Pre-July U.S. S&D/Wheat Updates - Despite A Lower U.S. Soybean Acreage, The Market Focus Is On Weather

Image Source: Unsplash

Market Analysis

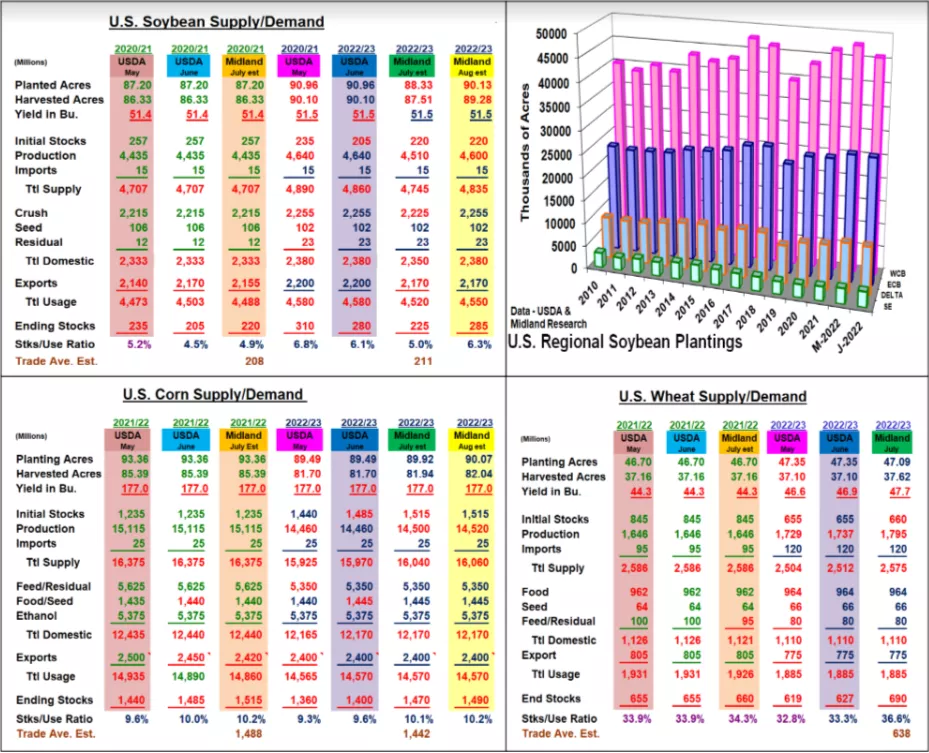

The USDA’s unexpected drop in their 2022 soybean plantings on their June 30 acreage report remains the market’s biggest unknown ahead of the July S&D updates. This year’s 7.8 million larger unplanted acres of mostly N

Plains corn & soybean fields when the survey ended were behind these lower acres. The USDA announced a resurvey of ND, SD & MN during July to help finalize 2022’s acreage levels in their August’s report. The USDA will use last week’s plantings in their July 12 US balance sheets. This acreage data, June’s quarterly stock levels which were near the trade’s ideas & the current US processing & export trends will be utilized for July’s US supply/demands. The USDA will also project their first overall US wheat crop with actual spring wheat & durum seedings this month.

US soybean shipments have been slipping below the seasonal pace to hit the USDA’s forecast. This suggests old-crop exports could be shaved by 15 million bu resulting in 220 million old-crop stocks. When utilizing June’s 2.63 million smaller acres, 2022’s US output will be calculated at 4.51 billion bu, down 130 million. With recessionary concerns rising & the potential for 1.5-2.0 million larger N Plains seedings surfacing in the August resurveying, the USDA could slice 60 million from 2022/23’s demand. This would project 225 million bu stock level for 2023.

In corn, last week’s stocks suggest US feed usage is on target & current strong US margins should hold ethanol demand. Recent weakness in exports suggests a possible 30 million bu cut. Last week’s higher US seedings & a 30 million higher carryover could increase US supplies by 70 million bu raising 2022/23’s stocks to 1.47 billion.

Wheat’s final old-crop stocks were 5 million higher on likely smaller feed demand. Reports of strong soft red yields & PNW prospects may boost winter wheat output by 13 million to 1.195 billion. June’s N Plains spring wheat seedings are only 30,000 less than March & high prices prompting higher SW harvesting, Overall, 2022’s US wheat output could rise to 1.795 billion & stocks to 690 million.

What’s Ahead

The upcoming July USDA report has interest, but August’s N Plains acreage revisions will rearrange US fundamentals. After heavy fund liquidation, prices are recovering. Recent rains have moderated US crop stress. With moisture, finalize last 5% of old-crop at $6.30 & $15.10 in Sept & Aug. Advance new-crop sales to 33% in $6.30-40, $13.90-14.10 ranges. Hold 2022 wheat sales for a post-harvest rally.

(Click on image to enlarge)

More By This Author:

Wet Spring Cuts Soybean Plantings, While Stocks Near Estimates

More Corn, Less Soy - Wet Spring Slowed US Plantings

Ethanol & Export Demand Are Strong, But Recession Fears Strike