US LNG Exports Surge, Why Aren't You Profiting?

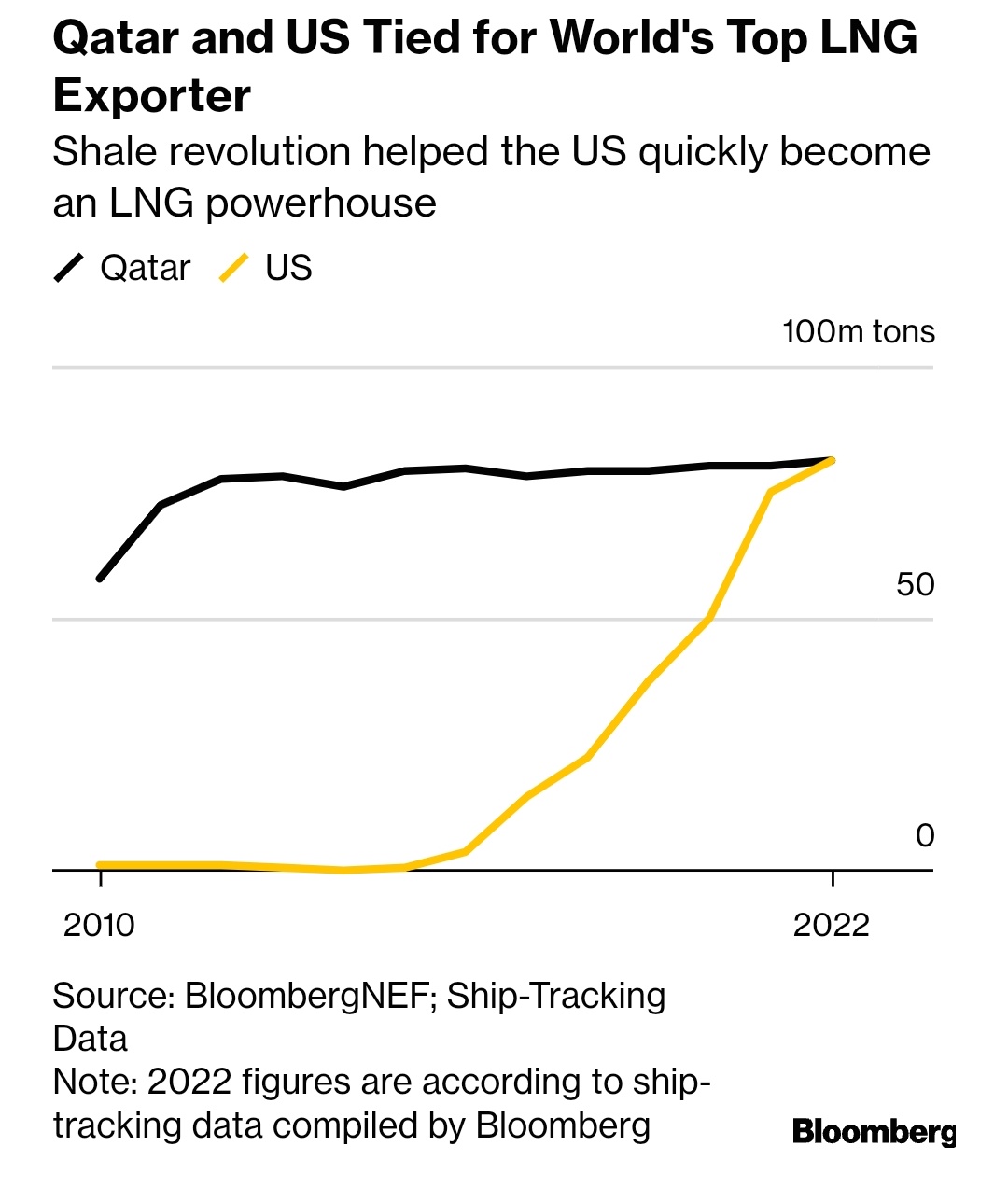

In a recent tweet, I pointed out that the United States has now tied with Qatar as the largest exporter of liquefied natural gas in the world:

(Click on image to enlarge)

Source: Bloomberg

This is something that I have been predicting will happen for quite some time as various energy companies have been constructing liquefaction plants along the East Coast, Texas, and Louisiana.

The Surge Is Likely To Continue

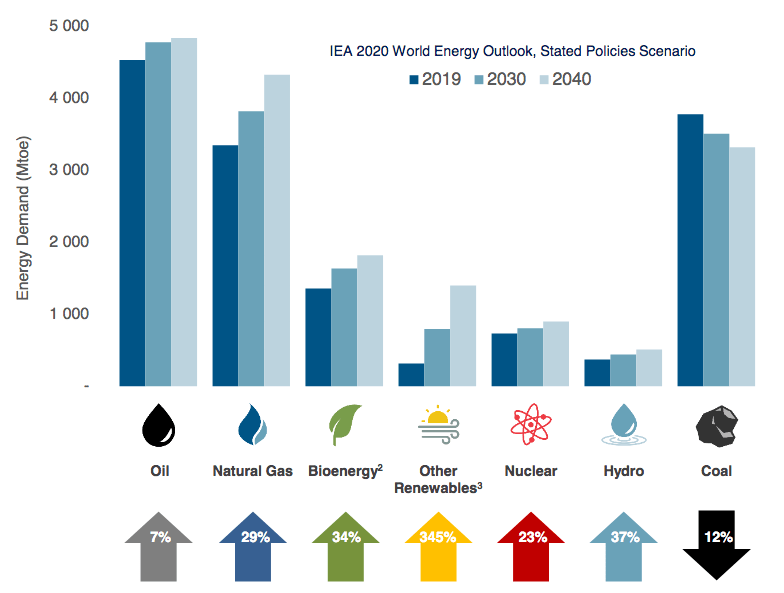

This is a long-term trend as the global demand for natural gas is likely to surge over the coming years. As I have pointed out many times before, the International Energy Agency projects that the global demand for natural gas will increase by 29% over the next twenty years:

Source: Pembina Pipeline/Data from IEA 2021 World Energy Outlook

This is likely to happen despite the fact that many nations around the world are attempting to reduce the carbon emissions of their respective nations. In fact, it is these very fears of climate change that will drive the surge in natural gas demand growth. The biggest reason for this is that natural gas has a vital role to play in the generation of electricity. Although renewables are becoming increasingly popular, they have a critical flaw. In short, renewable energy generation is intermittent. After all, solar power cannot generate electricity when the sun is not shining and wind power cannot work when the air is still. The problems with renewable energy were discussed in great detail in this hour-long video that I would recommend everyone take the time to watch. Natural gas does not have these problems so it is becoming a common supplement to renewable energy generation as it provides a way to ensure that the electric grid remains functional when renewables cannot.

The only way that natural gas can be transported over large bodies of water, such as the ocean, is by converting it into a liquid state. This is because natural gas is, as the name implies, a gas so it will normally expand to fill any container that it is placed in. As the major importers of natural gas are in Asia and Europe, the United States is being forced to turn to the production and export of liquefied natural gas in order to supply these markets.

How To Profit

Fortunately, there are a few ways for investors to profit. Here are just a few:

LNG Producers

Liquefied natural gas producers are likely to be some of the direct beneficiaries of the increase in liquefied natural gas exporters. This makes a great deal of sense because these companies will be seeing a growing demand for their products. One obvious example here is Cheniere Energy (LNG), which I discussed most recently back in August. Cheniere Energy has been making great strides at strengthening its balance sheet all while it is expanding one of its liquefaction plants to increase its production. The stock is currently trading at a reasonable 8.41 times forward earnings.

Midstream Companies

Midstream companies are a less obvious choice to profit from the liquefied natural gas boom but they are still a reasonable play. These companies transport natural gas through massive pipelines across great distances to deliver it to their customers. In some cases, these customers can include liquefied natural gas producers. As these companies charge money based on the volume of natural gas that they deliver, the volume increases that they see due to the demand from liquefied natural gas producers should result in growing cash flow. One potential beneficiary here could be Energy Transfer (ET), which I discussed only a few weeks ago. Energy Transfer made great strides over the past year in overcoming the disappointment that many investors had with it at the end of 2020 and it is now one of the better-performing master limited partnerships around. The company's units are up a phenomenal 35.41% over the trailing twelve-month period and it boasts a 9.09% distribution yield at the current price.

More By This Author:

Could 2023 Be The Year For Gold?

Remembering 2022 And Opportunities For 2023

European And Asian Demand For LNG Is Increasing

Disclosure: I am long various energy-focused funds that may have positions in any stock mentioned in this article. These positions may change at any time without warning. I exercise no control over ...

more