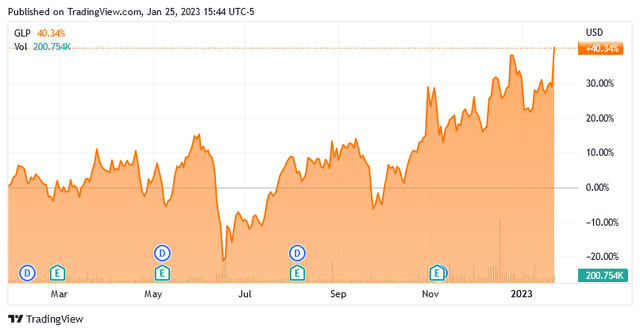

Crack Spread Jumps To Three-Month High, Gas Prices To Follow

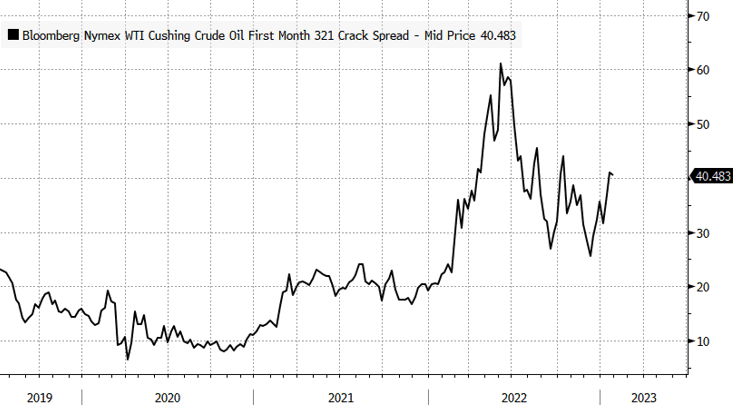

Yesterday morning, the 3-2-1 crack spread jumped to a three-month high:

(Click on image to enlarge)

Source: Zero Hedge

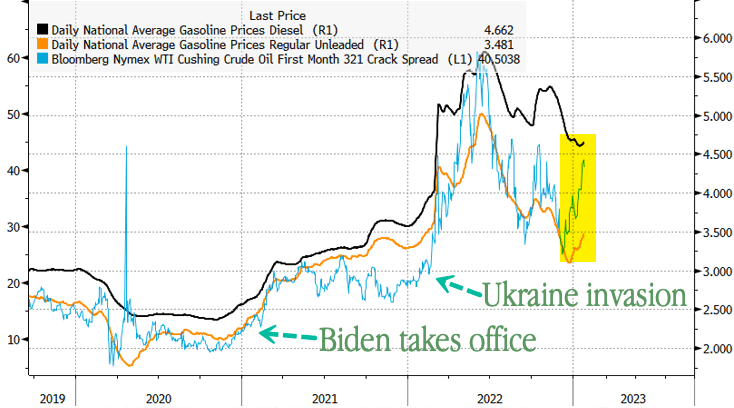

This is a sign that gasoline prices may be about to soar, which will put extra pressure on consumers struggling to make it in today's inflationary economy.

I mentioned the pressure facing consumers a few times in recent articles. According to a recent Prudential Pulse survey, roughly 81% of Generation Z members and 77% of Millennials have either taken on a second job, entered the gig economy, or are considering doing so. The rationale for this is that they are unable to earn enough money at their regular 9-5 job to keep the bills paid and feed themselves. One of the biggest reasons for this is that energy prices have soared, applying upward pressure on pretty much everything that we buy.

The increase in the crack spread will not make matters any better. In fact, AAA reports that gasoline prices nationwide have begun to edge higher after several months of declines:

(Click on image to enlarge)

Source: Zero Hedge

This is unlikely to bode well for companies that are heavily dependent on consumer spending, with the notable exception of those companies selling necessities. After all, it is highly unlikely that consumers that are being forced to take on second jobs and copious amounts of debt will rush out and spend $1,000 or more to buy Apple's (AAPL) newest iPhone! As such, it could be a good idea to include companies in your portfolio that sell items that people will buy out of necessity.

What Is The Crack Spread And Why Is It Important?

The 3:2:1 crack spread is a measure of refinery profitability. In fact, this is the most important measure for determining how profitable a refinery will be at any given time. The U.S. Energy Information Administration helpfully provides a definition on its webpage:

A crack spread measures the difference between the purchase price of crude oil and the selling price of finished products, such as gasoline or distillate fuel, that a refinery produces from the crude oil. Crack spreads are an indicator of the short-term profit margin of oil refineries because they compare the cost of the crude oil inputs to the wholesale, or spot, prices of the outputs (although they do not include other variable costs or any fixed costs). The 3:2:1 crack spread approximates the product yield at a typical U.S. refinery: for every three barrels of crude oil the refinery processes, it makes two barrels of gasoline and one barrel of distillate fuel.

The fact that the crack spread shot up yesterday is a clear sign that fuel supplies are getting tighter. Reuters confirms this and mentions that a few refinery outages are exacerbating the problem:

- A diesel-producing unit at one of PBF Energy's (PBF) Chalmette, Louisiana caught fire on Saturday. It could be out for at least a month.

- ExxonMobil (XOM) is currently performing maintenance on several units at its refinery complex in Baytown, Texas.

- Winter Storm Elliott knocked out 1.5 million barrels per day of capacity in Texas last month. This capacity has not fully returned to service and even when it does, fuel supplies will remain understocked for a while.

- Suncor's (SU) refinery in Commerce City, Colorado has been completely offline for a month.

There will likely be a great deal of pressure on fuel supplies for a while as numerous refineries will be undergoing maintenance this Spring. This maintenance work was supposed to be done a while ago but the pandemic-related lockdowns and various government rules from that era caused it to be postponed. This will exert further upward pressure on fuel prices over the next several months due to the inherent economic laws of supply and demand.

How To Profit

Obviously, the higher prices at the pump will continue to pressure the wallets of consumers everywhere. This probably includes most of the people reading this. However, there are some ways that you can protect your finances and even make a profit.

One possible idea is to buy refinery operators. As just mentioned, the widening crack spread should prove to be good for these companies profit margins. I presented Delek US Holdings (DK) last week. This company would be one possibility and the article mentions several of the company's peers that would also benefit from tightening fuel supplies and widening crack spreads.

Another possibility is to purchase the units of a master limited partnership that owns gasoline stations and other fuel depots. Global Partners (GLP) is a company that I have been recommending for a long time now. Global Partners is up 40.34% over the past year:

Source: Seeking Alpha

In addition to completely trouncing the market, the company boasts a 6.96% forward yield and just announced a $0.9375 per unit special distribution. Wouldn't you like to have had something like that in your portfolio to offset your losses in 2022?

More By This Author:

Understanding The Strong Fundamentals For Natural Gas Liquids

The Jobs Report Tells A False Narrative

Oil Prices Cannot Decline Too Much From Today's Levels

Disclosure: I am long various energy-focused funds that may hold any stocks mentioned in this article. I exercise no control over these funds.

I hold long positions in several of the stocks ...

more