Weather May Nip Corn & Soy Yields, But Will Resurvey Show More Beans?

Photo by Waldemar Brandt on Unsplash

Market Analysis:

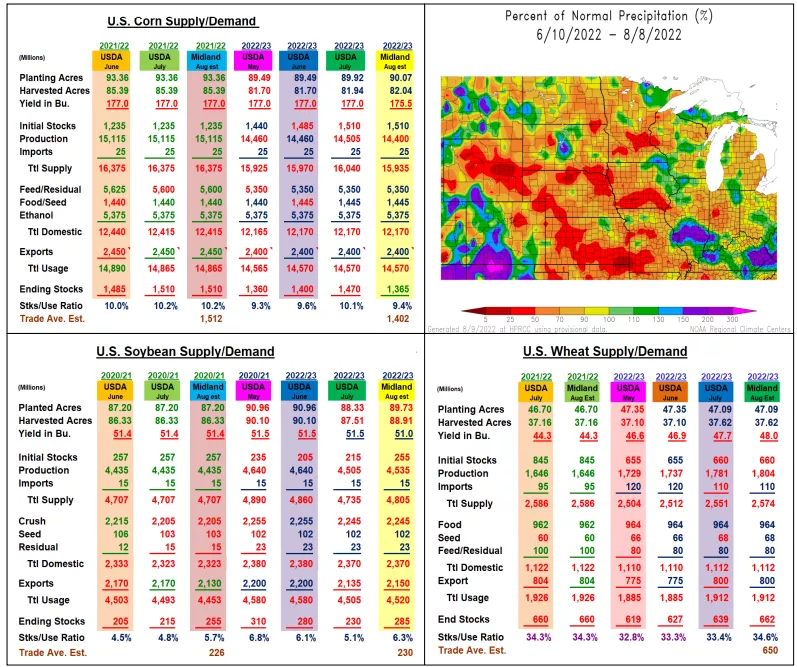

Going into the USDA’s August 12 crop report, the trade talk has turned mixed about 2022’s US corn & soybean output. The satellite firms have turned negative about the vegetative look & the WCB’s soil moisture while recent ECB rains have others optimistic about this region carrying the load. 2022’s cool & wet spring that delayed US plantings was the initial crop concern. This issue plagued the NW Corn Belt all the way into June. Conversely, the S Plains dryness built back into the Mid-South and WCB by mid-summer. The USDA’s 2022 G/E crop ratings have dropped by 15 points to 58% in corn and 11% to 59% in beans since June. Over the past 60 days, a major portion of the western Midwest received only 25-70% of its normal rainfall – a troubling situation. Our recent C. IL crop tour revealed much strong green corn & clean bean fields. However, corn emergence problems reducing ear counts & slow soybean growth reducing pod sets to date were observed when stepping into the fields. Overall. 2022’s C. IL corn yield was up 2.4 bu from 2021 prompting a 205 bu August IL estimate, but no bin buster for us. For the 3rd year, the USDA’s August crop estimates are based on their producer survey & enhanced satellite crop views. No enumerator field counts until September. Utilizing our tour data & Midwest rainfall maps, our August US yield is 175.5 bu for a 14.4 billion crop. With 4 weeks left in the crop year, no change in corn’s ethanol or exports seems necessary. Corn’s 105 million lower output will likely slice 2023’s ending stocks to 1.365 billion. Our IL crop tour revealed many clean fields, but late seedings reduced podding making August weather even more important. The USDA’s resurvey of N Plains plantings remains a concern about a possible sizable jump in seedings. Drought cut 2021 plantings, but high soil moisture makes the gamble stronger. Overall, a 4.535 billion bu crop is possible even with a 51 US yield. Recent slow exports could slice 40 million in this demand & higher ending stocks of 255 and 285 million bu for 2022/23. Better N Plains & PNW weather could raise both US winter & spring wheat outputs modestly. This 23 million in higher US output could go to stocks, but Europe’s & Argentina’s dryness may raise US export demand leaving 2023’s stocks unchanged.

What’s Ahead:

Despite smaller US corn & soybeans yield expectations in the upcoming August report, the USDA resurvey could be a surprising jolt to 2022/23 prices. Given the abundant N Plains soil moisture & strong prices, producers could have planted a sizable portion of the 1.8 million lower June seedings. Utilize $14.40-60 Nov prices to boost sales to 45% if moisture is available. Hold corn & wheat sales.

More By This Author:

US Wheat Stocks Remain Tight, But US Weather Remains Focus

Pre-July U.S. S&D/Wheat Updates - Despite A Lower U.S. Soybean Acreage, The Market Focus Is On Weather

Wet Spring Cuts Soybean Plantings, While Stocks Near Estimates

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more