Summary

- The Wave 2 corrections are likely over. If the recovery seen in pre-NY market goes further, then we have passed the most dangerous part of the correction. Trend remains up.

- WTI CLc1 oil is still trading alongside the 10yr yield. There is nothing to write home about, yet. But once the 10yr rises past 1.60%, we can OIL breath easier.

- We have no illusions that gold will diverge for long versus the inverse of yields. We wait further and see if there is a chance of hitting $1520 models' target.

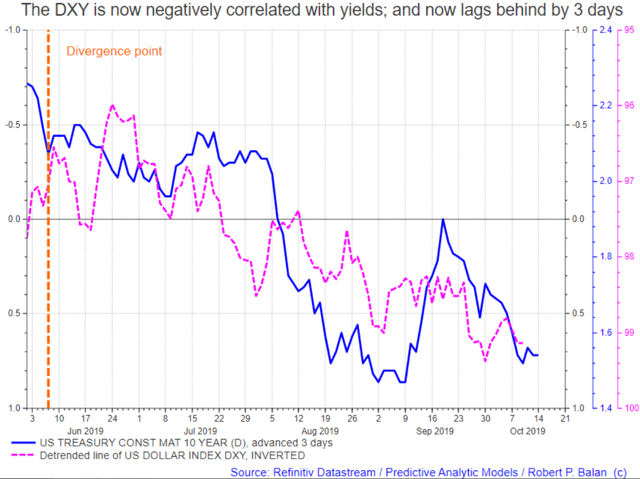

- From the chart provided, the DXY is now negatively correlated with yields and now lags behind by 3 days. The DXY should be setting up a bounce good to sell.

- Since early June, the DXY and yields have been on negative covariance. The DXY firms when the yields fall, and vice versa. Our conclusion: the DXY has been rallying in the wake of falling yields, as a safe haven asset. But as yields rise, as we expect, then the safe haven trades will unwind, and DXY will fall.

Original article: here

(This actual Market Report was written pre-NY market opening, on October 9, 2019, and was updated until the NY market closed. Seeking Alpha has been encouraging SA service providers to become more transparent, and show actual reports and interaction between providers and subscribers. We are providing this report to showcase what PAM provides to the members of the community).

Why not take a free two-week trial subscription, have a look at us and see if this community of veteran investors is a good fit for you?

Please go here

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 2:41 PM

GOOD MORNING

Market Report At The Chat, October 9, 2019

The Wave 2 corrections seems to be over. If the recovery seen in pre-NY market goes further, then we probably have passed the most dangerous part of the correction. It means the trend is now up.

Here is the reason why: the inevitable "test of the lows" in a second wave counter-reaction context has no fixed percentage to the previous rally. We started with 50 pct because that is the most common occurrence, but wave 2s can go 100 pct, and that gives rise to the technical pattern of "double bottoms".

We are not yet totally free and clear, but the signs look good this morning.

In this context, let me just explain something that will clear up the air and prevent future misunderstandings. I was asked in a DM why PAM did not exit the longs (some of them making close to 7% at the top of the recent rally), as we were expecting a 50 pct correction. The implication is that the sender of the text would have gladly took profits too, saying that our expected correction would wipe up the paper profits. The fact that the correction extended even deeper than 50 pct likely aggravated the text sender's feeling even further.

As I explained a lot of times before (and I am doing this again for the benefit of the new members of PAM), we have a way of managing our risk, and that not only includes managing the losses but also managing the profits. In the sense that it takes a while for us to take a loss, we also prefer to run profits if we could. That system is not suitable for everyone, and we certainly do not go out of our way to recommend it. It takes a combination of capital availability and sense of certainty about the market's direction to make this style work. A modicum of certainty is provided by our time-tested investing tools.

In this particular situation, PAM wants to be invested to the upside, and that has over-ridden the urge to take quick profits. Also, Mr. Tim Kiser pointed out wryly that it was Mr. Robert Balan's conjecture that we may see a deep, 50% correction -- not the models. What if it did not work out that way? Tim's point: PAM is more certain of the imminent take off in risk assets (per the models) than the extent of the EWP-derived correction conjecture from Mr. Balan.

Here is why we manage PAM's risk we do it today. As we explained before, we have validated the concept that the risk asset markets are mean-reverting, and if there is a way to even modestly predict where the market is LIKELY to go next, then there is no need to cut losses/profits short at the first sign of adverse market conditions -- if you invested along the perceived trend provided by your vetted tools.

That runs counter to a lot of materials that is available out there in the Web -- of cutting losses quickly and letting profits run. My retort has always been -- how can you let profits run when at the first sign of perceived adversity, you bail?

The issue actually stems from insufficient risk capital. That is something that cannot be redressed even by good market analysis -- there is always random news flow which can blow the insufficiently funded trade away. Adverse random news in the age of a Twitter-engaged Donald Trump is almost a certainty every other day. With this kind of volatility environment, you have to provide buffer for unfortunately-timed tweets -- or stay out the markets altogether.

But that is just me (and Tim) speaking. Since we provide daily outlook of what to expect from the market TODAY and even tomorrow, it is up to the individual member to manage his/her style of taking profits and losses -- do not take the cue from us (PAM). Take the cue from your own sense of "correctness" -- if it is correct (for you) to take a profit (or a loss), then go ahead and do it. Waiting for us for leads on what to do might be disastrous to your risk capital -- PAM almost certainly has a higher pain thresh-hold; you may have to wait awhile. That could put you in dire straits before the market become friendlier.

Unfortunately, we cannot, by SEC and Seeking Alpha regulations, provide specific, tailored trading advice. We can speak of market direction, targets levels of expected moves, and other stuff that help make a coherent trading decision, The only concrete way we can do is to show actual trades, with real money. But we can not trade every opportunity that comes along. So we provide the daily analysis, and if you feel you want to do something to take advantage of those narratives, then do it -- your way. You can ask us for directions and help, and we are always happy to oblige.

I am sorry, I am spending a lot of time explaining this, as we have done this several times before. But we do realize that some of the new members have not been apprised of this. So for the longer-term members, my apologies, and please bear with us, as we go through the same explanatory cycle again. And thank you for your forbearance.

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 3:37 PM

WTI CLc1 oil is still trading alongside the 10yr yield. There is nothing to write home about, yet. But once the 10yr rises past 1.60%, Tim and I will breath easier. We just have to wait for what the NY market will do. The NY just opened.

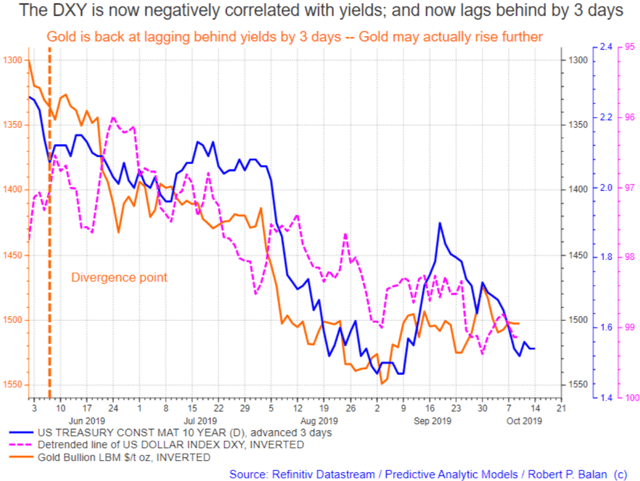

Nominally, gold still looks bid. And that is even with the yields looking likely to turn higher. Nonetheless, we have no illusions that gold will diverge for very long versus the inverse of the yields. We will wait further and see if there is a chance of hitting the models' 1520 target (XAU) or thereabouts. Then we bail from the long Gold positions. Yields inverted in the chart above.

Cross-currents in the DXY and yield relationship. It could be that if safe haven trades disappear, yields will rise and the DXY will fall. This seems an inevitable conclusion of the puzzling, new covariance between the two assets.

Since early June, the DXY and yields have been on negative covariance. The DXY firms when the yields fall, and vice versa. Our conclusion: the DXY has been rallying in the wake of falling yields, as a safe haven asset. But is yields rise, as we expect, then the safe haven trades will unwind, and DXY will fall.

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 4:06 PM

From the chart above, the DXY is now negatively correlated with yields; and now lags behind by 3 days. The DXY may still rise somewhat but the DXY should be setting up a bounce good to sell.

NGc1 seems to be bottoming out. We may not see 2.26 from here. But we shall see. 2.32 is upturn key level.

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 4:13 PM

ETH crypto perks up, but no response yet from the rest of the crypto universe.

Will have to wait for this one.

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 4:16 PM

For once, yields seem to be leading the charge higher. Nice to see this change.

Open to discussions.

Gold is back at lagging behind yields by 3 days -- Gold may actually rise further (along with the DXY)

bopseth @bopsethOct 9, 2019 6:12 PM

Today’s narrative is greatly appreciated. Equally impressive is how superbly the models are performing. Thank you.

vjapn @vjapnOct 9, 2019 6:34 PM

Robert, NG tested 2.26 earlier today and rallied however breaking it now. Any new analysis?

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 6:39 PM

Lets see what happens next in NG. These trendlines are not cast in stone. We could see a double bottom test.

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 6:57 PM

Testing time for the resistance levels in the 10yr yield.

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 8:43 PM

Here is the selling time for Clc1

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 8:46 PM

Now lets see it this oil sell off translates into a gold (XAU) rally. A positive reaction from Gold may just bring us to 1520, thereabouts.

Acetaia @acetaiaOct 9, 2019 9:39 PM

Stanley Druckenmiller said in an interview lately tht the the market now have a reverse to the mean where in the past market would go the direct way, but that gives you always the option to put new money in your trade if you have the path right. For us that means the setbacks are possibilities to take new long positions. All in all I would say PAM make their money because they they know when to release the trades.

Robert P. Balan Oct 9, 2019 9:41 PM

Very perceptive Acetaia. Thanks a lot.

goodkind6 @goodkind6Oct 9, 2019 9:43 PM

The shorter the time frame the harder to time.

I have been watching.

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 9:44 PM

Agree with you 100 pct there goodkind6

goodkind6 @goodkind6Oct 9, 2019 9:51 PM

Natgas tomorrow could be a break day. your thought tomorrow is very helpful

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 10:09 PM

Three things, goodkind6.

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 10:13 PM

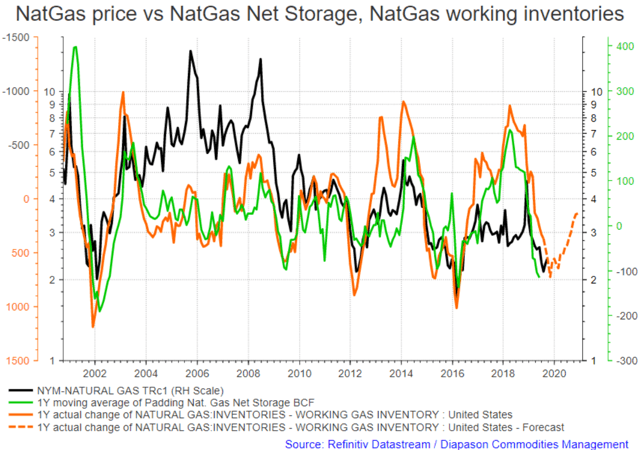

For the immediate term, gas inventory is significant. But our model suggests that October is the month when inventory build will peak, an start drawing wll into late Q1 next year.

Nonetheless, what impacts NatGas in the long term, is the lagged effect of production. Although production started rising about 4 weeks ago, the impact is lagged (delayed) meaning that the previous decline in production remains a significant prime move of current NtGas prices for the next three to four months.

Robert P. Balan @robert.p.balanLeaderOct 9, 2019 10:20 PM

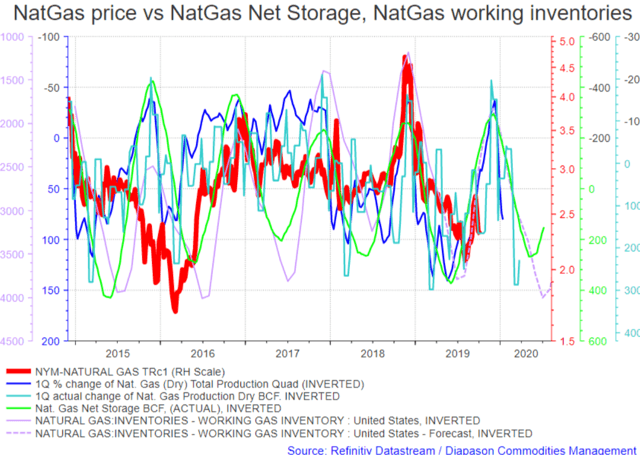

We can use the lagged changes in production as timing NatGas trades (see chart above). And it happens that Natgas is due for an upturn until the end of the year-early January.

The third is outlook for atmospheric temperature in the near future.Next week, the weather conditions are expected to get significantly colder and in absolute terms, the temperatures are expected to drop below the norm.Total demand is also expected to average 82.7 bcf/d (some 15.7% above the 5-year average), supported by strong exports - specifically into Mexico - and also helped by robust LNG sales.All in all, these factors support the theme that NG prices may be bottoming.

MARKETS CLOSED

Predictive Analytic Models (PAM) provides REAL-TIME trading advice and strategies using guidance from US Treasury, Federal Reserve and term market money flows. PAM also provides LIVE modeled tools to subscribers in trading equities, bonds, currencies, gold and oil -- assets impacted by ebb and flow of systemic money. Sophisticated LIVE models to trade and invest in the oil sector are provided as well. PAM's veteran investors and seasoned traders can use PAM's proprietary tools 24X7 via PAM's SA service portal.

Try us for two-weeks, free. Please go here

Disclosure: I am/we are long equities. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Disclosure: I am/we are long equities.