Outlook For Interest Rates And The Federal Reserve

This has certainly been an interesting week in terms of the impact of Federal Reserve policy on the market. In particular, we saw how expectations can lead to exuberance that will not exactly play out in the market. This would not have been a problem prior to the financial crisis as interest rates rarely had an impact on the stock market. However, the market and companies have become addicted to free money over the past decade so the central bank's policy may now matter more than it ever has in the past. After what we saw this week, it is more important than ever to understand how monetary policy can impact your portfolio and what direction the Federal Reserve will take as we enter 2023.

Historical Primer - Interest Rates And The Market

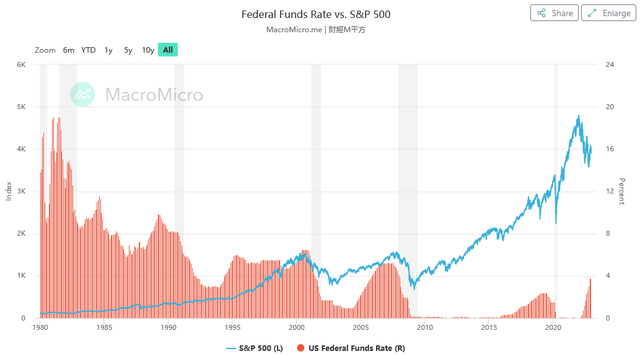

As mentioned in the introduction, prior to the financial crisis that occurred over the 2007 to 2009 period, interest rates had a very limited effect on the market. In fact, the Federal Reserve actually started hiking interest rates in the early stages of the technology boom of the late 1990s and the market shot up anyway:

Source: MacroMicro

In fact, we can see numerous periods here in which interest rates had a very limited impact on the performance of the S&P 500 (SPY). What little connection there is was due largely to the historical use of the monetary policy. In short, the Federal Reserve lowers interest rates during a recession in order to get money moving throughout the economy. The hope is that when the Federal Reserve lowers interest rates, it is cheaper for banks to obtain financing in order to make loans. In addition, savers have a reduced incentive to hold money for future consumption as opposed to spending it now. Finally, lower interest rates also make it cheaper for businesses to obtain the loans that they need to expand their businesses.

The reverse is also true. When the central bank raises interest rates, it makes it more expensive for companies to borrow money to spend on expansion. As such, they may hold back on their expansion plans until a more accommodative policy comes along. In addition, savers are rewarded by not spending money so they may be encouraged to put off spending on certain consumer goods. This generally causes a reduction in corporate profits and slows the economy down.

The Federal Reserve made a big mistake back in the late 2000s though when the financial crisis happened. At that time, the central bank cut rates to their lowest levels in history. It then kept them at those levels for nearly a decade despite the fact that the economy had largely been revived by 2010. This was the Federal Reserve's biggest mistake. As people saw the stock market and other asset prices rising, they began to borrow money at near-zero rates and use that money to purchase stocks and other assets that were rapidly increasing in price. Many companies did the same thing and we even saw a number of companies borrowing money just to buy back their own stock. In effect, the Federal Reserve created a decade-long environment in which holding anything was preferable to having cash. It backed itself into a wall with this policy.

This leads us to today.

The End Of Free Money

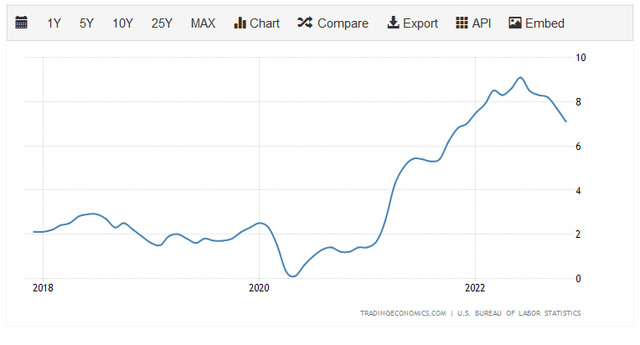

By March 2022, inflation in the American economy had been raging out of control for several months. The consumer price index had been above the Federal Reserve's target rate of 2% since the middle of 2021 and was showing no signs of abating:

Source: Trading Economics

After the bank finally abandoned the myth that inflation was "transitory," it decided to do something about it. The Federal Reserve started raising interest rates in March 2022. As of the time of writing, the federal funds rate is 4.25% to 4.50%, up from 0% to 0.25% in February 2022.

This had a devastating effect on a stock market that was by this point addicted to free money. Many traders were margined to the hilt so when the decline started, they were forced to sell in order to meet margin calls. In addition, companies were no longer able to borrow money for essentially nothing so many investors began to reduce their expectations for growth.

Latest CPI Print And Central Bank Policy

The November CPI report, which was released on Tuesday, December 13, 2022, brought hopes from several people on Wall Street that the Federal Reserve would abandon its raising interest rate policy. This is because the report showed a year-over-year price increase of 7.1%, which was below the 7.2% expectation. The month-over-month numbers showed a 0.1% increase, which is well below the Federal Reserve's 2% inflation target.

The market rallied very significantly in response. The Nasdaq had an intra-day high of 4.5% and Bitcoin hit its highest price in over a month. We also saw gains in crude oil, gold, and even Treasuries. The dollar index was the only thing that was down.

This shows exactly how far the addiction to free money has gone. In the third quarter of 2022, consumers added 15%, or $121 billion, to their credit card balances. The consumer is tapped out yet the market mysteriously thought that people would be able to increase their purchases of televisions, electric cars, and consumer gadgets. This clearly makes no sense in an environment with negative real wage growth and people being forced to take on second jobs just to purchase food.

Naturally, the Federal Reserve spoiled the party and left the market with a rather nasty hangover. The central bank hiked rates by only 0.5%, which was expected. However, it did not commit to a pivot in early 2023 and Chairman Powell's comments hinted at keeping rates "higher for longer." The Federal Reserve's economic projections for 2023 also project a 1% increase in the unemployment rate. The central bank still appears to believe that inflation can be brought down without pushing the economy into a recession.

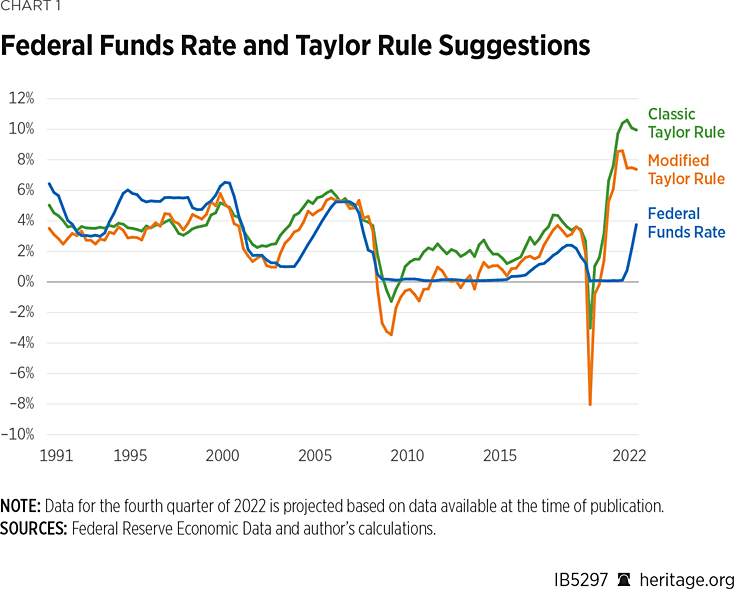

The real question is where exactly interest rates will peak. Fortunately, we do have some history to guide us on this. In 1992, American economist John Taylor proposed a rule for central banks to follow when setting monetary policy. According to Taylor, monetary policy is stabilizing whenever the nominal interest rate is higher than the increase in inflation. This is the policy that the Federal Reserve followed prior to 2000. Based on the most recent CPI data, the Federal Reserve would have to raise rates to 7.25% to 10% in order to defeat inflation.

In the 2000s, Federal Reserve Chairman Ben Bernanke proposed an alternative to the Taylor rule that considers whether or not the economy is producing at its potential or not and adjusts interest rates accordingly. This has allowed interest rates to be set at below the level suggested by the Taylor rule for the past twenty years. However, even Bernanke's modified version suggests a federal funds rate substantially above today's level:

Source: Heritage Foundation

Thus, it appears that the Federal Reserve will almost certainly be forced to raise rates well above today's level, particularly since the real interest rate is still negative today. The Federal Reserve is currently projecting that interest rates will peak next year at 5.1% and 5.4%. That seems highly unlikely considering the inflation rates that we are seeing. The market may thus be in for some further rude awakenings in the near future.

More By This Author:

Biden's SPR Release Will Have Minimal Effect On Oil Prices

FOF: This Fund Of Funds Looks Attractive For Income Investors

JPS: A Great Income Fund To Help You Beat The Fed

Disclaimer: All information provided in this article is for entertainment purposes only. Powerhedge LLC is not a licensed financial advisor and no information provided should be construed as ...

more