FOF: This Fund Of Funds Looks Attractive For Income Investors

One of the biggest problems facing investors today is an inability to generate any significant amount of income off the assets in their portfolios. This is an especially big problem for retirees because there are dependent on their portfolios for the income that they need to pay their bills and finance their lifestyles. The reason for this is the policies that have been pursued by the Federal Reserve over the past decade or so. There are some ways around this problem, fortunately. One is the best way is to invest in closed-end funds because these assets provide investors with access to a professionally managed portfolio that can use a variety of strategies that allow it to, in many cases, deliver a higher yield than pretty much anything else in the market. It can be difficult to find the right fund for any individual investors. One possible option then might be to purchase a fund that invests in other funds. This option may be even able to pay out a higher yield than even closed-end funds. In this article, we will discuss the Cohen & Steers Closed-End Opportunity Fund (FOF), which does exactly this. This fund even boasts a very attractive 7.45% yield at the current level. I have discussed this fund before but several months have passed so many things have changed. This article will focus specifically on these changes as well as provide an updated analysis of a fund’s financials.

About The Fund

According to the fund’s website, the Cohen & Steers Closed-End Opportunity Fund has the stated objective of providing a high level of total return consisting both of current income and capital appreciation. This is not exactly surprising as many closed-end funds focus on total return, particularly those funds that specialize in equity investments. There are also many funds that aim to provide their investors with a high level of current income among both equity and fixed-income funds. Thus, it does make a lot of sense that a fund that invests in other funds would have a combination of most fund’s objectives as its own. The majority of investors are interested in either current income or total return (or both) so this works out quite well.

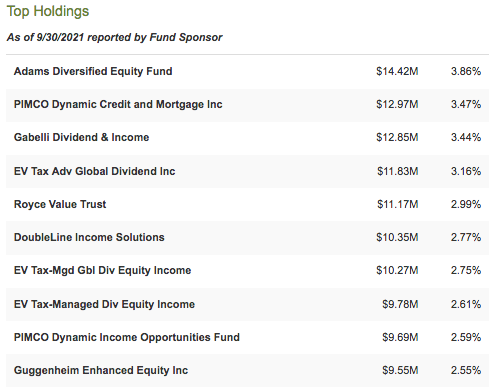

As my regular readers likely know, I have spent a great deal of time and effort in recent months discussing various closed-end funds. As such, a few of the names that make up the largest positions in the fund may be familiar. Here they are:

Source: CEF Connect

I have discussed several of these funds, but not all of them, in the recent past. These include all three of the Eaton Vance funds, The Gabelli Dividend & Income Trust (GDV), and the DoubleLine Income Solutions Fund (DSL). These funds use a variety of strategies including options, ordinary equity investing, dividend growth, and fixed-income investing. This can be quite good because of the diversification that it provides investors. Thus, it appears possible to obtain an incredibly well-diversified portfolio by simply purchasing this fund. This is also nice because of the protection that it can provide us against concentration risk. Concentration risk refers to the tendency of many funds to invest in the same assets, such as the largest firms in the S&P 500 index (SPY). This can pose a problem for people that invest in multiple funds because they can end up thinking that their portfolio is more diversified than it actually is. As this fund invests in many funds utilizing different strategies, it helps to reduce their risk.

One thing that we notice is that many of these funds in the largest positions list are the same as they were the last time that we looked at the fund, although the weightings have changed a bit. The only notable additions in the list are the PIMCO Dynamic Credit and Mortgage Fund (PCI), DoubleLine Income Solutions Fund, Adams Diversified Equity Fund (ADX), and the Guggenheim Enhanced Equity Income Fund (XGPMX). This suggests that the fund does not actively trade its positions very often. It actually has an annual turnover of 54.00%, which is fairly middle of the road. As a general rule, the lower a fund’s turnover the better. This is because trading costs money and the less money a fund spends on its expenses, the more that is available to make its way down to the investors all else being equal. This is one of the reasons why index funds have become popular as they do a relatively little trading. With that said, high trading costs do not necessarily mean that a fund will underperform but it does make it harder for management. This one appears to be reasonable but remember that many of the funds that it invests in will also have their own trading costs.

As my regular readers on the topic of closed-end funds are likely aware, I do not like to see any single position in a fund account for more than 5% of the total portfolio. This is because this is approximately the level at which a position begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk which any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if it accounts for too much of the portfolio then it wll not be completely eliminated. Thus, the concern is that some event may occur that causes the price of an asset to decline when the market does not and if that asset accounts for too much of the portfolio then it may end up dragging the entire fund down with it. As we can see above though, there is no single asset that accounts for more than 5% of the portfolio so this is not something that we need to worry about here.

The Problem For Income Investors

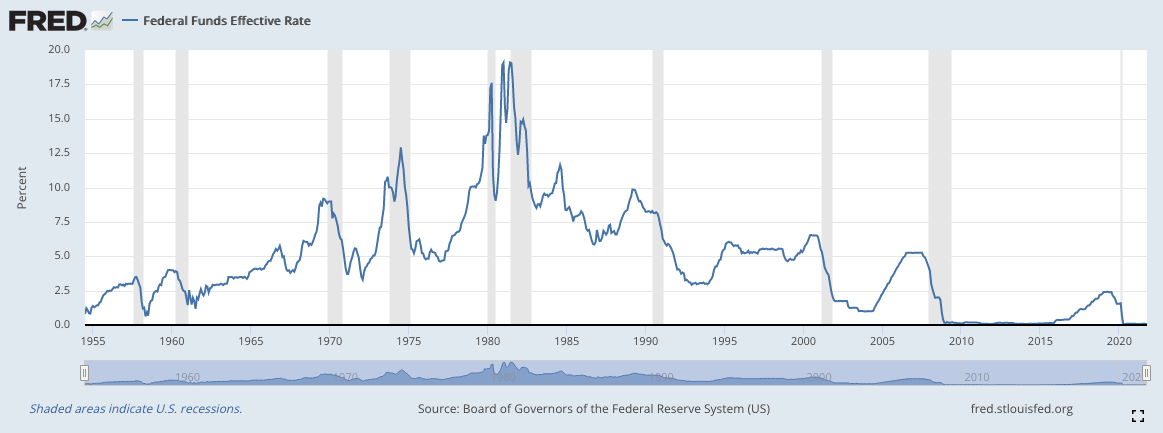

As mentioned in the introduction, one of the biggest problems facing investors today is an inability to generate any significant amount of income off of the assets in their portfolios. This is an especially big problem for retirees because they are heavily dependent on their portfolios to produce the income that they need to finance their lifestyles and pay their bills. The reason for this problem is the policies that have been pursued by the Federal Reserve in the years since the financial crisis. Specifically, this refers to the central bank’s control over the federal funds rate, which is the rate at which the nation’s commercial banks lend money to each other on an overnight basis. As we can see here, the Federal Reserve cut the rate to all-time lows following the 2007 collapse of Lehman Brothers. The bank kept the rate at these levels for more than a decade until the Trump Administration. Although the bank began raising the rate at this time, it still remained at historically low levels. This all changed with the outbreak of the coronavirus pandemic, which prompted the Federal Reserve to once again cut the rate to all-time lows, where it remains today:

(Click on image to enlarge)

Source: Federal Reserve Bank of St. Louis

As of the time of writing, the federal funds rate sits at 0.08%. This is important because this rate influences the rate of everything else in the economy. This is the reason that mortgage rates are currently at such low levels. It is also the reason why savings accounts and certificates of deposit are yielding essentially nothing. This has rendered tradition retirement strategies such as laddering certificates of deposit essentially useless. Retirees have thus been forced to pursue other options.

The primary option that most have chosen to utilize is to move their money out of safe bank accounts and into risk assets such as stocks and bonds. This influx of new money into the capital markets is one reason why we have seen such tremendous asset appreciation over the past decade. This has been great for capital appreciation but it has also had the effect of suppressing yields. We can see this by looking at the yield on the S&P 500 index, which is 1.21% as of the time of writing. The bond market is not really any better as the iShares Core U.S. Aggregate Bond ETF (AGG) only yields 1.82% currently. At these yields, even a $1 million portfolio would generate less income than a minimum wage job in the absence of asset appreciation, which is by no means guaranteed.

Closed-end funds are able to do much better than this due to the strategies that they use, which vary from fund to fund. By extension, a fund that invests in closed-end funds can also deliver a much higher yield than other funds. As mentioned earlier, the Cohen & Steers Closed-End Opportunity Fund yields 7.45% as of the time of writing. This fund would produce $74,500 in annual income from a $1 million investment. This should be enough to support a reasonable retirement in most areas of the country when combined with Social Security.

Distribution Analysis

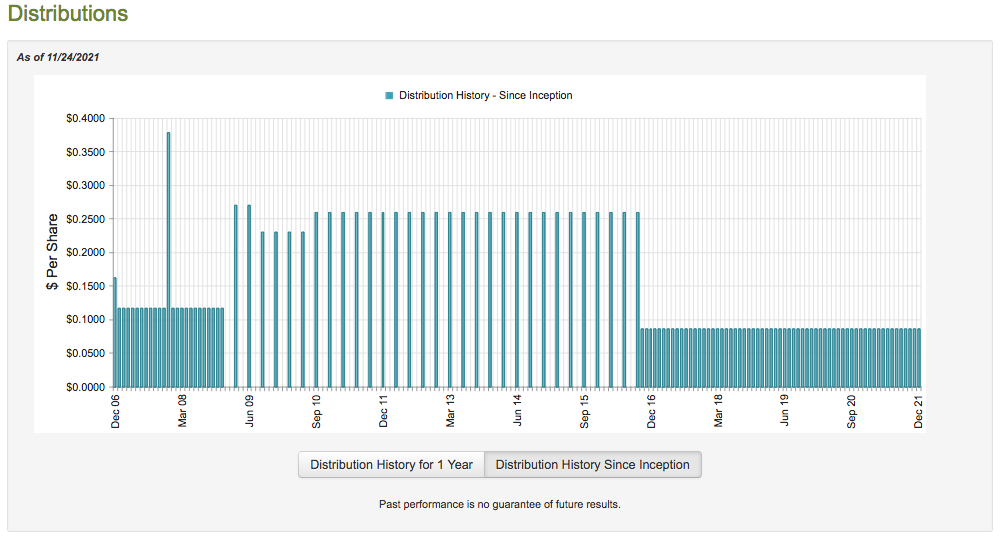

As mentioned earlier, the primary objective of the Cohen & Steers Closed-End Opportunity Fund is to provide its investors with a high level of total return consisting of both current income and capital appreciation. Due to the current income component, we might expect the fund to pay out a regular distribution to its shareholders. This is indeed the case as the fund currently pays out $0.0870 per share monthly ($1.044 per share annually), which gives it a 7.45% yield at the current price. The fund has been remarkably consistent about this payout over its lifetime:

(Click on image to enlarge)

Source: CEF Connect

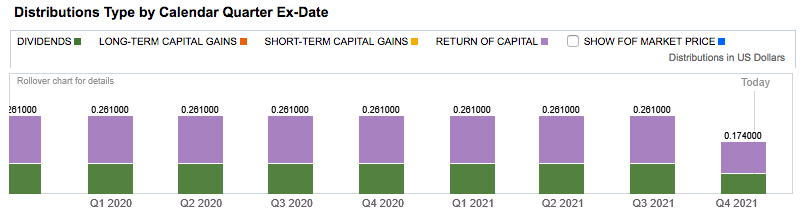

This overall consistency seems quite likely to appeal to those investors seeking a reliable source of income to meet their needs. Unfortunately, these same investors may be somewhat turned off by the fact that a significant amount of this distribution consists of return of capital:

(Click on image to enlarge)

Source: Fidelity Investments

The reason why this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. There are many things that can cause a distribution to be classified as return of capital, however, such as the distribution of unrealized capital gains. The funds held by this fund may also be using option strategies or investing in various partnerships, which can likewise cause a distribution to be classified as a return of capital. As such, we want to examine how exactly the fund is financing its distribution in order to determine how sustainable they are likely to be.

Fortunately, we have a somewhat recent report to consult for this task. The fund’s most recent financial report corresponds to the six-month period ended June 30, 2021. As such, it will not include information about the past few months but it will still provide us with a great deal of insight into the fund’s performance in the very strong market conditions that we saw in the first half of the year. This is also a much newer report than what we had the last time that we looked at the fund. During that period, the fund reported only a total dividend income of $5,313,285 off its investments. The fund paid its expenses out of this, leaving it with $3,583,169 available for the investors. This was not nearly enough to cover the $14,232,171 that it actually paid out during the period. Fortunately, though, the fund does have other ways to obtain the money that it needs to pay its distributions such as capital gains. It was quite successful in this, realizing $22,189,006 in net gains and seeing another $25,459,747 in unrealized gains. This was substantially more than it needs to cover the distribution so we can conclude that the distribution is likely sustainable.

Valuation

As is always the case, it is critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate suboptimal returns off that asset. In the case of a closed-end fund like the Cohen & Steers Closed-End Opportunity Fund, the usual way to value it is by looking at a metric known as the net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them for less than the fund is actually worth. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. That is, fortunately, the case today. As of November 24, 2021, the fund had a net asset value of $14.10 per share but they only trade for $13.91 per share. This gives it a 1.37% discount at the current price. This is much more attractive than the 1.48% premiums that the shares have traded at on average over the past month. Thus, the current price appears to be reasonably attractive.

Conclusion

In conclusion, closed-end funds offer investors a very nice opportunity to generate income well in excess of most other things in the market. The Cohen & Steers Closed-End Opportunity Fund offers an easy way to purchase a well-diversified portfolio of these entities with one trade that shares the high yield of its investments. It also boasts a significant amount of consistency with regard to its distribution so it is likely to appeal to those investors seeking a steady and reliable source of income, especially when combined with its overall sustainability. Finally, the fund’s current valuation is rather attractive compared to its historical level so the price is right. Overall, this fund may be worth considering right now.

Disclaimer: All information provided in this article is for entertainment purposes only. Powerhedge LLC is not a licensed financial advisor and no information provided should be construed as ...

more