KRE Shorts, Having Aggressively Built Position

Post-SVB collapse, community and regional banks have come under shorts’ attack. Bruised KRE, having sliced through the neckline of a head-and-shoulders formation last month, has more to go on the downside should the pattern complete.

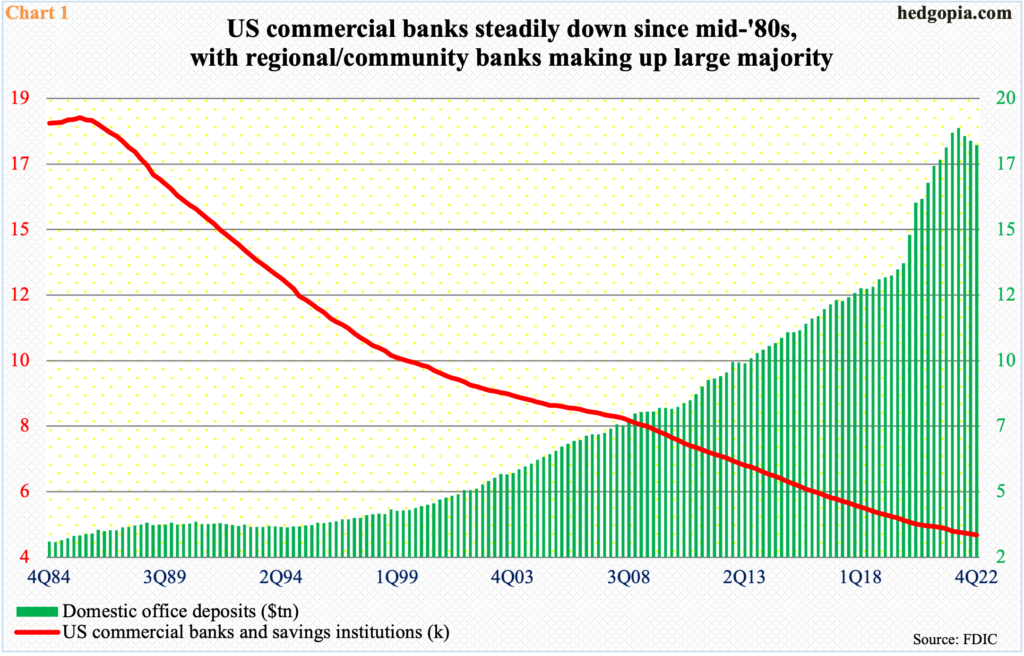

The number of commercial banks in the US is substantially down over the decades. In 1Q86, there were 18,083 of them. By 4Q22, this had shrunk to 4,706 (Chart 1), the majority of which is made up of small and mid-size community and regional banks.

Asset-wise, the Big Four – JP Morgan (JPM, $3.2 trillion), Bank of America (BAC, $2.4 trillion), Citibank (C, $1.8 trillion), and Wells Fargo (WFC, $1.7 trillion) – of course, dominate. Combined, as of 4Q22, they accounted for $9.1 trillion, which is 38.6 percent of the total commercial bank assets of $23.6 trillion. Leaving aside the front of the pack, a whopping 4,656 were under $50 billion; of this, 3,725 were under a billion, and 761 were under $100 million.

In 4Q22, these banks held $17.7 trillion in domestic office deposits. Once again, the leading ones obviously own a big chunk of this. But the role played in the economy by the hundreds of small banks with a small deposit base is no small. Yet, right here and now, they have their back against the wall.

The Silicon Valley Bank fiasco early last month has motivated many a depositor to yank their money out of small banks and seek the “safety” of large banks. First Republic Bank (FRC) is the latest victim of this. In March, the San Francisco bank lost $100 billion in deposits. It is reportedly weighing up to $100 billion in asset sales. Survival has become a question mark.

This uncertainty is weighing heavily on KRE (SPDR S&P Regional Banking ETF). It reached an all-time high of $76.30 in January last year, with a lower high of $67.37 last August and $64.77 this February. Come March, it began to fall apart, slicing through the neckline of a head-and-shoulders pattern (Chart 2).

For six weeks, KRE went sideways just above $41. With two sessions to go this week, it is at risk of losing this support. It closed out Wednesday at $41.16, having tagged $40.67 intraday and $40.77 intraday Tuesday. If the head-and-shoulders pattern completes, bears will be eyeing mid-$30s.

And they are putting their money where their mouth is.

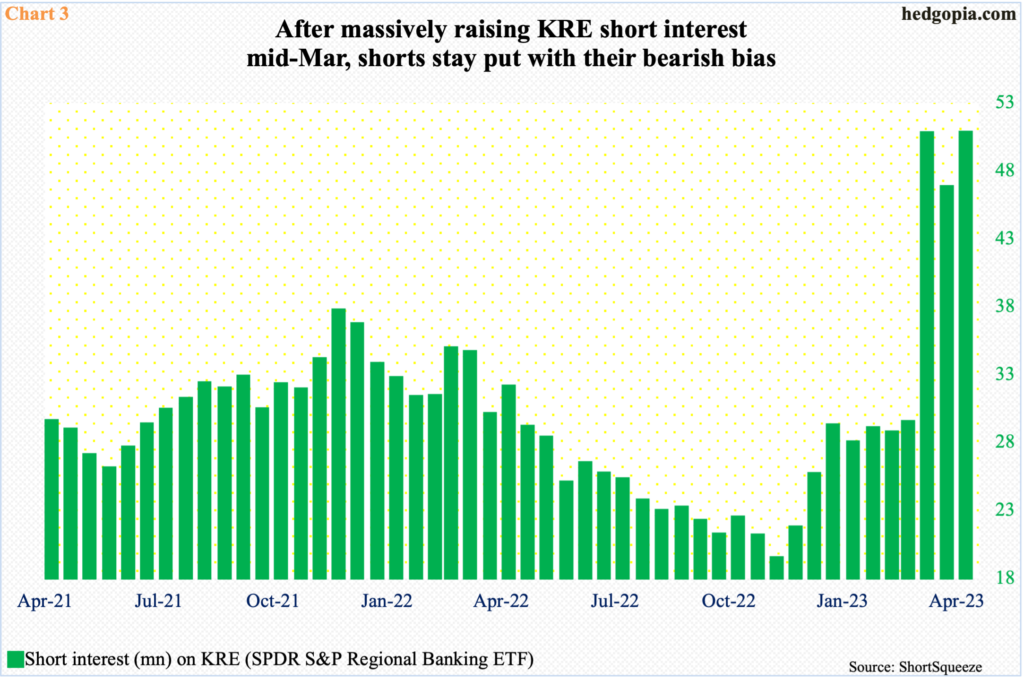

At the end of February, short interest on KRE stood at 29.2 million. In the next period – that is, by mid-March – this shot up to 50.4 million, followed by a drop to 46.5 million at the end of March and then rebounded to 50.5 million by mid-April (Chart 3).

Shorts are staying put. They probably expect the head-and-shoulders pattern to complete, in which case the ETF has a shot at the mid-$30s.

More By This Author:

Big Tech Ready To Report – Make-Or-Break For Tech-Heavy Indices

CoT: Peek Into Future Thru Futures, Hedge Funds Positionings

CoT Report: Peek Into Future Through Futures, How Hedge Funds Are Positioned

Disclaimer: