Oil Prices Cannot Decline Too Much From Today's Levels

Photo by Timothy Newman on Unsplash

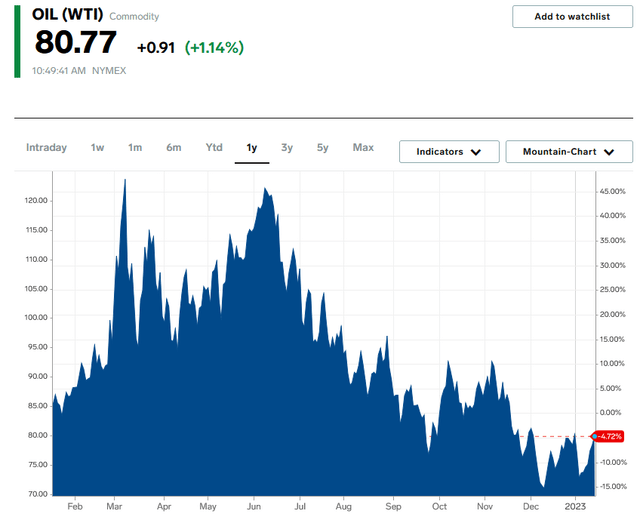

The past six or seven months have been quite brutal for crude oil. Back on June 8, 2022, the price of West Texas Intermediate closed at $122.11 per barrel, which was its highest price since the Russian invasion of Ukraine. The price has generally declined since then with West Texas Intermediate crude oil currently trading for $80.77 per barrel, which represents a 4.72% decline over the past twelve months:

Source: Business Insider

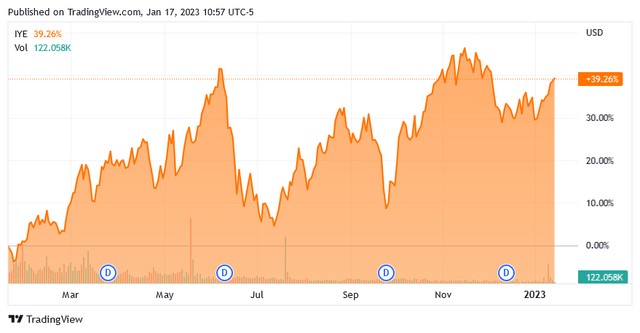

This has not had a significant effect on energy stocks as the U.S. Energy ETF (IYE) is up 39.26% over the same period:

Source: Seeking Alpha

Despite this, traditional energy companies are significantly undervalued relative to their forward earnings growth. I discussed this in a previous blog post. That is, however, not the topic of this post. Rather, my intent is to show that energy prices cannot decline very much from today's levels.

Supply And Demand Fundamentals

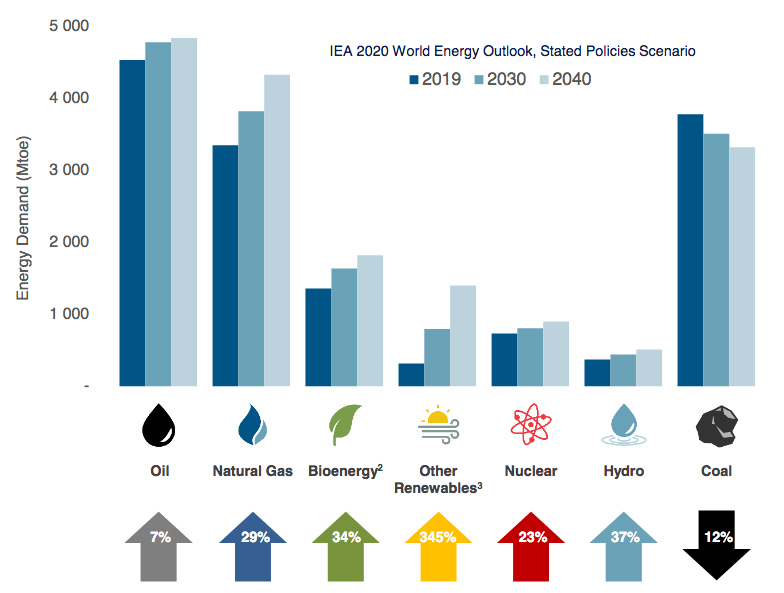

As I have pointed out in many previous articles and blog posts, the demand for crude oil and natural gas is likely to rise over the coming years. This is something that will undoubtedly be surprising for many people considering that most of us live in areas in which the government is actively trying to discourage the consumption of fossil fuels. One notable example of this is the California law requiring that no fossil fuel-powered vehicles be sold in the state after 2035. There are similar laws in several other areas around the world. Despite this, the International Energy Agency projects that the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% by 2040:

Source: Pembina Pipeline/Data from IEA 2021 World Energy Outlook

The demand growth for natural gas is being driven by global concerns about climate change. One of the strategies that are being employed around the world to reduce carbon emissions is to retire old coal-fired power plants because coal burns much dirtier than other fossil fuels. These retired plants are being replaced with new solar and wind generation facilities. Unfortunately, these technologies suffer from a lack of reliability. After all, wind power does not work when the air is still (or ironically when it is blowing too quickly) and solar panels do not work at night. While batteries have been proposed as a solution to this, current energy storage technology is nowhere near capable enough to ensure the "always-on" capability that people expect from a modern electrical grid. Thus, most utilities are opting to supplement their renewable generation facilities with natural gas turbines as natural gas is reliable enough to ensure a properly functioning grid and burns cleaner than any other fossil fuel. Admittedly, this technology is not quite as good environmentally as nuclear power but many people do not want that source of power for some reason.

The case for crude oil demand growth may be somewhat harder to understand. After all, we have already seen how some governments are actively working to reduce or eliminate the consumption of crude oil as a source of power. However, it is a very different story if we look at the various emerging nations around the world. These nations are expected to see tremendous economic growth over the projection period, which will have the effect of lifting the citizens of these nations out of poverty and putting them securely into the middle class. These newly middle-class people will naturally begin to desire a lifestyle that is similar to their developed nation counterparts. That will require increased energy consumption, including energy derived from crude oil. As the populations of these nations are considerably larger than the populations of the various developed nations around the world, the rising energy consumption from these parts of the world will more than offset the stagnant-to-declining demand in the world's developed markets.

It is highly unlikely that the production of crude oil and natural gas will grow sufficiently to meet the demand growth for these resources. One reason for this is the growing power of environmental, social, and governance investing. I have written various articles (such as this one) that show the enormous size of these funds. These funds are not the only financial institutions in which ESG principles can be found, however. We have seen some banks begin to incorporate some of these principles into their capital allocation decisions. This has had the overall effect of making it difficult for oil and gas companies to obtain the capital that they need to expand. This is one of the reasons why we have seen upstream producers and midstream energy companies aggressively pay down their debt over the past year. Indeed, the strongest shale producers now can easily pay off all of their debt within a few months if needed. We even have companies like Pioneer Natural Resources (PXD) that have almost no net debt. In short, energy companies have been making themselves completely independent of the market.

Energy producers have also been on the receiving end of pressure from their own investors. Prior to the pandemic, the energy industry was one of the worst performers in the S&P 500 Index (SPX), resulting in shareholders deriving minimal benefit from the surge in domestic production that accompanied the shale revolution over the past decade. This has caused companies to change their business model to one in which they simply sustain their production and pay out a substantial portion of their free cash flow to investors in the form of dividends. In a recent article at Energy Profits in Dividends, I pointed out that Devon Energy (DVN) is only willing to grow its production by 5%, which is not enough to satisfy the demand growth. We are seeing similar moves from Diamondback Energy (FANG), Pioneer Natural Resources, and numerous other shale operators.

This points to a situation in which the demand for hydrocarbons is likely to grow faster than the supply of those resources. According to the laws of economics, this scenario should result in rising prices for crude oil and natural gas going forward.

The Government's Put

In a somewhat little-followed story, the Biden Administration was using the Strategic Petroleum Reserve to try and suppress gasoline prices during the second half of 2022. As of early December, the Administration has sold off 250 million barrels from the reserve, which is about 40% of America's emergency crude oil stockpile. The Strategic Petroleum Reserve now has the lowest level of crude oil that it has had since 1984.

The importance of this for oil prices comes from the fact that the Administration has stated that it will buy oil at $72 per barrel to refill the reserve. When we consider the amount of crude oil that is needed to refill the Reserve and the current supply tightness in the market, this acts as an effective floor on energy prices. Basically, crude oil prices cannot go below $72 per barrel because the instant they do, the enormous demand from the government will drive prices right back up. There is not nearly enough surplus supply in the market for the government to refill the Strategic Petroleum Reserve without having this effect on energy prices.

A price of $72 per barrel is 10.87% below today's price of crude oil. Thus, crude oil prices cannot decline more than 10% from today's levels! This is a far better situation than pretty much any other sector of the economy is in as we head into the most well-telegraphed recession in history. It thus could be a good idea to add some energy exposure to your portfolio to help ensure that you can comfortably ride through the impending conditions.

More By This Author:

The S&P 500 Continues To Look Expensive

US LNG Exports Surge, Why Aren't You Profiting?

Could 2023 Be The Year For Gold?

Disclosure: I am long various energy-focused funds that may hold positions in any stock mentioned in this article. I exercise no control over the contents of these funds and their holdings may change ...

more