Daily Market Outlook - Thursday, March 27

Image Source: Unsplash

Asian stocks declined after President Donald Trump announced a 25% tariff on US auto imports, prompting investors to reduce risk exposure amid concerns over growth in the world's largest economy. Shares of automakers also fell. The MSCI regional benchmark dropped, though Hong Kong shares posted gains. US equity-index futures and European markets are under pressure. The evolving US trade sanctions on both allies and adversaries have amplified market uncertainties, leaving investors grappling with the potential impacts on global trade and economic performance. Just two months into Trump’s presidency, market sentiment has turned cautious, with optimism tempered and the Federal Reserve signalling no immediate urgency to adjust interest rates. Trump issued an order enforcing a 25% tariff on all automobiles not manufactured in the US. In a statement released later on Wednesday, he confirmed the tariffs would take effect at 12:01 a.m. Washington time on April 3. In a Truth Social post, Trump reiterated his stance, threatening further tariffs on the EU and Canada if they acted against US interests.

European auto stocks fell sharply on Thursday after President Trump announced new tariffs on imported cars and light trucks. The move sent shockwaves through the auto sector, hitting shares of Asian car manufacturers and triggering strong reactions across the industry. German automakers, including Mercedes-Benz, BMW, and Porsche, are expected to bear significant pressure from the policy change. The European automobiles and parts index plunged to a seven-week low on Wednesday, with further declines likely. Volkswagen, the region's largest automaker, appears especially vulnerable, as 43% of its U.S. sales come from Mexico, according to S&P Global Mobility. In 2022, European carmakers exported around 800,000 vehicles to the U.S.—a figure nearly four times greater than U.S. car exports to Europe. Chrysler's parent company Stellantis and Volvo Cars are also expected to draw attention amid the unfolding developments. The European Commission stated it would assess Trump’s tariffs while continuing to seek negotiated solutions and safeguarding its economic interests. Prolonged auto tariffs could significantly raise the cost of an average U.S. vehicle by thousands of dollars. Research by GlobalData reveals that nearly half of all cars sold in the U.S. last year were imports. Investors are also anticipating reciprocal tariffs, expected to be announced next week. Trump hinted these measures might differ from the equivalent levies he had previously pledged to impose.

In the UK, the Spring Statement announced a smaller-than-expected gilt sales programme of £299.2 billion for 2025-26, easing market concerns by staying under £300 billion and reducing the share of long-dated gilts, thus lowering interest rate risks. However, the five-year fiscal outlook raises questions. The Chancellor’s slim £9.9 billion headroom under fiscal rules and upgraded GDP growth forecasts (1.7%-1.9% from 2027) rely on productivity rebounding from 0.3% to 1.1%. The OBR warns that if productivity stagnates, the current budget surplus of 0.3% (£9.9 billion) could swing to a 1.4% GDP deficit (£48 billion). Market focus may soon shift from the 2025-26 remit to underlying fiscal vulnerabilities ahead of the autumn budget.

Today's macro slate features US Q4 GDP, IJC, home sales, and events from the Kansas City Fed. Notable central bank speakers include BoE's Dhingra, ECB's Guindos, Villeroy, Escriva, Schnabel, Lagarde, and the Fed's Barkin.

Overnight Newswire Updates of Note

- Trump’s Auto Tariffs Reduce Likelihood Of BoJ Rate Hike In May

- Goldman Sees Limited Hit From Trump’s 25% Auto Tariffs On Japan

- Trump’s Cuts To US Govt Raise Worries Over Economic Data Quality

- Gold Awaits US PCE Inflation Data For A Sustained Move Higher

- European Companies Rush To Tap Defence Spending Boom

- European Oil Traders Weigh Russia Return In Market Reshaped By War

- BP Receives Final Green Light From Iraqi Government For Kirkuk Project

- China Banks Ramp Up Bad Property Loan Disposals To Boost Economy

- China’s Industrial Profits Slip On Deflationary Pressures, Tariff Risks

- Australia Rushes Through Tax Cuts As Election Speculation Grows

- Australia’s Bond Demand Gauge Relative To Supply Falls To Record Low

- Bets On US Weakness Are Fueling A Rally Across Emerging Markets

- Ex-Intel Chief: TSMC’s $100B Trump Pledge Won’t Revive US Chipmaking

- OpenAI Close To Finalizing Its $40B SoftBank-Led Funding

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0750 (1.8BLN), 1.0770 (408M), 1.0800 (2.7BLN)

- 1.0820-25 (2.1BLN), 1.0850-55 (1.8BLN), 1.0900 (741M)

- 1.1000 (976M)

- USD/CHF: 0.8645-50 (520M), 0.8800 (340M), 0.8870 (325M)

- EUR/GBP: 0.8465 (1.7BLN), 0.8600 (1.5BLN)

- GBP/USD: 1.2800 (665M), 1.2900 (1.1BLN), 1.2960 (324M)

- 1.3075 (491M), 1.3090 (290M)

- AUD/USD: 0.6220 (896M), 0.6260-65 (622M), 0.6300-05 (591M)

- 0.6325-30 (775M), 0.6350 (248M), 0.6400 (451M)

- NZD/USD: 0.5710 (254M). AUD/NZD: 1.0975 (292M)., 1.1000 (200M)

- USD/CAD: 1.4300 (259M), 1.4350 (395M)

- USD/JPY: 149.30 (377M), 150.0 (1.1BLN), 150.50 (354M)

- 151.00 (410M)

Banks are now issuing signals for FX hedge rebalancing at the end of the month and quarter. Models indicate a strong demand for the USD in both scenarios. The Barclays model highlights significant demand for the USD against all major currencies at month-end. Conversely, the quarter-end model, which utilizes the same methodology, reflects a moderate signal against all major currencies. Nonetheless, this model also forecasts a robust demand for the USD compared to the EUR. It's worth noting that short-term expiry FX options have been set up for potential setbacks in the EUR/USD.

CFTC Data As Of 21/3/25

- In the foreign exchange markets speculative traders have adopted a bearish stance on the US dollar. The euro holds a net long position of 59,425 contracts, while the Japanese yen leads with a net long position of 122,964 contracts. In contrast, the Swiss franc shows a net short position of -34,375 contracts, and the British pound maintains a net long position of 29,402 contracts. Bitcoin's net long position is modest at 1,841 contracts.

- In the bond market, speculators have reduced the net short position for CBOT US Treasury bond futures by 20,694 contracts, bringing it down to 13,510. Similarly, the net short position for CBOT US Ultrabond Treasury futures has decreased by 4,236 contracts to a total of 247,158. For CBOT US 2-Year Treasury futures, the net short position has been trimmed by 1,659 contracts, now standing at 1,220,556. However, the net short position for CBOT US 10-Year Treasury futures surged by 144,299 contracts to reach 881,374, while CBOT US 5-Year Treasury futures saw an increase of 32,573 contracts, totaling 1,905,940.

- In the equities market, equity fund managers reduced their net long position in the S&P 500 CME by 9,572 contracts, bringing it to 832,269. Meanwhile, equity fund speculators cut their net short position by 9,127 contracts, now totaling 195,491.

Technical & Trade Views

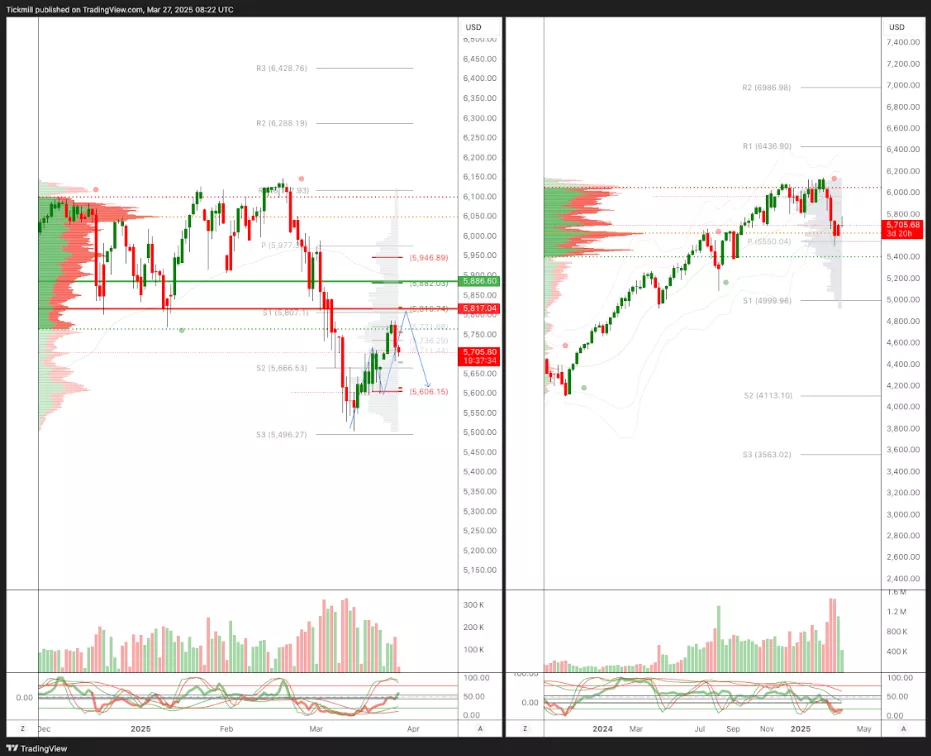

SP500 Pivot 5790

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into late April

- Above 5885 target 5950

- Below 5815 target 5415

(Click on image to enlarge)

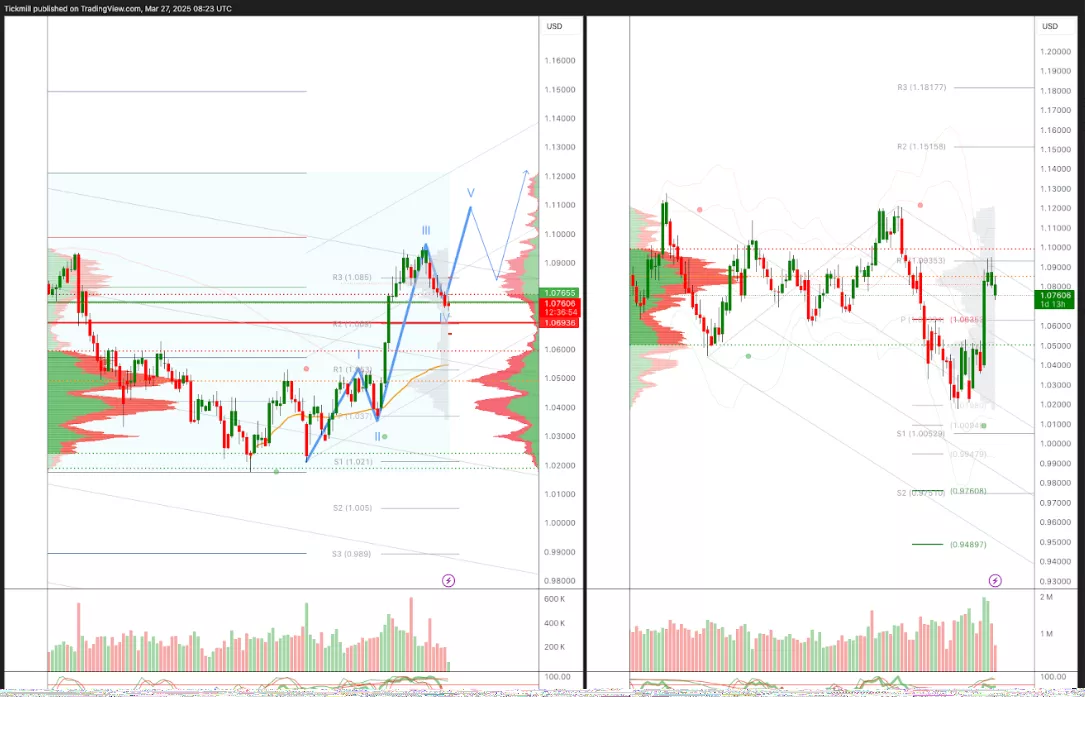

EURUSD Pivot 1.0750

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0750 target 1.11

- Below 1.0690 target 1.0550

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

USDJPY Pivot 150.50

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 1.52 target 153.80

- Below 150.50 target 145

(Click on image to enlarge)

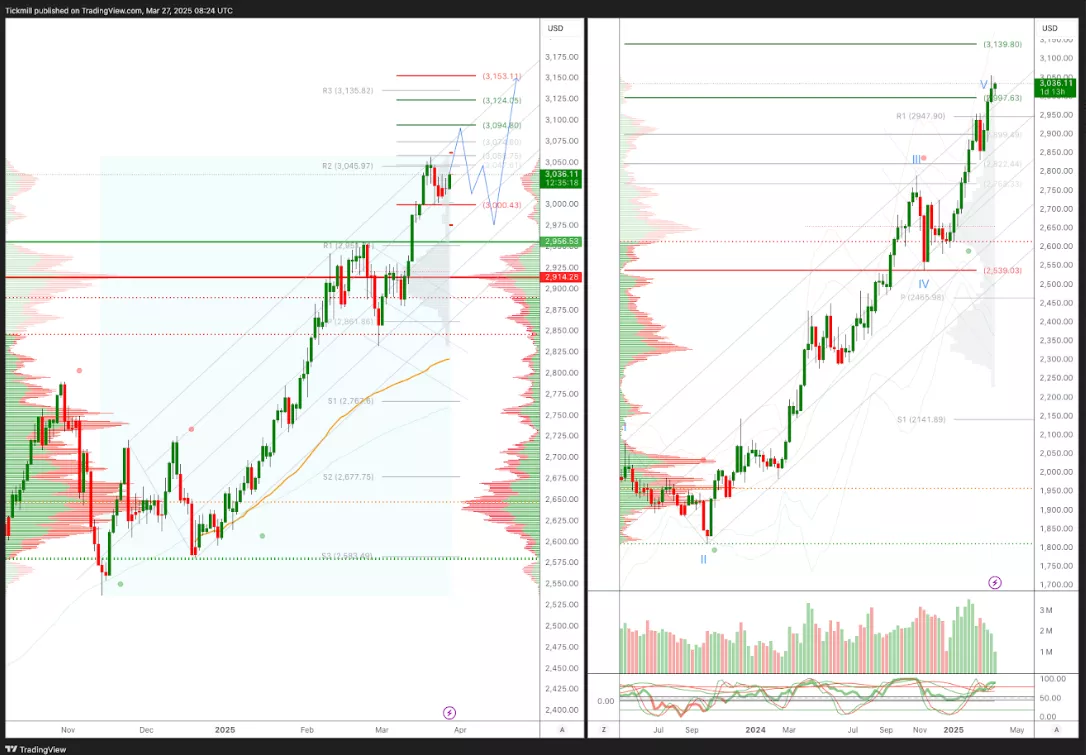

XAUUSD Pivot 2950

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late March

- Above 2900 target 3100

- Below 2880 target 2835

(Click on image to enlarge)

BTCUSD Pivot 90k

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, March 26

Daily Market Outlook - Wednesday, March 26

The FTSE Finish Line - Tuesday, March 25