The FTSE Finish Line - Wednesday, March 26

Image Source: Pexels

The FTSE 100 in the UK rose slightly on Wednesday as inflation figures were reported to be marginally lower than anticipated, providing reassurance to investors. The value of Sterling dipped slightly after the inflation figures were published. Economists cautioned that increasing energy costs will likely drive inflation upwards once more in the near future. The British finance minister, Rachel Reeves, announced on Wednesday that public spending on a day-to-day basis is projected to increase by 1.2% annually in real terms. "In total, day-to-day expenses will decrease by £6.1 billion ($7.9 billion) by the fiscal year 2029-30, with anticipated growth averaging 1.2% per year above inflation, slightly down from 1.3% last autumn," Reeves stated in her Spring Statement update to parliament. Last year, Reeves established a fiscal guideline aiming to align day-to-day public spending with tax income by 2030 to demonstrate to investors her commitment to maintaining control over public finances. Reeves reduced the government's proposed spending increases on Wednesday in an effort to adhere to her fiscal objectives, but risks in the global economy may lead to potential tax increases in the UK later this year. Reeves’ Budget forecast update was overtaken by events, as the Office for Budget Responsibility (OBR) warned the government would miss a fiscal target under existing plans. Despite previous claims that these targets are “non-negotiable”, the government introduced key measures today, including cuts to welfare and non-ring-fenced departmental spending. While no tax changes were announced, higher tax receipts are expected due to reduced tax avoidance. The OBR now projects the fiscal targets will be met but cautions that the government’s flexibility remains limited, potentially leading to tough decisions in the Autumn Budget.

Single Stock Stories & Broker Updates:

- Babcock shares climb 1.6% as the defence firm secures a five-year, £1 billion ($1.29 billion) contract extension with the UK Ministry of Defence, bringing the total contract value to £1.6 billion. Shares are up 46% year-to-date.

- Ithaca Energy shares rise 6.32% before settling at ~2% ahead of a restructuring process affecting a small part of the workforce, aiming for completion by July 1. Production increased by 14% year-on-year, with the stock up 28.8% YTD.

- Shares of Evoke dropped 8.5%, making it the biggest loser on the FTSE small-cap index. The British betting firm expects Q1 revenue to grow in low single digits, below the 5%-9% FY forecast, but maintains FY 2025 expectations. The stock has risen approximately 16.4% this year.

- Shares of Bakkavor rose 5.9% amid reports of a potential increased bid from Greencore, after rejecting two previous offers. The latest cash-and-stock bid values Bakkavor at 1.14 billion pounds ($1.5 billion). The stock has increased 15.41% this year up to Tuesday's close.

- Shares of Ocado Group Plc rose 10.2%, the top gainer on the FTSE midcap index, which fell 2.65%. The stock may reach its highest level in nearly a month if gains hold. J.P. Morgan upgraded the rating to "overweight" from "neutral", raising the price target to 400p from 340p, citing a higher likelihood of new deals in the eGrocery space and improving profit margins in retail and solutions divisions, leading to positive free cash flow by the end of 2026. The average rating from 15 brokerages is "hold", with a median price target of 268p. OCDO shares are down approximately 8.7% year-to-date.

- Shares of J D Wetherspoon drop 4.73%. Deutsche Bank downgrades rating to "sell" and price target to 450p from 600p. Co's HY PBT down 8% despite 5% LFL sales growth. YTD stock down ~5%.

- Vistry Group shares fell 10.6%, becoming the largest percentage loser on the FTSE 250 index. The British homebuilder did not pay a final dividend and aims to save £200 million after a 35% drop in annual profit. By the end of 2024, net debt is projected to exceed £180.7 million. Investec analyst Aynsley Lammin indicated that 2025 volume is expected to remain flat, with a focus on cash generation and debt reduction. The stock is down 7.2%, reducing YTD gains to about 5%, and is at its lowest since January 15.

Technical & Trade View

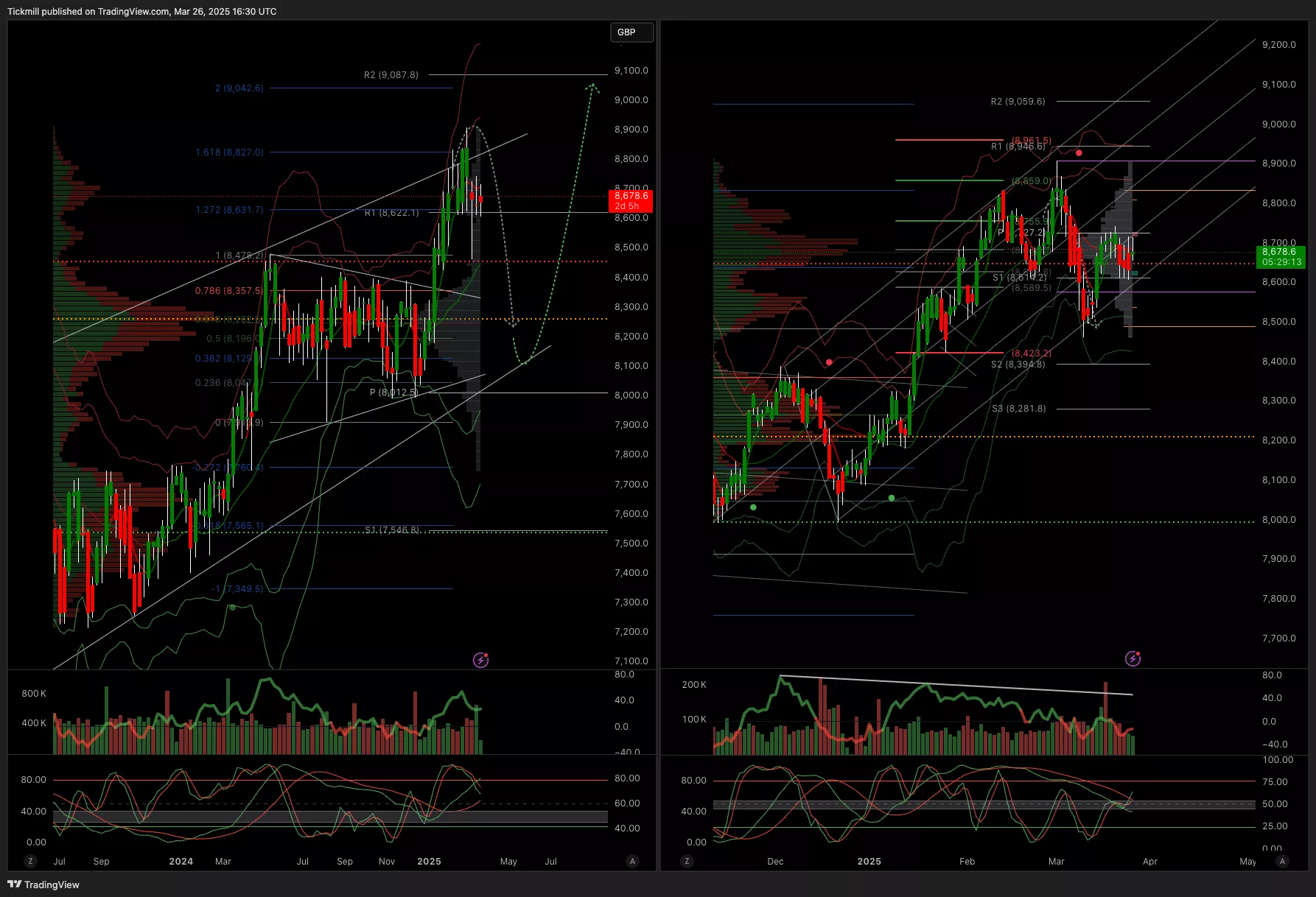

FTSE Bias: Bullish Above Bearish below 8950

- Primary support 8700

- Below 8700 opens 8600

- Primary objective 9050

- Daily VWAP Bearish

- Weekly VWAP Bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, March 26

The FTSE Finish Line - Tuesday, March 25

Daily Market Outlook - Tuesday, March 25