European And Asian Demand For LNG Is Increasing

Image Source: Unsplash

On Tuesday, the Norwegian Petroleum Directorate released preliminary data regarding the production of crude oil and natural gas in the nation. The data was, to put it mildly, quite disappointing although it could create some opportunities for investors.

About The Data

During the month of November, the northern European nation produced an average of 1.74 million barrels of crude oil per day. This was 8.7% below the forecast of 1.905 million barrels of crude oil per day and slightly below the 1.749 barrels of crude oil per day that the country produced during the month of October.

Norway's production of natural gas also came in below estimates. The nation produced an average of 346.4 million cubic meters per day, which was 1.8% below the government's estimates.

This comes at a poor time because Europe needs all the natural gas that it can get. As many people reading this are no doubt aware, Europe has been in the midst of an energy crisis for quite some time now and with Russia reducing the supply of natural gas that it provides the European Union, the continent is being forced to turn to other sources in order to keep people warm this coming winter.

Incoming LNG

One way that Europe has been looking to increase its natural gas supply is liquefied natural gas from friendly countries like the United States and Canada. Last week, LNG shipments to European destinations totaled 4.4 billion cubic meters, which represents an all-time high. The continent is expected to import 17-18 billion cubic meters of liquefied natural gas this month, which would be an increase over the 16.4 billion cubic meters that it imported in December.

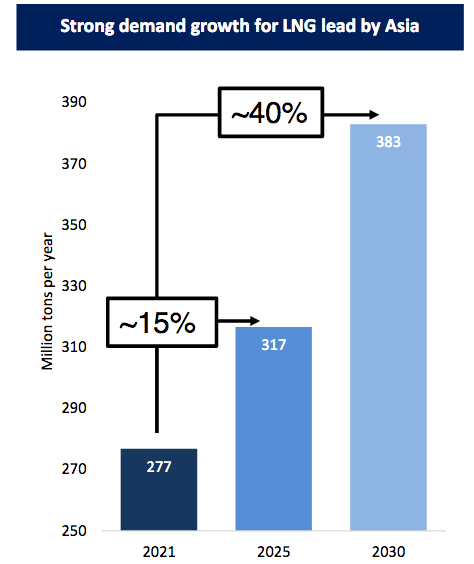

Europe is not the only place that is importing liquefied natural gas. As I pointed out recently, China is expected to increase its imports of natural gas by at least 7% next month. A significant part of its imports will be in the form of liquefied natural gas. In this respect, China is joining the rest of Asia as the continent is expected to increase its annual liquefied natural gas imports by 40% by 2030:

Golar LNG

This is due partly to the region attempting to temper its smog problems as natural gas burns much cleaner than coal or other fossil fuels. When we combine this with the growing demand out of Europe, we can start to see some very real investment potential.

Companies To Benefit

There are a few companies that will obviously benefit from this situation. Many of these are in the United States or Canada as those are two of the only countries in the world that can actually increase their production of natural gas in order to satisfy the demands of these importers.

One obvious play here is Cheniere Energy (LNG), which is the largest producer of liquefied natural gas in the United States and one of the largest in the world. The company recently secured a long-term contract to supply Norway's Equinor (EQNR) with natural gas that it can use to supply the thirsty European market. Cheniere Energy just started work on an expansion project on its liquefaction plant in Texas to take advantage of this. The company has a consensus earnings estimate of $17.20 for the full-year 2023 period, which gives it a forward P/E of 8.70 at the current price.

Another good play could be Energy Transfer (ET), which is positioning itself as a midstream provider to various liquefied natural gas plants under construction. The company enjoys very stable cash flows due to its volume-based business model along with growth potential as it brings some of its projects online. I discussed this company and its opportunity in this market in more detail recently. Energy Transfer boasts a very strong balance sheet and an attractive 42.24% distribution yield.

Next Actions

There are many more companies that are well-positioned to profit from this growing trend. In fact, I discussed one that is certain to prosper earlier this week at Energy Profits in Dividends (pay-walled)..

More By This Author:

Natural Gas Prices Seem Likely To Continue To Rise

Outlook For Interest Rates And The Federal Reserve

Biden's SPR Release Will Have Minimal Effect On Oil Prices

Disclaimer: All information provided in this article is for entertainment purposes only. Powerhedge LLC is not a licensed financial advisor and no information provided should be construed as ...

more

Agreed, that $WMB is good investment choice.