The CPI Report: Rally Time For Gold?

Oil is the world’s biggest medium-term driver of inflation. If Western governments waved huge “Drill, baby drill!” banners today, the millions of barrels of oil that they have sanctioned off the market would take years to replace with freshly drilled supply.

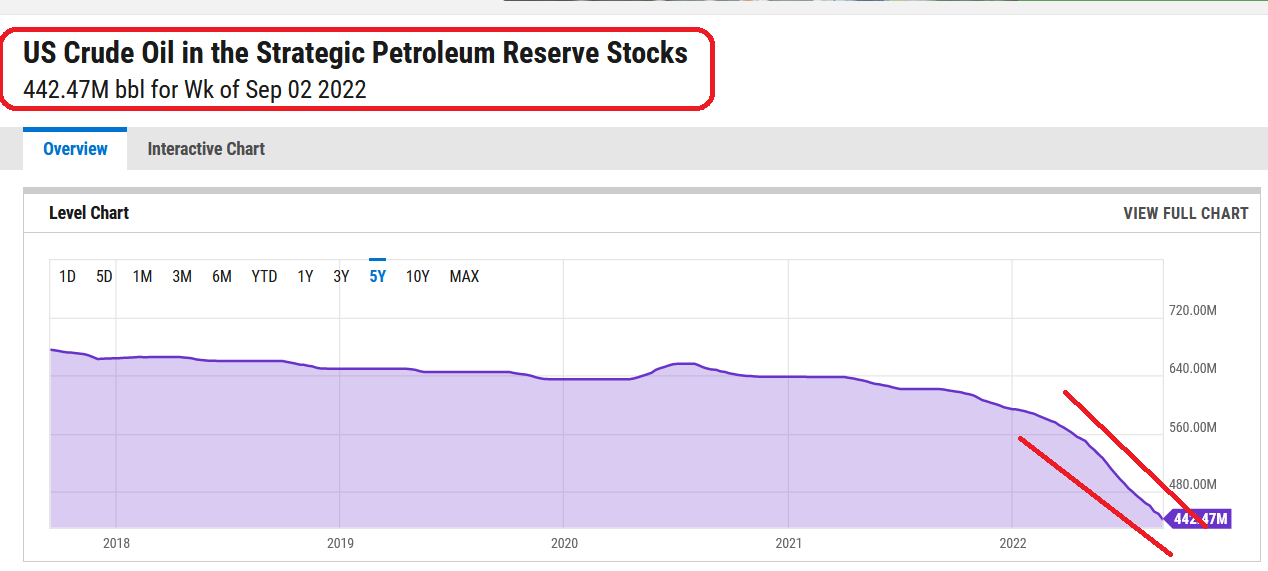

Rather than piping oil from staunch ally Canada, the US government has aggressively pumped oil out of its strategic reserve.

Has the market priced in the fact that the government must replenish these reserves? Sadly, no.

Western governments are promoting a green energy transition, which is a good thing, but they are trying to make a 30-year transition into a 3-year deal that features the “bonus” of ruining Ukraine and much of Europe.

The bottom line is this: The “Gmen” of the West look like Vincent Price movie characters promoting macabre war-oriented pipedreams instead of magnificently engineered pipelines.

(Click on image to enlarge)

US citizens grumbled as oil roared to $130 but they never experienced the amount of “fuelflation pain” that European citizens did.

That could change quite dramatically if oil begins a new leg higher. How could that happen and what are the ramifications for citizens of the world if it does?

Well, the US elections in November could see the Democrats retain their control and stop the strategic reserves drain because they would have more time to get US citizens accustomed to higher prices.

The Republicans could win and try to impeach war enthusiast “Jackboot Joe” Biden… but if the Republicans win, they likely continue the sanctions on Russia. Waving “Drill, baby drill” banners in December won’t stop thousands of Eurozone citizens from potentially freezing to death and…

Gold tends to have violent rallies against US fiat when major new themes of horror appear.

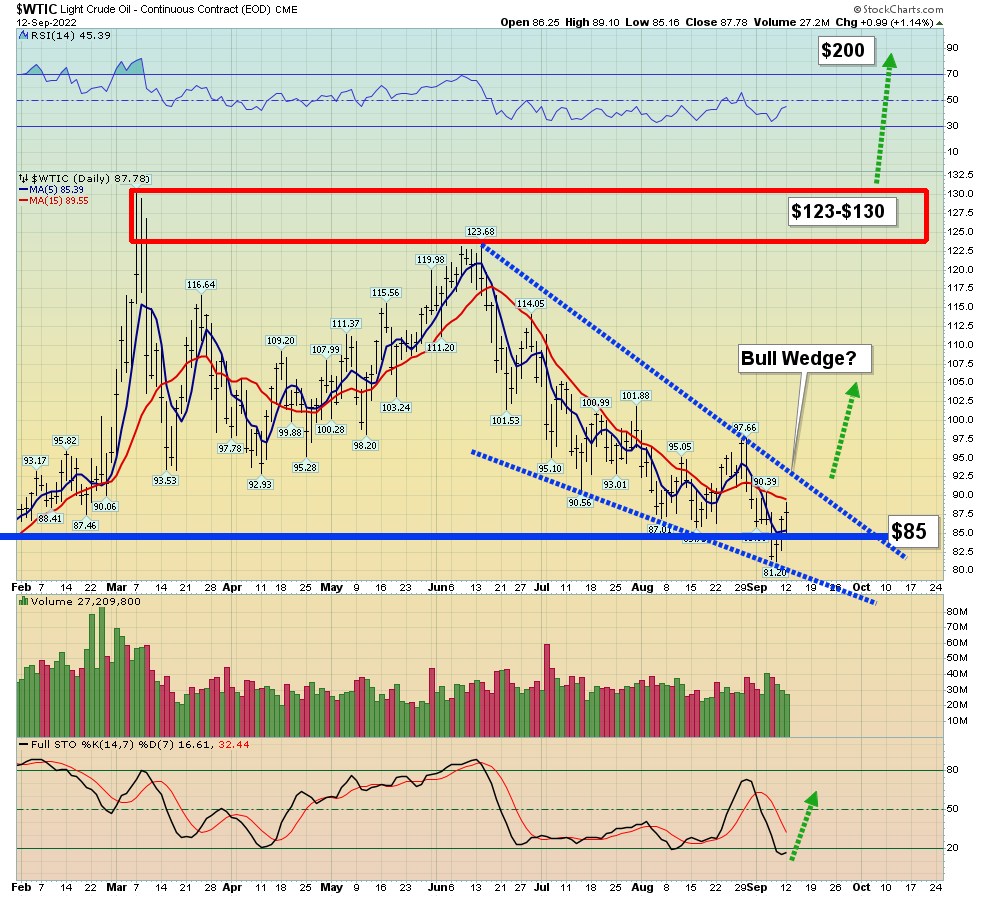

(Click on image to enlarge)

SGOL gold ETF chart.

Technically, gold is in a superb position; there’s a Stochastics buy signal in the oversold zone, the commercial traders have added COMEX longs, and a Friday close over the red-dotted downtrend line should ignite a powerful rally.

Silver?

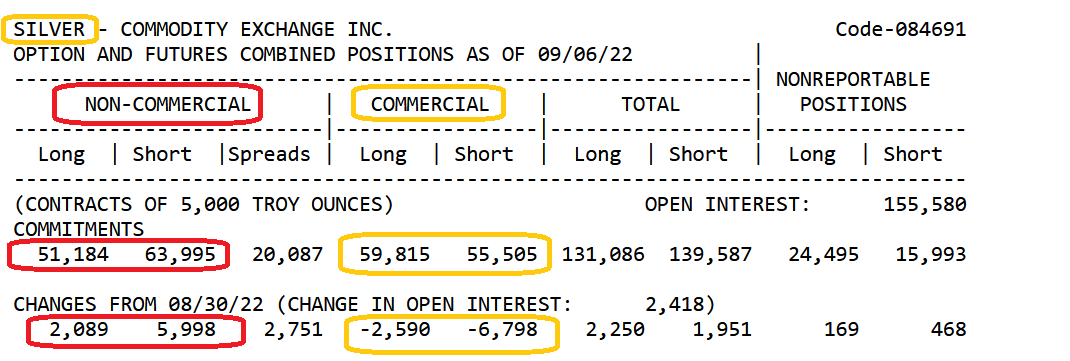

(Click on image to enlarge)

This mighty metal had an awesome rally yesterday and now there is a bullish flag-like pattern in play.

The latest COT report is incredibly positive. Commercial traders now net long what gold bugs view as the world’s second greatest metal, and silver bugs view as… number one!

What about the miners?

(Click on image to enlarge)

Hourly GDXU triple-leveraged ETF chart. It’s surged about 30% in a week!

The CPI inflation report will be released today and I issued a sell GDXU alert yesterday to my swing trade newsletter subscribers. Short-term leveraged trading can be helpful from an emotional standpoint as well as a financial one if the investor keeps the “fun trades” in a separate account from the bigger core positions.

For unleveraged positions, which should form the bulk of the portfolios of most gold bugs, it’s too early to sell… much, much too early!

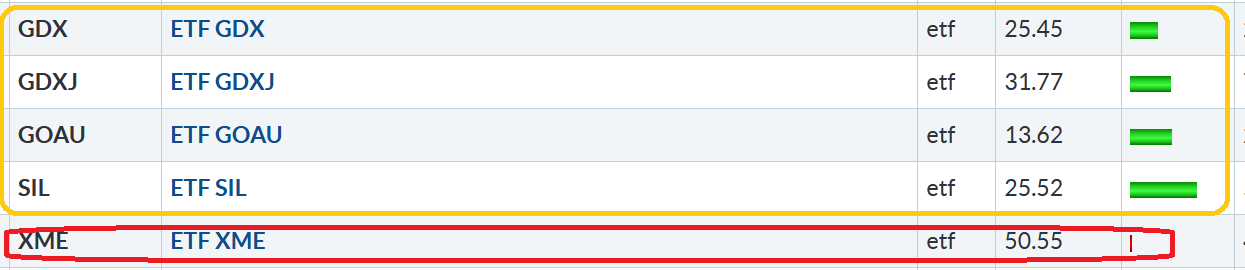

I recently suggested investors could follow me and move their ETF focus from XME to GOAU, GDX, GDXJ, and SIL, and yesterday showcased the potential wisdom of that play.

XME contains industrial metal stocks, and it was an outperformer on gold price rallies, as central banks began hiking.

In the next phase of the 2021-2025 war cycle, Eurozone hunger, lack of heating, and infighting over sanctions are likely to be key themes, as is mayhem following the US election.

As the situation deteriorates, the stock market rally could end while the gold/silver rally intensifies.

(Click on image to enlarge)

GDX chart.

While volatility around the CPI and PPI reports is expected and normal, once that smoke clears GDX should stage its biggest rally of the year.

(Click on image to enlarge)

GOAU chart.

The volume bars are stellar, there’s a Stochastics buy signal, and the key 5,15 moving averages are looking good.

(Click on image to enlarge)

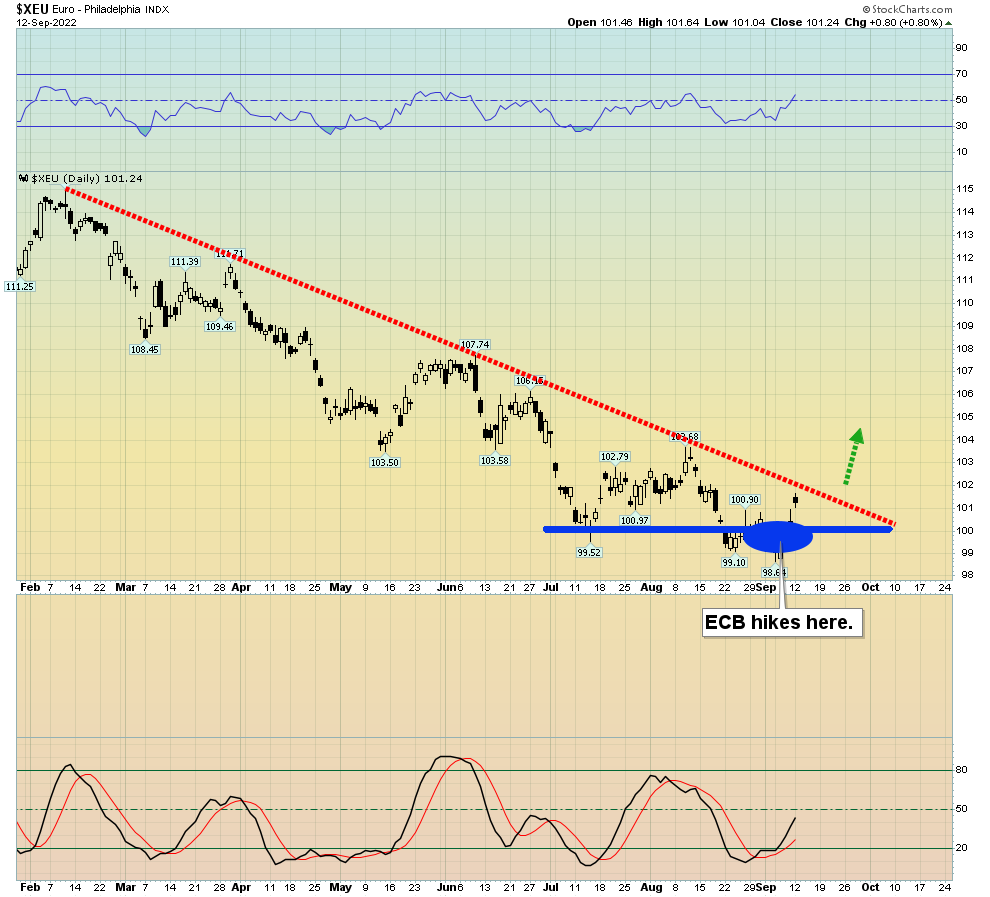

Euro vs dollar chart.

Investors appear to be overly focused on the Eurozone’s GDP meltdown, and under-focused on the ECB. In the coming months, the Fed is likely to keep hiking (destroying the stock market) but at a lesser pace, while the ECB becomes relatively more aggressive. Gold, silver, and oil are on the move. The euro is next, and that flashes an “All systems go!” signal for the miners!

More By This Author:

Gold $1810 The Launchpad For Miners

Systemic Inflation And Euro Wasteland, Got Gold?

War And Inflation Rally Time For Gold