Daily Market Outlook - Tuesday, March 25

Image Source: Pexels

Chinese stocks experienced the largest declines in Asia, as local markets struggled to maintain the positive momentum generated by earlier expectations of reduced tariffs in April. A key index tracking Chinese tech stocks in Hong Kong dropped as much as 3.8%, marking its steepest fall in three weeks, with Alibaba Group Holding and Xiaomi among the hardest hit. Futures for US and European equity indices dipped slightly. Additionally, cryptocurrencies fell, and the yield on 10-year Treasury bonds decreased by 1 basis point to 4.33%. Recent trading in Chinese equities has been volatile, as investors grow increasingly cautious about corporate developments following a remarkable rally. Global markets, anxious about the economic repercussions of a severe trade conflict, found some relief from indications that the upcoming US tariff measures would be more targeted than the broad threats previously issued by President Donald Trump. Xiaomi, based in Beijing, saw its shares tumble by as much as 6.6% after announcing a fundraising initiative involving the sale of shares at a discount. The stock had surged over threefold from a low in August, making it the top performer on Hong Kong’s Hang Seng Index. Alibaba fell by over 3% after its chairman cautioned about a potential bubble in datacentre construction.

The flash March PMIs by S&P Global reveal stagnant or contracting activity across most European surveys, though at a slower pace, with widespread but slightly easing price growth. The UK stands out, as manufacturing weakened significantly (-2.3pts to 44.6) while services expanded (+2.2pts to 53.2). Elevated UK service sector price indices largely reflect rising labour costs due to upcoming April tax changes. Despite a 4-point rebound in the UK employment index, it remains in job-loss territory at 47.3, though labour market indicators show signs of stabilising. The services-led rise in the UK composite PMI, coupled with modest price easing, supports the MPC's "gradual and cautious" stance.

USD long positioning appears fragile but not extreme. Since the start of the year, markets have shifted from USD longs to a net short position, favouring yen and euro while maintaining some preference for USD over CAD and antipodean currencies. Non-commercial CME FX contracts now show a $10 billion net USD short, higher than last September but far below historical bearish peaks of $30 billion. Most long positions were initiated above EUR/USD 1.0800, leaving them vulnerable to near-term corrections, especially given rate differentials. Nonetheless, from a broader perspective, the market isn’t overly stretched, and key USD-negative factors remain intact. Any USD rebound would likely be corrective.

Today's agenda highlights the UK CBI survey, Germany's IFO report, US housing data, and consumer confidence metrics. Key central bank speakers include Holzmann, Nagel, Kazmir, and Vujcic from the ECB, as well as the Fed's Williams. Dominating the market landscape, however, is the ongoing situation with tariffs—those already in place, newly proposed, and anticipated—and their potential to hinder economic growth in the United States. Even if market reactions remain subdued for now, global trade conflicts are expected to stay at the forefront of attention.

Overnight Newswire Updates of Note

- ECB’s Escriva: Downside Risks Are Outweighing Upside Risks

- UK Chancellor Braces For Spring Statement On The Start Of Fiscal News

- UK Watchdog To Cut Financial Sector Rules After Calls From Business

- UK ‘Boost’ Of £2B For Affordable Homes Marks A Reduction

- Industry Body: Half Of UK Oil, Gas Demand Can Be Produced At Home

- Volkswagen's $1.4B Tax Bill In India

- Bayer Ordered To Pay $2.1B In Latest Roundup Weedkiller Loss

- Hyundai To Invest $20B In US Manufacturing

- Ark Investment’s Cathie Wood Sticks With Tesla, Predicts Rise To $2,600

- US Farmers Express Dismay Over Proposal Levies On China-Built Ships

- China Explores Services Subsidy To Boost Weak Domestic Demand

- BoJ Jan Meeting Minutes, One Member: 1% Rate Desirable In 2H FY25

- Aussie Treasurer Chalmers Promises To Deliver ‘Responsible’ Budge

- Ethereum Faces ‘Midlife Crisis’ As Rivals Play Catch-up

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0700 (392M), 1.0750 (777M), 1.0850 (1.4BLN), 1.0860-75 (1.2BLN)

- 1.0900 (1.3BLN)

- USD/CHF: 0.8725 (350M), 0.8815 (710M)

- GBP/USD: 1.2700 (377M), 1.2835 (577M), 1.2970 (266M)

- AUD/USD: 0.6255-65 (878M), 0.6300 (445M), 0.6350-60 (1.3BLN)

- NZD/USD: 0.5740 (282M), 0.5850 (305M)

- USD/CAD: 1.4230-45 (520M), 1.4280 (200M), 1.4470 (220M)

- USD/JPY: 148.50 (370M), 151.00 (310M)

Banks are now issuing signals for FX hedge rebalancing at the end of the month and quarter. Models indicate a strong demand for the USD in both scenarios. The Barclays model highlights significant demand for the USD against all major currencies at month-end. Conversely, the quarter-end model, which utilises the same methodology, reflects a moderate signal against all major currencies. Nonetheless, this model also forecasts a robust demand for the USD compared to the EUR. It's worth noting that short-term expiry FX options have been set up for potential setbacks in the EUR/USD.

CFTC Data As Of 21/3/25

- In the foreign exchange markets speculative traders have adopted a bearish stance on the US dollar. The euro holds a net long position of 59,425 contracts, while the Japanese yen leads with a net long position of 122,964 contracts. In contrast, the Swiss franc shows a net short position of -34,375 contracts, and the British pound maintains a net long position of 29,402 contracts. Bitcoin's net long position is modest at 1,841 contracts.

- In the bond market, speculators have reduced the net short position for CBOT US Treasury bond futures by 20,694 contracts, bringing it down to 13,510. Similarly, the net short position for CBOT US Ultrabond Treasury futures has decreased by 4,236 contracts to a total of 247,158. For CBOT US 2-Year Treasury futures, the net short position has been trimmed by 1,659 contracts, now standing at 1,220,556. However, the net short position for CBOT US 10-Year Treasury futures surged by 144,299 contracts to reach 881,374, while CBOT US 5-Year Treasury futures saw an increase of 32,573 contracts, totalling 1,905,940.

- In the equities market, equity fund managers reduced their net long position in the S&P 500 CME by 9,572 contracts, bringing it to 832,269. Meanwhile, equity fund speculators cut their net short position by 9,127 contracts, now totalling 195,491.

Technical & Trade Views

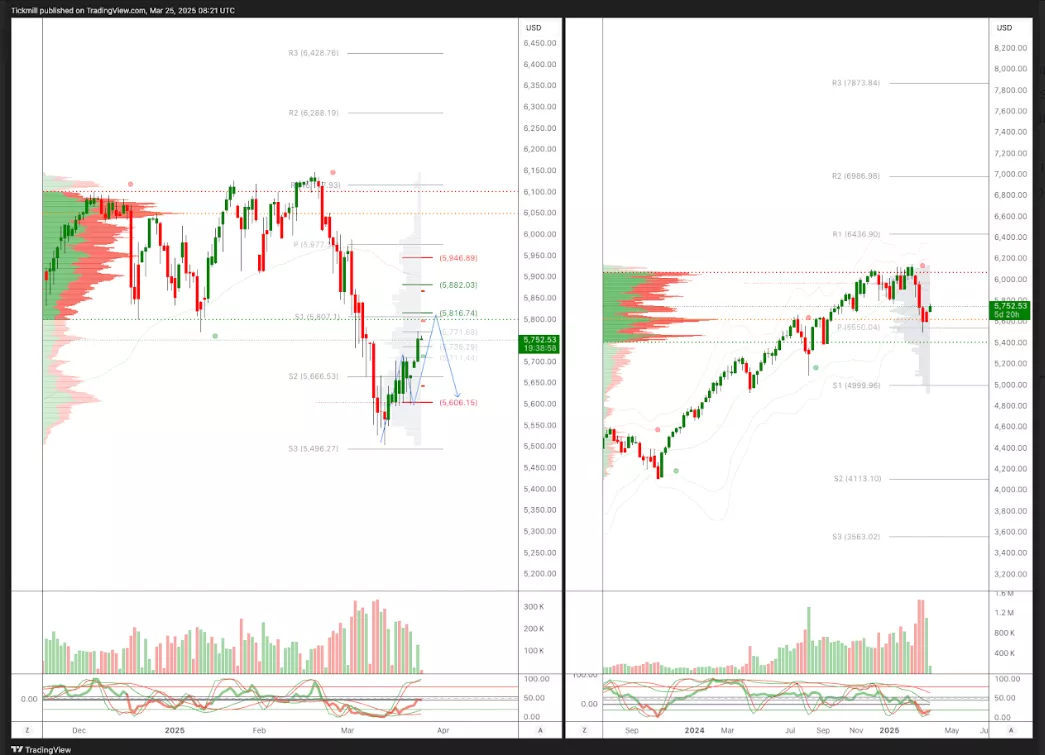

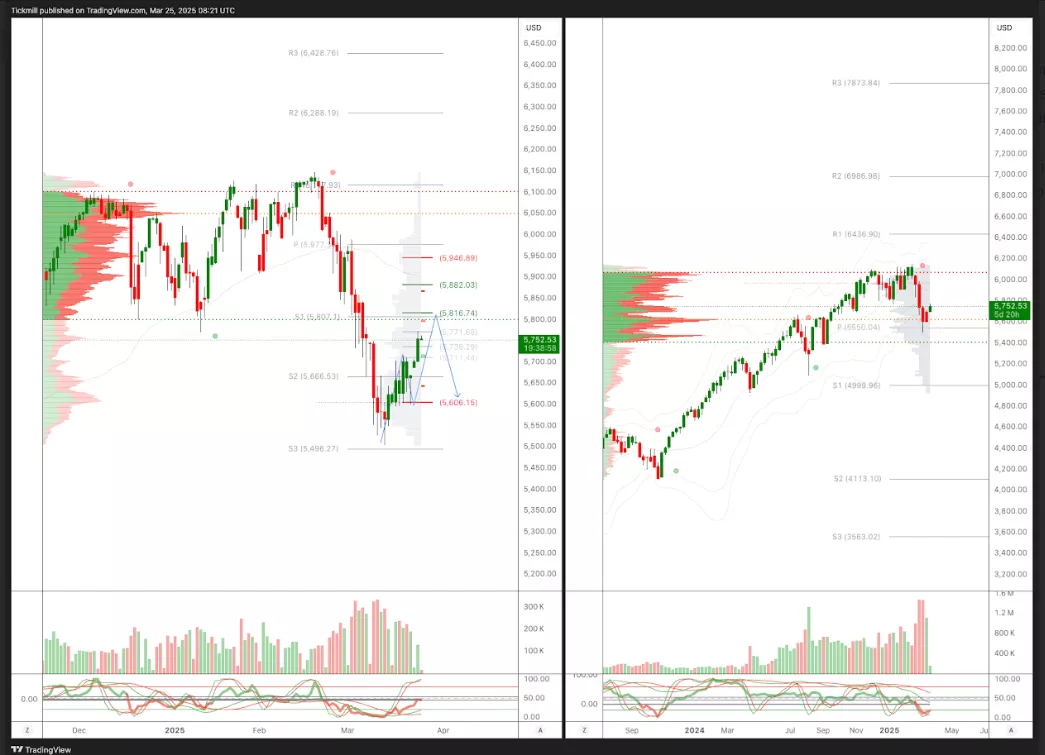

SP500 Pivot 5790

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into late April

- Above 5865 target 5950

- Below 5816 target 5415

(Click on image to enlarge)

EURUSD Pivot 1.0750

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0750 target 1.11

- Below 1.0690 target 1.0550

(Click on image to enlarge)

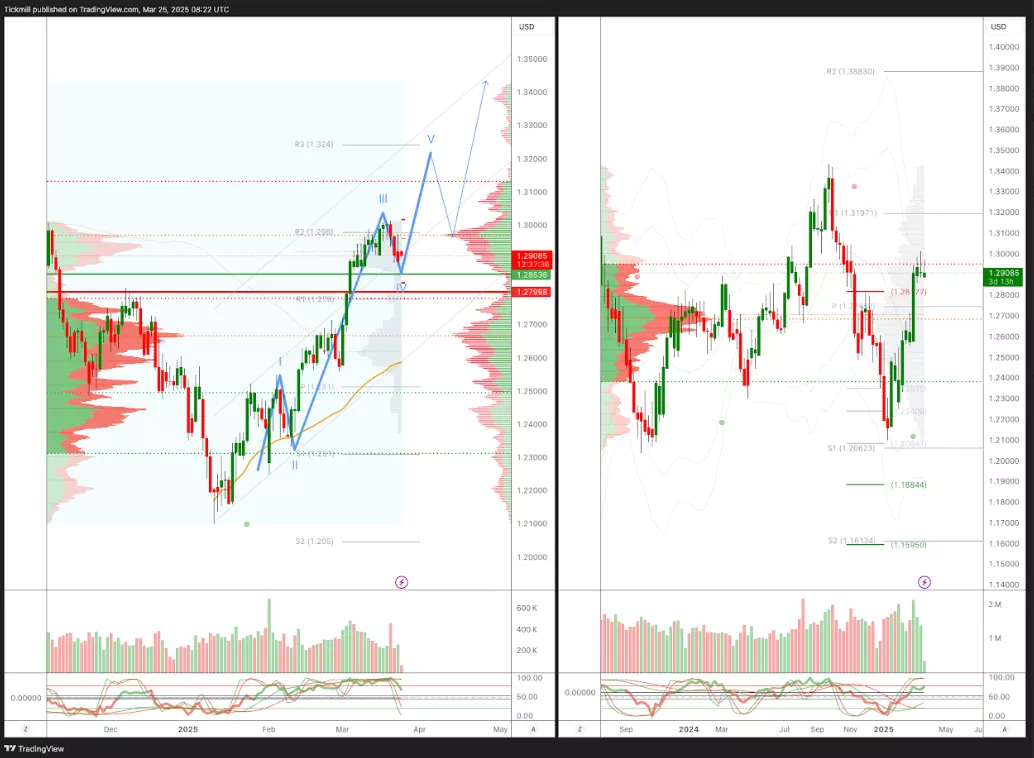

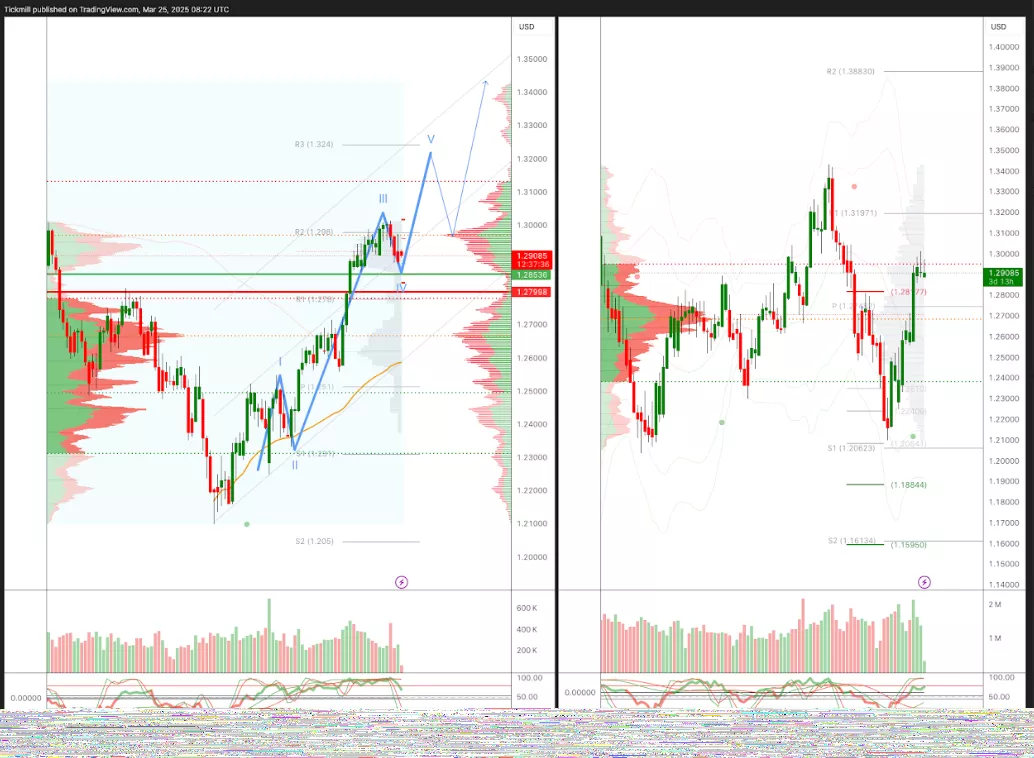

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

USDJPY Pivot 150.50

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 1.52 target 153.80

- Below 150.50 target 145

(Click on image to enlarge)

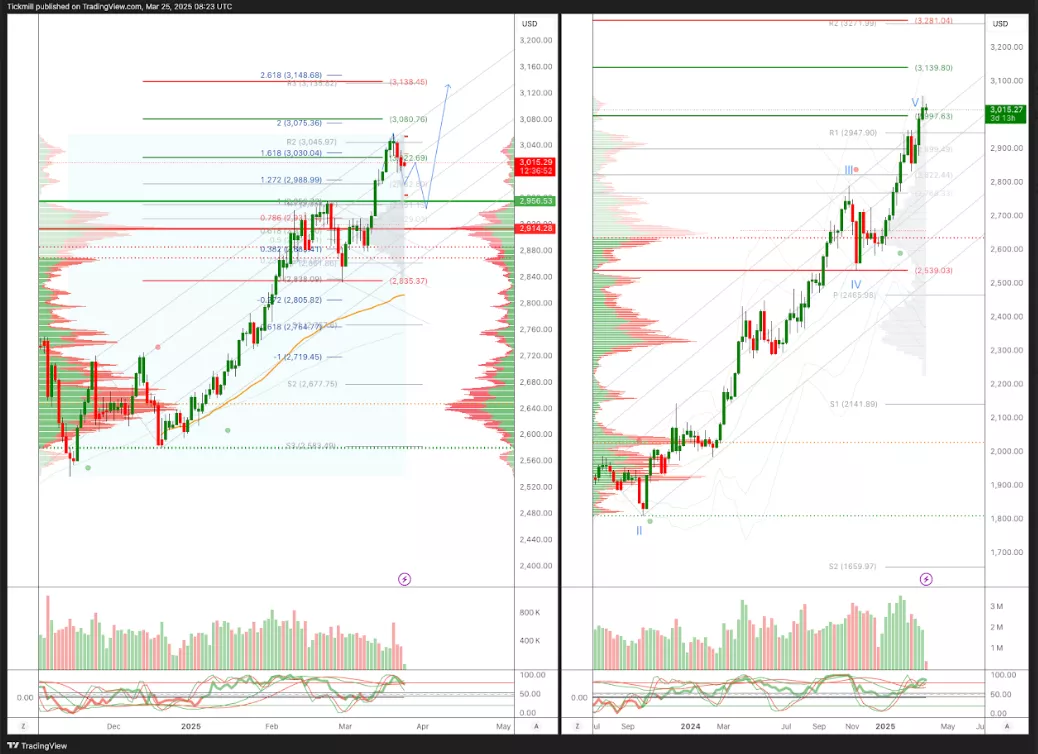

XAUUSD Pivot 2950

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late March

- Above 2900 target 3100

- Below 2880 target 2835

(Click on image to enlarge)

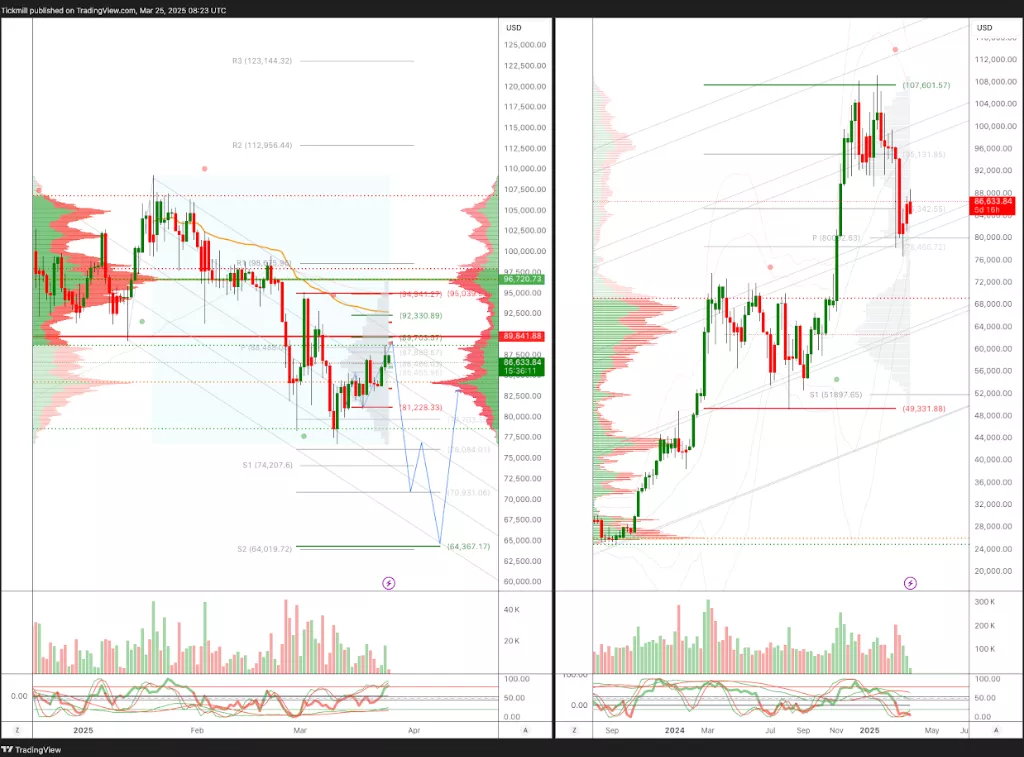

BTCUSD Pivot 90k

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Monday, March 24

Daily Market Outlook - Monday, March 24

The Pros And Cons Of Adding To Winning Trades