way through borrowing and spending decisions.

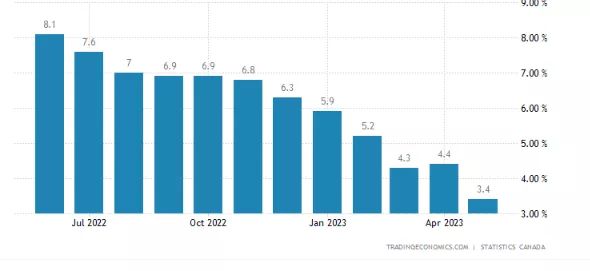

Canada's inflation rate

Like so many other central bankers, the Bank of Canada seems to be impatient regarding the speed with which inflation has come down. Stung be criticism that it was too slow to recognize inflationary pressures in 2020-21, the Bank of Canada now exhibits considerable anxiety that inflation is not falling fast enough. Accordingly, it has raised rates to the highest in 22 years in a space of less than 18 months. So far, the results have been effective with the CPI falling from 8.1% to 3.4% in just over a year. So, why not let existing rates continue to work through the economy? The pain the Bank alludes by doing too much could well be upon us very shortly.

More By This Author:

Central Bankers Are No Longer So Self-Assured

Canada Needs To Promote Business Capital Investment If It Hopes To Tame Inflation

The Bank Of Canada Continues To Struggle With Timing Its Policy Changes

Disclosure: None.