Inflation: Tactics For Ebb & Flow

Will Jay Powell be “less hawk than expected” tomorrow? Will there be a huge stock market rally to celebrate his return to a dovish stance for markets?

(Click on image to enlarge)

long-term US rates chart.

It’s possible that there’s some short-term pause in the rise of inflation and rates but…

In the big picture, it won’t matter what Jay says or does tomorrow; US rates appear to be heading far higher (and rightly so) than most investors think is possible.

(Click on image to enlarge)

TBF versus gold chart.

This ETF gives investors direct exposure to profiting from the Fed’s hiking cycle and I consider it a “must own” for serious gold bugs around the world.

I’ve been recommending it since the Fed hikes began. Is it too late to buy now? No, and here’s why:

US rates are in a base pattern that should push them above the 1980 highs… and they are about 80% below those highs now.

What about the stock market?

(Click on image to enlarge)

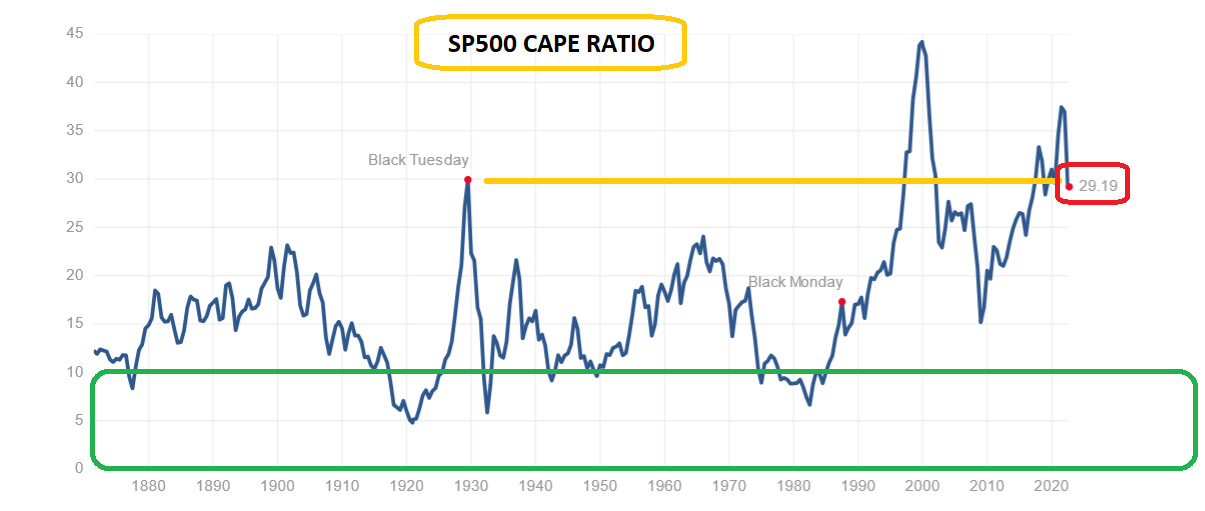

A CAPE ratio of 20 is high. It’s 29 now, barely below the highs of 1929.

This is not a time to be “averaging down” in the stock market, but there will be a short-term opportunities for traders on that note:

(Click on image to enlarge)

Nasdaq ETF chart.

The 10,100 moving averages have done a good job of signaling short-term moves for traders.

Sadly, there’s no buy signal now and the current decline could turn into an “avalanche” if Jay comes out as “more hawk than expected” tomorrow.

Savvy traders wait for Jay to signal the next play rather than trying to outsmart him.

A long-term hiking trend related to inflation likely means the stock market's good times are finished for the next 20 to 30 years in America, but what about gold?

There’s an ebb and flow to the inflation and rising rates super cycle. An all-weather approach to investing is required for investors to be happy… and to succeed.

The “ebb” sees cash and direct bets on rates (think ETFs like TBF) do best, and the “flow” sees gold and related items do best.

(Click on image to enlarge)

weekly gold chart.

It’s unknown whether the price moves up to above $1810 or down to $1610 next, but those are the zones for mining stock enthusiasts to focus on for buying.

Note the 14,5,5 Stochastics oscillator at the bottom of the chart. It’s reached oversold status. A crossover buy signal would be a positive development...

And it looks imminent.

(Click on image to enlarge)

weekly GDX chart.

The Stochastics oscillator is also heavily oversold.

Rallies of 20% or 30% (and sometimes more) are typical from this position.

(Click on image to enlarge)

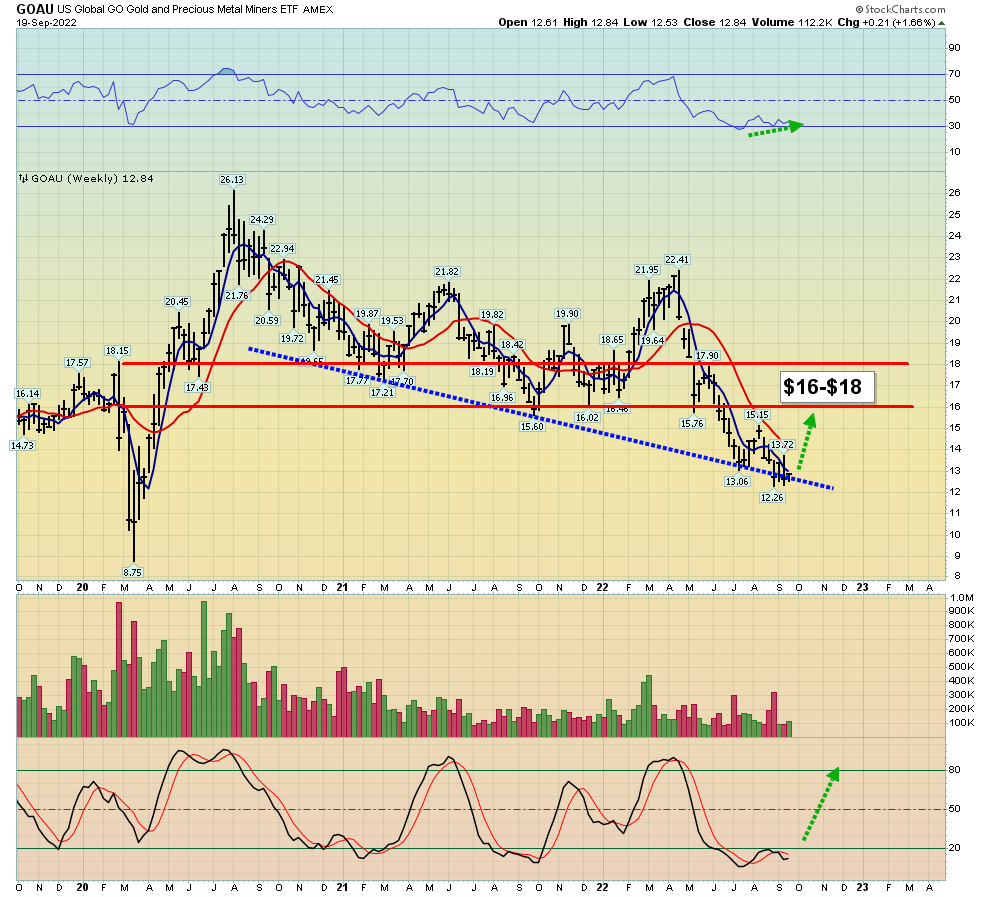

It’s a similar Stochastics situation for GOAU, and there’s a bullish non-confirmation of RSI with the price.

A rally to $16-$18 seems likely.

The dip under $1675 for gold will attract some Indian interest but the faltering global economy means demand from both China and India will remain muted.

That puts a limit on upside action… until the next wave of inflation in America begins. That’s almost certainly to be launched by a surge in the price of oil.

As the winter begins and European governments reduce imports from Russia “to save freedom”, oil should begin another bull run.

At that point, the Fed leaders will have a big decision to make. Do they accelerate the pace of hiking to manage the second wave of inflation…and risk causing an implosion of the government bond market? I think they do… and as it happens, America’s money managers will begin to relive the 1970s, with a ruined bond market, substantial stagflation, and a big focus on gold!

More By This Author:

The CPI Report: Rally Time For Gold?Gold $1810 The Launchpad For Miners

Systemic Inflation And Euro Wasteland, Got Gold?