The Perils Of Forecasting Inflation

“It's tough to make predictions, especially about the future.” .... Yogi Berra

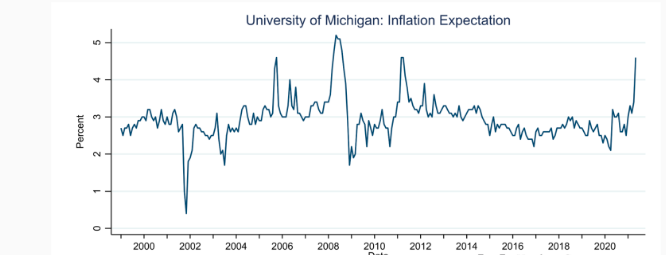

No truer words were said when it comes to predicting inflation over, say, the next 6 months. Monetary policymakers are obsessed with measuring the changes in inflation expectations as the world grapples with supply shortages driving up producer and consumer prices. The bump in long term bond yields is often cited as an example of how investors now anticipate continued upward pressures on prices. The change in expectations is an example of ‘recency bias ‘, best defined as placing greater emphasis on the most recent event. Recent price upsurges means that prices will continue to surge, or as so many believe. Today, analysts are looking at the supply restrictions in commodities production and their impact on manufacturing and proclaim that we can expect a continuation of inflationary pressures.

Let’s just put aside recency bias and try to be more objective when it comes to dissecting what goes into affecting inflation. So, what do we know about the current forces affecting price changes?

To begin with, COVID-19 has introduced a one-time shift in the cost of production. The introduction of mandatory vaccinations means activities, such as air travel, will have an additional layer of costs to incorporate. But this is not inflation, just a one -time shift in the general price level, thereafter there is no more price increases related to COVID restrictions since they will have integrated fully in the production function.

The growth in aggregate demand has definitely slowed. Incoming data indicates that consumption is slowing and growth is assuming a pattern similar to the years preceding the pandemic. More significantly, savings rates remain quite elevated and consumers are not about to go on any buying binge ( myth of pent up demand). Banks are sitting on excess supply of deposits as consumers exercise considerable caution, given a very uncertain outlook.

The business sector has been far more restrained regarding capital expenditures than many expected, especially in a world of supply shortages. Here again, uncertainty continues to plague the economy in one of its most important sectors. Finally, the only component of aggregate demand that has any impact on the economy is government expenditures in the form of an unparalleled degree of transfer payments to prevent a total collapse. However, governments have already started to pull back on support payments and this will contribute to a slow down in economic activity. Government subsidies managed to fill a hole, but has yet to provide stimulus for future growth.

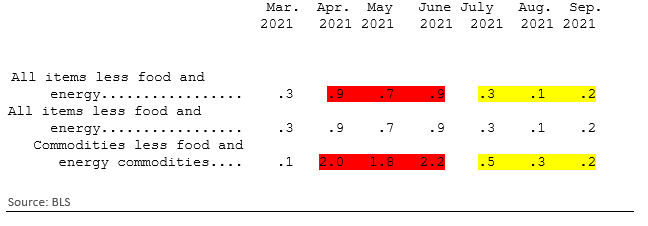

Much of the anxiety over inflation relates to the run up in energy prices. But this is just short run problem as production and distribution recovery from shutdowns during the depth of the pandemic in 2020. We have seen this movie before (e.g., in 2007 when oil hit $140 and then collapsed to $40 by 2008). Moreover, energy plays a smaller role in the economy than it did in the '70s and so that invalidates any comparison to the stagflation experienced in that decade. A more relevant measure of inflation is the increase experienced month-over-month. Excluding food and energy---the most volatile components—have been declining over the past quarter. Recency bias now suggests that price increases are moderating and in many areas are declining.

"Excluding food and energy" is certainly a way to make the inflationnlook less real. Those are the non-disgression parts of our basic cost of living. Eating is habit forming and most folks simply can not kick the habit. And energy for lighting and heat just seems so very basic a need these days.

AND those prices jumped and kept growing, and still keep growing. And cars seem to be getting more expensive every day, also. Now there is some argument about the cause, but does the massive amounts the fed is handing out have any effect, do you suppose? SPREADING MORE MONEY AROUND DOES LEAD TO THE PRICES OF EVERYTHING BEING BID TO HIGHER LEVELS. Why is that so hard for some to understand??

Govt spending is NOT the source of inflation. You have to look at revenues less spending--the deficit- in govt. That deficit is very small relative to the size of the economy is less than 10%. The inflation from shortages as we restart the economies is the source of inflation.

Possibly this time, with spending intended to protect those folks who are suffering, all of that money will not lead to immediate inflation, and possibly some of the price increases are indeed caused by shortages. But dumping an extra 10% of cash into the mix is certainly going to have an impact. Not every poison acts immediately, after all.

So while some of the immedite increases are caused by shortages, and folks having the money to pay those increased prices, the fact is that for the past hundred years or so, it is federal reserve actions that have reduuced the purchasing power of our money. Most of that time nothing was in short supply while the economy kept inflating. You know that and I know that. And we also know that the fed has stated that their policy is to always push for some inflation. So why defend what we all know has been the cause every time in the past??

Right on Norman. The problem with these so called temporary shocks (oil prices, some agriculture products, etc.) is that we dont have a good handle on how long it itakes to return to supply normalcy.

Your perpective on weakening econmic demand is also important.