Daily Market Outlook - Monday, March 24

Image Source: Pixabay

US and European stock-index futures rose, buoyed by signs that the next round of tariffs from President Donald Trump may be less aggressive than previously anticipated. Futures for the S&P 500 and Euro Stoxx 50 advanced, even as the broader MSCI index of Asian shares edged lower. Meanwhile, the yield on the 10-year US Treasury climbed, reflecting a cautiously optimistic market mood. Investor sentiment appears to be improving as the US prepares to implement its next set of tariffs on April 2. Sources suggest these measures will be more targeted, moving away from the sweeping, global approach Trump had initially hinted at. However, traders remain wary, with officials from China and Australia warning of potential ripple effects on the global economy stemming from US trade policies. President Trump is expected to introduce broad reciprocal tariffs on certain countries or blocs but plans to exempt some nations. Additionally, the administration is reportedly holding off on announcing separate, sector-specific tariffs, despite earlier suggestions to that effect. Australia’s treasurer Jim Chalmers warned that the impact of the US administration's trade policies could be “seismic” for the global economy. Similarly, Chinese Premier Li Qiang stated that China is prepared for “shocks that exceed expectations”.

Macro highlights for the week include the flash March PMIs from S&P Global, UK CPI figures, the Chancellor's Spring Forecast, and US PCE data. The week begins with the release of S&P Global’s flash March PMIs, reflecting the growing alignment in policy rate expectations between the US and the eurozone (as shown in the accompanying chart). Markets may overlook any unexpected weakness in euro area surveys, given the anticipated boost from new defence spending initiatives. In the UK, the composite index barely surpassed 50 last month, so any negative surprises could strengthen forecasts of a potential rate cut in May. Later today, Bailey will address growth prospects; however, the key UK focus will shift to Wednesday’s Spring Statement, preceded by inflation figures on Wednesday morning, where a 3.0% year-on-year rate is projected. The Chancellor is expected to expand fiscal capacity, but we anticipate gilt sales for 2025-26 to rise to £315 billion, with upside risks following February’s public finances data.

In the US, attention turns to February’s PCE data on Friday, as the decline in CPI inflation reported for January is unlikely to recur. Other notable events include consumer confidence updates on Tuesday and housing market statistics, though Fed commentary appears limited this week. In the eurozone, Spanish and French flash March CPI figures are due on Friday, while Thursday will feature ECB speakers and euro area credit data. Additionally, the German IFO survey is scheduled for Tuesday.

Today's macro slate includes preliminary March PMI data for the Eurozone, US, and UK; speeches from BoE Governor Bailey, ECB officials Holzmann and Escrivá, and Fed representatives Bostic and Barr; the release of BoJ Minutes; and an update on German funding.

Overnight Newswire Updates of Note

- Bond Market Looks To Inflation Data To Back Steeper Yield Curve

- Options Market Focused On Jobs And Inflation Over Tariff Reveal

- WH Scales Back April 2 Tariff Plan, Focuses On Reciprocal Levies

- The Rise Of Eurozone Bond Yields Outside Germany Is Unwarranted

- Ukraine Urges EU To Renew Duty-Free Trade Deal

- UK Chancellor £700M Tax Break For US Tech Giants To Avoid Trade War

- Turkey Bans All Short Selling, Relaxes Buyback Rules After Market Rout

- AI Boom Turns Asian Data Centers Into Magnets for Loan Deals

- South Korean Court Overturns Impeachment Of Prime Minister

- Japan Has Not Yet Conquered Deflation, Finance Minister Warns

- Japan's Factory Activity Declines Accelerate, Services Sag, PMI Shows

- Yen Weakens Amid Prospects Of Narrower US Tariffs

- Aussie Dollar To Snap Losing Streak On RBA Stance, China Support

- Australia PMI Rises At Fastest Pace Since Aug 2024

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0775 (1.5BLN), 1.0800 (1BLN), 1.0835 (740M), 1.0850-60 (1.8BLN)

- 1.0900 (367M), 1.0925 (1.3BLN)

- USD/CHF: 0.8730 (742M). EUR/GBP: 0.8375 (220M)

- AUD/USD: 0.6350 (322M), 0.6365 (571M). AUD/NZD: 1.0940 (610M).

- USD/CAD: 1.4230 (526M), 1.4250 (337M), 1.4395-1.4400 (560M)

- EUR/JPY: 159.00 (688M), 160.40 (497M), 163.10 (766M) , 165.00 (200M)

- USD/JPY: 149.00-10 (1.8BLN), 149.20 (300M), 149.50 (450M)

- 150.00 (916M), 151.00 (365M)

CFTC Data As Of 21/3/25

- In the foreign exchange markets speculative traders have adopted a bearish stance on the US dollar. The euro holds a net long position of 59,425 contracts, while the Japanese yen leads with a net long position of 122,964 contracts. In contrast, the Swiss franc shows a net short position of -34,375 contracts, and the British pound maintains a net long position of 29,402 contracts. Bitcoin's net long position is modest at 1,841 contracts.

- In the bond market, speculators have reduced the net short position for CBOT US Treasury bond futures by 20,694 contracts, bringing it down to 13,510. Similarly, the net short position for CBOT US Ultrabond Treasury futures has decreased by 4,236 contracts to a total of 247,158. For CBOT US 2-Year Treasury futures, the net short position has been trimmed by 1,659 contracts, now standing at 1,220,556. However, the net short position for CBOT US 10-Year Treasury futures surged by 144,299 contracts to reach 881,374, while CBOT US 5-Year Treasury futures saw an increase of 32,573 contracts, totaling 1,905,940.

- In the equities market, equity fund managers reduced their net long position in the S&P 500 CME by 9,572 contracts, bringing it to 832,269. Meanwhile, equity fund speculators cut their net short position by 9,127 contracts, now totaling 195,491.

Technical & Trade Views

SP500 Pivot 5790

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into late April

- Above 5865 target 5950

- Below 5790 target 5415

(Click on image to enlarge)

_638784055487019503.webp)

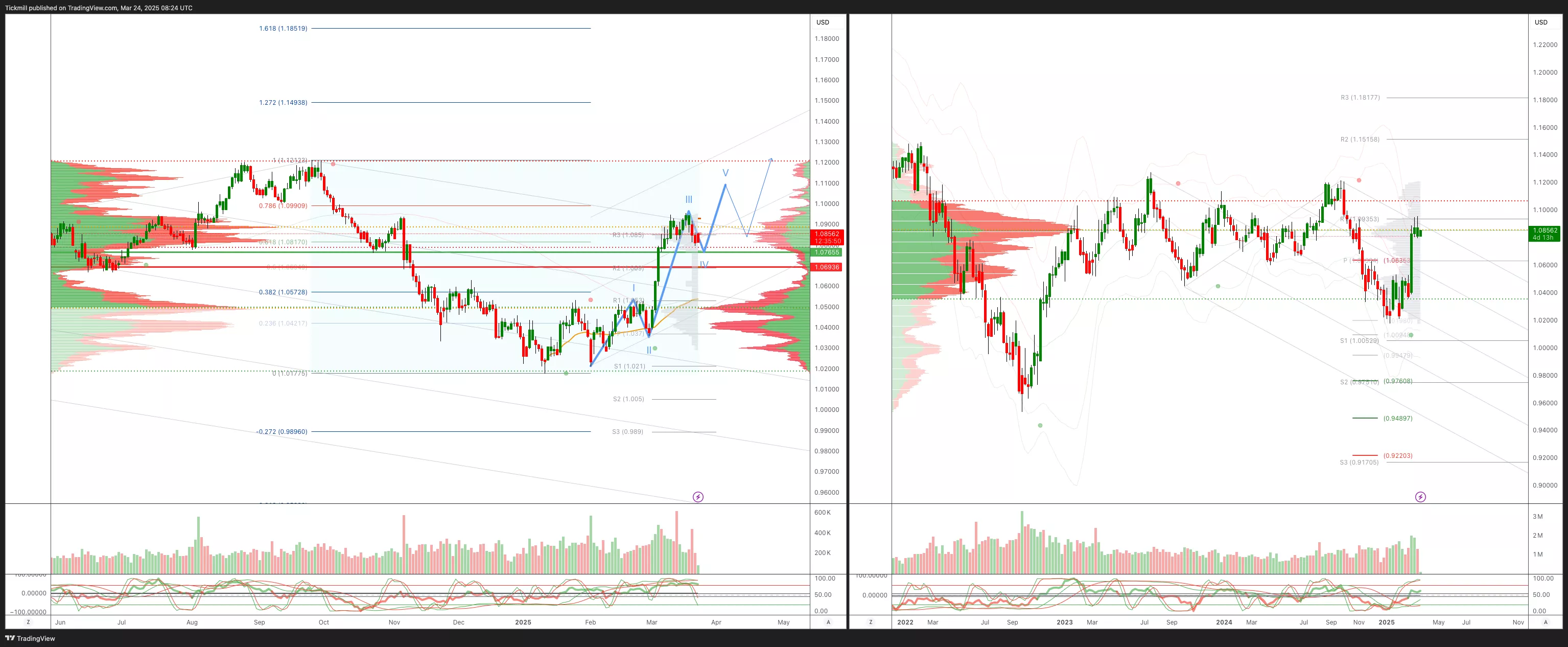

EURUSD Pivot 1.0750

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0750 target 1.11

- Below 1.0690 target 1.0550

(Click on image to enlarge)

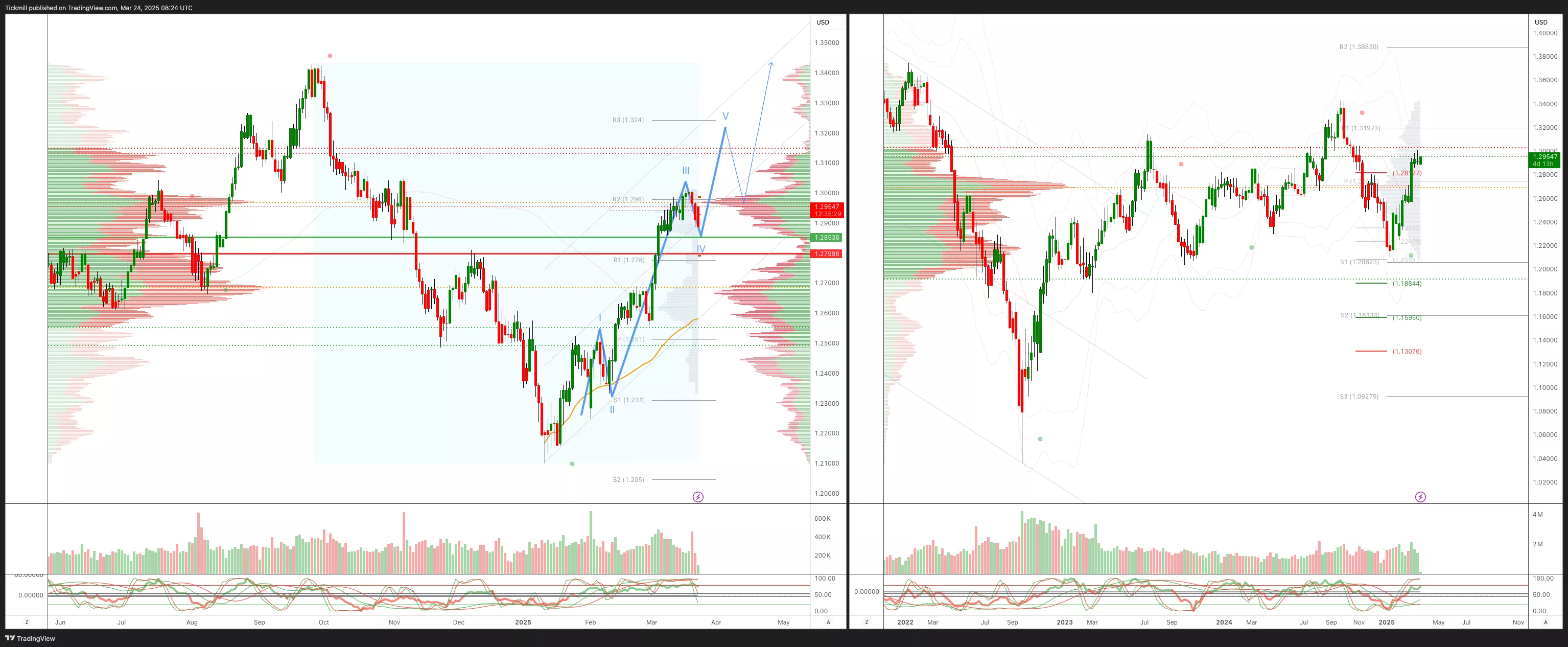

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

USDJPY Pivot 150.50

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 1.52 target 153.80

- Below 150.50 target 145

(Click on image to enlarge)

.webp)

XAUUSD Pivot 2950

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late March

- Above 2900 target 3100

- Below 2880 target 2835

(Click on image to enlarge)

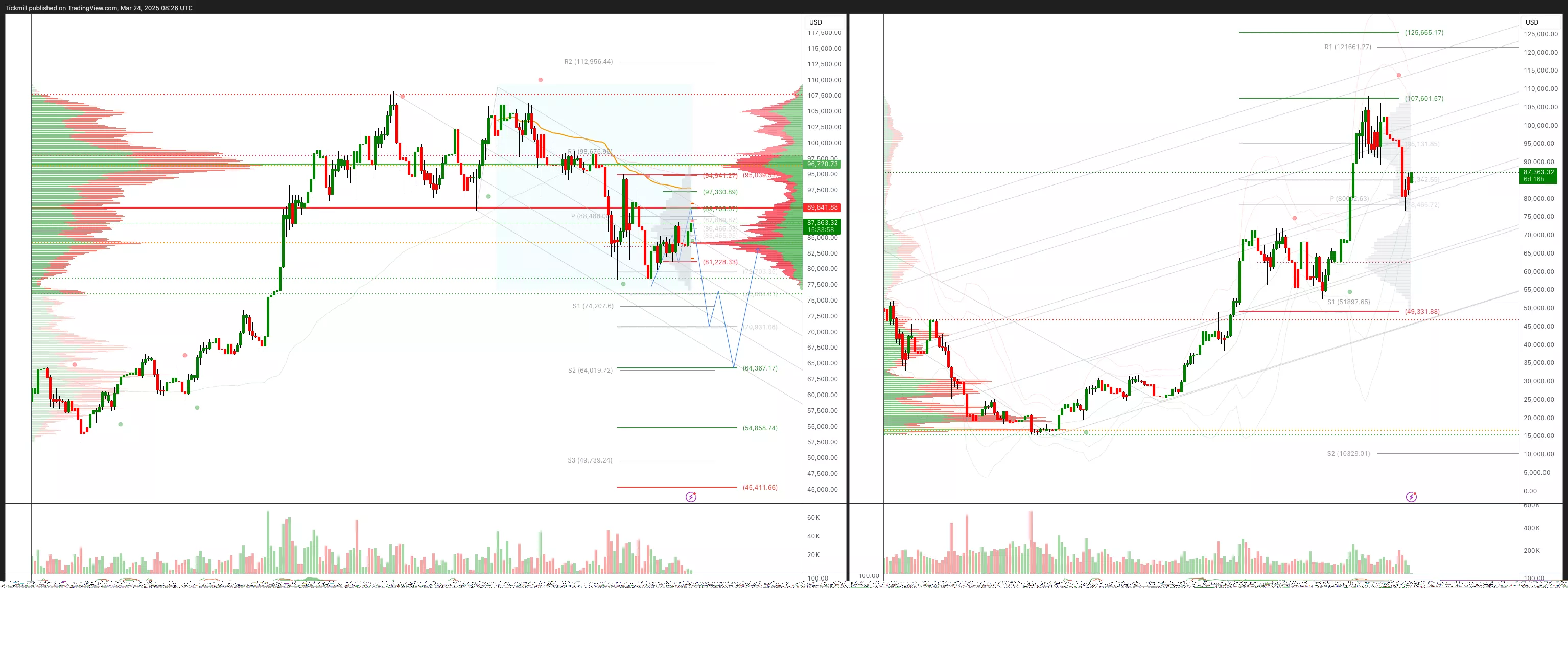

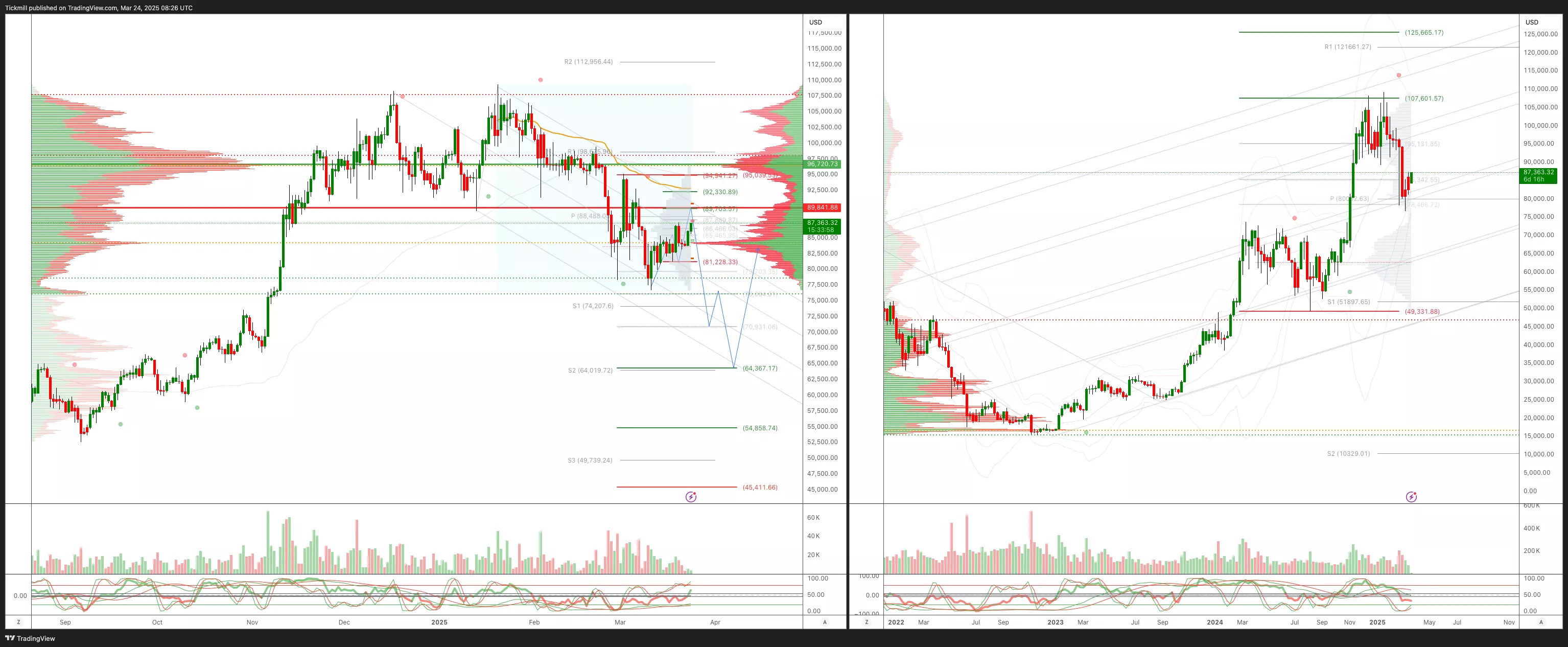

BTCUSD Pivot 90k

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The Pros And Cons Of Adding To Winning Trades

The FTSE Finish Line - Friday, March 21

Daily Market Outlook - Friday, March 21