LNG Shipping Cannot Keep Up With World LNG Demand

Image Source: Pixabay

Europe Leads The Race For Lng Imports As Global Competition For The Fuel Heats Up

I will say more later about two companies I am invested in but first will expand on that world demand.

If readers have ideas of their own about these things then please tell us in the comments as we all learn from such knowledge sharing.

Natural Gas Is Changing The World Map

Overall global LNG demand is now around four times what it was in 2000 and liquefaction capacity is expected to increase by 30% by 2025/26.

Europe has already tapped almost every available source of natural gas, from increased LNG imports to asking Norway to maximize pipeline deliveries for months. The EU will boost its ability to import LNG through floating terminals in Germany and the Netherlands but they’ll be competing for the same limited pool of world supply. And without Russian gas, the EU will need even more LNG over the next 12 months and coming years

US company Venture Global has said it would expand a 20-year contract with German utility EnBW by 500,000 tonnes of LNG a year, to 2mn tonnes. US companies have executed about 47mn annual tonnes of sale and purchase agreements with various countries in 2022, according to Webber Research and Advisory.

Politics will help! Two Texas reps have introduced a bipartisan “LNG for Allies” bill, which would expedite licensing for exports of U.S. LNG. Climate change envoy, John Kerry, who was once against natural gas and is now supporting it provided methane emissions are controlled. I have long tried to ensure the companies I invest in do that.

The EU is investing $2 trillion in its “economic recovery and transformation plan”. Similar investments are being made from Japan to Latin America.

Natural gas for heating in cold weather is one thing. In Germany - the EU’s economic leader - the manufacturing sector’s scope for further natural gas savings is dwindling with only ~39% of companies saying they would be able to reduce their consumption without decreasing production.

Germany has finished construction of its first import terminal for liquefied natural gas, a crucial milestone in its efforts to end its energy dependency on Russia. The completion of the terminal, at Wilhelmshaven on the North Sea, will ease fears that Europe’s largest economy might face gas rationing this winter.

Germany has been striving to build new import infrastructure for gas since Putin’s full-scale invasion of Ukraine on February 24 last year, which led to a sharp decline in Russian gas supplies to Europe.

Picture source: Financial Times

Earlier this year, it chartered five floating storage and regasification units (FSRUs), one of which will be installed at Wilhelmshaven and the other at nearby Brunsbüttel by the end of the year. The first LNG tankers are due to dock at the two sites early this year.

However, Europe could still face a 30bn cubic-meter shortfall during next summer’s key storage refilling period if Russia halts all pipeline deliveries and Chinese demand for liquefied natural gas increases to 2021 levels as it lifts more coronavirus restrictions, according to the International Energy Agency.

The US will supply some of that LNG when more export facilities are built. One important happening by March 2023 will be the reopening of the Freeport LNG terminal which has been closed since June last year due to an accident there. In normal times that terminal handles around 15% of US LNG exports!

Asia’s needs are massive too led by China and Japan with India’s needs growing fast too - it has recently ousted the UK as the 5th largest economy in the world and some forecasts say it will be the 3rd largest by 2030, with the US and China remaining as 1st and 2nd. India has seven of the most polluted cities in the world caused using filthy fuels including coal which accounts for almost 75% of its electricity production and natural gas which accounts for only 6% of total energy compared to a global average of about 25%. If it is to continue to grow India must massively expand its energy supplies and the authorities plan to spend $2.5bn to set up FSRUs at all major ports.

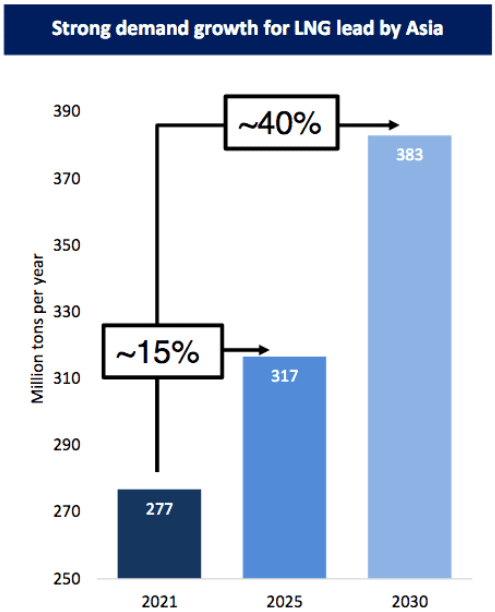

The following chart summarises Asian demand forecasts better than I can do with words...

Chart Source: Golar LNG

China has been written off by many but the dictator there has backed away from Covid lockdowns due to people power. Its demand for LNG will soar again soon especially since China already consumes a quarter of all the electricity generated in the world and its growing economy will need more. Much is generated by coal at present and I expect that will change to natural gas to reduce pollution, as it has in the US.

Also, some US companies have been leaving for political or other reasons but foreign investment is still high even if not from the US. French world-leading electrical equipment maker Schneider Electric (OTCPK: SBGSF) is expanding its existing large presence there. German chemicals giant, Bayer (OTCPK: BAYRY) is expanding its plants in China. Chemical making needs gas.

That LNG Has To Be Shipped From Producer To User And There Is A Shortage Of Ships

Shipbuilders enjoyed a record year for liquefied natural gas tanker contracts in 2022 and they expect the boom to continue for some time as demand for the fuel rises. According to Refinitiv, global orders for the vessels reached 163 in 2022, more than double the figure in 2021 and the highest since 2011, the earliest data available.

A large number of those orders were tied to Qatar’s expansion of its North Field project, a plan to increase the Gulf state’s LNG export capacity from 77mn tonnes a year now to 126mn tonnes by 2027. The International Gas Union estimates that the North Field project alone would need about 150 LNG carriers.

More LNG export terminals are being built in the US which is now the largest supplier of LNG to Europe.

Rising labor and steel price costs mean that the average cost of an LNG tanker rose to $250mn in 2022, from $200mn in 2021, according to industry experts.

Similar cost increases apply to building new FSRUs.

That demand and cost increase means strong growth and profit potential for the two companies I am invested in...

Flex LNG

Flex LNG is not yet a well-known company. It was listed on the Oslo exchange until June 2019 when Flex LNG was also listed on New York Stock Exchange, also under the symbol (FLNG). It is an LNG shipping company with a fleet of thirteen fuel-efficient, fifth-generation LNG carriers. The fleet consists of nine M-type, Electronically Controlled, Gas Injection (“MEGI”) LNG carriers and four Generation X Dual Fuel (“X-DF”) LNG carriers built between 2018 and 2021. All the vessels are state-of-the-art ships with the latest generation two-stroke propulsion (MEGI and X-DF). These modern ships, built between 2018 and 2021, offer significant improvements in fuel efficiency, and thus also a lower carbon footprint including methane slip compared to the older steam and four-stroke propelled ships. That low carbon footprint including methane emission is very important given that many ships sailing the oceans are huge air and sea polluters!

The Company’s operating vessels Include Flex Endeavour, Flex Enterprise, Flex Ranger, Flex Rainbow, Flex Constellation, Flex Courageous, Flex Aurora, Flex Amber, Flex Artemis, Flex Resolute, Flex Freedom, Flex Volunteer, and Flex Vigilant.

Photo courtesy of Flex LNG

I mentioned earlier that rising labor and steel price costs mean that the average cost of an LNG tanker rose to $250mn in 2022, from $200mn in 2021. Their fleet has been acquired at historically attractive prices compared to the new building prices today, while book equity values reflect historical costs adjusted with regular depreciation.

That cost differential is huge and building those 13 ships today at an average price of $50mn more each would cost $650mn more! That will reflect in higher charter rates when existing contracts expire and then over the 15 years or so of the vessels remaining life span.

The growth and financial performance are superb. Those wanting full details can find them here on Flex LNG's website.

In the past 2022 when the S&P500 went down around 14% and most investors lost money, FLNG went up 39% and helped me end the year up. The company also pays a 10.7% dividend which looks very safe.

Financial results show continued growth and the cash position is Once that LNG arrives at its destination it needs to be regasified and my favorite for doing that is...

Execelerate Energy

Like FLNG, Execelerate Energy (EE) is relatively unknown to investors yet it has one of the world's largest fleets of floating storage and regasification units (FSRUs). They take LNG off trans-ocean vessels and convert the LNG back into normal natural gas to go into a country's pipeline infrastructure.

Photo source: Exelerate Energy.

That vessel is chartered to Germany for five years.

EE is a US-based company located in The Woodlands, Texas. It was founded in 2003 by George B. Kaiser but was only listed in April, 202, so - although its FSRUs are in great demand by customers - EE's name remains below the surface for most investors.

Its main focus has been providing flexible LNG solutions to emerging markets around the world. The company operates a fleet of ten purpose-built floating storage and regasification units (FSRUs), has completed more than 2,400 ship-to-ship transfers of LNG with over 40 LNG operators and delivered more than 5,900 billion cubic feet of natural gas through 15 LNG regasification terminals. That is more than any other company in the industry and - like FLNG's vessels - they were all bought at much lower prices than new builds today.

In October 2022, Excelerate signed a binding Shipbuilding Contract with Hyundai Heavy Industries Co., Ltd. for a new FSRU to be delivered in June 2026. that will be at the higher prices but new charters will have that priced in. The state-of-the-art FSRU will be equipped with HHI’s proprietary LNG regasification system, dual fuel engines, selective catalytic reduction system, best-in-class containment system and boil-off gas management, and other innovative technologies which will drive improved performance and efficiency while lowering emissions.

EE's business spans the globe, with offices in Abu Dhabi, Antwerp, Boston, Buenos Aires, Chattogram, Dhaka, Doha, Dubai, Helsinki, Ho Chi Minh City, Manila, Rio de Janeiro, Singapore, and Washington, DC.

Financial results show continued growth and the cash position is excellent: As of September 30, 2022, Excelerate had $345.7 million in cash and cash equivalents. As of September 30, 2022, the Company had letters of credit issued of $40 million and no outstanding borrowings under its $350 million senior secured revolving credit facility.

Also, EE has started to pay a dividend. On November 8, 2022, Excelerate’s board approved a quarterly dividend equal to $0.025 per share of Class A common stock. That is around 0-5% and, if a pun can be excused, I expect that dividend payment will accelerate nicely in the future and maybe get to FLNG's 10% level one day.

Those wanting to know more about all aspects of the company can find it on EE's website

Where will those vessels take FLNG and EE investors from here?

The market performance of both companies has been poor to start this year. Partly that could be due to the volatile price of natural gas which is now at its lowest level since around April 2021 but while that might hurt producers' profits it does not hurt either company at all. In fact, it makes LNG a more attractive buy and Thailand has just announced its return to buying more.

Insiders at EE were big buyers at the listing time in April 2022. They bought it for $24. The last closing price as I write was $23.38. I doubt they invested with the expectation they would lose money!

Nor do analysts...

Analyst Consensus & Trends

EE Highlights

First Call expects 0.23 EPS for the next quarter.

The current Price Target for EE is $31.86.

If they are proven right that means an increase of 36%.

I cannot find forecasts for FLNG but - given the world backdrop that I have mentioned here - I see no reason why that should why it should not do just as well.

I shall be a long-term holder of both and it would be interesting to hear the views of others in Comments on my article as we all learn from sharing knowledge.

More By This Author:

The Euro Is In Crash Territory

Five Power And Pollution Disrupters

Oil And Gas And ... Edelweiss?

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

@James Hanshaw

Hello, on conf call FLEX ceo said 2024 25 will be weak with a lot of supply coming in the market and older ships not scrapped. Do you think EE and FLEX are affected by low prices of NG and mainly by low barriers of entry?

actually, low price should probably be good for them. Still wondering about what FLEX CEO said and what you think. How come gas in Europe is below pre-war price. Thanks

My latest article maybe of interest: https://talkmarkets.com/content/global-markets/sika-unknown-and-undervalued-swiss-world-leader-with-enormous-growth-potential?post=385671

Good post.

Thank you. I hope it proves to be good for those - like me - who are invested in these companies.

With over 60% TR in 2022, FLNG was an excellent performer in my portfolio. Glad we are in the same boat James. 😉

David, thank you for the comment and others. I will get back to you on those when I get a bit more time. James

What is the current state of global LNG demand and the role of Europe, the US, and Asia in the industry?

I tried to cover that as much as possible in the article. Since that was published the CEO of Shell said the world will soon be facing a big shortage of LNG and producing more will be their main focus now.

The Excelerate Experience (the FSRU in the photo) is in Brazil, not Germany...

It might be but an EE news release said they have signed a charter for it in Germany.

They did sign a charter for an FSRU in Germany, but it wasn't the Excelerate Experience. It was the Excelerate Excelsior: https://ir.excelerateenergy.com/news/news-details/2022/Excelerate-Energy-and-the-German-Government-Sign-FSRU-Charter-Agreement/default.aspx

Interestingly, I can't find anything about the contract for the Experience, but it's probably valid for a couple more years given the length of these things. The only contract that Excellerate Energy signed for an FSRU in Germany over the past three years is for the Excelsior.

Interesting, thank you. Maybe I got the names mixed up because they are similar at a glance

The share prices are up nicely since my article was published. Not sure if I can claim credit for that but, hopefully, that is the start of an upwards trend. James

Well, these two are something to add to the watchlist. Putting economic hardship to work for you is often a winning combination.

Great read, thanks for sharing.

Thank you for reading and the complement.

Does Russian's war in Ukraine affect any of this?

Hello Alexis,

Yes, it made most other European countries find new sources of natural gas. It was piped in from Russia but most replacements must be shipped in in the form of LNG. James

But won't Russia react to this in some antagonistic way?

Hopefully it does not expand the war to include other countries! The sanctions must be hurting it financially plus a lot of young, talented Russians have left the country.

I appreciate your report very much, but here you are missing something. First, sanctions have proven to be completely ineffective and harm the European population in particular. Second, the war in Ukraine is entering its tenth year because the origins of the conflict are traced to the coup d’état in Kiev in February 2014 sponsored by the American CIA and other NATO agents. The NeoNazi regime that was installed then and which continues in power (headed up by a Jewish president nonetheless) was weaponized and covertly supported by the United States and its NATO partners to aggress the Russian-speaking people of formerly southeastern Ukraine. The bigger objective for the regime was to draw the Russian Federation into an existential confrontation that is now underway.

There is no doubt that sanctions have not worked nor that the US perpetual war machine baited the Russian bear but nothing can excuse Putin's barbaric behaviour.

The western debate on the war in Ukraine tends to treat it as essentially about borders: who governs which territories. It has paid far too little attention to how the territories in question are governed by each side. But the difference is stark. It is most shockingly exposed in how the Russian occupiers behave. Their cruelty goes beyond the murders, rapes, mutilation and plunder by Putin’s forces.

After invading Crimea, Moscow restarted its old persecution of Tatars. There is a state campaign of child abduction. There is a pattern of torture, documented by such initiatives as the Reckoning Project. What this behaviour lays bare is the wantonness of the occupiers’ violence and oppression.

If he wins it will be more of the same - barbaric treatment of those he claims to be rescuing and I hope the west helps him lose and does not seek appeasement - even if it costs a lot of money.

However my article was not about that but about the consequences that should benefit the companies I feature because replacements for Russian gas must mostly come in the form of LNG. James

What an absurd comment, David (if that's even your real name). And you are wrong on every point- the sanctions have been crippliing to Russia, and Russia has clearly been the agressor in this war. Worse, there is no question that Putin and the Russian army/mercenaries are guilty of having committed war crimes.

Sounds to me like you are part of Putin's propaganda machine, spreading lies under a fake profile.

I added my views about Putin's sickening behaviour above.

One interesting damage to Russia has been the mass exodus of many better educated people from Russia to countries where their skillls have been welcomed.

I seriously wonder who has succumbed to propaganda here. However, this Russophopia is deeply rooted in the Western world.The US (NATO) in deliberately provoking a war with Russia by implacably pushing its hostile military organization, despite Moscow’s repeated notifications about crossing red lines, right up to the gates of Russia. This war did not have to be if Ukranian neutrality, á la Finland and Austria, had been accepted. Instead Washington has called for clear Russian defeat.

As the war grinds to a close, where will things go?

PS.Yes, Iam real and am an investor who sees only his own advantage. Making economic hardship work for you is often a winning combination. It doesn't matter whether it's the plight of the Europeans or the Americans. It is completely indifferent to me whether you like it or not.

I'm glad to see that steps are finally be taken to elimate Europe's dependence on Russian energy.

Agreed. The only way to stop a neighborhood bully is to take away his power.

It is interesting to see that several other countries in the Russian federation and under Putin's power are now seeking allies elsewhere.