Could The Short-Term Oil Optimism Be Misplaced?

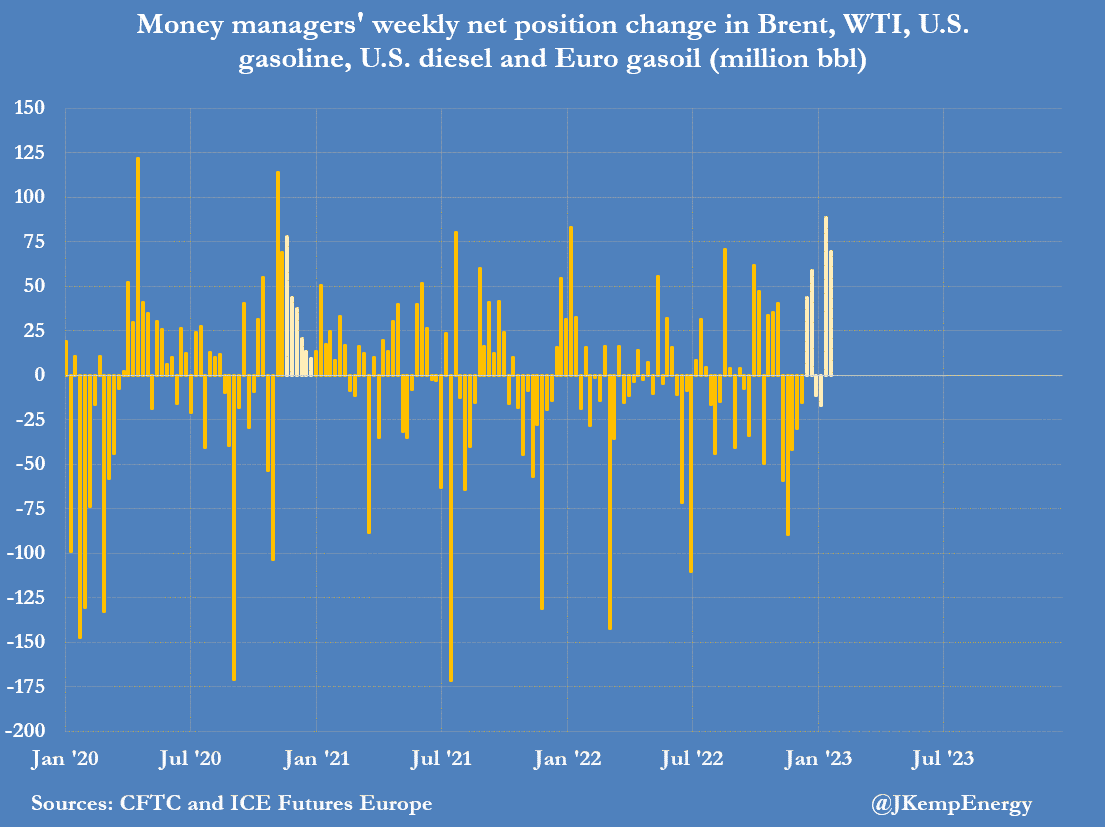

Yesterday, John Kemp, senior energy analyst at Reuters, reported that portfolio investors have begun to very aggressively buy oil futures. In fact, these investors are currently taking long positions in crude oil at the fastest rate since the COVID-19 vaccine was revealed in late 2020:

(Click on image to enlarge)

As many of you may recall, the COVID-19 pandemic had a devastating effect on the demand for crude oil. After all, while the pandemic was raging, people generally were curtailing their travel activities and opting to remain at home. This naturally reduced the demand for crude oil, which is very heavily used as a transportation fuel. This sharp decrease in demand caused crude oil prices to plunge and West Texas Intermediate crude oil prices even went negative in April of 2020. That means that oil producers were literally paying their customers to take the crude oil. Fortunately, that situation did not last long.

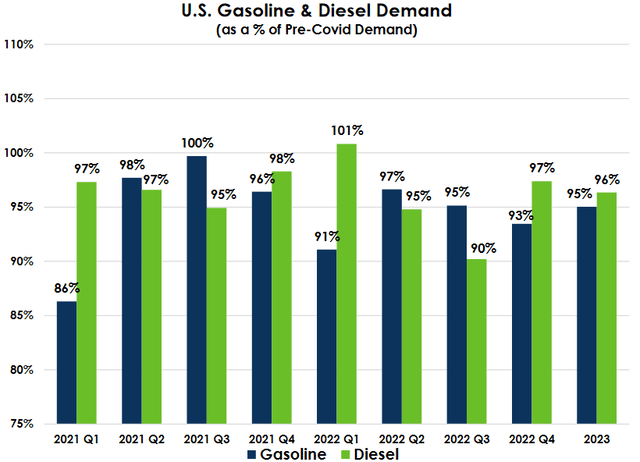

When the vaccine was revealed, many in the market saw that as a sign that life would soon return to normal. In short, that people would once again begin traveling, actively driving, and all the other oil-consuming activities that they engaged in prior to the pandemic. This was expected to cause demand for crude oil to return and by extension push prices up. That is exactly what happened, although the demand for both gasoline and diesel fuel remains somewhat below 2019 levels:

ESAI

The fact that portfolio investors are currently taking long positions in crude oil futures at the fastest rate in two years implies that they are expecting a similar price increase in crude oil as we saw in 2021. Unfortunately, that may be a misplaced belief.

Recession Likelihood

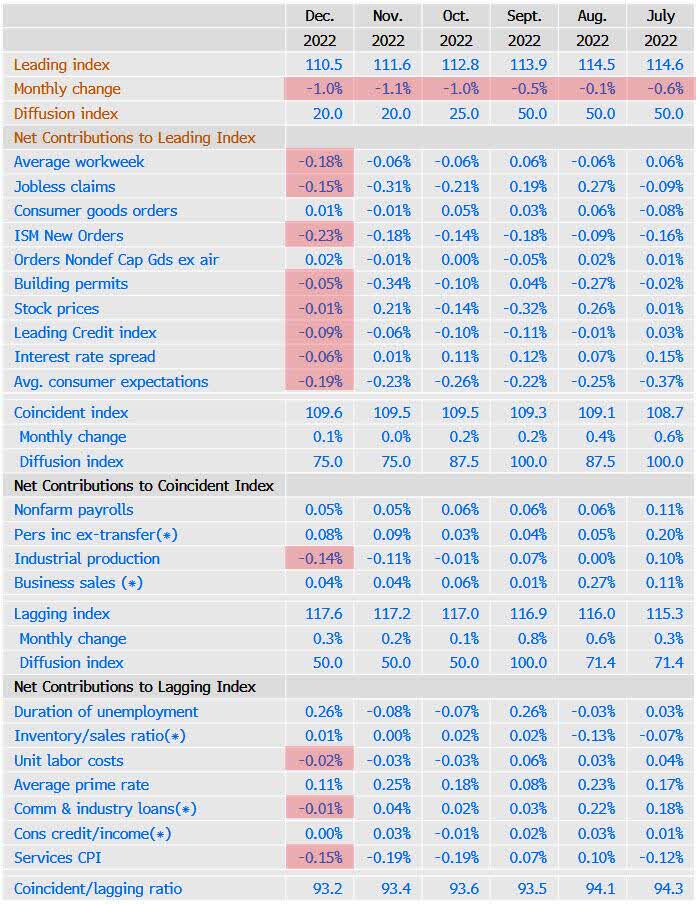

The real reason why the demand for oil may not push prices higher is that the economy looks very likely to enter a recession in the near future. We can see this by looking at the Leading Economic Index. As we can see here, this index has been steadily declining over the past several months:

Zero Hedge

This is a sign that the economy may soon enter into a recession. In fact, the Federal Reserve has been trying to tip the economy into a recession in order to reduce the stubbornly high inflation rate that the nation has been suffering from over the past year.

One of the characteristics of a recession is that the demand for crude oil tends to decline. This is because some businesses cut back on their workforce, which leads to fewer people working and many people having to reduce their discretionary spending. Thus, they will be less willing to drive to the local shopping mall or take vacations. Those people that do still have their jobs will also frequently cut back on such indulgences due to fear that their own job may be in jeopardy. This reduction in crude oil demand is likely to cause oil prices to decline, not rise as the market seems to believe right now. With that said, I doubt that energy prices will decline much more than about 10% from today's levels. I discussed my rationale for this belief in a previous blog post.

Rising Or Falling Crude Oil Prices

The biggest question as to the near-term direction of crude oil prices is whether or not the economy enters a recession. As we just saw, most of the economic indicators state that we will, if the economy is not already in one. However, the labor market remains very tight and this is frustrating the Federal Reserve. The Federal Reserve is unlikely to blink on interest rates until the labor market begins to weaken so it seems very unlikely that the pivot that the market seems to be counting on will occur soon. Thus, it may turn out that crude oil prices will not rebound as quickly as some institutional investors seem to expect.

More By This Author:

Chevron Vs. The S&P 500 Index

Crack Spread Jumps To Three-Month High, Gas Prices To Follow

Understanding The Strong Fundamentals For Natural Gas Liquids

Disclaimer: All information provided in this article is for entertainment purposes only. Powerhedge LLC is not a licensed financial advisor and no information provided should be construed as ...

more