Making The Case For High Oil Prices

It is unlikely to come as a surprise to anyone reading this that energy prices have generally not performed very well over the past year. As of the time of writing, West Texas Intermediate crude oil has declined 17.1% over the past twelve months:

(Click on image to enlarge)

Source: Business Insider

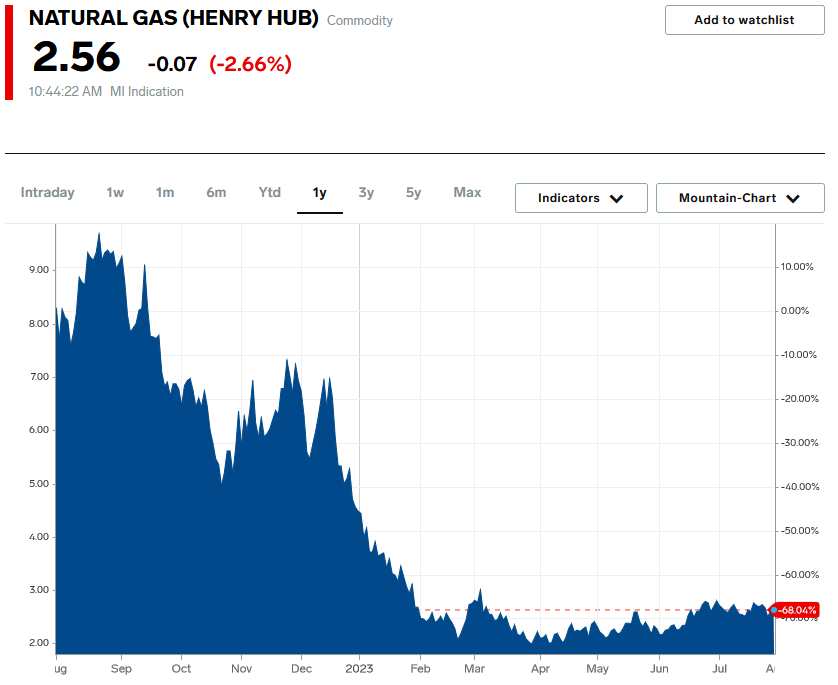

Natural gas has certainly not performed any better. This commodity is down a whopping 68.04% over the same period:

(Click on image to enlarge)

Source: Business Insider

As such, it may be difficult to make the case for either crude oil or natural gas, despite the fact that energy stocks have delivered a much stronger performance. As we can see here, the iShares U.S. Energy ETF (IYE), which tracks an index of American energy stocks, is actually up 10.25% over the trailing twelve-month period:

(Click on image to enlarge)

The market may know something here, as the strong performance in energy stocks strongly implies that the market expects crude oil and natural gas prices to make a recovery. There are reasons to believe that this may be correct.

Forward Strength In Crude Oil Prices

As we can see from the chart above, crude oil has been staging a rally since the start of July. In fact, it has now come very close to hitting its year-to-date peak that occurred back in April when the Organization of Petroleum Exporting Countries stated that it would begin cutting production in an attempt to bring oil production and consumption into balance.

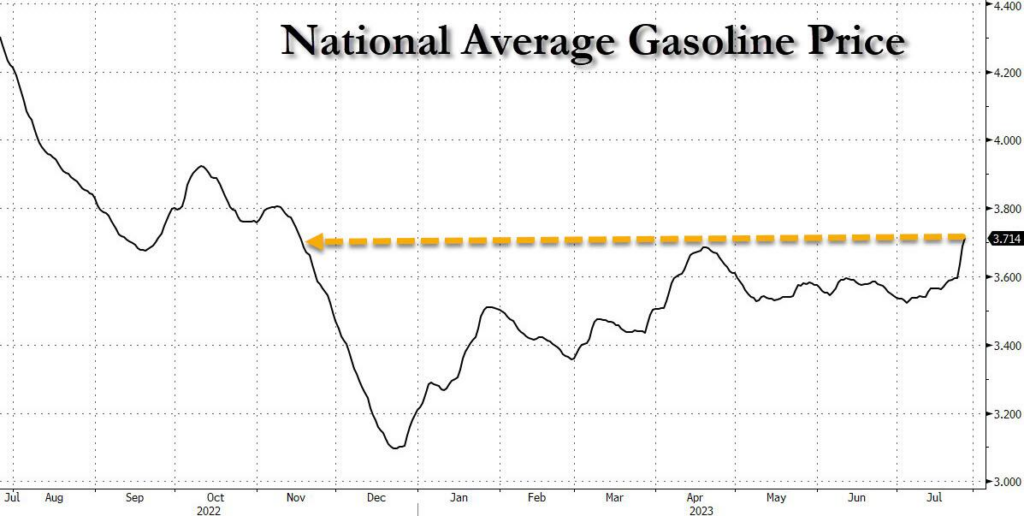

It appears that some progress has been made on this front. Last week, Zero Hedge reported that gasoline prices hit a year-to-date high in the United States:

(Click on image to enlarge)

Source: Zero Hedge

This is the second-highest level for the month of July over the past decade. The highest level, for those wondering, was hit in July of 2022. One of the biggest reasons for this spike in gasoline prices is that inventories are declining. According to the Energy Information Administration, American gasoline inventories fell by 800,000 barrels last week to a level that is 7% below the five-year average for this time of year. In addition to this, gasoline production was 9.5 million barrels last week, which is the lowest level that has been seen since 2015. I am quite certain that everyone reading this remembers the devastation that swept the oil market in 2015 when Saudi Arabia tried to maintain artificially low prices and destroy the American shale oil industry.

There are a few possible factors that are causing this weakness in both gasoline and crude oil. I discussed them in detail in a recent article, so for now, I will provide an updated summary.

First, China is injecting government support into its economy to try and increase the pace that it recovers from the effects of the country’s zero-tolerance policy over COVID-19, which ended earlier this year. According to a recent article on Zero Hedge,

Oil prices extended recent gains today – back near the OPEC-Cut levels from April – helped by tighter supplies and optimism that China’s government will boost the country’s economy. As Bloomberg reports, China, the world’s largest oil importer, indicated more support for the real estate sector alongside pledges to boost consumption on Monday.

China has been the wildcard in the oil supply-demand balance for most of this year, and I pointed that out in this blog numerous times over the past several months. This country’s recovery from its COVID-19 economic shutdowns, which were far more draconian than those in either the United States or Europe, has been weaker than many analysts and economists expected. The fact then that its government is injecting stimulus into the economy to get it growing at a much faster pace is creating optimism that this growth will boost the country’s consumption of crude oil. That would naturally increase the demand and given that supplies are already somewhat tight, could lead to a supply shortage in the second half of the year. The International Energy Agency currently projects this scenario as well. That would, obviously, drive energy prices higher during the second half of 2023.

Strategic Petroleum Reserve

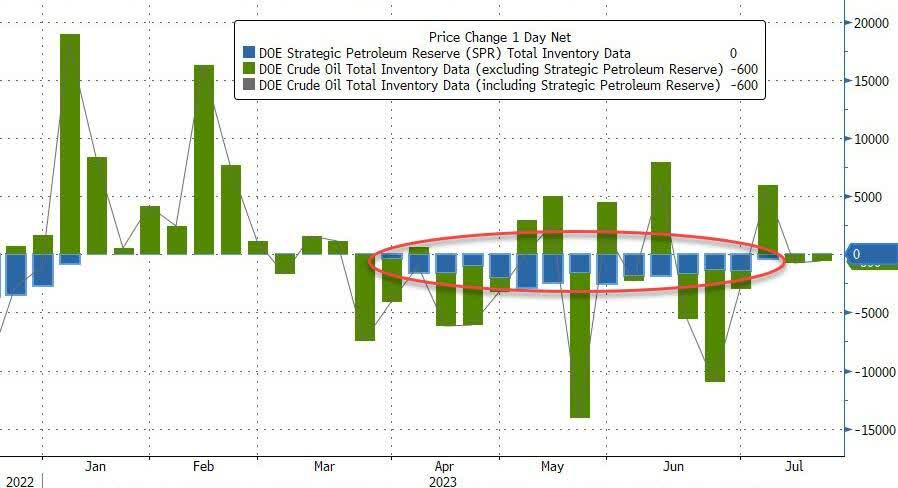

A second source of large incremental crude oil demand comes from the United States itself. As I have reported on before, the Biden Administration started selling crude oil from the Strategic Petroleum Reserve last year in an attempt to increase the supply of crude oil in the market and cause prices to fall. That strategy generally worked, and it was one of the reasons why prices began to decline last summer. The Administration consistently stated that it would begin buying crude oil to refill the Strategic Petroleum Reserve once prices reached $72 per barrel. That never actually happened. In fact, the Administration has not only not repurchased any crude oil to refill the national stockpile, but it resumed sales of crude oil in March, following a brief lull over the winter:

(Click on image to enlarge)

Source: Zero Hedge

These sales, which went on for fifteen straight weeks, occurred despite the fact that the previously stated $72 per barrel price had been breached. Curiously, we can see that the sales from the Strategic Petroleum Reserve stopped right about the time that energy prices started to rise last month. Thus, one could conclude that a very big reason for the crude oil price weakness that we saw in the first half of this year was caused by the United States government flooding the market with crude oil using the Strategic Petroleum Reserve!

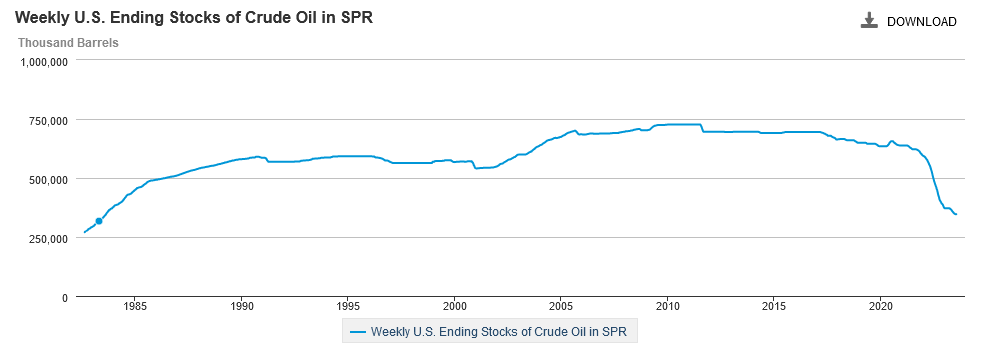

This also creates a source of crude oil demand for the second half of the year. As of July 21, 2023, there are 346.759 million barrels of crude oil remaining in the Strategic Petroleum Reserve. To put this in perspective, this is the lowest level since 1983:

(Click on image to enlarge)

Source: United States Energy Information Administration

It is obviously well below the 714 million barrels that the Strategic Petroleum Reserve is designed to hold. At some point, the national reserves will need to be refilled and that will obviously represent a very large new buyer entering the market. The question is when this will happen. The Biden Administration has suggested that it will begin refilling the reserves during the second half of this year. When we consider the sheer amount of oil that will need to be purchased to accomplish this task, we can see that this process could very easily take years to complete. However, it does seem rather unlikely that the United States government will attempt to manipulate prices downward anymore, given the limited amount of crude oil remaining in storage and the need to keep some on hand in the event of an actual emergency. Thus, we could start seeing fundamentals finally return to the energy market and those fundamentals all support a bullish narrative. Thus, there are some reasons to believe that crude oil prices will go up over the second half of this year.

More By This Author:

Consumers Continue To Face Considerable Financial Stress

Student Loans To Deliver Another Blow To Consumer Spending

U.S. Debt Ceiling Deal Could Be Good For Gold

Disclosure: I am long various energy-focused funds, but not one of them is mentioned in this article. I exercise no control over these funds and their holdings may change at any time without my ...

more