On The Eve Of November FOMC

Expected economic activity, medium-term market-based inflation expectations, and risk/uncertainty measures.

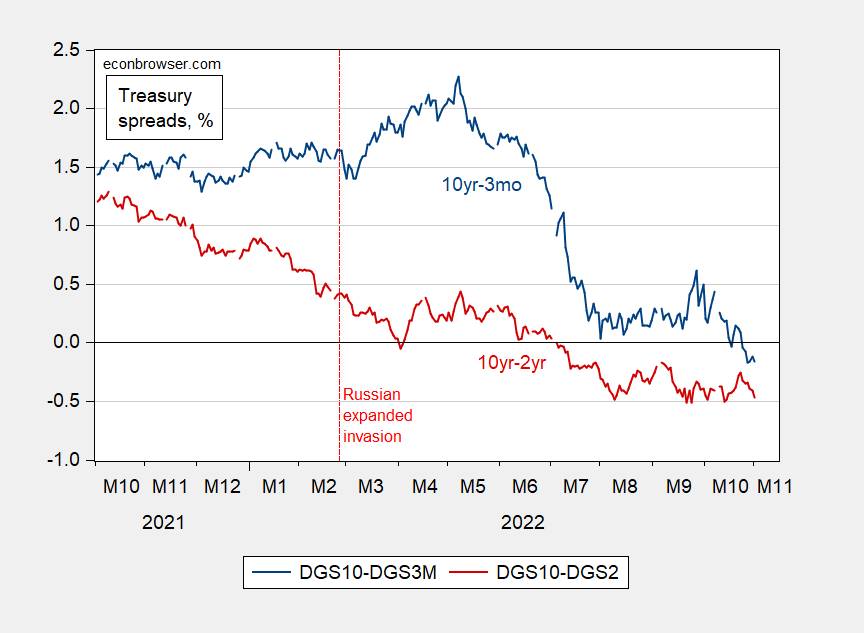

Figure 1: Ten year-three month Treasury spread (blue), ten year-two year spread (red), both in %. Source: FRB via FRED, Treasury, and author’s calculations.

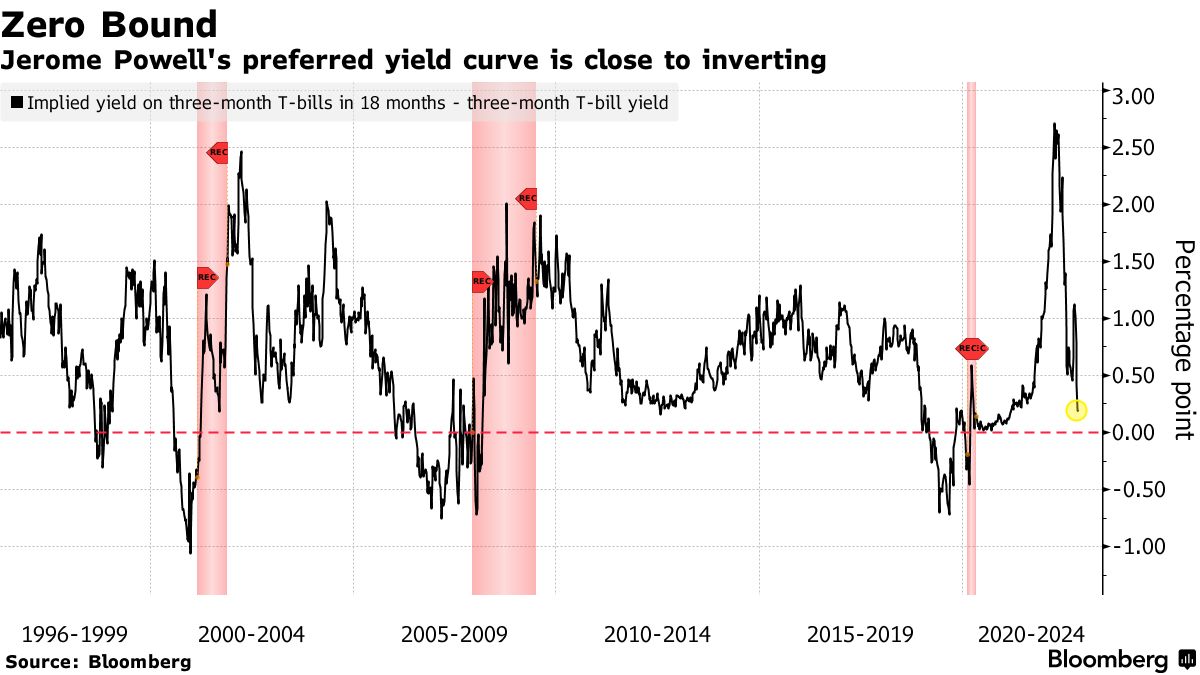

Inversion of both term spreads is a pretty sure harbinger of a recession in the next year. Powell’s favored term spread — 3 month spread relative to 3 month forward 18 months — is also coming close to inversion.

Source: Reynolds, Geldhill, Bloomberg, 11/1/2022.

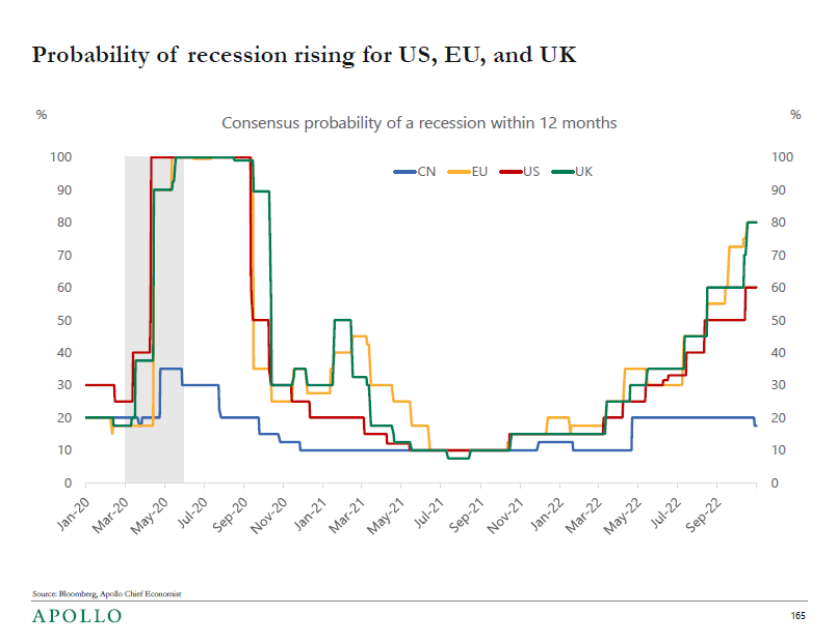

Economists seem pretty convinced of impending recession as well (across countries). From Torsten Slok (11/1/2022):

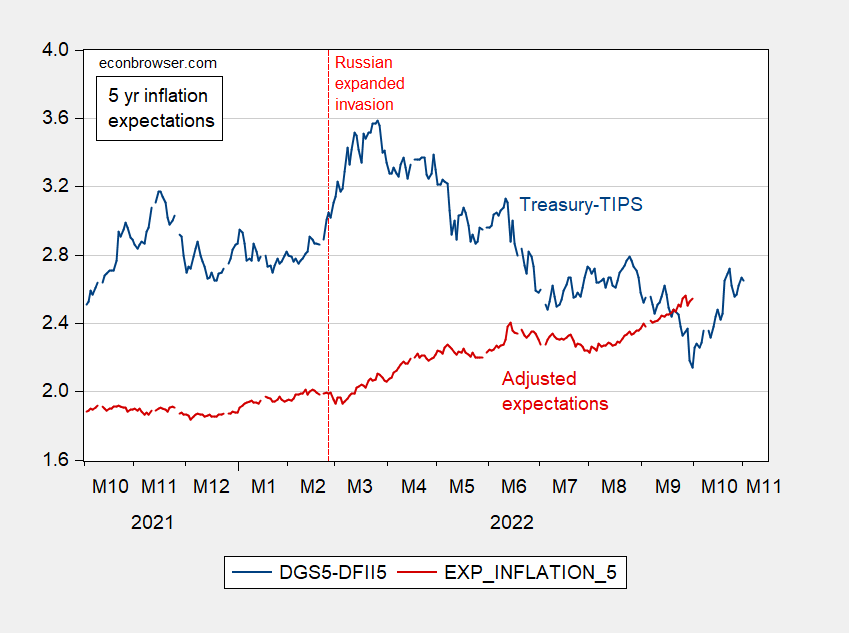

What about market based inflation expectations? At the five year horizon, expectations inferred directly from Treasury-TIPS spread is back up to levels at end-August, but still far below March 2022 peaks.

Figure 2: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red), both in %. Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 11/2, and author’s calculations.

That being said, the estimated inflation expectations accounting for premia has been trending upward through the last date available, end-September.

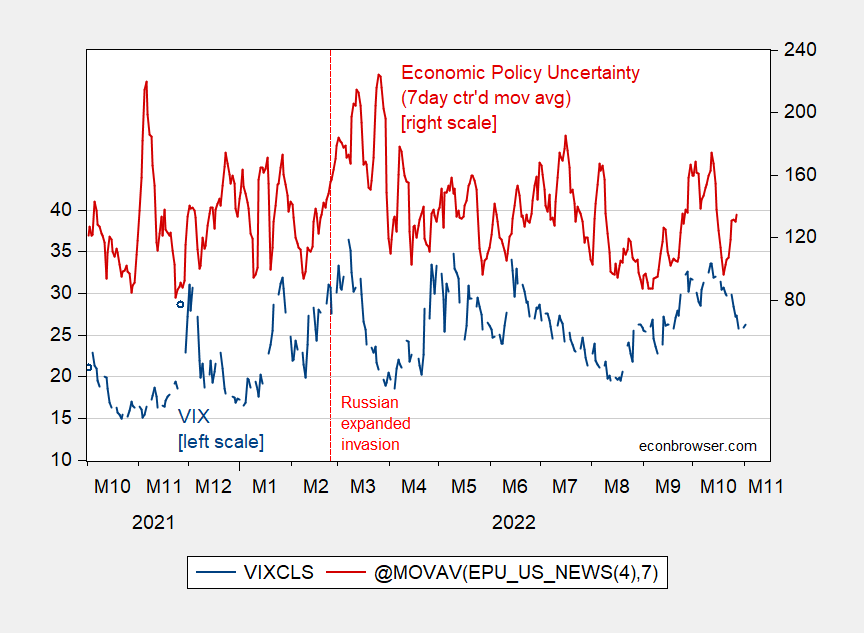

Finally, the VIX has cycled up and down while the EPU has trended downward since the month following the expanded Russian invasion.

Figure 3: VIX (blue, left scale), and 7 day centered moving average of EPU (red, right scale). Source: CBOE via FRED, policyuncertainty.com.

More By This Author:

Natural Gas And LNG Exports Vs. Goods ExportsLiquified Natural Gas' Contribution to Goods Exports (Balance of Payments Basis)

How Long The Dollar Upswing?