Inflation - In Decline?

Earlier today, I encountered an article written by Brendan Brown of the Mises Institute. In this article, he appears to be suggesting that inflation was always going to decline following its initial spike due to the pandemic. His reasoning for this statement rests in a belief that the high inflation that we experienced in 2021 and much of 2022 was caused by supply-side disruptions that came about from the pandemic. To quote Mr. Brown:

Reported consumer price index (CPI) inflation has been falling in the US and Europe; but this has little to do with the advertised monetary tightening by the Federal Reserve, European Central Bank (ECB), and Bank of England.

Rather the decline in reported CPI inflation is consistent with a natural downward rhythm of prices, reflecting fading pandemic restraints on supply. In a good money system, the essence of which is the absence of monetary inflation, average consumer prices (as represented by the CPI) would have long ago returned to their prepandemic levels.

For his part, Mr. Brown does not appear to necessarily be incorrect here. The disruption to the supply chains due to the pandemic lockdowns almost certainly did have the effect of increasing prices. After all, the root cause of inflation is an increase in the money supply relative to the supply of actual economic goods. That is almost certainly the rationale that the economists at the Federal Reserve were using when they called inflation “transitory” back in 2021. In this respect, Austrian and Keynesian economists appear to be in agreement.

Mr. Brown does miss one very important factor that contributed to the falling consumer price index during much of the past year, however. That factor is commodity (specifically crude oil and natural gas prices).

The Root Cause Of Inflation

As I have pointed out in numerous previous articles and blog posts in the past, inflation is caused by the money supply increasing more rapidly than the production of goods and services in an economy. This is because such a situation implies that more units of currency are available to purchase a given unit of economic output. This is basically the law of supply and demand in action.

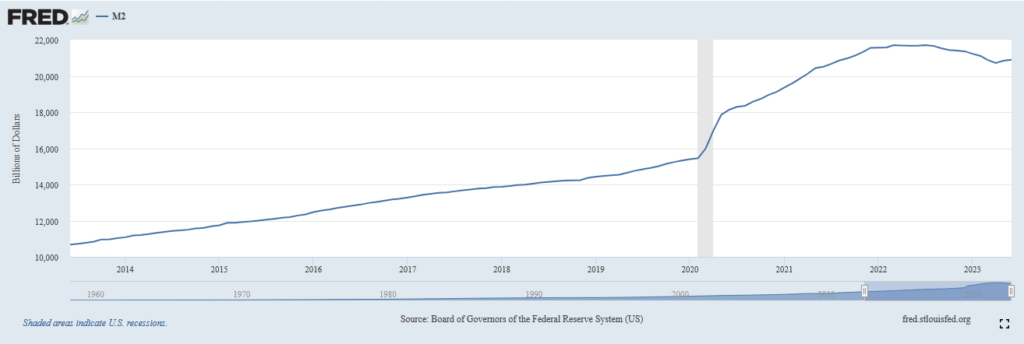

It goes without saying that the money supply has been growing much more rapidly than the economy over the past several years. We can see this quite clearly by looking at the M2 money supply, which is the measure that is usually used by the Federal Reserve’s own economists to measure the supply of money in the economy. This chart shows the M2 money supply over the past ten years:

(Click on image to enlarge)

Source: Federal Reserve Bank of St. Louis

As we can see, the M2 money supply went from $10.6787 trillion in June 2013 to $20.8895 trillion in June 2023 (the most recent date for which data is available). That works out to be a 95.62% increase over the ten-year period. We can see that the money supply was actually a bit higher back in the first half of 2022, but it has declined a bit since then due to banks cutting back on the provision of credit.

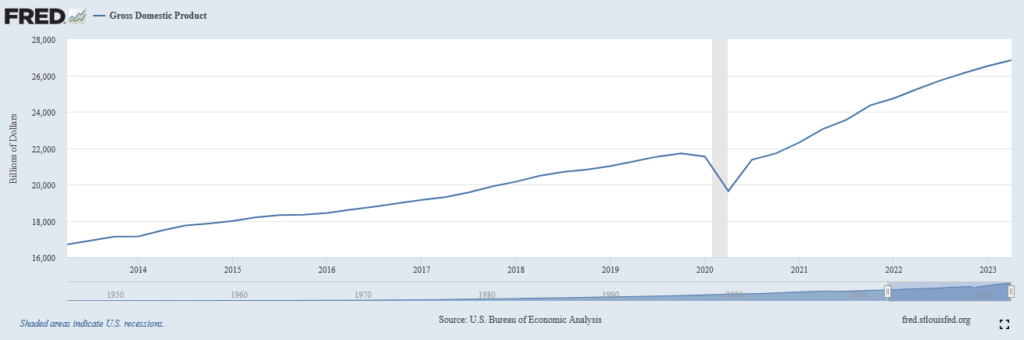

This is a much greater amount than the actual increase of goods and services produced by the economy. The usual way that we would measure that is by looking at the nation’s gross domestic product. This is shown here:

(Click on image to enlarge)

Source: Federal Reserve Bank of St. Louis

Over the ten-year period, the gross domestic product went from $16.699551 trillion to $26.834953 trillion. That is only a 60.69% increase over the period. We can therefore clearly see that the money supply increased by significantly more than the actual production of goods and services in the American economy. This is the root cause of the inflation that we are suffering from today.

It does appear that Mr. Brown realized this too, as he specifically refers to a “good money system” in the quote above. I will admit that I am not certain about what he means by that, but he might be referring to a system in which the money supply increases at about the same rate as economic output. It could also be referring to a gold-backed currency, since money supply growth in such a system is inherently restricted by the annual production of gold.

It is certainly true though that the inflationary conditions that have been building in the American economy ever since the Great Financial Crisis back in 2008 were exacerbated by the pandemic and the accompanying lockdowns. Prior to the lockdowns, most of the newly-created money remained in the hands of people that would invest it into financial assets as opposed to spending it. This is a big reason why the S&P 500 Index (SPY) increased by substantially more than the gross domestic product over that period. The various pandemic stimulus programs directly put money into the hands of people that would spend it, which they attempted to do once the lockdowns ended. When this is combined with the limited supply of certain goods and services that existed at the time, we ended up with an inflationary spike.

Commodity Prices

One of the factors that Mr. Brown overlooks in his analysis is that energy prices are a significant component of the consumer price index. Investopedia states that energy is about 7.3% of the consumer price index. Over the past year, crude oil and natural gas prices have declined.

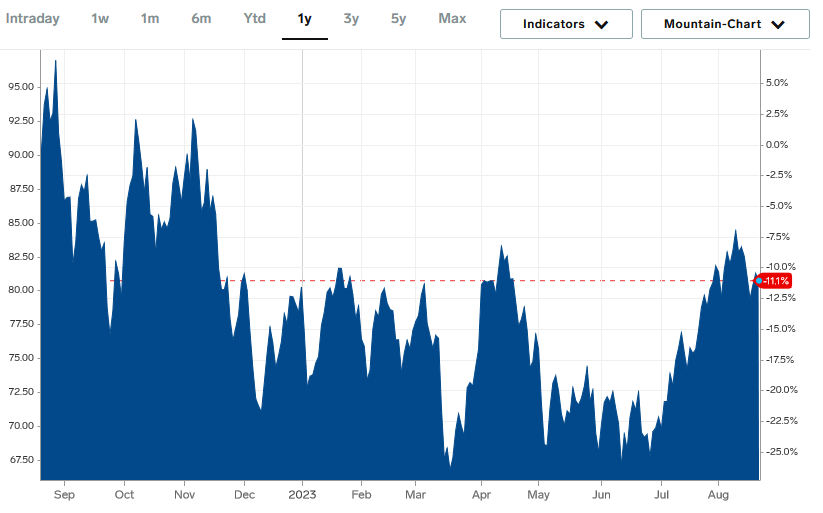

For example, consider the following chart of West Texas Intermediate crude oil prices over the past twelve months:

(Click on image to enlarge)

Source: Business Insider

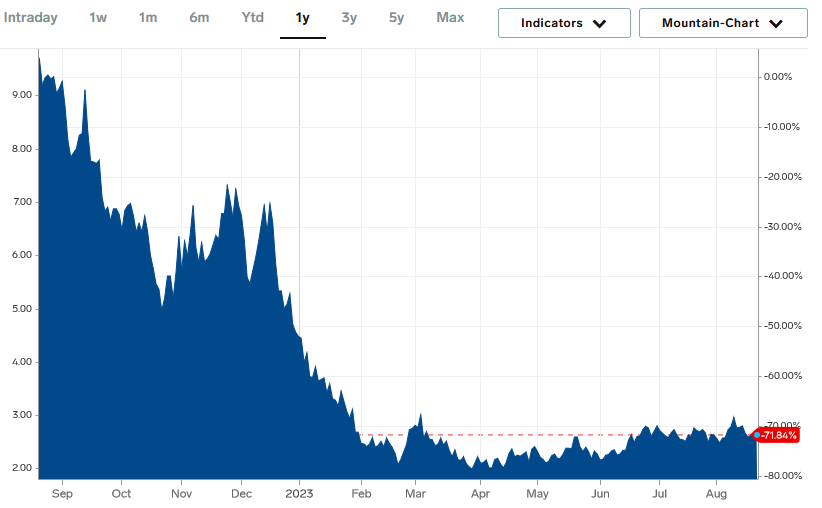

The decline in natural gas prices has been even more extreme, at least in the United States:

(Click on image to enlarge)

Source: Business Insider

This is the exact opposite of the situation that we had in 2022, in which both crude oil and natural gas prices reached their highest levels in years driven by the reopening of most Western economies and the outbreak of war in Ukraine. When we consider how significant the prices of these commodities are in the consumer price index, it should be fairly obvious how falling energy prices offset inflation elsewhere in the economy.

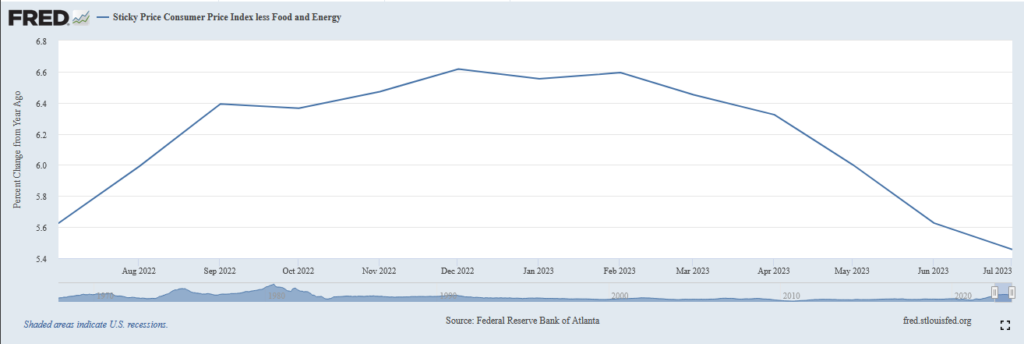

We can in fact see that in the fact that the sticky price consumer price index, which excludes food and energy prices, is still running at 5.45609% year-over-year:

(Click on image to enlarge)

Source: Federal Reserve Bank of St. Louis

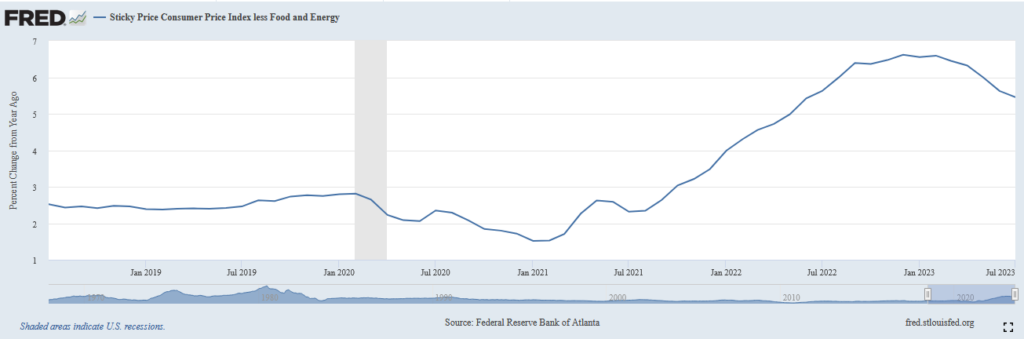

The rate of inflation, when measured by this index, is obviously running far hotter than the headline consumer price index. It too has been coming down somewhat, but the fact that this index never went above 6.61722% over the past five years should illustrate the impact that energy prices have on the headline numbers:

(Click on image to enlarge)

Source: Federal Reserve Bank of St. Louis

With that said, I do agree completely with Mr. Brown that the Federal Reserve’s monetary tightening policies has had very little effect on inflation so far. It appears that most of the inflation has been due to energy prices. Indeed, the Taylor Rule suggests that the federal funds rate needs to be far higher than it is currently in order to truly bring prices back down to the level at which the Federal Reserve desires.

More By This Author:

Making The Case For High Oil Prices

Consumers Continue To Face Considerable Financial Stress

Student Loans To Deliver Another Blow To Consumer Spending

Disclaimer: All information provided in this article is for entertainment purposes only. Powerhedge LLC is not a licensed financial advisor and no information provided should be construed as ...

more