The FTSE Finish Line - Tuesday, March 25

Image Source: Pexels

On Tuesday, the UK's FTSE 100 posted a modest gain, buoyed by strength in homebuilder and energy stocks as investors braced for key economic data and a budget update later in the week. The blue-chip index climbed 0.35% by the close. Among homebuilders, Barratt, Redrow, Persimmon, and Taylor Wimpey rose between 1% and 1.3%, while Bellway outperformed with a 2.4% jump after reporting a 12% increase in half-year profits, attributed to lower mortgage rates and improved consumer confidence. In contrast, Kingfisher tumbled 12.3%, marking the steepest decline on the index, after the home improvement retailer revealed a 7% drop in annual profits. Energy stocks advanced 1.7%, supported by a fifth consecutive day of rising oil prices amid expectations of tighter global supply following U.S. tariffs on nations purchasing Venezuelan crude. Shell emerged as a top performer, benefiting from its enhanced shareholder distribution strategy and a reduced spending forecast, solidifying its position as the world's largest liquefied natural gas trader.

Investors are closely watching UK inflation data and the U.S. Personal Consumption Expenditure (PCE) index—widely regarded as the Federal Reserve's preferred inflation gauge—both due later this week. Additionally, British Finance Minister Rachel Reeves is set to unveil an updated forecast from the Office for Budget Responsibility on Wednesday, with projections indicating a sharp cut to Britain's 2025 growth outlook, from 2% to approximately 1%, according to the Financial Times. Markets remain vigilant over potential global economic fallout from reciprocal tariffs proposed by U.S. President Donald Trump.

Single Stock Stories & Broker Updates:

-

Shares of Segro rise 3.21%, becoming the top gainer on FTSE 100 after announcing a joint venture with Pure DC to develop a £1bn data centre in Park Royal, London. The project is expected to yield 9%-10%, with Segro's cash equity contribution around £150m. CEO David Sleath anticipates an attractive risk-adjusted return and enhanced expertise. Stock is down ~1.45% YTD.

-

Kingfisher's shares fell 13.5%, the largest loser on FTSE 100, after a 7% drop in annual adjusted profit to £528 million due to weak demand for big-ticket items. Annual sales fell 1.5% to £12.8 billion, but market share grew in key regions. The company announced a £300 million share buyback and expects FY 25/26 adjusted PBT between £480 million and £540 million. Year-to-date shares are up 12.5%.

-

Shares of IP Group fell 6.6%, making it the top loser on London's mid-cap index. The company reported a 15% decline in net asset value per share for the year ended December 31 and a loss before taxation of 206.7 million pounds, compared to 176.3 million pounds the previous year. CEO Greg Smith expressed confidence in generating over 250 million pounds from exits by 2027. The stock has dropped 17.6% year-to-date.

-

Morgan Sindall's shares rose 10.2% to 33.5 pounds, on track for their highest one-day gain since October 2024. The company expects full-year results to slightly exceed the market consensus of 178 million pounds in adjusted pretax profit. Its Fit Out division is expected to surpass both previous expectations and the top end of its revised medium-term targets of 60-85 million pounds. Brokerage Panmure Liberum noted that the early update indicates confidence. However, shares have fallen about 22% this year.

-

Shares of Smiths Group rose 4.7%, becoming a top gainer on London's blue-chip index after reporting a 9.5% rise in operating profit to £269 million for the six months to Jan. 31, below analysts' forecasts of £271 million. The company plans to stay listed in the UK and has acquired a U.S. metal duct manufacturer for $40.5 million. SMIN reaffirmed its FY2025 outlook of 6-8% organic revenue growth and a margin expansion of 40-60bps, with stock up approximately 16% year-to-date.

-

Tullow Oil's shares rise 3.6% as the company reports a profit after tax of $55 mln for the year ended December 31, reversing a $110 mln loss in 2023. The profit is attributed to lower impairments and asset revaluation gains. Tullow also agreed to sell its Gabon interests for $300 million to reduce debt, impacting FY26 FCF by decreasing it from $139 mln to $12 mln, assuming a $70 per barrel oil price. However, shares are down 34.7% YTD.

-

Fevertree Drinks shares rose 8.9% after reporting an annual profit slightly above expectations, with adjusted core profit of £50.7 million, surpassing the £50.6 million forecast. The company anticipates a "transition year" for its U.S. business in 2025 and has extended its buyback program by £29 million. Year-to-date, the stock is up approximately 105%.

Technical & Trade View

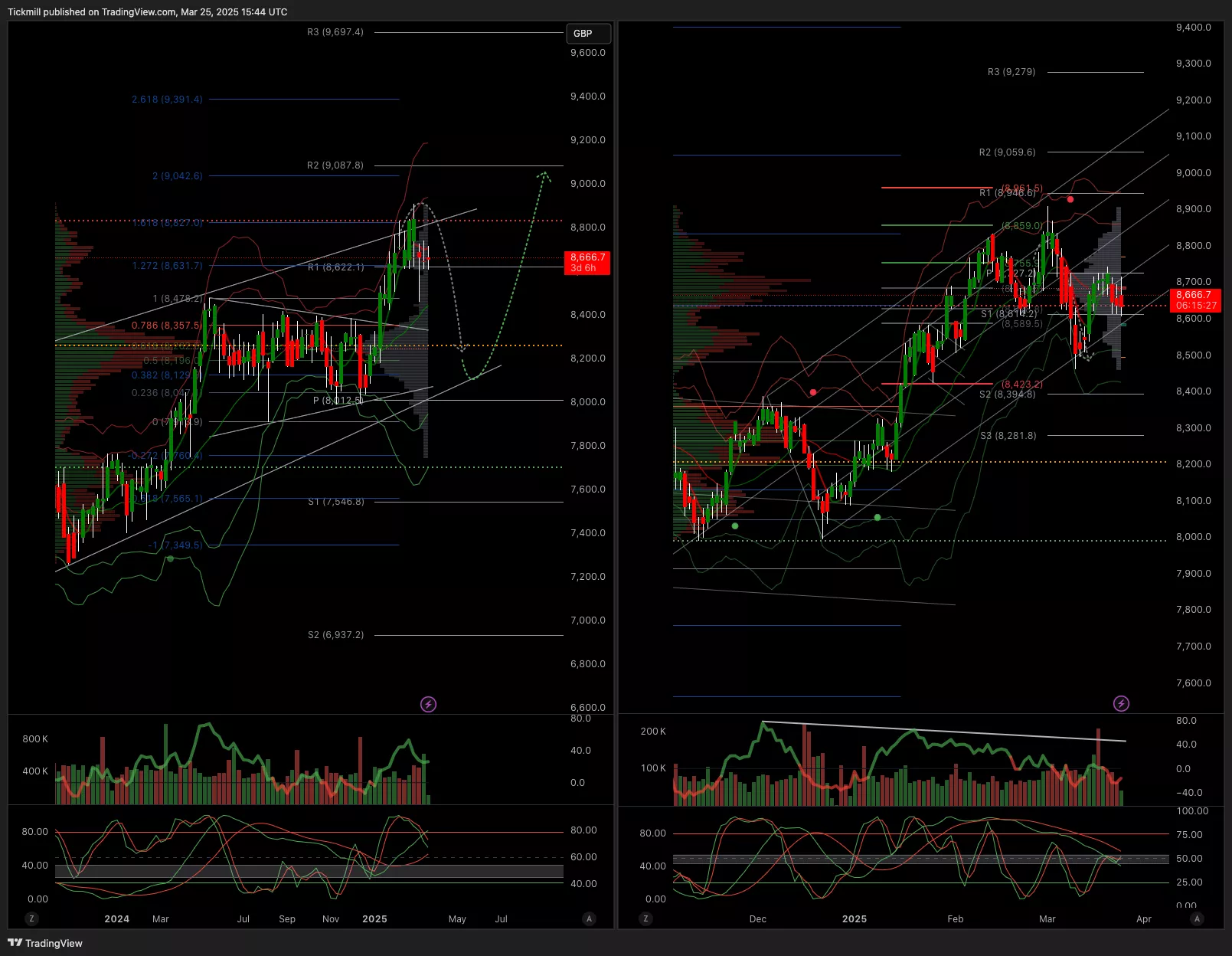

FTSE Bias: Bullish Above Bearish below 8950

- Primary support 8700

- Below 8700 opens 8600

- Primary objective 9050

- Daily VWAP Bearish

- Weekly VWAP Bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, March 25

The FTSE Finish Line - Monday, March 24

Daily Market Outlook - Monday, March 24