Remembering 2022 And Opportunities For 2023

There are almost certainly going to be a lot of people that would rather forget 2022 as it was one of the worst years for market-watchers in a generation. It seems that almost everything went down and, indeed, almost everything did. Overall, more than $30 trillion in market value was lost in 2022, which was about double the value destruction that occurred worldwide in 2008. Unlike 2008 though, the country was plagued with incredibly high rates of inflation that crippled the budgets of many households. The fact that much of the inflation was in food and energy did not help matters as these are not sectors that people can simply choose to exclude from their budgets. Fortunately, not all was bad and, just as we saw back in 2008, there are some opportunities for investors today.

Market Devastation

As just mentioned in the introduction, the market devastation of 2022 was immense. Globally, more than $30 trillion in stock and bond values was destroyed as central banks started raising interest rates aggressively to combat near double-digit inflation, ending the "easy money" policies that had persisted since the Great Recession more than a decade ago. This was quite evident in the S&P 500 Index (SPX), which is down 20.46% over the trailing twelve-month period as of the time of writing:

Source: Seeking Alpha

There were some sectors that were down much more than this. The mega-cap technology stocks, collectively known as the FAANGs, ended their reign as market darlings. Indeed, many of them were down much more than the S&P 500 index:

| Company | TTM Market Price Performance |

| Apple (AAPL) | -30.22% |

| Amazon (AMZN) | -50.40% |

| Meta Platforms (META) | -63.21% |

| Google (GOOG) | -38.88% |

| Microsoft (MSFT) | -28.88% |

| Netflix (NFLX) | -50.92% |

| Tesla (TSLA) | -73.72% |

Needless to say, anyone that had been pinning their retirement hopes on these companies has likely had their hopes dashed by now. This is unfortunate and it shows the folly of betting everything on one stock.

It may be comforting to know that one is hardly alone in their losses though. As of December 16, 2022, the average retirement account lost about $30,000 in 2022 with average balances going from $126,100 to $97,200 over the trailing twelve-month period. That is nowhere close to enough to retire but we will ignore the fact that most retirement accounts are sorely underfunded. The point is that this past year was a sorely depressing one for just about everybody. As was the case in 2008, it is likely that many of us would prefer to forget it.

Potential For Opportunity

Fortunately, as was the case in 2008, there could be some reason for optimism. Anyone that bought bank or real estate stocks at the height of the financial crisis back then made a lot of money. I still have very fond memories of picking up companies like Travelers (TRV) for less than $30 per share. Real estate stocks also quickly rebounded, as did preferred shares. All one needed was to not let their emotions get the better of them and to have enough cash available to take advantage of the opportunities. That would be good advice today as well and I have personally been increasing the cash balances in my investment accounts while I watch for opportunities.

One opportunity today could be in traditional energy. As everyone reading this is no doubt well aware, crude oil and natural gas prices rose significantly in 2022. Although energy prices have fallen since the first quarter spike that saw the Russian invasion of Ukraine, they are still higher than at the same time last year. As of the time of writing, West Texas Intermediate crude oil is up 6.71% over the trailing twelve-month period:

(Click on image to enlarge)

Source: Business Insider

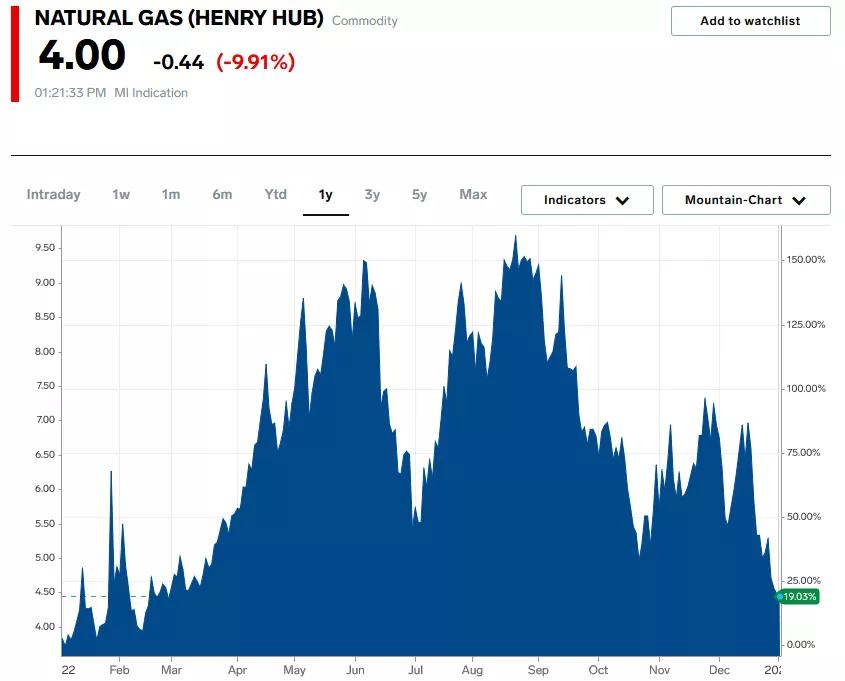

Natural gas has done much better and is up 19.03% over the trailing twelve-month period:

(Click on image to enlarge)

Source: Business Insider

Natural gas has been falling significantly today due to the warm weather that we have been experiencing in much of the United States after the Arctic blast a week ago. As I have pointed out numerous times over the past year or two though, the fundamentals remain quite strong as the demand for natural gas is likely to grow much quicker than the supply of the resource. This is particularly true if the tensions between Russia and NATO do not abate any time soon, which seems more and more likely with each passing day considering the hostile rhetoric coming out of both sides. There are also some technical reasons to expect that energy prices will rise over the course of 2023.

This overall strength in energy prices has certainly not gone unnoticed by the market. This is evident by looking at energy stocks, which outperformed the S&P 500 Index substantially over the course of the year. Over the past twelve months, the iShares U.S. Energy ETF (IYE) is up a remarkable 49.27%:

Source: Seeking Alpha

Despite this, many of the largest players in the industry are substantially undervalued. We can see this by looking at the current price-to-earnings-growth ratio of many of the major American energy producers:

| Company | PEG Ratio |

| ExxonMobil (XOM) | 0.32 |

| Chevron (CVX) | 0.64 |

| Diamondback Energy (FANG) | 0.25 |

| Pioneer Natural Resources (PXD) | 0.86 |

| EQT Corporation (EQT) | 0.15 |

| Range Resources (RRC) | 0.17 |

(all data courtesy of Zacks Investment Research)

As I have pointed out numerous times before, a price-to-earnings-growth ratio of less than 1.0 is a sign that the stock may be undervalued based on the company's forward earnings per share growth. Thus, all of these companies appear remarkably undervalued today despite the strong performance that they delivered in 2022.

There is, even more, to attract potential investors to these names. A few of these companies, such as Diamondback Energy and Pioneer Natural Resources, have committed to paying out at least 75% of their free cash flow to investors. As the high energy prices have boosted free cash flows and the stock prices still remain quite low, this has resulted in many of these companies having dividend yields exceeding 7% at today's prices! Thus, not only are you able to get the stock for a very affordable price but you are also well-compensated to simply hold it until the valuation better reflects the company's actual financial performance. This is a much better position to be in over the next year than holding technology stocks that will likely be flat or decline and have no dividends.

More By This Author:

European And Asian Demand For LNG Is Increasing

Natural Gas Prices Seem Likely To Continue To Rise

Outlook For Interest Rates And The Federal Reserve

Disclosure: I have positions in XOM, FANG, CVX, and PXD through various energy-focused funds. These funds may change their holdings at any time and may include any energy stock mentioned in this ...

more