More Corn, Less Soy - Wet Spring Slowed US Plantings

Market Analysis

The USDA surveys US producers during the 1st half of June to see if their initial planting ideas were carried out as the spring developed. A strong upper-level jet stream across the Northern US completely turned around the N Plains spring soil conditions from below normal to extremely wet during late March thru April.

Below normal Midwest temperatures thru the first half of May added to the planting delays. On May 15, the USDA projected only 75.5 million of the three major spring crops (corn, beans & s, wheat) had been plant of 192 million intended back in March.

However, warmer weather & the rains subsiding in the N Plains after this date prompted producers to significantly seed much of these 116 million acres. Some shifting of crops was likely and some fields found the prevent plan program, but 2022’s high prices encouraged seeding if possible.

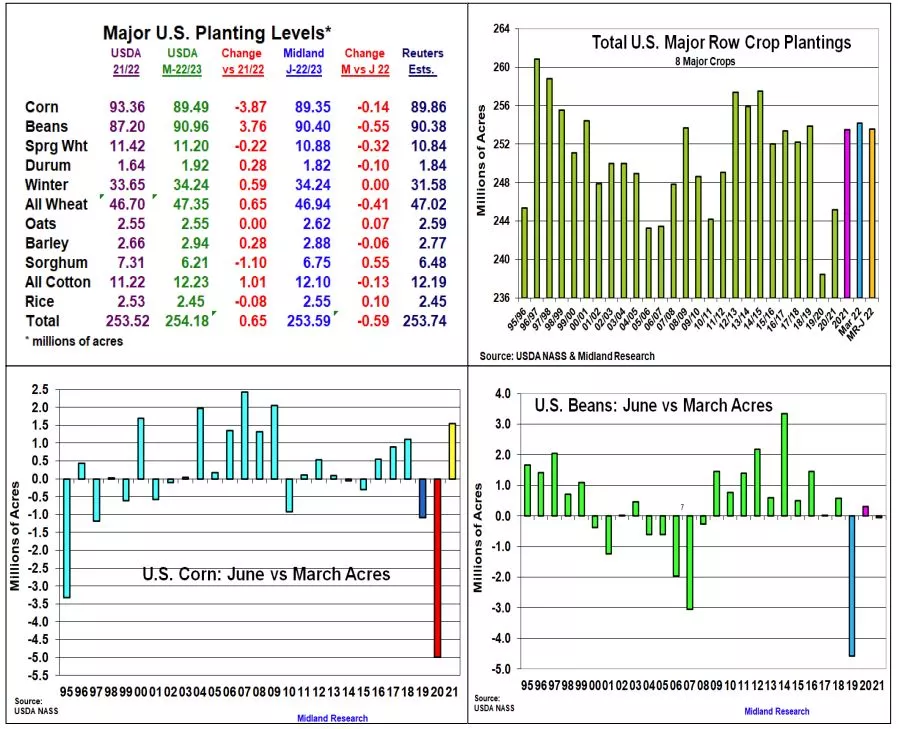

Per usual, the trade’s focus will be on the US corn and soybean plantings in this week’s June acreage update. Corn’s high input costs prompted a lower March intentions and larger soybean plantings than expected. Late seedings in the N Plains & Ohio may have shaved 600-700,000 corn acres while I-State switches from beans suggests 2022’s corn plantings may only slip 140,000 from March to 89.35 million acres. This year’s C Midwest shifts from beans to corn has us expecting a 550,000 lower US soybean seedings of 90.4 million acres.

Some declines in spring wheat, durum and the small grains are likely, but the ongoing SW drought & high prices could attract sizable cotton & sorghum acres. Overall, 2022’s total US major crop plantings will likely be near last year’s level at 253.6 million acres.

There have been some dramatic changes in US soybean and corn seeding from the March to June in past few years. The extremely wet 2019 Midwest planting season that slashed soybean plantings and 2020’s overreaction to the COVID pandemic that prompted a substantial drop in corn seeding from US intentions to the June acreage report.

We don’t see any big changes on the upcoming corn and soybean planting level like most years in the recent past.

What’s Ahead:

Last week’s hefty fund liquidation on expanding recession fears & the forecast of cooler temperatures and rains revealed the CBOT’s likely volatility going forward.

We suggest slicing your remaining old-crop supplies to 5% on Sept corn & August beans at $6.75-80 and $15.45-55 prices. Holding new sales at 25%, but looking to up new-crop beans to 30-35% on post report strength.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more