U.S. Debt Ceiling Deal Could Be Good For Gold

Over the Memorial Day holiday weekend, it was announced that Speaker McCarthy and President Joe Biden had reached a deal to resolve the debt ceiling impasse that has been weighing on the market for the past few weeks. That was not a surprise as neither side seriously wanted to entertain the possibility of the United States being unable to pay the bills that it has already accumulated and promised to pay.

The market had an interesting reaction to this as both gold and bitcoin were up significantly in pre-market trading on Tuesday morning. I commented on this on my Twitter feed:

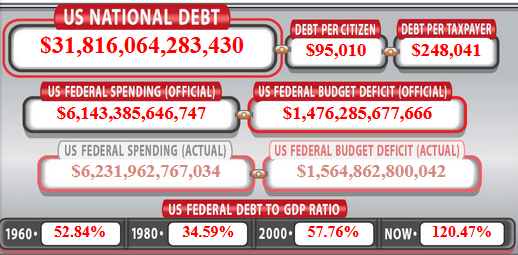

Ultimately, the end result of this deal is that the United States will continue to run a sizable deficit for the next few years. The exact estimates of the deficit vary, but most sources agree that it will allow the United States to add approximately $4 trillion in new debt over the next two years. As of the time of writing, the U.S. national debt stands at $31.8 trillion:

Source: USDebtClock.org

The United States is thus looking at a national debt of approximately $36 trillion by the end of Joe Biden’s presidential term. The question is who will finance this additional spending.

U.S. Debt Financing

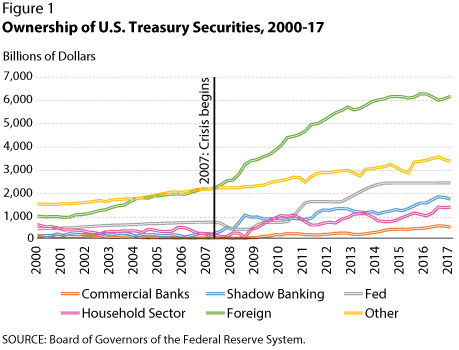

Obviously, some of the authorized spending will be paid for by foreign central banks. However, as I pointed out in a previous article, there is some evidence that foreign appetite for U.S. Treasury securities has been declining over the past decade. This is particularly true for a few countries that have historically been among the largest buyers of American Treasuries:

- Russia: It should be pretty obvious why the Russians are not particularly willing to fund the U.S. debt spending.

- China: China has its own agenda, which appears to be increasing its own dominance of the global economy at the expense of the United States.

- Japan: Japan’s aging population will reduce the amount of savings that the country has available to purchase U.S. Treasury securities.

- Saudi Arabia: Various reasons, including the fact that China is a much larger purchaser of crude oil from Saudi Arabia than the United States.

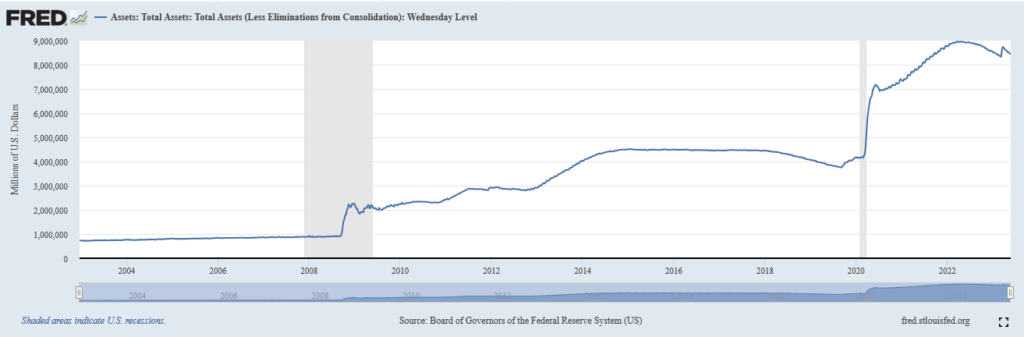

This reduction in international appetite for U.S. Treasuries has not gone unnoticed by the monetary authorities in the Eccles Building, although American politicians and the media continue to ignore it. This was one of the biggest reasons for the successive rounds of quantitative easing that occurred over the past decade. As we can see here, prior to 2008, the Federal Reserve’s balance sheet was relatively static at $800 billion to $900 billion. All that changed following the Great Financial Crisis:

(Click on image to enlarge)

Source: Federal Reserve Bank of St. Louis

If the economy truly recovered from that event, why did the central bank see the need to print a substantial amount of currency to purchase U.S. Treasury securities over the 2013 to 2014 period? That was about the time that things started to change. The Federal Reserve itself points this out:

Take a look at 2014. As clearly shown, foreign ownership of Treasury bonds stopped growing. As the United States certainly did not start running a balanced budget around that time, somebody had to step in and be the marginal buyer. That was the Federal Reserve.

The question today is who is going to step in today and continue to buy Treasury securities to allow the United States government to spend $4 trillion over the next two years? It will not be the Federal Reserve unless Chairman Powell wants to risk reigniting inflation. It will not be foreigners. The household sector may step in and buy some, but the majority of households with sufficient assets are approaching or already in retirement so it is difficult to believe that they will be able to keep growing their assets at sufficient levels needed to finance all of this.

The market right now appears to believe that the Federal Reserve will abandon its inflation fight and start monetizing the debt once again. This is the only possibility that I can think of as well, which will prove bullish for gold, cryptocurrencies, crude oil, and other commodities.

More By This Author:

Could The Oil Sell-Off Reverse? IEA Says Yes

The Market Continues To Look Overvalued

Traditional Energy Continues To Look Undervalued

Disclosure: I am long physical gold, bitcoin, and various energy-related funds.

Disclaimer: All information provided in this article is for entertainment purposes only. Powerhedge LLC is not a ...

more