Could 2023 Be The Year For Gold?

Image Source: Pexels

I think that everybody can admit that 2022 was a very interesting year for the markets. We finally saw the inflation that numerous alternative economists had been predicting for years, which resulted in a reversal of the Federal Reserve's longstanding easy money policy. The stock market certainly didn't like the reversal of this policy and we saw more than $30 trillion in value wiped out over the course of a year. However, the performance of gold was curious given gold's historical use as a store of value. One of the reasons why investors purchase gold is to protect themselves against inflation, yet gold did not appreciate as we would expect in such an environment. Rather, the shiny yellow metal was essentially flat over the course of the year. However, there may be some early signs that 2023 could turn out somewhat different so let us have a look and see what we can determine.

Gold Prices in 2022

As stated in the introduction, the price of gold was essentially flat over the course of 2022. As we can see here, the metal both started and ended the year at just over $1,800 per ounce, although it did fluctuate a bit between $1,600 and $2,000 per ounce:

(Click on image to enlarge)

Source: Goldprice.org

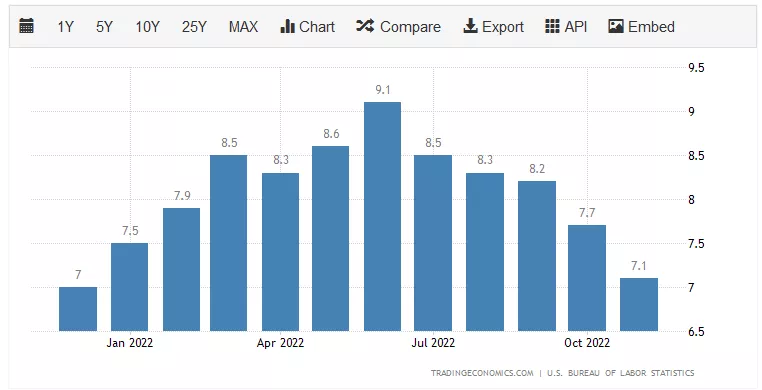

This is despite the fact that gold is historically viewed as a hedge against inflation. As everyone reading this is no doubt well aware, the United States (and just about every other country around the world) suffered from some of the highest inflation that we have seen in more than forty years. There was no month in which the year-over-year inflation rate was less than 7%:

Source: Trading Economics

So any gold bug would likely ask what is going on here. Why is gold not reacting the way that we were expecting it to? Why did it not go up despite the fact that everything else did?

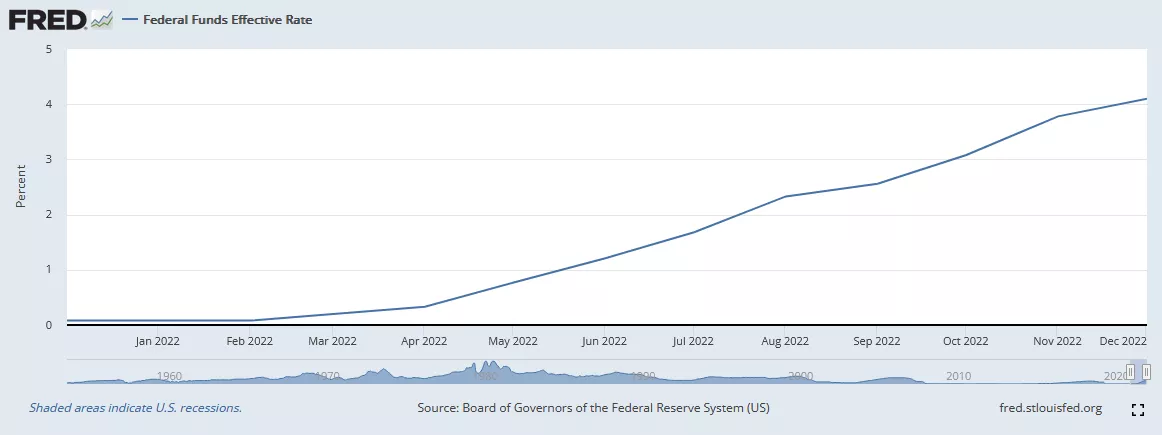

There admittedly is not an especially easy answer to this question. However, Peter Schiff made a good case in early 2022 when he pointed out that the market was focused on nominal interest rates as opposed to real interest rates. As we are all well aware, the Federal Reserve was very aggressive about hiking interest rates in 2022. In February 2022, the federal funds rate was at 0.08% but had risen to 3.78% by the end of November. The rate was set from 4.25% to 4.50% at the meeting that was held in December. The current effective federal funds rate is 4.10%:

(Click on image to enlarge)

Source: Federal Reserve Bank of St. Louis

This created an opportunity cost for holding gold. After all, idle cash began to actually generate more interest income than it has at any time in more than fifteen years. However, gold generates nothing so by using the cash to purchase gold, an investor is sacrificing the potential income that the idle cash could generate in a money market fund or similar vehicle. However, the market ignored the fact that real interest rates were negative over the entirety of 2022. They still are as we can easily see by looking at the above chart which shows that inflation never dropped below 7%.

Gold As A Hedge Against Inflation

Gold, however, should benefit anytime real interest rates are negative, which is the case today despite the Federal Reserve's rate hikes. In order to understand why this is the case, we need to understand the actual cause of inflation. Economists commonly state that inflation is a naturally occurring phenomenon but this is not exactly correct. Rather, inflation is the direct result of the money supply growing faster than the actual production of goods and services in the economy. This has been the case over the past decade, which we can clearly see by comparing the American gross domestic product against the money supply.

This chart shows the M3 money supply over the past ten years, which is the most comprehensive measure of the money supply in an economy:

(Click on image to enlarge)

Source: Federal Reserve Bank of St. Louis

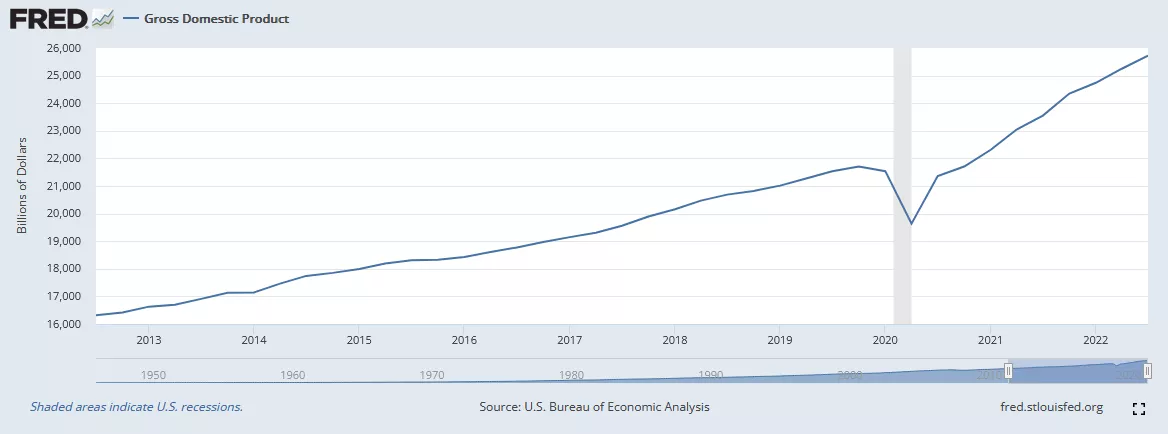

As we can clearly see, the M3 money supply went from $10.2673 trillion to $21.4152 trillion over the ten-year period. This is a 108.58% increase, which is substantially greater than the actual increase in economic production over the period. This chart shows the actual productive output out the economy, as measured by gross domestic product:

(Click on image to enlarge)

Source: Federal Reserve Bank of St. Louis

As we can see, the gross domestic product went from $16.31954 trillion to $25.723941 trillion over the ten-year period. This is only a 57.63% increase, which is obviously substantially less than the increase that we saw in the money supply. This is the root cause of the inflation that we have been seeing in the economy.

This causes inflation because it results in a greater amount of money being available and willing to purchase each unit of economic output. The basic economic law of supply and demand states that such a scenario will result in rising prices. Gold benefits from inflation because it has the same qualities as everything else that increases in price due to inflation. After all, gold is only available in limited supply and cannot be created out of thin air like fiat currency. It also requires real human or mechanical effort to create and cannot be created simply by pushing a button on a computer. Thus, gold should increase in price during inflationary times, despite the fact that it did not during 2022. Over longer time periods though, it does serve pretty well as a hedge against inflation.

The Changing Dynamic

We have already begun to see that things may be different for gold this year. On the first trading day of 2023, gold climbed and hit $1,850 per ounce, which is the highest price that it has had since June 2022:

Source: Zero Hedge

Earlier, I mentioned that investors may have seen the increase in interest rates and kept gold suppressed because of the opportunity costs of holding gold. However, despite the Federal Reserve's steep interest rate increases, real interest rates still remain negative. As such, the investor holding cash is still losing purchasing power to inflation. The only thing that higher interest rates accomplish is to ensure that the loss of value to inflation is less than it would otherwise be. However, gold is a protection against the loss of purchasing power. Thus, investors should look at the real interest rate when deciding whether or not to hold gold or cash. As long as the interest rate is negative, an investor should hold gold. The market may have realized that yesterday by bidding up gold.

More By This Author:

Remembering 2022 And Opportunities For 2023

European And Asian Demand For LNG Is Increasing

Natural Gas Prices Seem Likely To Continue To Rise

Disclaimer: All information provided in this article is for entertainment purposes only. Powerhedge LLC is not a licensed financial advisor and no information provided should be construed as ...

more

Yes, it will be!