Matador Resources: High Leverage, But Could Be A Solid Undervalued Energy Play Today

Image Source: Pixabay

On Tuesday, February 20, 2024, Pemian-based independent shale drilling company Matador Resources (MTDR) announced its fourth-quarter 2023 earnings results. At first glance, these results were quite solid as the company managed to beat the expectations of its analysis in terms of both top-line revenue and bottom-line net income. The company also managed to achieve fairly strong year-over-year revenue growth, which we can always appreciate.

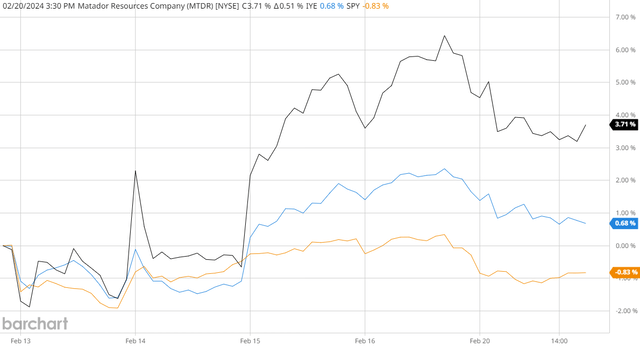

For its part, the market has generally been pretty favorable to Matador Resources heading into earnings. As we can see here, over the past five days, the market pushed the company’s stock price up 3.71%, which is much better than the 0.68% gain of the iShares U.S. Energy ETF (IYE) or the 0.83% decline of the S&P 500 Index (SPY) over the same period:

Source: Barchart

Admittedly, the earnings announcement was made after-hours so we have not yet seen how the market will react to the report when it opens on Wednesday morning. Overall, though, there certainly appears to be quite a lot to like in this earnings report as the company’s production set a new record and made some significant progress at reducing its operating costs. Unfortunately, the company does not expect this growth trajectory to continue in 2024, as the company’s production guidance is in line with its actual fourth-quarter output.

As is the case with many things in the oil and gas space right now, Matador Resources looks remarkably cheap at its current price despite the strong performance that the company’s stock price delivered over the past week. As such, it might be worth considering if you are seeking an investment opportunity in this industry right now.

Earnings Results Analysis

As regular readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Matador Resources’ fourth-quarter 2023 earnings report:

- Matador Resources reported a total revenue of $836.132 million in the fourth quarter of 2023. This represents an 18.19% increase over the $707.475 million that the company reported in the prior year quarter.

- The company reported an operating income of $365.611 million in the most recent quarter. This represents a slight 1.64% decrease over the $371.700 million that the company reported in the year-ago quarter.

- Matador Resources produced an average of 154,261 barrels of oil equivalent per day during the reporting period. This represents a 38.06% increase over the 111,735 barrels of oil equivalent per day that the company produced on average during the equivalent quarter of last year.

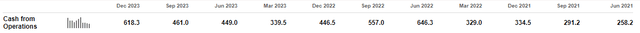

- The company reported an operating cash flow of $618.347 million in the current quarter. This represents a 38.48% increase over the $446.523 million that the company reported in the corresponding quarter of last year.

- Matador Resources reported a net income of $275.941 million in the fourth quarter of 2023. This represents a respectable 1.48% increase over the $271.909 million that the company reported in the fourth quarter of 2022.

It seems essentially certain that the first thing that anyone reviewing these highlights will notice is that Matador Resources experienced improvements in nearly every measure of financial performance. The company managed to achieve these improvements despite the fact that crude oil prices were lower in the fourth quarter of 2023 than they were in the fourth quarter of 2022. This chart shows the spot price of West Texas Intermediate crude oil from October 1, 2022 to December 31, 2023:

Source: Barchart

As we can see, crude oil prices declined by 14.34% over the fifteen-month period. However, this by itself does not mean that average prices were lower. After all, we can see a few periods in October 2023 in which oil prices were higher than they were around the end of 2022. However, overall, Matador Resources did find itself adversely affected by oil prices. The company reported an average sales price of $79.00 per barrel in the fourth quarter of 2023. This compares unfavorably to the $82.49 per barrel sales price that the company realized on average during the fourth quarter of 2022.

We saw the same year-over-year decline in natural gas prices, which is perhaps easier to understand. After all, we all are very well aware of how low natural gas prices in the United States fell following the warm winter of 2022-2023. This chart shows that clearly:

Source: Barchart

As we can see, the price of natural gas at Henry Hub fell 61.13% over the October 1, 2022, to December 31, 2023 period. We can also see that most of the decline took place after the start of 2023 so it would not have had an adverse impact on the company’s fourth quarter 2022 earnings results. Curiously, though, Matador Resources’ realized prices for its natural gas production held up better than might be expected in this environment:

|

|

Q4 2023 |

Q4 2022 |

% Change |

|

Average Sale Price, without realized derivatives |

$3.01 |

$3.56 |

-15.45% |

|

Average Sale Price, with realized derivatives |

$2.92 |

$3.34 |

-12.57% |

We can clearly see that the company’s average sales price for its natural gas did not decline to nearly the same extent as natural gas prices. This was certainly beneficial for helping the company maintain its revenue year-over-year, although we can still see that the firm did experience some adverse impacts here as its realized prices still declined by a double-digit value.

The company did not provide a reason for why its realized natural gas prices held up much better than the Henry Hub market price for natural gas over the period. We cannot exclusively credit the company’s hedging program for this, as the average sale price only declined 15.45% year-over-year without including the impact of the company’s hedges. The one thing that we do note though is that the company’s average sale prices during the fourth quarter of 2022 were far below the Henry Hub natural gas price. However, its fourth-quarter 2023 sale prices were much more in line with the Henry Hub natural gas price. This is shown in the above chart:

Source: Barchart

As we can see, the Henry Hub natural gas price was in the $6.00 to $7.00 range during the final three months of 2022. That is far above the company’s average sale price even excluding the impact of its derivative hedging program. However, the Henry Hub natural gas price was in the $2.50 to $3.50 range during the fourth quarter of 2023. That was very close to the price that the company actually realized, both with and without the impact of its derivative hedging program.

The biggest reason for this discrepancy is probably regional pricing fluctuations. Unlike crude oil, natural gas prices can sometimes vary considerably from region to region due to the fact that it is more difficult to transport. As such, the price of natural gas in the Permian Basin itself might be higher or lower than the price of natural gas at Henry Hub in Erath, Louisiana. This could very well be what we are seeing here.

Regardless though, we can see that the company’s realized prices for both crude oil and natural gas declined year-over-year. However, its revenue and overall financial performance improved over the same period. This is exactly the opposite result that we would expect, as most oil and gas companies’ financial performance exhibits a positive correlation to energy prices. The answer to this question can be found in the fact that Matador Resources significantly increased its production year-over-year. As noted in the highlights, the company reported an average production level of 154,261 barrels of oil equivalent per day in the most recent quarter. This compares favorably to the 111,735 barrels of oil equivalent per day that the company produced on average during the prior year quarter. The increase in production naturally boosted the company’s revenues because it gave it more products to sell. In this case, that was sufficient to offset the impact of lower energy prices and caused the company’s revenue to increase. All else being equal, an increase in revenue means that more money is available to cover the company’s costs and make its way down to the company’s earnings and cash flows. This is pretty much what we see here.

However, all else is rarely equal in the oil and gas industry. As I mentioned in the introduction to this article, Matador Resources made some progress at reducing its production expenses over the trailing twelve-month period. From the earnings press release:

Matador achieved another record quarter in the fourth quarter of 2023, which was another strong finish to yet another record year. Matador not only produced a record amount of oil and natural gas through strong well performance during the fourth quarter of 2023 but also steadily decreased costs during the quarter, resulting in better-than-expected free cash flow per share. We used this higher free cash flow to repay borrowings under our credit facility, make profitable investments in our oil and natural gas properties and our midstream business and pay a steadily increasing fixed dividend to our shareholders.

In addition, the earnings press release states the following:

In addition to increasing production, we also decreased our operating costs during the fourth quarter of 2023. For example, our lease operating expenses decreased 5% to $5.06 per BOE in the fourth quarter of 2023, as compared to $5.34 per BOE in the third quarter of 2023 and significantly outperformed our expected fourth quarter guidance range of $5.40 to $5.80 per BOE.

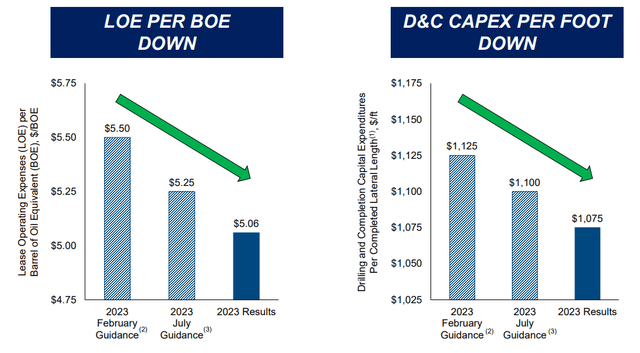

We can also see that the company beat its own expense guidance from earlier in the year. For example, back in February 2023, Matador Resources was expecting that its lease operating expenses would come in at $5.50 per BOE for the full-year 2023 period. The company also expected that its drilling & completion expenses would come in at $1,125 per foot. The company managed to beat both of these estimates in the fourth quarter of 2023, with lease operating expenses coming in at $5.06 per barrel of oil equivalent produced and drilling & completion expenses coming in at $1,075 per foot.

Source: Matador Resources Company

The fact that the company had lower expenses during the fourth quarter than it expected, or than it had in the fourth quarter of 2022 had a positive impact on the company’s results. It should be fairly obvious why this would be the case. After all, the less money that the company has to spend on producing its product, the greater the percentage of its revenue that is available to make its way down to the company’s cash flow and net income. This means that more money is available to use to reward the stockholders.

As mentioned in the introduction, investors should probably not expect much in the way of growth from Matador Resources over the course of 2024. This is in direct contrast to the statements that the company made in its earnings press release. In the press release, the company stated the following:

While we celebrate our 2023 accomplishments, we remain focused on continued growth, profitability and increased efficiencies in 2024. Matador anticipates another record year in 2024 with an 18% increase in our expected total average production of 156,000 BOE per day in full-year 2024, as compared to total average production of 131,800 BOE per day in full-year 2023.

The company’s guidance for full-year 2024 production is 153,000 to 159,000 barrels of oil equivalent per day. That is in line with what the company produced in the fourth quarter of 2023. As such, it appears that the company is not planning to grow its production by very much over the course of the coming year compared to what it achieved in the fourth quarter. However, its production should come in higher than the company averaged over the full-year 2023 period. Matador Resources received a significant production boost due to the acquisition of Advance Energy Partners in April, meaning that it still had a full quarter without the incremental production from this purchase in 2023. This will not be the case in 2024 so it should average a higher production level over the full-year period.

Financial Considerations

In a number of previous articles, including some on Matador Resources (see here), I pointed out the importance of looking at a company’s balance sheet before investing in it. To quote myself:

It is always important that we investigate the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is usually accomplished by issuing new debt and using the proceeds to repay the existing debt. That can naturally cause a company’s interest expenses to go up following the rollover in certain market conditions. When we consider that interest rates are at the highest level that we have seen since early 2001, that is a very real risk today. In addition to interest rate risk, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flow to decline could push it into insolvency if it has too much debt. As we have already seen, Matador Resources has significant exposure to commodity prices so this is a risk that we should be cognizant of.

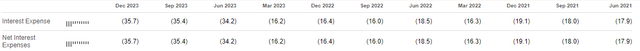

Unfortunately for shareholders, Matador Resources has seen its interest expenses increase significantly over the past year or so. Here are the company’s total and net interest expenses for the past eleven quarters:

Source: Seeking Alpha (all figures in millions of U.S. dollars)

As we can clearly see, Matador Resources’ interest expense has gone from $17.9 million in the second quarter of 2021 to $35.7 million in the most recent quarter. However, note the timing of this increase. We can see that the company’s interest expense did not start increasing until the second quarter of 2023. Prior to that, the company’s interest expenses were relatively flat. In fact, over nearly all of 2022, the company’s interest expenses were lower than they were during the zero-interest rate environment of 2021. Thus, for about a year after the Federal Reserve started raising interest rates, Matador Resources was completely unaffected.

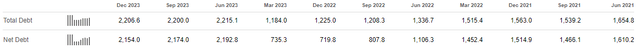

The timing and degree of the increase in interest expenses suggest that something else was the cause of this and not interest rates. In fact, we can see that the company’s debt load increased substantially during the second quarter of 2023:

Source: Seeking Alpha (all figures in millions of U.S. dollars)

This timing corresponds perfectly to the consummation of the takeover of Advance Energy Partners. Thus, the logical conclusion is that the company partially funded this acquisition with debt. Matador confirms this, as the company stated in an April 13, 2023 press release that the $1.6 billion acquisition was funded by a combination of cash on hand and borrowings under the company’s revolving credit facility. A revolving credit facility is usually a variable interest-rate facility (similar to a consumer credit card) so the company’s borrowing was probably done at a floating rate. Thus, the additional debt that the company took on to fund this acquisition probably was at a much higher interest rate than its outstanding fixed-rate borrowings prior to the acquisition. That could be somewhat concerning to investors, but as long as the acquisition increases the company’s cash flow by more than the increase in the interest expenses it is probably okay. As we can see above, the company’s interest expenses only increased by $18 million or so during the second quarter of 2023. This was far less than the increase in the company’s operating cash flow:

Source: Seeking Alpha (all figures in millions of U.S. dollars)

Thus, it appears that this acquisition worked out to the benefit of the company and its shareholders, regardless of the increase in net interest expense. Overall, this is a good thing for shareholders.

The usual ratio that we use to analyze an exploration & production company’s ability to carry its debt is the leverage ratio. This ratio is generally defined as net debt-to-adjusted EBITDA, and in theory, it tells us how many years it would take a company to completely pay off its debt if it were to devote all of its pre-tax cash flow to this task.

For the trailing twelve-month period, Matador Resources reported an adjusted EBITDA of $1.849547 billion. The company’s net debt was $2.1540 billion as of December 31, 2023. This gives the company a leverage ratio of 1.16x today. This is disappointing, as we would ordinarily prefer this ratio to be under 1.0x for a company in this industry. This is also a worse ratio than the 1.0x leverage ratio that the company had on September 30, 2023. This is a problem that the company will need to address, and Matador has promised to devote considerable amounts of money to paying down its debt over the next two years. We will want to monitor it though to make sure that the company actually follows through on this promise.

Valuation

One method that we can use to value an independent exploration and production company is by looking at the forward price-to-earnings ratio. This ratio basically tells us how much we have to pay today for each dollar of earnings that the company is expected to generate over the next twelve months.

According to Zacks Investment Research, Matador Resources has a forward price-to-earnings ratio of 8.10 at today’s price. This is much lower than the 22.78 forward price-to-earnings ratio of the S&P 500 Index. However, the oil and gas industry has been perpetually cheap for quite some time, so it would be a good idea to compare Matador Resources to some of its peers in order to get a good idea of its relative valuation:

|

Company |

Forward P/E Ratio |

|

Matador Resources Company |

8.10 |

|

Diamondback Energy (FANG) |

9.71 |

|

Pioneer Natural Resources (PXD) |

10.74 |

|

Devon Energy (DVN) |

8.13 |

|

Coterra Energy (CTRA) |

10.98 |

(all figures courtesy of Zacks Investment Research)

As we can clearly see, Matador Resources appears to compare quite well with its peers in terms of current valuation. This could be a sign that the stock is worth picking up today, assuming that you are comfortable with its high level of leverage.

Conclusion

In conclusion, Matador Resources reported very strong fourth-quarter 2023 earnings results. The company managed to beat the expectations of its analysts and it is likely that the full-year 2024 period will be better than the full-year 2023 period. The big concern here is that the company’s leverage is higher than we really want to see. If it is serious about devoting some of its free cash flow to paying down this debt, it could prove to be a solid and undervalued investment today.

More By This Author:

BWG: International Exposure Could Be Nice To Reduce Fed Risk

Oil Price Continues To Rise

Inflation - In Decline?

Disclosure: This article was originally sent out to subscribers to my paywalled energy investment service. Subscribers to that service received it at 11:15 a.m. on February 21, 2024. These ...

more