Metal Miners Gold $1610 Is The Key

Since early March of this year, “King Dollar” has fared incredibly well against almost every asset.

(Click on image to enlarge)

Horrifically, the only asset the dollar is failing against… is the one the US government promised the dollar would annihilate, the ruble!

I’ve repeatedly cautioned gold bugs that gold is unlikely to rally to new highs until the US government gets its currency act together… and fosters a decent dollar rally against the ruble.

That could involve sanctions that are designed to weaken Russia’s government rather than ruin the citizens of Europe and ruin the citizens of Russia. It could involve getting rid of the sanctions altogether (an act of sanity).

It could involve ending the addiction to meddling in nations around the world and replacing the addiction with a focus on America’s own backyard (Cuba and Mexico) where it has failed so horrifically.

If a nation is themed on fiat, and debt, and can’t have an orderly backyard, can it really call itself an empire that is mandated to lord over the world? Sadly, “Bozo the Meddling Fiat Clown” may be the phrase that sums up the US government most succinctly today.

What about the stock market? Well...

(Click on image to enlarge)

New lows create investor adrenaline, but when a new low occurs… it’s usually only a few days (and often just one day) before a substantial rally occurs!

The Dow just made a new low so a rally is expected now. The Aug-Sept time frame is “crash season”, but an ongoing “stagflationary ooze” (for the next 20 to 30 years) is the most likely scenario for the US stock market, rather than “the big crash”.

Gamblers can play the rally, which will almost certainly fail and be followed with deeper lows. Everyone else should focus on being short the bond market, long the dollar, and…

Get ready to go long gold, commodities, and crypto!

(Click on image to enlarge)

spectacular gold chart

Gold is finally moving close to my $1610 buy zone for mining stock enthusiasts.

It’s not quite there (and it may not get there) but if it happens, investors should be ready to buy. Note the fabulous position of the 14,5,5 Stochastics osciallator.

The time for professional investors to short gold (and get richer) was at round number $2000.The time for amateur investors to short gold (if they want to fail again) is now. Horrifically, that’s what many amateur gold investors are doing… shorting it now.

(Click on image to enlarge)

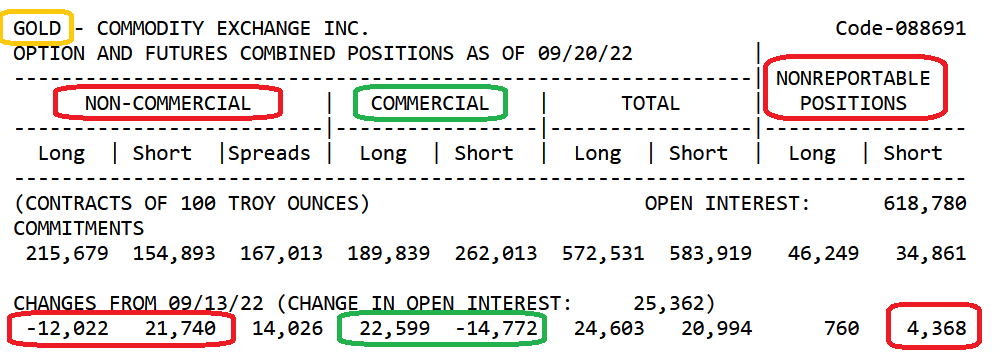

My suggestion for all gold bugs is to pay attention to the professionals (commercial traders on the COMEX) who are eagerly buying all that the amateurs sell.

Just because the pros are buying aggressively while the silly amateurs sell… that doesn’t mean every gold bug should buy too.

If a gold bug is already heavily allocated to the sector, there’s no need to buy more to “average down” their entry price. Here’s why:

A gold bull era lies ahead, driven first by the 2021-2025 war cycle, then by energy transition, and finally by empire transition (from fiat orientated to gold-oriented China and India). There’s no need to back up any trucks to buy. Nothing is “getting away”.In a nutshell, this is an era that is likely to last 200 years.

(Click on image to enlarge)

SIL ETF chart

Silver bugs will find it hard to get richer by staring at this chart (or at the silver bullion chart) and buying on bullish set-ups there.

For the miners, both gold and silver, it’s all about gold bullion, and for gold bullion, it’s all about $1610.

(Click on image to enlarge)

XME chart

The chart looks better than the SIL chart, but that doesn’t mean the next rally will be better too.

XME has retraced most of the summer rally, and I sold what I bought at $40 into the highs that were defined by the gold price resistance at $1785.

I urged gold bugs to take similar action, and many did. A new rally looks imminent, but it will be the action of gold bullion (and the Dow, to a degree) that determines whether it plays out or not.

(Click on image to enlarge)

GDXJ chart

There’s no guarantee that the gold price declines to the $1610 “buy zone of mining stock champions” area, but the odds of huge gains for investors who buy there… are substantial!

More By This Author:

Inflation: Tactics For Ebb & Flow

The CPI Report: Rally Time For Gold?

Gold $1810 The Launchpad For Miners