Daily Market Outlook - Wednesday, March 26

Image Source: Unsplash

Asian markets held steady on Wednesday as investors sought clarity amid waning US consumer confidence and uncertainty surrounding President Donald Trump’s proposed tariffs.

The MSCI Asia Pacific Index managed to halt a three-day losing streak, rising 0.45% despite losing some initial momentum. US copper prices hit a record high as traders braced for potential import tariffs. Meanwhile, futures for US and European equities remained stable, and the yield on 10-year US Treasury bonds edged higher. The dollar showed minimal movement after ending a four-day rally on Tuesday. Earlier this month, the Trump administration hinted that the impending tariffs might be narrower and more targeted than previously anticipated. On Tuesday, Trump remarked that while he aims to limit excessive exceptions, he may adopt a "more lenient than reciprocal" approach, acknowledging that strict reciprocity could pose challenges for many. US tariffs on copper imports could be enacted in the coming weeks, possibly ahead of the original deadline, according to sources familiar with the matter. The Hang Seng Tech Index, which tracks major Chinese tech stocks, rebounded on Wednesday after nearly entering correction territory the previous day. Morgan Stanley strategists raised their year-end index targets for Chinese stocks looking ahead to 2025. Similarly, Goldman Sachs strategists expressed optimism about further gains in the ongoing rally, projecting that positive earnings revisions will fuel additional momentum.

In February, UK CPI inflation was 2.8% y/y, 0.2 ppts below market expectations, reversing last month’s 0.2 ppt overshoot. This aligns with the BoE’s February MPR forecast, framing January’s overshoot as a blip. Services inflation remained at 5.0% y/y, 0.1 ppt above consensus but 0.1 ppt below BoE projections. The headline rate drop was mainly driven by falling clothing prices, despite expectations of a food price correction. Headline and services inflation now align with policymaker forecasts, supporting the BoE’s ‘gradual’ easing approach and a potential May rate cut. However, March MPC minutes’ comment on no “pre-set course” for rates adds uncertainty. The next CPI release on 16 April will be pivotal. At 12:30 PM GMT, the UK Chancellor will deliver the Spring Statement on the Budget, expected to last under 30 minutes. Markets are poised for some key themes to emerge: Weaker economic growth and higher debt servicing costs will worsen the fiscal outlook. Gilt sales for 2025-26 are expected to exceed the £315bn estimate due to recent public finance data. A gradual reduction in the weighted average maturity of gilt supply is likely. The government’s £10bn fiscal rule headroom could turn into a £5bn deficit without policy changes. Savings in welfare and departmental budgets are unlikely to restore the original £10bn headroom. Limited fiscal improvements will leave underlying vulnerabilities unresolved heading into the Autumn Budget.

Aside from the UK Statement on the Budget, today's data slate includes: US durable goods report,and BoC minutes. Central bank speakers include ECB's Villeroy and Cipollone, along with Fed's Kashkari and Musalem.

Overnight Newswire Updates of Note

- Fed Goolsbee: Market Angst Over Inflation Would Be ‘Red Flag’

- Australia’s Monthly Inflation Cools, Boosting Case For Rate Cut

- Bank Of Italy Panetta: ECB Must Remain Pragmatic In Setting Rates

- Chancellor To Unveil £2.2B UK Defence Boost In Spring Statement

- UK Chancellor To Announce More Welfare Cuts In Spring Statement

- UBS Floats Concessions To Broker Swiss Capital Compromise

- UK Oil, Gas Licenses Challenged in Court by Environmental Group

- China’s LNG Thirst Slackens As Annual Imports Set For Rare Drop

- CK Hutchison Is Said To Proceed With Port Deal Despite China Ire

- Morgan Stanley Raises China Stock Targets Again, Citing Earnings

- Nvidia’s China Sales Face Threat From Beijing’s Environmental Curbs

- Toyota Delays Japan Battery Plant Project On EV Slowdown

-

GameStop To Set Aside Cash For Bitcoin, Joining Other Companies

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0720-25 (800M), 1.0750-60 (1.4BLN), 1.0770-80 (1.1BLN),

- 1.0790-1.0800 (865M), 1.0825-35 (783M), 1.0900-05 (1.4BLN) [Related comment]

- USD/CHF: 0.8740 (343M), 0.8870 (420M)

- GBP/USD: 1.2945-50 (506M), 1.3075 (413M)

- AUD/USD: 0.6300 (273M), 0.6370-80 (700M)

- USD/CAD: 1.4240 (684M), 1.4275 (360M), 1.4290-1.4300 (950M), 1.4320 (708M)

- USD/JPY: 149.50 (328M), 151.50 (400M), 151.75 (922M), 152.00 (1.1BLN)

- EUR/JPY: 161.60 (309M)

Banks are now issuing signals for FX hedge rebalancing at the end of the month and quarter. Models indicate a strong demand for the USD in both scenarios. The Barclays model highlights significant demand for the USD against all major currencies at month-end. Conversely, the quarter-end model, which utilizes the same methodology, reflects a moderate signal against all major currencies. Nonetheless, this model also forecasts a robust demand for the USD compared to the EUR. It's worth noting that short-term expiry FX options have been set up for potential setbacks in the EUR/USD.

CFTC Data As Of 21/3/25

- In the foreign exchange markets speculative traders have adopted a bearish stance on the US dollar. The euro holds a net long position of 59,425 contracts, while the Japanese yen leads with a net long position of 122,964 contracts. In contrast, the Swiss franc shows a net short position of -34,375 contracts, and the British pound maintains a net long position of 29,402 contracts. Bitcoin's net long position is modest at 1,841 contracts.

- In the bond market, speculators have reduced the net short position for CBOT US Treasury bond futures by 20,694 contracts, bringing it down to 13,510. Similarly, the net short position for CBOT US Ultrabond Treasury futures has decreased by 4,236 contracts to a total of 247,158. For CBOT US 2-Year Treasury futures, the net short position has been trimmed by 1,659 contracts, now standing at 1,220,556. However, the net short position for CBOT US 10-Year Treasury futures surged by 144,299 contracts to reach 881,374, while CBOT US 5-Year Treasury futures saw an increase of 32,573 contracts, totaling 1,905,940.

- In the equities market, equity fund managers reduced their net long position in the S&P 500 CME by 9,572 contracts, bringing it to 832,269. Meanwhile, equity fund speculators cut their net short position by 9,127 contracts, now totaling 195,491.

Technical & Trade Views

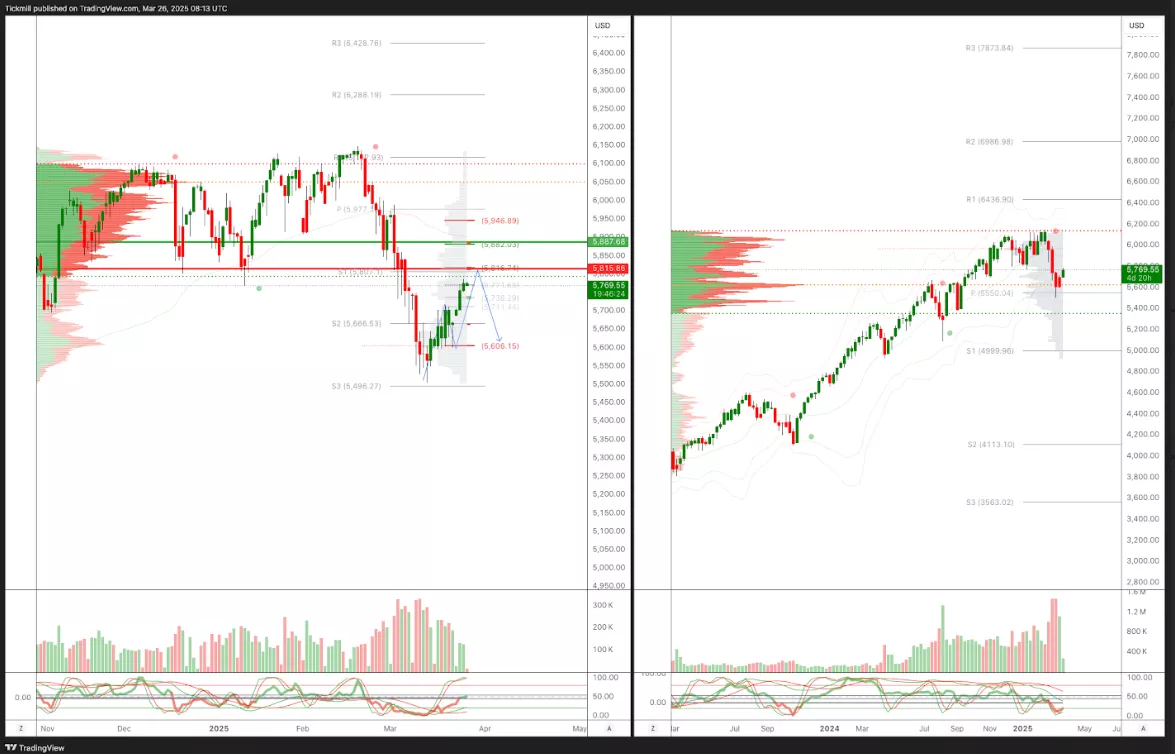

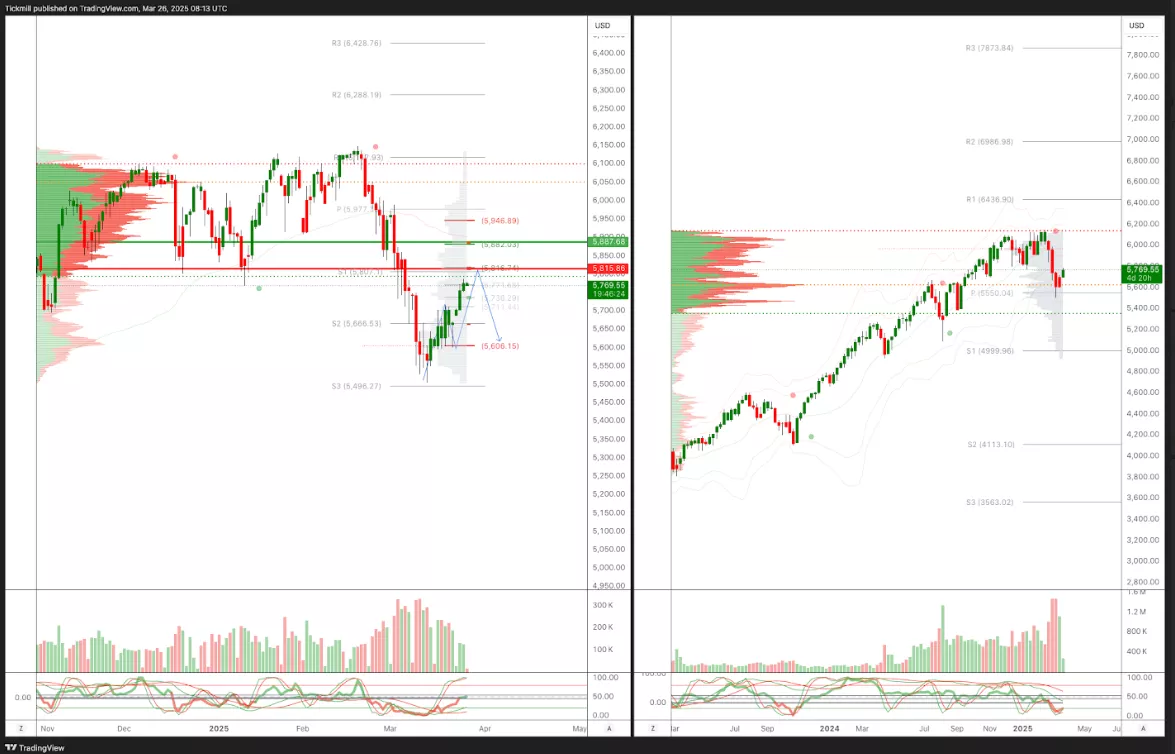

SP500 Pivot 5790

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into late April

- Above 5885 target 5950

- Below 5815 target 5415

(Click on image to enlarge)

EURUSD Pivot 1.0750

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0750 target 1.11

- Below 1.0690 target 1.0550

(Click on image to enlarge)

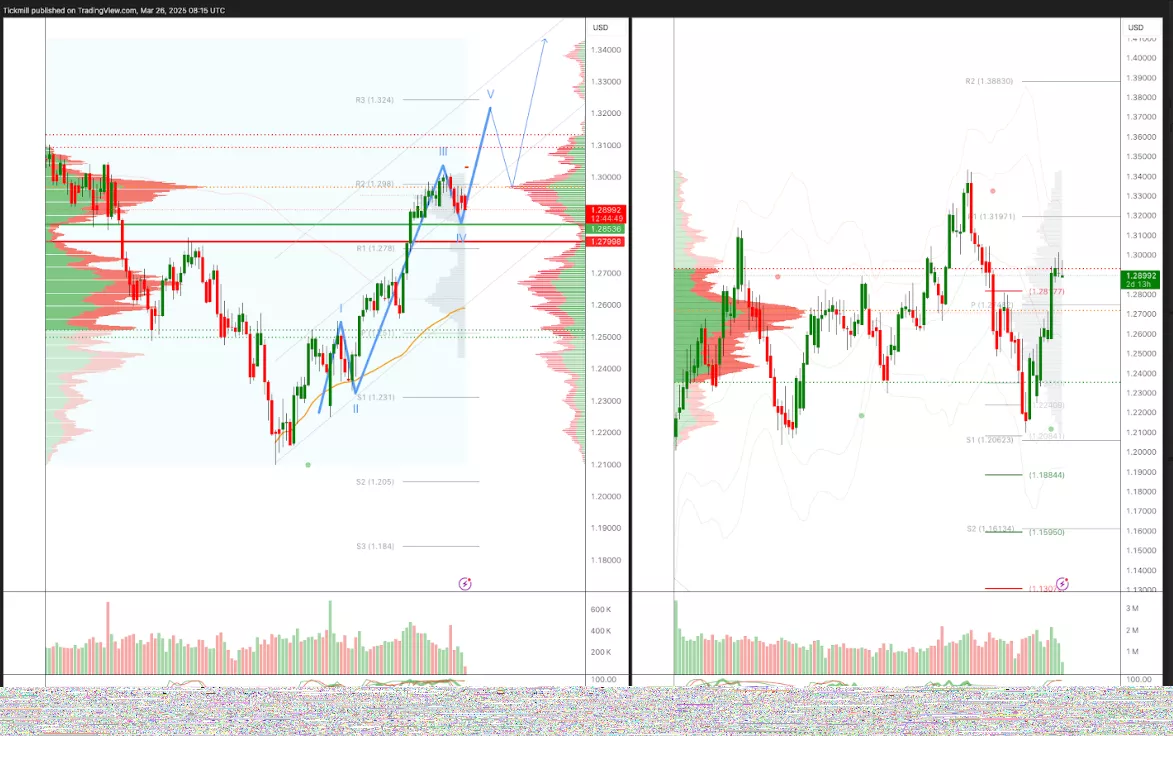

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

USDJPY Pivot 150.50

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 1.52 target 153.80

- Below 150.50 target 145

(Click on image to enlarge)

XAUUSD Pivot 2950

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late March

- Above 2900 target 3100

- Below 2880 target 2835

(Click on image to enlarge)

BTCUSD Pivot 90k

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, March 25

Daily Market Outlook - Tuesday, March 25

The FTSE Finish Line - Monday, March 24