Natural Gas Prices Seem Likely To Continue To Rise

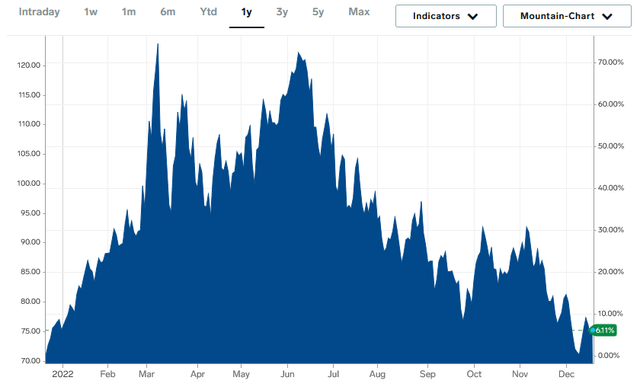

As everyone reading this is certainly well aware, we have seen a sharp increase in energy prices over the past year. Currently, WTI crude oil is up 6.11% over the past year:

Business Insider

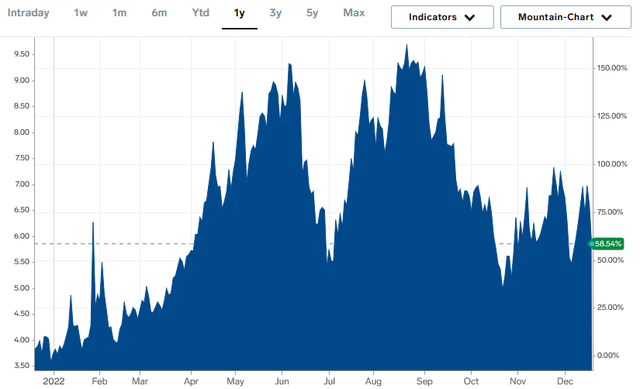

Natural gas prices are doing much better though as the price of natural gas at Henry Hub is up a whopping 58.54%:

Business Insider

There are some signs that natural gas is likely to increase further. One of the biggest drivers of this is the reopening of China. China had a much stricter lockdown policy than the Western world in response to the COVID-19 pandemic. In fact, the country has had its economy at least partially shut down over the past two years. That has begun to change though as the country has begun reopening in order to quell the rising unrest that has emerged from the lockdown policies. The reactivation of the country's economy is expected to cause an increase in its natural gas demand, with state-owned CNOOC predicting that the nation will increase its natural gas imports by 7% over the next year. As much of these imports will be in the form of liquefied natural gas, this is good news for LNG shipping companies.

This increased demand for liquefied natural gas could not come at a worse time for natural gas consumers however as the supply-demand balance of the resource is already incredibly tight. The increased demand will therefore push natural gas prices up as it is highly unlikely that the production of the substance will increase to that degree.

This is both a short-term and a long-term driver as the country is expected to be gradually increasing its demand over the next year. However, we do have a very short-term driver as an arctic blast hits the eastern two-thirds of the United States. This storm is expected to result in the coldest weather that many parts of the country have seen in two decades and obviously push up demand for heating. As natural gas is one of the most widely-used fuels for space heating, this storm can be expected to increase the demand for natural gas. When we consider the tight supply-demand balance, we very easily see the price being pushed up simply due to the law of supply and demand. While not a particularly good thing for consumers, the higher price of natural gas is likely to benefit companies such as Range Resources (RRC) and EQT (EQT). The stock prices of these companies have not really benefited though as both are slightly down so far this week.

Long-Term Trends

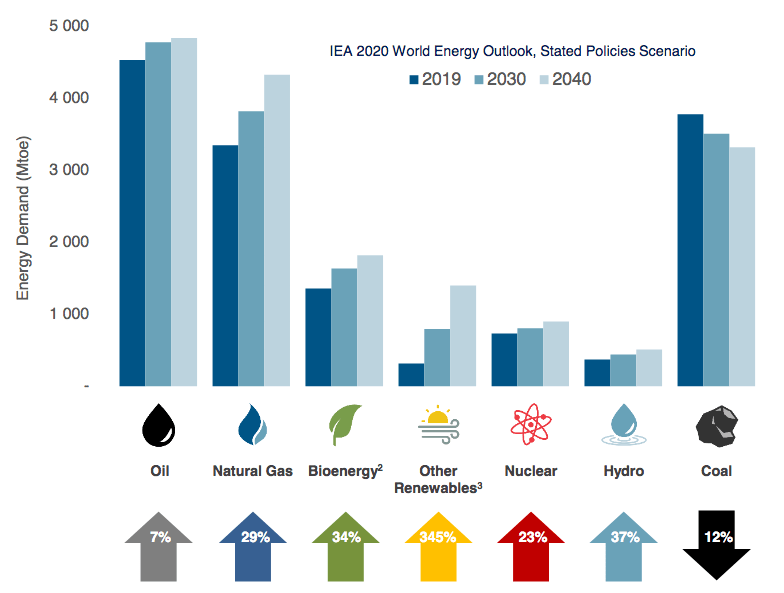

As I have discussed in various previous articles, the long-term fundamentals for natural gas are also likely to be quite positive. This is because the demand for the substance globally is likely to rise more than the production of it. This is something that may be surprising considering the efforts of politicians and activists to wean the world off fossil fuels but it is in fact these very efforts that cause these positive fundamentals. According to the International Energy Agency, the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2020 World Energy Outlook

This is due to international concerns about climate change. As everyone reading this likely knows, these concerns have caused governments all around the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. The most common strategy currently being employed is to encourage utilities to retire old coal-fired power plants in favor of renewables such as wind and solar. However, these renewable energy sources are unreliable, preventing them from providing the "always-on" performance that people have come to expect from a modern electrical grid. After all, wind power does not work when the air is still and solar power does not work at night. While batteries have been proposed as a solution to this problem, they lack the capacity needed to have much of an effect. Thus, the usual solution is to supplement renewable energy sources with natural gas turbines. This is because natural gas is reliable enough to carry the grid as needed and it burns cleaner than any other fossil fuel.

It is somewhat unlikely that the production of natural gas will increase sufficiently to meet this demand. Although there are areas such as Appalachia in which companies specifically produce natural gas, most natural gas is produced alongside oil. The energy industry has been severely underinvesting in both crude oil and natural gas production since the energy bear market that occurred in 2015, which is one reason why we still have not seen a recovery in the offshore drilling industry. In fact, this underinvestment is so severe that Moodys projects that the industry must immediately increase its upstream spending by $542 billion in order to avoid a supply shock. It is, to put it mildly, incredibly unlikely that this will happen. After all, oil companies are currently besieged by environmental activists and politicians trying to force them to improve sustainability and by shareholders demanding higher returns. In addition to this, all three of the largest asset managers in the United States (BlackRock, State Street, and Vanguard) have committed to pushing ESG and DEI policies on the companies contained in their index and mutual funds. We are also even seeing banks refusing to lend to energy companies because of environmental policies. Thus, the industry is being deprived of the capital that it needs to increase its production spending. This all points to a scenario in which demand is going to increase much more than supply in the fossil fuel sector. This naturally pushes up prices for these fuels.

More By This Author:

Outlook For Interest Rates And The Federal Reserve

Biden's SPR Release Will Have Minimal Effect On Oil Prices

FOF: This Fund Of Funds Looks Attractive For Income Investors

Disclosure: I am long various energy-focused mutual funds that may hold any stock mentioned in this article. I exercise no control over the contents of these funds.

Disclaimer: All information ...

more

Continue? Aren't we down 20%+ in a week?