The Euro Is In Crash Territory

I paint a word picture here about the EU backed up with a couple of photos that paint pictures of a thousand words hopefully showing that much of the EU is in deep recession, even depression. The euro and Germany are a major cause of that as this paper shows; The Euro debt crisis and Germany’s Euro Trilemma

My section later on the rise and fall of empires might be of special interest.

The EU today...

The EU’s new euro 1.8tn budget and rescue package includes E750 billion for the worst-hit pandemic countries. That amount proposed by the European Commission in July 2020. Those countries urgently needed the money but it was not to be dispersed until 2021. Since then there has been internecine wrangling about the conditions for dispersal by the heads of the European Council and their latest summit again kicked the can down the road - this time about compliance with EU law and order rules - giving recalcitrant states money and two years before the next review instead of addressing and fixing the problem now. They ignored the fact that one of the four conditions underpinning a sound currency is for the rule of law to reign supreme!

Those leaders patted themselves on the back with one saying that summit “had the same feel” as June 1988, one that launched to start of the euro! If that is deemed a success one wonders what their definition of failure is.

But having achieved that further fudge the money is still not yet available to be dispersed! The EU will be able to borrow money for the first time to partly finance that E750 billion. That should raise more red flags about the dangers ahead. How will it be paid back? The EU has long wanted to have its own taxation powers and such borrowing is a stepping stone to that. Add another tax burden to already overtaxed citizens means their ability to spend and restore desperately needed economic growth becomes even more impossible!

A survey by McKinsey showed that around half of Europe’s SMEs - the lifeblood of the European economy - doubt they can survive for another 12 months.

And to show their concern for those living in poverty - made worse by their policies - the leaders of Germany and Italy met recently in this monarch's palace in Germany near the capital, Berlin. Germany is also the de facto leader of the EU and still refuses to resolve its euro trilemma mentioned above.

These are the goals and values of the EU. They include many warm words; "sustainable development based on balanced economic growth and price stability, a highly competitive market economy with full employment and social progress, combat social exclusion”.

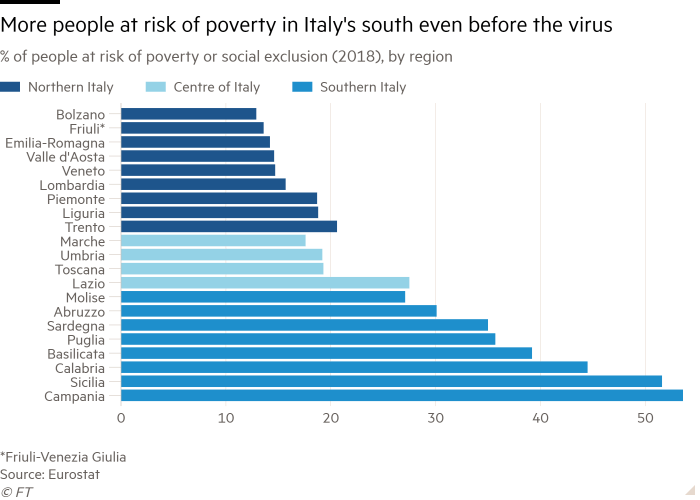

The results;

Meanwhile in the real world of Switzerland - outside the EU politically but in the centre of it geographically and affected by it economically - I make other observations about what is going on, or in the EU's case, not going on.

Whether the EU’s GDP figures eventually showed it or not my observations showed the EU was in a recession long before the virus came along.

Yet another of the EU’s many presidents - Mrs Lagarde of the ECB - recently told the world what it did not know - that the virus pandemic would cause...

"A Highly Unusual Recession"

Trucks on the road are one of my economic indicators of recession and I took this photo in January 2019, long before the virus hit the EU in March 2020...

I live near that autobahn (interstate/motorway) just outside Zürich, Switzerland. Although we are not in the EU our road and rail systems are essential for the EU and this is one of Europe’s main crossroads that runs, at this point, around 30 kms (19 miles) south of Germany's Baden-Württemberg border. B-W is the home state of Mercedes Benz and Porsche cars and many world-leading machinery makers. The lanes flowing towards us head on to south-east Germany - Bavaria, home of BMW, Audi and Siemens - Austria and many countries east from there; Poland, Czech Republic etc. Those flowing away split beyond those overhead direction signs with the right lanes heading to France then via France on to Spain in the south and north European countries such as Holland, Britain and Denmark etc. The left lanes head directly off south to Italy.

In former times one and sometimes two of those lanes each way are slow-moving conveyor belts of nose-to-tail trucks at the time of the day I took this photo. The registration plates on those trucks made a fascinating sight in those times; German, Spanish, Italian, French, Netherlands, Lithuania, Poland, Hungary, Sweden, Turkey, Russia etc. Those in the above photo are nearly all local Swiss-registered trucks.

The photo below I took at around the same time recently - in early December 2020 - when one would expect even more trucks to be on the road, filling up shops for Christmas. A highly unusual recession indeed!

We hear of Germany doing reasonably well but that is not because they are trucking goods via Switzerland to the countries I mentioned above. They are going northwards to Hamburg and other German seaports carrying cars etc., to be shipped to China. Without China, Germany - the EU's main financier and a country with serious internal wealth imbalances too - would also be in a mess. This article in the South China Morning Post shows the importance of China to Germany.

Next month, January 2021, marks the second anniversary of the great truck recession (depression) in Europe and there are no signs of it ending!

EU fragmenting? Britain has left and some of its parts want to separate from the country they are in. The euro has not necessarily been the cause of that but that is part of the centralising of control that many want to be free of. Catalonia wants out of Spain. Sud Tyrol out of Italy. The north of Belgium wants separation from its south. There are tensions in others with prosperous Bavaria dissatisfied with the fact it pays 50% of all of Germany's internal financial transfers, some of which goes to fund the dysfunctional EU etc.

Others such as Bulgaria, Hungary and Poland should be kicked out due to their disdain for EU law and order rules. Instead billions of euros from the EU have probably actually increased corruption and state capture according to Simeon Djankov who once served as Bulgaria's finance minister. Likewise such EU money strengthened the mafia in impoverished parts on Italy that the money was intended to help. The Financial Times recently published this article on the "EU's identity crisis"

Among those I say should be kicked out are some talking of getting out, as has Britain. Poland’s prime minister, Mateusz Morawiecki, delivered an impassioned speech to parliament in which he insisted Poland would not accept the EU’s new mechanism linking of EU funds to the rule of law. He warned that the bloc risked becoming an “oligarchy” in which strong states dominated the weak. “This is about whether our fate should be in our hands, whether we will decide ourselves about our affairs, or whether it will be in the hands of others. This is not a divide between right and left. This is a divide between those who want the Polish nation to decide for itself and those who think a few bureaucrats in Brussels should decide on our fate,” he said. Last week Last the new Polish education minister, Przemyslaw Czarnek branded the EU “the picture of a civilisation of death”.

Add to all that the...

EU banking mess and the fog thickens further. The ECB was supposed to supervise EU banks via stress testing and protect the euro. It has done an awful job as I recently wrote in Assuming the euro will recover is "suicidal"

Since then the president of the ECB's supervisory board, Andrea Enria, said that some of the 117 banks it oversees are "all over the place" on provisioning for non-performing loans. Apparently, a recent ECB model showed that banks could face an extra Euro1.4tn in bad loans. That is more than in the 2008 financial crisis from which many EU banks and parts of countries have not yet recovered. This is why the ECB announced an E500bn increase in the size of its main QE programmes as well as extending the duration of its main crisis-fighting tools - another deepening of the extend and pretend norms the EU has uses to stop the euro chain from breaking.

Saxo Bank recently commented, when speaking of debts, that France might be concerned now that its national debt is projected to rise to 120% of GDP by next year as its economy rapidly shrinks.

While enjoying one of the largest economies in the EU, Saxo thinks it’s possible that it all goes south in 2021, with a series of bankruptcies compelling investors to sell off the nation’s megabucks.

“Given the poor state of public finances and the already extraordinarily high level of debt, France has no other choice but to come begging cap in hand to Germany, in order to allow the ECB to print enough euros to enable a massive bailout of its banking system, to prevent a systemic collapse,” Saxo predicted.

Such banks and countries are in no position to help support any economic recovery and it is too late for EU leaders to stop the huge divergence between Germany and the south.

A chain is only as strong as its weakest link The EU convoy of countries is tied together by the euro - a chain with many weak links - so how can Germany race away from Italy and Spain without the chain and the convoy breaking? A two speed Europe has long been talked about but discarded. Now new words a second tier of membership is creeping into the political language. That too will be discarded ensuring the divergence gets larger.

In the view of many, the only saviour for the euro would be a separation into one euro for the north and another for the south. Germany - and other stronger economic like it - would leave the euro after trading closes on a Friday, return to their former currencies (the German Deutschmark and Dutch guilder are still legal tender) and the euro reentered at a 50% higher rate before the start of trading the following week. This has been well studied - together with all the consequences for businesses etc - and recommended by Germany’s leading economists but and as with all such recommendations that preceded the adoption of the euro and since political leaders ignored it. Thus the mess has worsened and any fix made harder. It is made even harder by the refusal of EU leaders to learn from the history of the...

Rise and fall of empires

A few more words to finalise my thoughts on the EU/euro: While civilisations are expanding geographically, riches and resources flow in increasing quantities to the centre, generating the wealth needed to improve living conditions and maintain the support of a growing core population. But as the geographic limits of their production and organising systems are reached, these riches and resources dry up, with diminishing (or negative) returns to further expansion as control or influence of far-flung provinces becomes increasingly expensive and ineffective. Without this increasing surplus from expansion, growth begins to slow. The emergence of rivals with similar capabilities can exacerbate this problem. China has emerged!

At a certain point in their expansion, civilisations pass a threshold and enter a ‘buffer zone’, within which they can still survive or even thrive for relatively long periods of time. However, with their centralized, brittle structure, they have limited ability to react to shocks that impact their productive capacity and ability to sustain themselves – single points of failure that render the whole inherently fragile. These shocks can be environmental, military (wars and invasion), sociopolitical (inequality) or pandemics.

As they reach the limits of their geographic spread, civilisations can no longer expand to exploit more land or resources to overcome these shocks. The impact of the end of the expansionary period can be compounded as narrow, embedded interest groups (religious, warrior, monarchical, commercial, aristocratic, elites) seek to improve their position further. Without the easy gains from expansion, they increasingly extract rents from within society, aided by a concentration of power that leads to a centralisation of wealth. These groups can capture governments at many levels to privatise and concentrate wealth and profits while socialising risks and waste. The end result is an extractive loop where more profits feedback to these interest groups. The end result is a concentration of profits and wealth in fewer hands, an increase in inequality, and a decrease in social cohesion and support.

As the system becomes more centralised and leveraged, it becomes less robust and more unstable. Progressively smaller shocks can threaten its very existence. The openness to new ideas and people that helped it succeed in the past, by encouraging diversity of thought and the exchange and fertilization of ideas, reverses and acts as a constraint on change and adaptation, resulting in a failure to make the changes necessary for long-term survival – organizing systems harden at a time when they need plasticity to adapt. The faster change happens, the more unstable the system becomes, which leads to an increasing desire for social stability and maintaining the status quo. And herein lies the fundamental flaw with all such civilisations. The extractive, exploitative, winner-take-all production system is concerned mainly with maximizing income from useful outputs for the centre. Both the finite nature of resources and the human and social impacts from production (described today as internal devaluations and necessary adjustments) are ignored. Indeed, civilisations that go too far in correcting for them handicap themselves competitively in the long term compared with those that do not, creating an inherent conflict between short and long-term interests. All previous leading civilisations were blind to the long-term effect of these impacts until it was too late, prioritising the short over the long-term and the narrow over the common interest.

Sound like the EU today?

Tip of an iceberg... if an outsider like myself can see these obvious signs of problems in the EU - now unsolvable because the years of political papering over cracks to save the euro have resulted in unbridgeable economic canyons - one can only speculate on just how bad the whole picture really is.

The Swiss National Bank still intervenes to stop the euro weakening further and if other currencies such as the British pound had stronger fundamentals the euro would fall even more. The USD is also held down by Fed policies at present.

The euro was a political tool intended to chain EU countries more closely together. The recommended economic tools to make it sound - such as a banking union - were blindly ignored for political reasons and it is highly doubtful that countries, such as Germany, will permit one now to save the euro given the mess many banks and economies are in.

The great disconnect has continued much longer than most expected

That illustrates, yet again, the unintended consequences of a policy approach that places an excessive burden on the ECB. The hope for 2021 is that, with a vaccine-enabled economic recovery, better corporate fundamentals will start validating elevated asset prices and allow for an orderly rebalancing of the monetary-fiscal-structural policy mix. There are two risks, and not just for markets. First, what is desirable may not be politically feasible, and second, what has proven feasible - the constant fudges - is no longer sustainable.

I will conclude with the concluding sentence in that Euro debt crisis paper; "There is a non-negligible risk that the political process may not produce timely decisions before ECB liquidity runs dry”. That was in 2012!

The great disconnect has truly continued...until when? I do not know when but until then - stay away from the euro.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

What's your current take on the global economy?

China will recover. Much of Asia is ok. Britain is in a mess and so is much of the EU. I think the US might have a mild recession.

The pound and euro have crashed and will stay low. The euro is now below parity against the Swiss franc.

Since I wrote this article Mario Draghi has become the new PM of Italy. When he was the head of the ECB he said he would do whatever it takes to save the euro. It will be interesting to see how he can now save the failed state of Italy that the euro contributed to the destruction of AND not damage the euro in doing so because the two things simply cannot be done while the euro remains Italy’s currency.

Agreed.

The problem is not the EU or the Euro per se. The major problem is that governments across Europe stifle innovation. Aside from the UK where there is some semblance of a high-tech industry there is none on the continent, despite a small concentration of software related businesses in the Netherlands. Until major concerns become truly public and funds for investment released from the grip of small family controlled entities, the best and brightest from France, Germany and England, not to mention the less prosperous countries will continue to leave for America (recent immigration restrictions aside). From personal experience many EU technology initiatives are fraught with bureaucratic potholes while providing gravy for well oiled consultancies who nevertheless know how to mine the process more for gain than innovation.

You both make good points.

I agree but those are integrated with, and additional to, EU/euro problems, they are not separate ones. Germany - the EU's de facto leader - is a madhouse of bureaucracies and has many internal financial imbalances. One example being the two southern states, Bavaria and Baden-Württemberg, paying 75% of Germany’s internal financial transfers some that paying for the EU. 12 German states are recipient states, some in near poverty mode. Infrastructure and schools have had nothing done to upgrade or even repair them since around 1980.

Italy is a failed country soon to have its 67th government since WW2.

Germany’s top economic professors published a paper several years ago that showed the euro is too weak for Germany and too strong for Italy by a factor of 50%. That has got worse since.

I wrote more about the EU in this article a couple of years ago; seekingalpha.com/.../4263834-recession-regression-through-suppression. Things have got worse since.

If you invest in currencies my advice is to stay away from the euro. My home country has the safest one - the Swiss franc - and we have some good companies to invest in as well. James

Definitely worth a read!

Thank you, Anne. It is a bit long but hopefully will prove of use to some. The section on Empires is based on living on 4 continents and having observed from outside the one I was born in - the British - decline yet its leaders are incapable of adjusting to being a mid sized power that continues to decline because of that.

The EU’s life has been shorter but its leaders also refuse to accept the self inflicted, negative consequences of their actions taking place under their noses. This is dangerous as they withdraw themselves into a shielded cocoon to protect themselves at the expense the people.

I hope the US does not go the same way. Tiny Switzerland’s well proven model would fix things but the last thing those “leaders” elsewhere will accept is the people being the sovereign and the highest political authority, as they are here. Bye. James