UTG: A Great Fund To Play A Recovery In Utilities

Image Source: Pixabay

The Reaves Utility Income Fund (UTG) is a closed-end fund that investors can use to obtain a very high level of income to meet their needs. This overall purpose is suggested by the name of the fund and supported by its 8.44% current yield. However, the method that the fund employs to achieve this objective is very different from that of most income-oriented closed-end funds. This fund does not invest its assets into a portfolio consisting primarily of fixed-income securities as many other income funds do, but rather it purchases the common stock of utilities and infrastructure companies. That is not likely to be surprising considering the name of the fund. It is something that is rather nice to see for long-term investors or for anyone who is worried about the impact that inflation might have on their portfolios. As I have noted in various previous articles, utilities typically raise their dividends every year and common stocks in general tend to provide a degree of inflation protection that is superior to that of any form of debt security. The fund should be able to pass on these features to its investors in the form of a growing distribution over time, and indeed its distribution history does support this conclusion. As such, this fund might be a good option for investors to obtain some income that grows over time. Retirees or others who are dependent on their portfolios for income might appreciate this.

The fund’s current yield compares reasonably well to that of its peers. Morningstar classifies the Reaves Utility Income Fund as an “Equity-Sector Equity” fund that invests specifically in the utility sector. Here is how the fund’s yield compares to that of similar funds:

|

Fund Name |

Morningstar Classification |

Current Distribution Yield |

|

Reaves Utility Income Fund |

Equity-Sector Equity |

8.44% |

|

BlackRock Utilities, Infrastructure, & Power Opportunities Trust (BUI) |

Equity-Sector Equity |

6.79% |

|

Cohen & Steers Infrastructure Fund (UTF) |

Equity-Sector Equity |

7.83% |

|

Duff & Phelps Utility and Infrastructure Fund (DPG) |

Equity-Sector Equity |

8.88% |

|

Gabelli Global Utility & Income Fund (GLU) |

Equity-Sector Equity |

8.16% |

|

Gabelli Utility Trust (GUT) |

Equity-Sector Equity |

10.87% |

As we can clearly see, the Reaves Utility Trust has a yield that compares pretty well to that of its peer funds. It is not the highest yield available in the sector, but as I pointed out in a recent article, it is not unusual for a fund with an outsized distribution yield relative to its peers to be at risk of a distribution cut. Indeed, a few years ago, it was a near guarantee that any security whose yield exceeded 10% would soon have to cut its payout. While there are some funds that can sustain double-digit yields in today’s high-interest rate environment, the basic rule still applies that investors should be cautious anytime an asset obtains a yield that is substantially higher than that of its peers. This does not appear to be something that we need to worry about with respect to the Reaves Utility Income Fund, however.

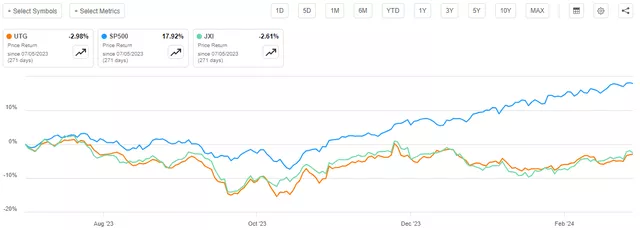

As regular readers can likely remember, we previously discussed the Reaves Utility Income Fund back in July 2023. The market since that time has experienced some fairly wild swings as most of the summer was characterized by rising long-term interest rates and falling asset prices. The exact opposite happened beginning in late October 2023, as equities entered into a raging bull market that continues through to the present. However, utilities in general have not been as beneficially affected by the recent market strength and indeed the sector has been one of the poorest performing sectors of the market over the past twelve months. As such, we might expect somewhat middling performance from the fund’s shares since our previous discussion on it. This is indeed the case, as shares of the Reaves Utility Income Trust are down 2.98% since the previous article was published. This is substantially worse than the 17.92% gain that the S&P 500 Index has delivered since the same date:

Source: Seeking Alpha

However, we can see that the fund’s performance was very comparable to the 2.61% decline of the iShares Global Utilities ETF (JXI). The fund’s share price performance might still be very disappointing for any investor right now though, as it seems like the financial media has been bombarding us with information about how much money everybody else is making. Those investors who are in this fund might feel left behind in the face of such constant media noise.

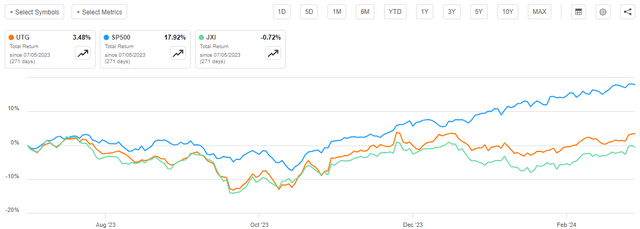

However, as I have pointed out in various previous articles, a simple look at the price performance of a closed-end fund does not tell the whole story. This is because funds such as the Reaves Utility Income Fund typically pay out all of their investment profits to their shareholders in the form of distributions. The basic business model is to keep the size of the fund’s portfolio relatively stable over time while giving the fund’s shareholders all of the profits that are produced by the portfolio. These distributions provide the fund’s investors with a return that is not reflected in the share price performance. In short, the fund’s shareholders will always do much better than the share price performance would suggest. As such, we should include the distribution in any analysis of the fund’s performance. When we do that, we see that shareholders in this fund actually experienced a 3.48% gain since the publication of my previous article on this fund:

Source: Seeking Alpha

Admittedly, this will still be small comfort to most investors as it is still far below the gain of the S&P 500 Index over the period, but it is much better than the 0.72% loss suffered by investors in the iShares Global Utilities ETF. It is also a net gain as opposed to the loss that is suggested by the share price performance alone. There may be some reasons to suspect that the fund’s performance will improve over the next year as the Federal Reserve appears to be committed to interest rate cuts, which should prove to be beneficial for utility stocks. There are some questions as to whether or not the Federal Reserve will actually be able to deliver on the cuts that it has been promising though, and if crude oil prices continue to trend up then it could be even more difficult to deliver these cuts. As I pointed out in a post on X (formerly Twitter) earlier today:

Source: X (formerly Twitter)

If indeed inflation comes in hot, it will be difficult for the Federal Reserve to justify interest rate cuts in the near future. With that said though, it does seem certain that interest rate cuts will happen at some point, if for no other reason than to alleviate the pressure that today’s interest rates are putting on the Federal government’s budget. Once those cuts occur, it will probably be good for utility stocks and by extension for investors in this fund.

The yield on this fund is sufficient that we do not need much in the way of share price appreciation in order to realize an attractive investment return. Of course, this is dependent on the fund’s ability to sustain this distribution, so we will want to pay close attention to that over the remainder of this article. We have a much newer financial report available to us than we did at the time of our previous discussion, so that should prove helpful for our purposes today.

About The Fund

According to the fund’s website, the Reaves Utility Income Fund has the primary objective of providing its investors with a high level of after-tax income and total return. This makes a lot of sense considering the strategy that the fund expects to use to achieve this objective. The website explains the strategy thusly:

The Fund’s investment objective is to provide a high level of after-tax income and total return consisting primarily of tax-advantaged dividend income and capital appreciation. The Fund pursues this objective by investing at least 80% of its total assets in dividend-paying common and preferred stocks and debt instruments of companies within the utility industry. Up to 20% of the Fund may be invested in securities of companies in other industries.

As I have explained in various previous articles, common stocks are by their very nature total return vehicles. After all, investors who purchase common stock do so for two reasons:

- The receipt of income via dividends paid by these securities.

- Capital gains that accompany the growth and prosperity of the issuing company.

Of the two, capital gains are usually the most important. After all, common stocks have generally had incredibly low dividend yields over the past fifteen years or so. This is even true in the utility sector as the iShares U.S. Utilities ETF (IDU) only has a trailing twelve-month yield of 2.79% and the iShares Global Utilities ETF has a trailing twelve-month yield of 3.74% at their current prices. These yields are both considerably lower than what a money market fund or high-yield savings account at an online bank provides so it is highly unlikely that anyone is buying utilities solely to obtain a high yield. The utilities sector historically has a higher yield than many other market sectors, so this drives home the fact that few investors are buying common stocks solely for yield. As the definition of total return is yield plus capital gains, the fund’s pursuit of total return makes sense.

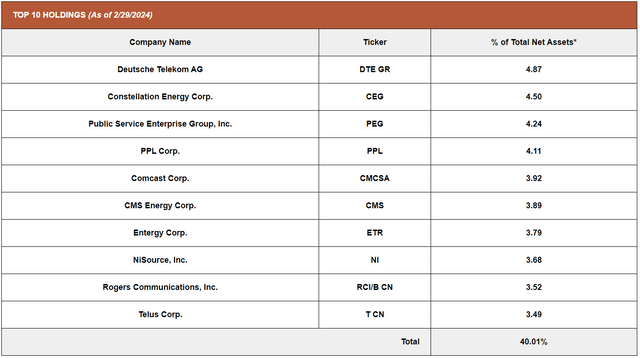

The Reaves Utility Income Fund also states that it pursues a high level of current income, which makes less sense for a common equity fund given the low yields prevalent in common equities. We can see this with this fund as well, as we only have to look at the largest positions. Here they are:

Source: Reaves

Here are the current yields of these stocks:

|

Company |

Current Yield |

|

Deutsche Telekom AG (DTEGY) |

3.17% |

|

Constellation Energy Corp. (CEG) |

0.76% |

|

Public Service Enterprise Group (PEG) |

3.60% |

|

PPL Corp. (PPL) |

3.75% |

|

Comcast Corp. (CMCSA) |

2.95% |

|

CMS Energy Corp. (CMS) |

3.43% |

|

Entergy Corp. (ETR) |

4.32% |

|

NiSource, Inc. (NI) |

3.86% |

|

Rogers Communications, Inc. (RCI) |

3.63% |

|

Telus Corp. (TU) |

6.88% |

With the notable exception of Constellation Energy, all of these stocks have a higher current dividend yield than either the U.S. or global utility indices, which is a good start at the provision of current income. However, a money market fund yields somewhere between 5% and 5.20% right now, so the only one of these companies that has an impressive yield relative to much safer options is Telus Corp. Telus’s share price performance over the past year has been terrible, to say the least. This company has seen its share price decline by 22.11% compared to only 4.52% for the iShares Global Utilities ETF over the past twelve months:

Source: Seeking Alpha

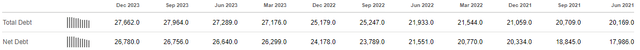

Thus, the company has a higher yield than many of its peers for a reason. Telus has been loading up on debt over the past few years and this has been one of the drivers causing the market to punish it. Here are the company’s net debt figures over the past eleven quarters:

Source: Seeking Alpha

(all figures in millions of Canadian dollars)

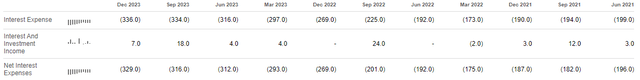

The company has been loading up on debt despite the fact that interest rates have been rising in both the United States and Canada over the period. This has resulted in the company’s interest expenses rising rapidly over the same period:

Source: Seeking Alpha

(all figures in millions of Canadian dollars)

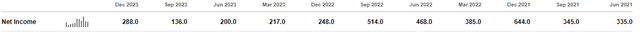

Thus, the stock’s poor performance has almost certainly been at least partly due to the company loading up on expensive debt in a high-interest rate environment. This would be okay if its income was growing rapidly enough to cover the higher interest costs, but this has not been the case as we can see here:

Source: Seeking Alpha

(all figures in millions of Canadian dollars)

Thus, the only company in the fund’s ten largest holdings list that has a yield that is higher than that of a money market fund is one that has been leveraging itself up more rapidly than it has been able to grow its income and has been getting punished by the market. This has not only been a drag on the fund’s portfolio performance, but it has also very quickly makes the point that we cannot really get a high level of current income by investing in common stocks. That obviously goes for this fund too.

As noted earlier in this article though, the Reaves Utility Income Fund does not invest solely in common equities issued by utility companies. The fund also invests in preferred stock and debt securities, which will generally prove to be better income vehicles than the common stock. This is because the yields on bonds and preferred equity are typically higher than that of the common equity issued by the same company. This is due to the fact that these securities are theoretically safer in the event of bankruptcy or forced liquidation and generally lack the same potential for capital appreciation that is possessed by the common stock. The yields are not necessarily that much higher than the common stock of utility companies though, at least if the indices are any indication:

|

Index ETF |

Trailing TTM Yield |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) |

4.13% |

|

iShares Preferred and Income Securities ETF (PFF) |

6.39% |

The preferred stock index has a higher yield than the common stock of most of the companies that comprise the top ten positions in the Reaves Utility Income Fund. However, the corporate bond index is not substantially higher than the current dividend yield of the common stock of most of the fund’s holdings. Most utility companies are investment-grade firms, so it seems unlikely that the yield of any of their bonds will be more than 100 to 150 basis points above the ten-year U.S. Treasury. This would put their bond yields somewhere around 6% based on the current price of the ten-year U.S. Treasury. That is not a sufficiently high enough premium relative to the common equity to justify giving up the potential capital gains. The fund’s management appears to agree, as the annual report states that only 0.10% of the fund’s holdings are in bonds:

|

Security Type |

% of Portfolio |

|

Common Stock |

124.04% |

|

Corporate Bonds |

0.10% |

|

Master Limited Partnerships |

0.14% |

|

Preferred Stock |

0.09% |

|

Money Market Funds |

3.40% |

While the asset allocations that are provided in the annual report are dated October 31, 2023, there is no real reason to expect that the fund has substantially increased its allocation to corporate bonds or preferred stock since that date. As such, the allocations shown above are probably reasonably close to what the fund holds now. Thus, it looks like this fund is investing almost exclusively in common stock despite what its description implies.

Earlier in this article, I mentioned that the performance of utility stocks over the remainder of this year could be somewhat dependent on the monetary policies enacted by the Federal Reserve. This is because utilities are frequently considered to be proxies for bonds by the market, rather than common stocks. As Fidelity International points out:

Shares of utilities companies have long been regarded as bond proxies for their stable cashflows and defensive qualities, and indeed, historically we’ve seen a strong negative correlation between the valuation of utility stocks and changes in interest rates, especially in developed markets.

As utilities tend to have fairly low growth rates and high yields, investors will sometimes treat them like bonds. Thus, when interest rates rise, utility stocks decline and vice versa. We have seen this somewhat over the past year. For example, this chart compares the iShares Global Utilities ETF to investment-grade corporate bonds:

Source: Seeking Alpha

We can see a very strong correlation between the two assets here. This is one of the reasons why utilities have been one of the worst performing sectors over the past year, as stocks in other sectors are less correlated to interest rates, despite what the media states. If the correlation between interest rates and utility stocks holds up, then we should see some upside movement as the Federal Reserve begins to reduce interest rates. It is not certain when it will begin this interest rate reduction cycle, as economic data is far too strong to support starting it right now without causing a resurgence in inflation. However, it is unlikely that the central bank will hike interest rates further, so now could be a good entry point for someone who wishes to play the monetary loosening cycle and does not want to invest in bonds. The Reaves Utility Income Fund could be one way to do that and obtain a much higher yield than is available from the index funds tracking the utility sector.

Leverage

As is the case with most closed-end funds, the Reaves Utility Income Fund employs leverage as a method of boosting the yield and total return that it earns from the assets in its portfolio. I explained how this works in my previous article on this fund:

In short, what the fund is doing is borrowing money and then using that borrowed money to purchase shares of utility companies. As long as the purchased assets deliver a higher total return than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the overall return of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case. However, it is worth noting that the use of leverage is not as advantageous today as it was a few years ago as far as boosting returns goes. This is because the fund’s borrowing rate is still going to be around 6% at best, which is higher than the yields of most utility stocks.

Unfortunately, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. I typically do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the Reaves Utility Income Fund has leveraged assets comprising 19.98% of its portfolio. This is considerably lower than the one-third level that we would prefer to see, which is a good sign. Here is how this fund’s leverage compares to that of its peers:

|

Fund |

Current Leverage |

|

Reaves Utility Income Fund |

19.98% |

|

BlackRock Utilities, Infrastructure, & Power Opportunities Trust |

0.00% |

|

Cohen & Steers Infrastructure Fund |

30.10% |

|

Duff & Phelps Utility and Infrastructure Fund |

29.66% |

|

Gabelli Global Utility & Income Fund |

31.00% |

|

Gabelli Utility Trust |

25.00% |

(all figures from CEF Data)

As we can see, the leverage of the Reaves Utility Income Fund is considerably lower than that of all of its peers except for the BlackRock Utilities, Infrastructure, & Power Infrastructure Trust. However, as we saw in the introduction, the BlackRock fund has a considerably lower yield than the Reaves Utility Income Fund. The absence of leverage from the BlackRock fund’s portfolio could be one reason for this.

Overall, this suggests that the Reaves Utility Income Fund is striking a pretty good balance between the risks and rewards of using leverage. Investors in this fund should not have to worry too much about the fund’s leverage.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Reaves Utility Income Fund is to provide its investors with a very high level of income. In pursuance of that objective, the fund invests its assets into a portfolio that consists primarily of common stocks issued by utility companies, although it does claim to have the ability to invest in fixed-income securities as management deems appropriate. While the utility sector does tend to have higher yields than most other market sectors, the yield of the average utility common stock is still lower than most income investors would like. The fund borrows money to allow it to collect dividends from more common stocks than it could purchase solely with its own equity capital, which boosts the effective yield somewhat. However, this fund will need to supplement its dividend income with capital gains on the common stocks in order to provide an acceptable yield. It pools together the money that it earns from these sources and then pays it out to its shareholders, net of its expenses. When we consider the combined returns of both dividends and capital gains, we can assume that this business model would allow the fund’s shares to boast a fairly high yield.

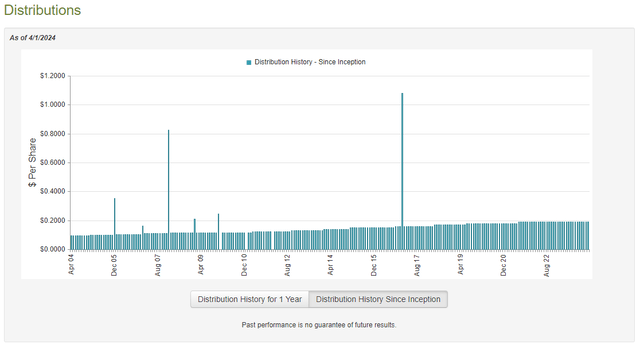

This is indeed the case, as the Reaves Utility Income Fund pays a monthly distribution of $0.19 per share ($2.28 per share annually), which works out to an 8.44% yield at the current share price. As we saw in the introduction to this article, that is a very reasonable distribution yield compared to similar closed-end funds. This fund has been remarkably consistent with respect to its distribution since its inception. As we can see here, the fund has never cut its distribution and it has instead increased it over time:

Source: CEF Connect

This makes the Reaves Utility Income Fund one of the only closed-end funds that has managed to grow its distribution over time. This is at least somewhat understandable considering that it invests primarily in utilities and most utilities increase their dividends annually. However, the Duff & Phelps Utility and Infrastructure Fund invests in similar assets to this fund and yet it had to cut its longstanding distribution last year.

The fact that the Reaves Utility Income Fund has managed to grow its distribution over time will likely endear it to any investor who is seeking to receive a safe and consistent level of income from their portfolio that they can use to pay their bills or finance their lifestyles. This proposition could be particularly appealing to retirees or others that are dependent on their assets for the money that they require for their daily lives. It is also very nice to see in today’s inflationary environment because a growing distribution should offset some of the loss of purchasing power that we suffer from in such an environment.

As is always the case though, we want to have a look at the fund’s finances to ensure that it can actually afford the distribution that it pays out. After all, we do not want the fund to be distributing more than it earns from its portfolio and destroying its net asset value in the process. That type of value destruction is not sustainable over any sort of extended period.

Unfortunately, we do not have an especially recent document that we can consult for the purposes of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the full-year period that ended on October 31, 2023. A link to this report was provided earlier in this article. Obviously, this document will not provide any information about the fund’s performance over the past five months. This is somewhat disappointing because a lot has happened over the past five months, including a raging bull market that has generally pushed up the price of every asset in the market. That obviously could have provided the fund with the opportunity to earn some capital gains. However, anyone can make money in a bull market. The most recent report will include the final few months of 2022 and the summer of 2023, which were both very challenging market environments that were characterized by rising long-term interest rates and declining asset prices. When it comes to determining the ability of a fund to sustain its distribution, we want to see how well the fund’s management navigated such challenging conditions. This report should give us a good idea of how well it handled these market environments.

For the full-year period that ended on October 31, 2023, the Reaves Utility Income Fund received $88,701,971 in dividends net of foreign withholding taxes. The fund surprisingly had no income from any other source during the period, so its total investment income was the same amount. It paid its expenses out of this amount, which left it with $40,904,434 available for shareholders. That was, unfortunately, nowhere close to enough to cover the $170,208,291 that the fund paid out in distributions over the period. At first glance, this could be concerning as the fund clearly did not have sufficient investment income to cover its distributions.

However, there are other methods through which the fund can obtain the money that it needs to cover its distribution. For example, the fund might have been able to realize some capital gains from the sale of appreciated common stock that could be paid out to the shareholders. Realized capital gains are not considered to be investment income for tax or accounting purposes, but they clearly do represent money coming into a fund that can be paid out to the investors.

The fund had mixed results in earning income via these alternative sources during the period. It reported net realized gains of $121,658,677 but these were more than offset by $236,934,488 net unrealized losses. Overall, the fund’s net assets declined by $100,948,746 after accounting for all inflows and outflows during the period. Thus, the fund technically failed to cover its distributions over the period.

However, the fund’s net investment income plus net realized gains totaled $162,563,111 over the period. That was very close to the amount of money that was needed to cover the distribution. The fund made up the difference through a massive capital raise that brought in $135,810,703 during the period. This reliance on new money to cover a distribution is not something that we would like to see, but it did get pretty close solely through its own operations.

Overall, we probably do not need to worry too much about a distribution cut right now. The fact that the fund was able to get so close to full coverage in a very challenging environment for utility stocks speaks very well of the quality of this fund’s management.

Valuation

As of April 1, 2024 (the most recent date for which data is currently available), the Reaves Utility Income Fund has a net asset value of $26.62 per share but the shares trade for $26.95 each. This gives the fund’s shares a 1.24% premium on net asset value at the current price. This is a larger premium than the 0.81% premium that the shares have had on average over the past month. As such, the current price looks rather expensive, and potential investors might want to wait and see if the premium declines before buying shares.

Normally, I would not recommend buying any closed-end fund at a premium on net asset value. This is because such a scenario implies that we are overpaying for the assets in the fund. In this case, the premium on this fund is probably small enough to justify it given the fund’s performance relative to its peers. In particular, the fact that it seems able to sustain distribution growth is quite nice. However, we should still be cautious and buy in when the premium is lower than normal.

Conclusion

In conclusion, the Reaves Utility Income Fund is probably the best utility closed-end fund available in the market. It is one of the few closed-end funds that has been able to consistently grow its distribution, and it appears to be able to sustain it. That is very nice for retirees, especially in an inflationary environment. The biggest downside here is the price, but the performance justifies a small premium.

Overall, I am going to assign a “buy” rating to this fund as it is a good way to play a recovery in the utility sector and should benefit from any interest rate cuts. However, it is best to buy in for as small of a premium possible. In addition, this might be a long-term play as there are reasons to be skeptical of the rate cut narrative.

More By This Author:

Matador Resources: High Leverage, But Could Be A Solid Undervalued Energy Play Today

BWG: International Exposure Could Be Nice To Reduce Fed Risk

Oil Price Continues To Rise

Disclosure: This article was originally published to Energy Profits in Dividends, my private subscription service. Subscribers to that service have had since the market close on April 2, 2024 to act ...

more

Excellent article. Highly recommended.

Nice Fund find.