Oil Fundamentals Remain Very Solid For 2023 And 2024

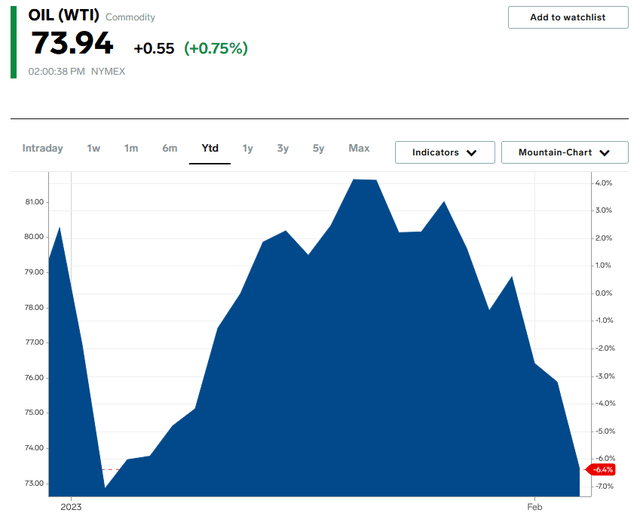

In a recent post, I discussed how oil prices could not decline too much from their mid-January levels of $80.77 per barrel of West Texas Intermediate crude oil. Since that time, we have seen prices decline to $73.94 today:

Source: Business Insider

This is just above the $72/bbl "Biden put," the level at which the Biden Administration has stated that the Federal government will begin buying crude oil to refill the Strategic Petroleum Reserve that it drained last year in a bid to reduce gasoline prices. It seems likely that the Administration will actually follow through on this commitment since sustained declines in crude oil prices weaken the case for renewable energy. However, the market currently does not appear to be accepting the reality of the supply-demand balance at the current time.

Goldman Sachs Chimes In

Back at the start of 2023, legendary investment bank Goldman Sachs (GS) was bearish on everything for the year except for crude oil and other commodities. This is highlighted in a (paywalled) article at Bloomberg in which the bank is projecting a 43% gain in commodities as "supply shortages bite." We have already begun to see this occur as China has begun to come back online and increased the demand for crude oil. In fact, less than two weeks ago, we saw a jump in the 3-2-1 crack spread that typically indicates a tightening of the supply-demand balance in refined products.

Goldman Sachs remains confident in its projection despite the decline in energy prices that has occurred since its original predictions. At a conference in Riyadh, Saudi Arabia on Sunday, Goldman's chief commodity strategist stated that crude oil will not only return to $100/barrel in 2023 but it will rocket much higher in 2024 as China returns to full output. The biggest reason that he gave for this is the same one that I have in many previous articles and blog posts.

Underinvestment In Production Capacity

In short, energy companies have been severely underinvesting in production capacity since the last energy bear market in 2015. This prompted Moody's Investor Service back in 2021 to state that upstream companies needed to increase their capital expenditures by $542 billion in aggregate in order to avoid a supply shock. Needless to say, this has not happened.

There have been a number of reasons why energy companies are not investing the capital necessary to ensure sufficient production of crude oil to meet global demand. One reason for this is that several major investment firms around the world have signed on to environmental, social, and governance principles that have the effect of cutting off traditional fossil fuel companies from obtaining financing. As such, these firms have reduced their capital expenditures in order to focus on reducing debt and maintaining their production. This is the reason why Diamondback Energy (FANG), ConocoPhillips (COP), and numerous other companies have provided guidance that only shows a very slightly higher production level in 2023 than they actually produced in 2022.

We have also seen that the markets did not reward the energy industry for the production growth that numerous companies delivered in the shale patch over the 2010 to 2020 period. We can see this in the fact that the Energy Select Sector SPDR ETF is almost flat over the past decade:

Fidelity Investments

The S&P 500 index most certainly has not been flat over the past ten years! Clearly, we can see that the industry has not been rewarded by the stock market no matter what it does in terms of production. This naturally has angered investors.

The industry has responded to this over the past two years by simply paying out a high percentage of its free cash flow to its investors. For example, Pioneer Natural Resources (PXD) has pledged to return 75% of its free cash flow to investors. We have seen similar commitments from Devon Energy (DVN), Diamondback Energy, and several others. When we combine this with the fact that most things in the traditional energy sector are quite undervalued today, this has pushed the dividend yields of many independent energy companies to 7%-10%. That is enough to allow for reasonably attractive returns even if the stock price remains completely flat, thus satisfying investors.

These factors have curtailed production growth, particularly in the United States. The United States is one of the only countries that can quickly increase its production of crude oil so this very quickly becomes a global problem. According to Currie at Goldman Sachs,

"Right now, we're still balanced to a surplus because China has yet to fully rebound. Capacity is likely to become a problem later this year when demand outstrips supply. Are we going to run out of spare production capacity? Potentially by 2024 you start to have a serious problem."

It is worth noting that Saudi energy minister Prince Abdulaziz bin Salman also stated that insufficient investment into production capacity has left the world severely undersupplied to meet forward demand. Thus, he apparently is warning of an impending crude oil supply shortage as well.

As everyone reading this is likely well aware, the laws of economics state that when demand outstrips supply, prices skyrocket. Thus, the current weakness that we are seeing in crude oil prices will likely be short-lived.

More By This Author:

Could The Short-Term Oil Optimism Be Misplaced?

Chevron Vs. The S&P 500 Index

Crack Spread Jumps To Three-Month High, Gas Prices To Follow

Disclosure: I am long various energy-focused funds that may hold positions in any stock mentioned in this article. I exercise no control over these funds or their positions.

Disclaimer: All ...

more