There are some well-known junior miners in eastern Canada’s province of Newfoundland & Labrador, including New Found Gold [NFG], Marathon Gold [MOZ] & Labrador Gold [LAB]. NFG has an adjusted Enterprise Value {market cap + debt – cash} of $779M (subtracting the est. value of a non-core property). That’s $5,156 per Newfoundland-only hectare.

Make no mistake, NFG’s high-grade deposits will become a mine. That means surrounding companies (if they don’t develop mines themselves) will become prime takeover targets as satellite deposits to operations that spring to life later this decade. Companies with large land packages will have multiple bites at the satellite deposit apple.

Admittedly, a comparison between NFG and other gold juniors is problematic. In 2019, NFG made one of the top 3 or 4 gold discoveries in Canada of the past decade. Although pre-maiden resource, it’s years ahead of one of my favorite juniors — Gander Gold (CSE: GAND) / (OTCQB: GANDF). Still, Gander is valued at $102/ha [GAND.c price of C$0.33 on the morning of Aug. 10th] vs. NFG at $5,156/ha.

By the end of next year, NFG could be acquired — perhaps at upwards of double today’s valuation. That would be ~$1.6 billion, or $10,312/ha. For comparison, Great Bear Resources (pre-maiden resource, owner of another blockbuster Canadian discovery) was acquired by Kinross for ~$1.8 billion.

Gander may never reach a valuation of $5,156-$10,312/ha, but consider Labrador Gold’s adjusted valuation of ~$1,100/ha, also pre-resource, also a few drill seasons ahead of Gander.

Notably, the majority of LAB’s valuation is attributable to its relatively small 7,700 ha Kingsway project. I argue that Kingsway alone is valued at ~$4,000/ha. Gander’s claim to fame (until late last week) was the sheer size of its property holdings at 226,300 ha, making it possibly the largest gold claims holder on the Island.

One more name to drop… I estimate that Sokoman Minerals’ [SIC] flagship 2,540 ha Moosehead project is valued at roughly $7,000/ha. To be clear, these examples do not guarantee that Gander will develop properties that command strong valuations. However, a tremendous amount of option value is embedded in Gander’s 226,300 hectares.

Of course, there will be equity dilution, and some gold claims will be dropped, but a great thing about controlling > 9,000 claims is the ability to sell, JV, or farm-out all or portions of some properties, (while retaining the best ones). This diminishes cash burn and de-risks the overall story.

To the extent that management can strike deals with larger companies and receive a mix of cash, shares + production royalties on the properties, that would be a very nice, long-term call option on the price of gold.

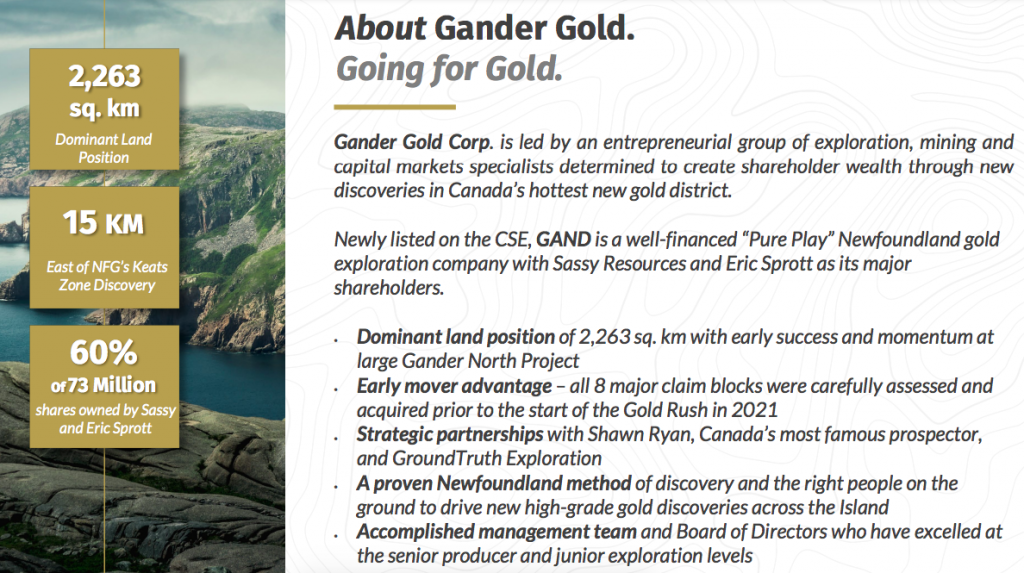

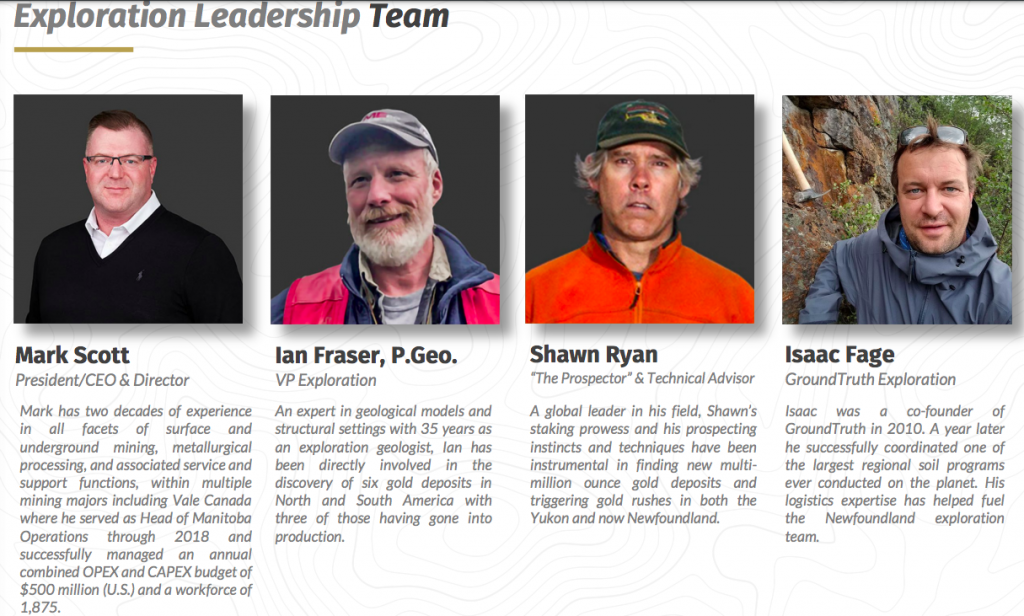

Getting deals done is something Gander is good at. This is a strong management/tech. team, especially for a company with an Enterprise Value {market cap+debt-cash} of just C$24M [see bios below].

To reiterate, NFG, LAB & SIC are more advanced in their exploration activities, but none have delivered a maiden mineral resource estimate. It’s clear that it doesn’t require a large footprint to carry a strong valuation. I’ve referred to three projects valued well into the $1,000’s/ha (companies that are down an average of 60% from 52-wk highs).

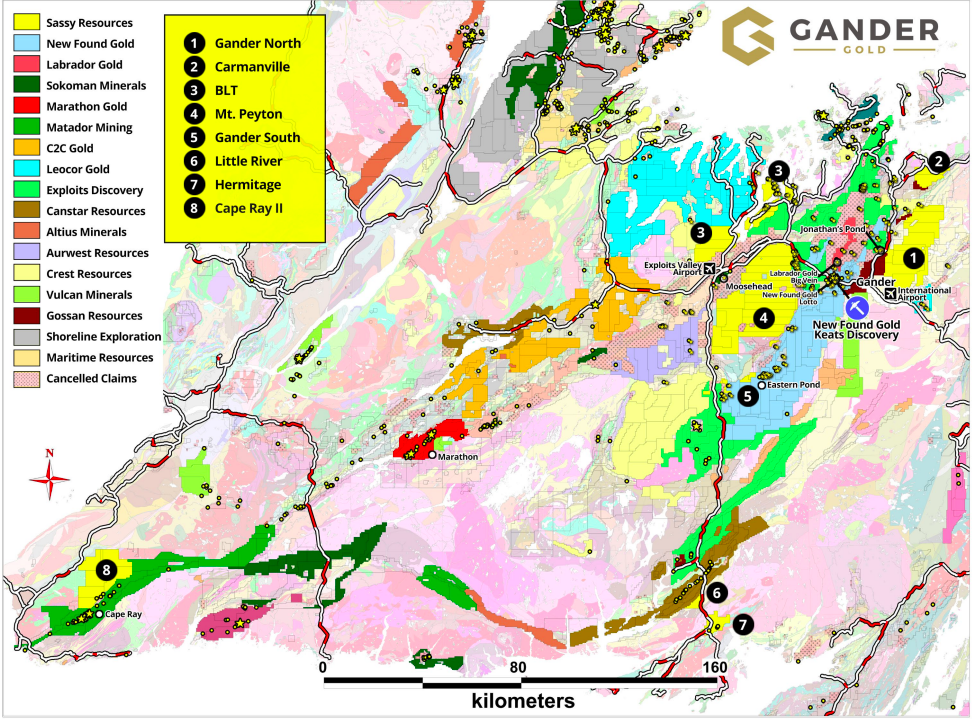

Importantly, Gander’s four biggest properties are not on the fringes of key areas in Newfoundland, they’re right in the heart of the action. Readers should know that the top Newfoundland companies are drilling > 400,000 meters in 2022 alone.

Imagine what could happen to Gander’s share price if 1) gold prices rebound [we’re just 11% away from $2,000/oz.], 2) more drilling successes are announced around Gander’s properties, and 3) Gander makes one or more discoveries of its own.

Two out of three of those premises seem very likely, we just need Gander’s expert technical team to point the drills in the right direction… Readers are reminded that when gold was stronger back in the 4th qtr. of 2021, Newfoundland juniors were some of the hottest natural resource names in N. America.

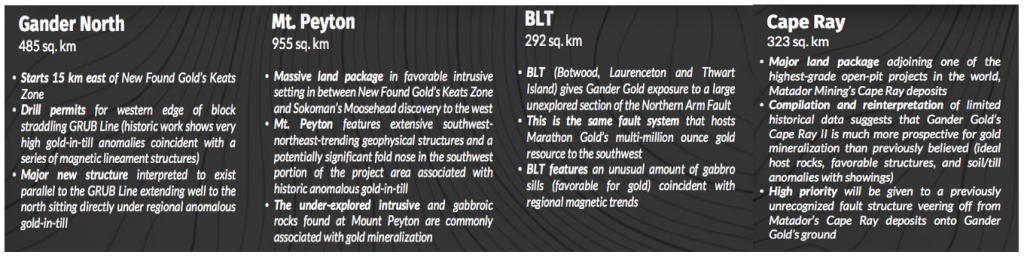

On August 5th, this press release described a potential game-changing development at one of the Company’s eight properties, the Gander North Project (GNP). As a frame of reference, please note that four of Gander’s properties are much larger than LAB’s Kingsway — averaging 51,375 ha each.

By comparison, Marathon Gold’s flagship Newfoundland project is 24,000 ha ($19,258/ha, but it’s at the Bank Feasibility stage).

Management has identified a “potentially major” new gold trend at the GNP within the Gander Gold Belt starting ~12 km east of the GRUB Line & ~25 km east of the Appleton trend that hosts NFG’s & LAB’s bonanza, high-grade discoveries.

A main NE-trending zone extends > 25 km across the GNP and remains open to the NE. Numerous N-NE trending zones also cut across the GNP, adding significant economic potential. In total, these zones provide > 100 linear kms of structure, structure that management believes is “highly prospective” for gold.

Hundreds of anomalous samples generated from thousands of soil & till samples taken in 2021 coincide with results from a recent airborne Mag/VLF geophysical survey & a LiDAR survey. The best outcropping quartz veins, initially identified with high-resolution satellite & aerial photos, represent immediate targets for follow-up. CEO Mark Scott commented,

“Gander Gold holds the largest claim package in Newfoundland, eight strategically located properties prospective for gold. Early-stage exploration results from the Gander North project have exceeded expectations. We look forward to sharing the results from Gander’s other projects on the Island in the near future. We believe Gander’s developing projects & tight public float position the Company for significant share price appreciation potential.”

Clearly, Gander is an early-stage play, but if one believes in the Company’s technical team, precious metals investor Eric Sprott, Canadian prospector Shawn Ryan and Newfoundland as a world-class, wildly underexplored jurisdiction — then there’s substantial bang for the exploration buck here.

Technical Adviser Shawn Ryan commented,

“Broad areas of the GNP are lighting up from our Phase 1 soil sampling program. Results from our 2021 Airborne Mag/VLF & LiDAR surveys are in and have been very helpful in adding the next layer of detailed interpretation needed to advance the project. It’s remarkable how this previously unexplored area has become a ‘hot spot’ for potential new gold discoveries along what appears to be an entirely new gold trend east of the GRUB Line.”

Gander’s VP of Exploration Ian Fraser added,

“Our Phase 2 soil geochemistry program will extend known anomalies along strike, and sample in greater detail around some of the highest grade anomalies. Furthermore, there are numerous other interpreted structures that we will test.”

Management is very encouraged that initial detailed sampling has highlighted areas where continuous gold-in-soil anomalies occur over a significant distance. These gold-in-soil anomalies occur in areas interpreted to be of greater structural complexity and are viewed to be more likely to host gold deposits. Chasing multiple structures is a lot better than chasing just 1 or 2.

Gander Gold (CSE: GAND) / (OTCQB: GANDF) seems very well positioned to become a top player in Newfoundland and/or to partner with larger gold companies to play an important role in the ongoing gold rush on the Island.

Disclosures: The content of this article is for information only. Readers understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about GANDER GOLD, incl. but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of GANDER GOLD are highly speculative, not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was originally posted, Peter Epstein owned shares of GANDER GOLD and the Company was an advertiser on [ER].

Readers should consider me biased in my view of the Company. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.

More By This Author:

Blue Lagoon Resources, Near-Term Production Opportunity, High-Grade Gold & Silver In B.C.

First Cobalt Corp., Best Way To Play Irrepressible EV Strength & Growing Cobalt Demand?

Sassy Resources; “Lively & Bold…” But Does It Have Gold?

I'm a bit confused by your disclosure. So did the company pay you to publish this?

I can't see any of your images.