A Shocking Gold Price Rally

The 2021-2025 war cycle, inflation, energy transition, and empire transition are a perfect “golden storm”.

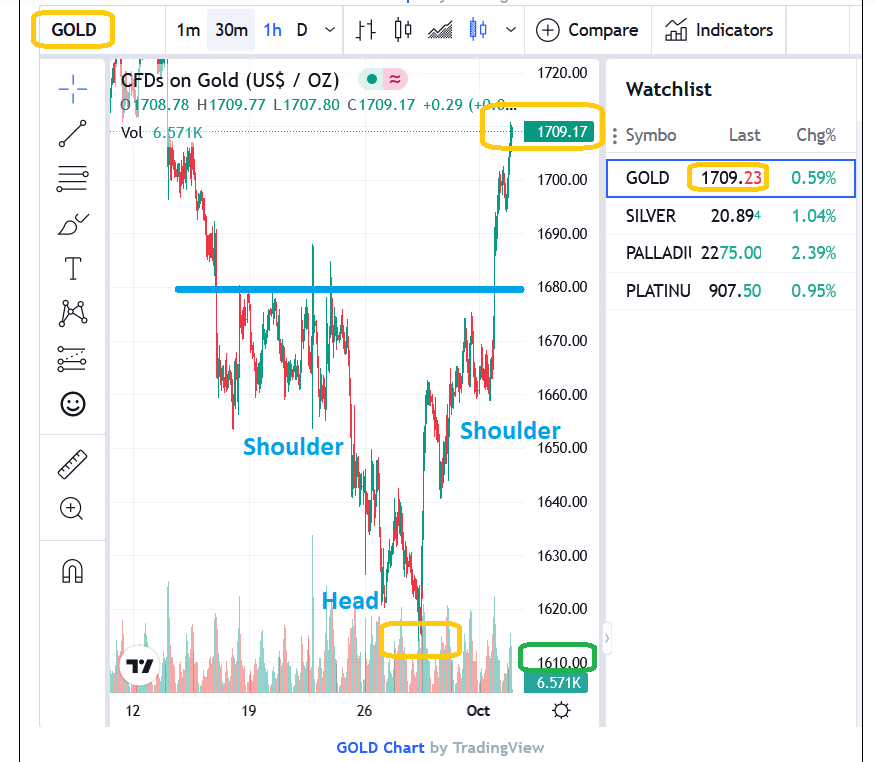

The intensity of these four gold price drivers is astounding. It’s the reason I urged Western gold bugs to consider the move under $1675 as potentially a false breakdown that could be reversed violently… and to buy the miners and silver as gold approached $1610.

(Click on image to enlarge)

majestic gold chart

A week after I suggested the false breakdown/buy into $1610 scenario, it’s played out even more gloriously than I envisioned.

For a look at the weekly chart, please see below.

(Click on image to enlarge)

Gold’s mighty rally from the $1610 buy zone has been so powerful that $1675 is becoming support again too!

Note the fabulous inverse H&S pattern on the Stochastics oscillator at the bottom of the chart. This is a very positive chart, but certainly not something that could be called the greatest chart in the history of markets.

To view one that arguably is...

(Click on image to enlarge)

The right side of the chart is a bit droopy, but it has the shape of a continuation pattern rather than a reversal.

It clearly reflects the big fundamental drivers in play!

Unlike the world’s richest man who is the defacto and sensible leader of the green energy revolution, the fiat-obsessed governments of the West have no interest in peace for the poorest nation in Europe…

Even if their sanctions and wars freeze millions of their own citizens to death in the winter of 2024 and create riots bordering on the civil war in 2023.

Western government war-mongering is relentless. It happened in Vietnam, Panama, Iraq, Syria, Libya, and many other nations. It’s now reaching a hideous crescendo in Ukraine.

Tomorrow’s OPEC meeting (that brings perhaps a million bbl/day supply cut) roughly coincides with the US government’s promised end to the one million bbl/day draining of the nation’s strategic reserve.

The bottom line: The price of oil, and global inflation, are poised for a fresh surge to the upside!

(Click on image to enlarge)

bullish oil chart

There was a bull wedge breakout yesterday and a move above $85 resistance could usher in a thunderous rally back to the $130 area highs.

What about the oil stocks?

(Click on image to enlarge)

enticing XLE chart

Note the beautiful gapping action and the bullish triangle in play.

Oil stock enthusiasts may feel compelled to buy more of their favorite stocks right now… and rightly so!

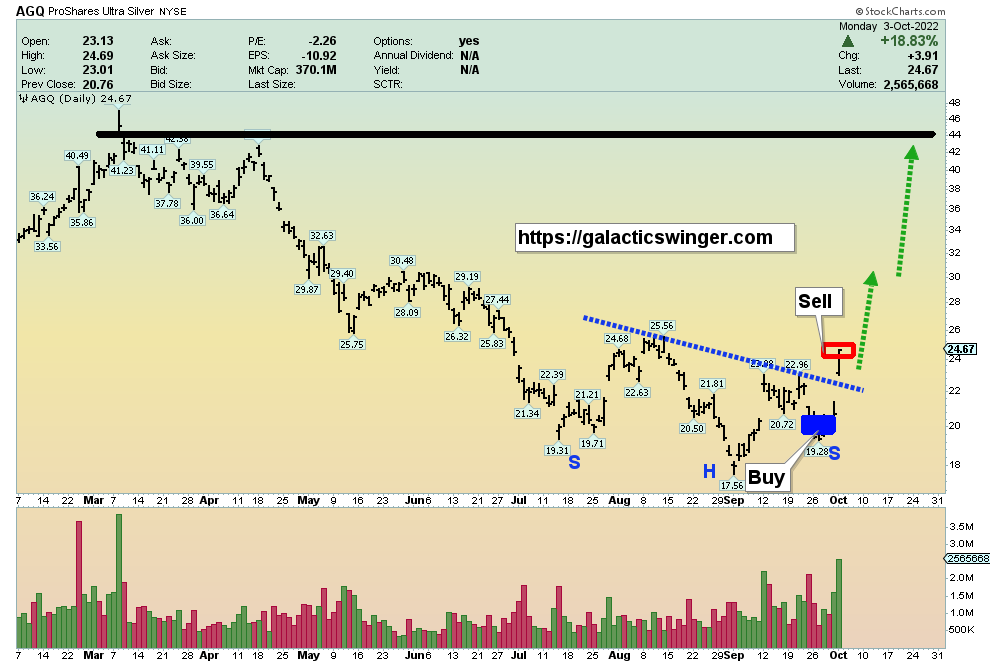

(Click on image to enlarge)

AGQ leveraged silver chart

While silver has been the superstar this week and looks to be heading “much higher”, there’s profitable fun to be had in trading this awesome metal too.

The stock, commodity, bond, and gold markets are gyrating wildly, and I’ll dare to suggest that action is about to intensify.

All gold bugs should probably own at least a token position in silver bullion too. The sky is the limit for silver bugs and for those investors who bought silver into my gold $1610 buy zone, there’s not much to do here… except to shout, “Hi ho, hi ho, it’s up the chart I go!”

(Click on image to enlarge)

SIL chart

A run to $31-$32 looks to be the play for October.

As the US government’s war against Russia continues to go off the rails, the citizens of the world will soon turn to silver bullion. The vile QE central bank programs have created a much bigger class of middle and poor earners.

Silver has always been the metal of the common man and it likely always will be so.2023 will probably be themed on a “Hi, Ho, Silver!” mantra.

If gold is the metal of kings, are gold stocks the stock for kings too? Perhaps, and on the rally from my gold $1610 buy zone, many miners already look like they deserve a crown and a throne.

(Click on image to enlarge)

GOAU ETF chart

A fresh breakout is in play.GOAU should be able to reach both $15 and $18 in October before there’s a swoon, and then it’s onto the “glory years” of the war cycle, in 2023, 2024, and 2025, when all the miners come alive and thrive!

More By This Author:

Metal Miners Gold $1610 Is The Key

Inflation: Tactics For Ebb & Flow

The CPI Report: Rally Time For Gold?