BWG: International Exposure Could Be Nice To Reduce Fed Risk

Image Source: Pixabay

BrandywineGLOBAL – Global Income Opportunities Fund Inc. (BWG) is a closed-end fund that specializes in providing its investors with a very high level of income from the assets in their portfolios. This is one of the few funds that accomplishes this by investing in securities issued from entities all over the world. As I have pointed out in various previous articles, one of the biggest problems that American investors have is that they do not have sufficient exposure to foreign assets. There are a few problems that may arise from this lack of international diversification, so it is important to ensure that your assets are not entirely exposed to the fortunes of any individual nation. This fund allows an investor to achieve some diversification globally without needing to sacrifice yield, as its 11.44% yield is easily comparable to the best domestic funds that focus on fixed-income securities.

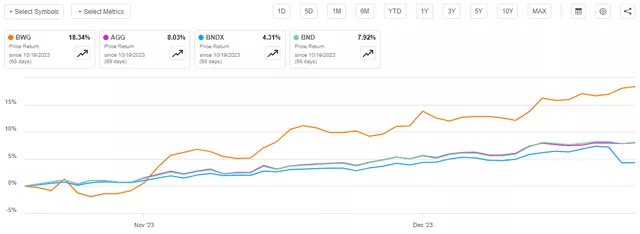

As regular readers may remember, we last discussed this fund around the middle of October. Coincidentally, this article was published on the day that the ten-year U.S. Treasury closed with a yield of 4.9880%, which was the highest yield that it has had since 2006. As such, both the stock market and the bond market have been on a general upward trend since the date that this article was published, and this market strength has been present in both the domestic and international markets. As such, we can expect that the shares of the fund have performed fairly well since my last article on it was published. This has certainly been true, as shares of the fund are up a whopping 18.34% since that date. This is substantially better than both the domestic and international bond market indices:

(Click on image to enlarge)

Source: Seeking Alpha

Unfortunately, the shares of this fund appear to have gotten ahead of themselves. Its net asset value per share is only up 14.59% over the period. As such, the valuation is not likely to be as attractive as it was the last time that we discussed the fund. It has still managed to deliver a stellar performance though, as the fund’s portfolio has also outperformed both indices.

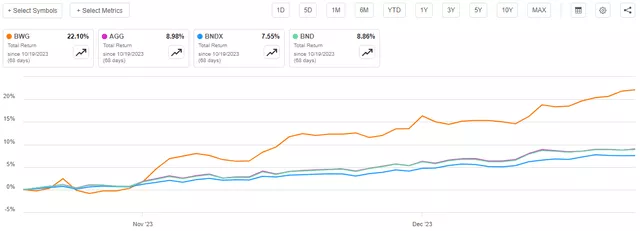

As is often the case with closed-end funds, the share performance tends to understate the fund’s actual results. This is because these funds pay out nearly all of their investment profits to the shareholders in the form of distributions. As such, the yields tend to be quite high and have a meaningful impact on the actual results that investors experience. We should therefore include the distributions that the fund paid out in our performance comparison. When we do that, we see that investors in the fund received an incredible 22.10% return over the past two months. That substantially outstrips the index:

(Click on image to enlarge)

Source: Seeking Alpha

This performance seems almost certain to appeal to any income-focused investor. After all, the fund is paying out a double-digit yield and delivering strong share price appreciation. As I have pointed out in a few previous articles though, there could be some reasons to believe that many traditional fixed-rate bonds are overpriced as the market is pricing in far more rate cuts than the Federal Reserve is likely to deliver. This is a bigger problem for domestic than foreign bonds though, so we should be sure to have a look at the fund’s composition to determine how risky its portfolio might be right now.

About The Fund

According to the fund’s website, BrandywineGLOBAL – Global Income Opportunities Fund has the primary objective of providing investors with a very high level of current income. This is not surprising when we consider that the website describes this as a bond fund. Specifically, the website states that the fund:

Offers investors a leveraged global, flexible portfolio that targets sovereign debt of developed and emerging market countries, U.S. and non-U.S. corporate debt, mortgage backed securities and currency exposure.

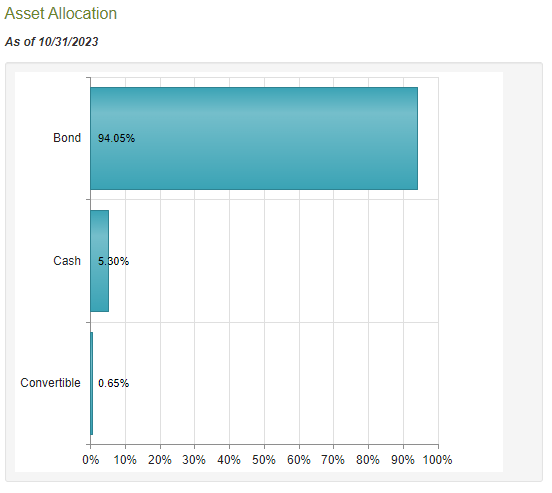

CEF Connect states that 94.05% of the fund’s assets are invested in various bonds, alongside much smaller allocations to cash and convertible securities:

Source: CEF Connect

As I have pointed out in numerous previous articles, bonds are by their very nature income vehicles. After all, investors purchase a bond for face value when it is first issued. The investor receives the face value back when it is redeemed. Thus, there are no net capital gains with these securities. Rather, investors receive a steady stream of coupon payments over the life of the bond that provides an investment return. These coupon payments are the only investment return that bonds provide on net, but it is possible to earn capital gains by selling them prior to maturity. This comes from the fact that bond prices go up when interest rates go down and vice versa. The fact that bond prices change with interest rates is the primary way that many of these funds were able to make money over the past decade or so of incredibly low-interest rates in most developed countries.

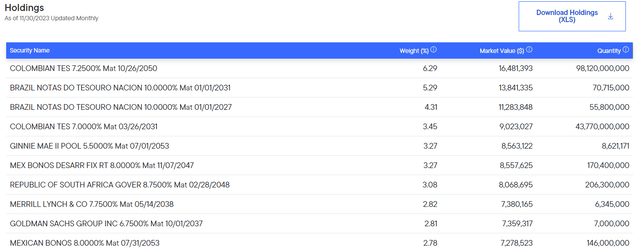

As the website states, BrandywineGLOBAL – Global Income Opportunities Fund invests in sovereign and corporate debt of issuers that are located in both developed and emerging markets. We can certainly see this by looking at the largest positions in the fund. Here they are right now:

Source: Franklin Templeton

We can immediately see a large number of foreign countries represented here. Ministerio de Hacienda y Credito Publico is the Colombian government’s Treasury department. Secretaria Tesouro Nacional is the Brazilian national government. We have to go to the fifth position in the list to find sovereign securities issued by the United States (Ginnie Maes are explicitly backed by the U.S. Treasury so they count as sovereigns). That is very different from most bond funds that invest in sovereign securities. The United States government is by far the largest issuer of sovereign debt securities in the world and nearly every fund that invests in sovereign debt has these securities either at the top of the list or very close to it. Those funds that do not will frequently have securities issued by an agency of the United States government as their top holding. The fact that this one does not include U.S. Treasuries in its top ten holdings at all and does not include anything connected to the United States until the fifth entry on the list should be quite attractive to those investors who are looking to improve the international diversification of their portfolios.

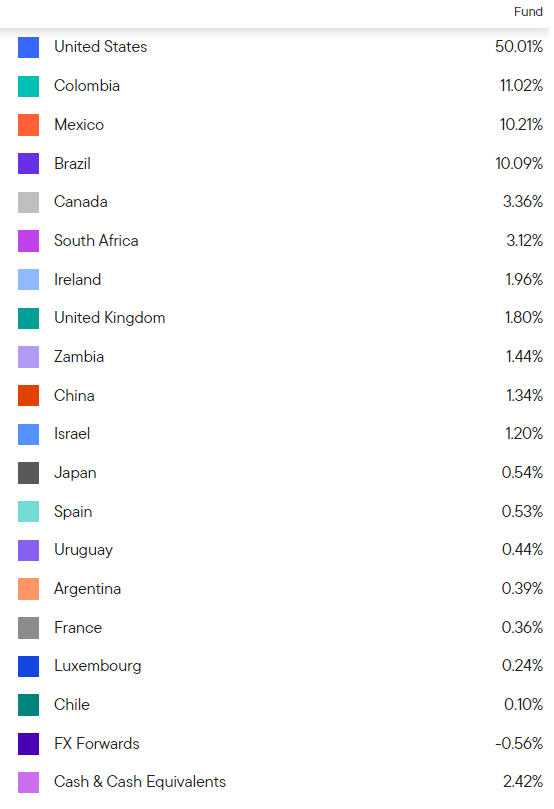

Unfortunately, the geographic diversity that we see in the fund’s ten largest positions does not extend over the entire portfolio. As of November 30, 2023, 50.01% of the fund’s portfolio was invested in securities issued by American governments or corporations:

Source: Franklin Templeton

As such, the fund will not reduce our American exposure to the degree that we might want. With that said, the Vanguard World Bond ETF (BNDW) has 50.90% of its assets in the American bond market:

Source: Vanguard

If we assume that this is representative of the actual weightings of each country in the global market, then the BrandywineGLOBAL – Global Income Opportunities Fund is actually slightly underweight to the American market relative to the actual representation of that nation’s debt market in the global economy.

The BrandywineGLOBAL – Global Income Opportunities Fund is more heavily weighted to the United States than the last time that we looked at it. In the previous article, we saw that 49.76% of the fund’s assets were invested in securities from American issuers. That slightly reduces our thesis of using this fund as a way to diversify away from the United States, but it does make a certain amount of sense when we consider the relative performance of American bonds versus international bonds over the past two months. As we saw in the introduction, the Bloomberg U.S. Aggregate Bond Index (AGG) outperformed the Bloomberg GLA ex-USD FltAdj RIC Capped Stats Index (BNDX) over the two-month period since the previous article on this fund was published. This is largely because the market is expecting that the Federal Reserve will reduce interest rates next year. That has inspired investors to put money into the domestic bond market and push up bond prices, along with driving down yields. This has also been occurring in the bond markets of some foreign countries as well, but not nearly to the same extent. Thus, unless the fund was actively selling off American bonds and purchasing foreign ones, the American allocation would increase due to the improved performance. This fund only has a 32.00% annual turnover, which suggests that it is not engaging in a significant amount of trading. Thus, what we are probably seeing is the American securities outperforming their foreign counterparts.

In a few recent articles, such as this one, I pointed out that American bonds might not be able to hold on to their recent gains. This is because the current price level is dependent on the Federal Reserve cutting the federal funds rate six times over the next eight committee meetings. That pretty much requires that the United States be in a severe recession two months from now. While indicators are mixed, the signs right now seem to indicate that the economy actually strengthened in November from October’s levels. As such, a very near-term recession seems unlikely. This could cause the American bonds held by this fund to reverse their recent gains in the near future. The foreign bonds should hold up somewhat better though, as their prices are not directly dependent on Federal Reserve policy. Thus, the BrandywineGLOBAL – Global Income Opportunities Fund might be less volatile than a pure domestic bond fund over the coming months. This is actually one reason why investors should ensure that they have proper international exposure in their portfolios, as it helps to reduce the risk that any single government or other authority can have adverse effects on your wealth. This fund does have a bit more international exposure than many other global funds so it might be worth considering for this reason.

Leverage

As is the case with most closed-end funds, the BrandywineGLOBAL – Global Income Opportunities Fund employs leverage as a method of boosting its effective yield beyond that of any of the underlying assets in the portfolio. I explained how this works in my previous article on this fund:

In short, the fund borrows money and then uses that borrowed money to purchase both domestic and foreign bonds, including bonds issued by entities located in emerging markets. As long as the yield that the fund receives from the purchased assets is higher than the interest rate that it has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage since that would expose us to an excessive amount of risk. I generally do not like a fund’s leverage to exceed a third as a percentage of its assets for this reason.

As of the time of writing, the BrandywineGLOBAL – Global Income Opportunities Fund has leveraged assets comprising 40.55% of its portfolio. As was the case the last time that we looked at this fund, its leverage is incredibly high for a fixed-income fund. This is obviously well above the one-third level that we normally like to see, and while fixed-income funds can usually carry a higher level of leverage than equity funds due to the lower volatility of fixed-income securities, this is still a very high figure that exposes the investors to more risk than a comparable fund might have. With that said, this high leverage could also be one of the big reasons for the incredibly strong performance that this fund has delivered over the past two months.

The fund’s leverage ratio is lower than it was the last time that we discussed this fund. When the previous article was published, the fund’s leverage ratio was 43.53% so the ratio has decreased quite a lot. The reason for this is that the fund’s portfolio has grown in size. As we can see here, the fund’s net asset value is up 14.59% since October 19, 2023:

Source: Seeking Alpha

Thus, it makes sense that the fund’s leverage has decreased over the period. After all, the increase in net asset value means that the fund’s portfolio has gotten substantially larger over the period. If its borrowings remain stable, then they will naturally account for a smaller percentage of the overall portfolio. That appears to be the case here.

Despite the improvement that we see in the fund’s leverage, it is still one of the more leveraged closed-end funds available in the market. As such, it will likely be more volatile than other funds that hold similar assets. This may be a problem for those investors who are looking for a safe source of income, although investors who are comfortable with a higher level of risk might like it.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the BrandywineGLOBAL – Global Income Opportunities Fund is to provide its investors with a very high level of current income. In order to achieve this objective, the fund invests in a variety of bonds from American and foreign issuers. As I pointed out in my previous article on this fund, foreign debt securities can sometimes boast substantially higher yields than American ones. This is particularly true for emerging market securities, and we already saw that the fund contains a number of emerging market bonds among its largest positions. The fund collects the payments that it receives from these bonds and combines them with any capital gains that it realizes from selling appreciated bonds prior to maturity. The fund even uses a layer of leverage to allow it to collect payments from more securities than it could control solely with its own equity capital. Finally, the fund distributes this pool of investment profits to its shareholders after subtracting its own expenses. We can probably assume that this will give the fund’s shares a very high yield.

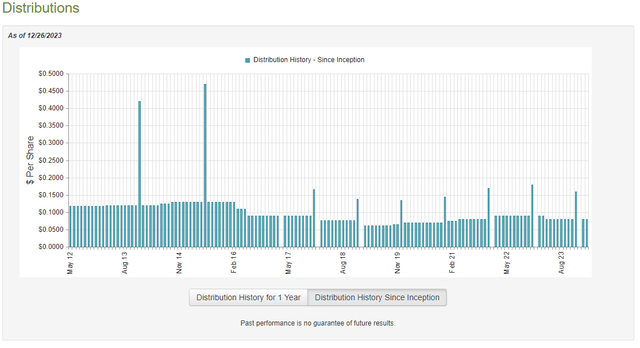

This is indeed the case, as the BrandywineGLOBAL – Global Income Opportunities Fund pays a monthly distribution of $0.08 per share ($0.96 per share annually), which gives it an 11.44% yield at the current price. This is certainly an attractive yield that is very much in line with the best domestic junk bond or leveraged loan funds, but of course this one focuses on a different asset class. Unfortunately, this fund has not been especially consistent with respect to its distribution over the years. As we can see here, it has both increased and cut its distribution multiple times over its lifetime:

Source: CEF Connect

The fact that the fund’s distribution has varied several times over the years could reduce its appeal somewhat in the eyes of those investors who are seeking to earn a safe and consistent income from the assets that they have accumulated. However, most funds that invest in bonds and similar assets have had to change their distributions at various times over the years due to the sensitivity to interest rates and monetary policy that these securities exhibit. The fact that this fund did have to cut its distribution back in April may still be problematic though, since we generally want our incomes to increase during inflationary times. After all, a growing income is the only way that we can maintain our purchasing power in such an environment. Thus, we want distribution increases instead of cuts. The fund is hardly alone in implementing a recent distribution cut though, as many central banks around the world have raised their interest rates over the past two years and inflicted damage on bond prices.

As I have pointed out numerous times in the past though, the fund’s history is not necessarily the most important thing for anyone who is considering purchasing the fund today. This is because anyone who purchases the fund today will receive the current distribution at the current yield and will be completely unaffected by actions that the fund has taken in the past. As such, the most important thing for our purposes today is the fund’s ability to sustain its distribution at the current level.

Unfortunately, we do not have an especially recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on April 30, 2023. As such, this report will not include any information about the fund’s performance over the past eight months. This is quite unfortunate due to the fact that a great many things have occurred over the interim period. For example, we saw a return of the bear market over the summer as investors sold off assets as they began to accept the Federal Reserve’s statements that interest rates would remain “higher for longer.” That attitude obviously eventually turned in mid-October, when the market started driving up the prices of most assets upwards once again. These two disparate periods obviously could have caused the fund to either suffer losses or realize gains, but we have no way of knowing the degree of either of these things right now. We will have to wait for the fund’s annual report to have better information, which should be released over the next few weeks. For now, we have to go with what we have available to us for our analysis.

During the six-month period, the BrandywineGLOBAL – Global Income Opportunities Fund received $10,345,418 in interest and $129,169 in dividends from the assets in its portfolio. From this, we subtract out the money that the fund paid in foreign withholding taxes, which gives it a total investment income of $10,386,466 during the period. The fund paid its expenses out of this amount, which left it with $6,656,630 available for shareholders. This was, unfortunately, not enough to cover the distributions that the fund paid out over the period. The fund paid $8,731,755 to its investors over the course of the six-month period. At first glance, this seems likely to be concerning as we would ordinarily prefer a fixed-income fund to be able to fully cover its distributions out of net investment income.

However, there are other methods through which the fund can obtain the money that it needs to cover its distribution. For example, it might be able to earn some profits by selling appreciated bonds in a friendly market. There was a friendly market over part of the period covered by this report, so perhaps the fund was able to take advantage of that. The fund had mixed results here, as it reported net realized losses of $14,937,278 over the period, but this was fully offset by $20,951,737 net unrealized gains. Overall, the fund’s net assets increased by $3,939,334 over the period. Thus, the fund technically did manage to cover its distributions, which is a good sign.

However, the fund’s net investment income and net realized gains were obviously not anywhere near enough to cover the payments. This fund only technically covered its distributions due to unrealized gains. As everyone reading this is no doubt well aware, unrealized gains can be very quickly erased by a market correction, so they are not a reliable way to ensure the sustainability of a fund over the long term. For the moment though, this does not appear to be a problem. Here is the fund’s net asset value performance since May 1, 2023 (the first day that is not covered by any released financial reports):

Source: Seeking Alpha

As we can see here, the fund’s net asset value is up 5.81% since the closing date of the most recent financial report. This strongly suggests that the fund has managed to earn sufficient investment profits to cover the distributions that it has paid out since May 1, 2023. Unfortunately, we do not know how much of this is split between net investment income, realized gains, and unrealized gains. As such, some of this performance could be undone by a market correction. For now, though, the fund’s distribution appears to be okay.

Valuation

As of December 26, 2023 (the most recent date for which data is available as of the time of writing), the BrandywineGLOBAL – Global Income Opportunities Fund has a net asset value of $9.66 per share but trades at $8.45 each. This gives the fund’s shares a 12.53% discount on net asset value at the current price. This is not quite as good as the 13.27% discount that the shares have had on average over the past month, but a double-digit discount is generally a reasonable entry point for any closed-end fund. As such, the current price appears to be reasonable if you wish to add this fund to your portfolio.

Conclusion

In conclusion, the BrandywineGLOBAL – Global Income Opportunities Fund is an interesting closed-end fund that provides investors with the ability to diversify their portfolios internationally without needing to sacrifice any yield or total return potential. The fund is slightly underweighted to the United States, which is nice to see. It is not, however, an international fund and some of the assets contained in this portfolio will be affected by the policies of the Federal Reserve. It seems likely that these assets are overpriced as it is unlikely that interest rates will be cut to anywhere near the degree that the market is expecting. Otherwise, though, this fund looks quite good as it is currently covering its distributions and is trading at an enormous discount on net asset value.

More By This Author:

Oil Price Continues To Rise

Inflation - In Decline?

Making The Case For High Oil Prices

Disclosure: I do not have any positions in any securities mentioned in this article as of the time of writing.

Disclaimer: All information provided in this article is for entertainment purposes ...

more