First Cobalt Corp., Best Way To Play Irrepressible EV Strength & Growing Cobalt Demand?

Battery metals Lithium, vanadium, nickel…. cobalt…. Each has traded at much higher levels, and each is widely expected to increase again (perhaps substantially). Note: unless indicated otherwise, all figures in US$.

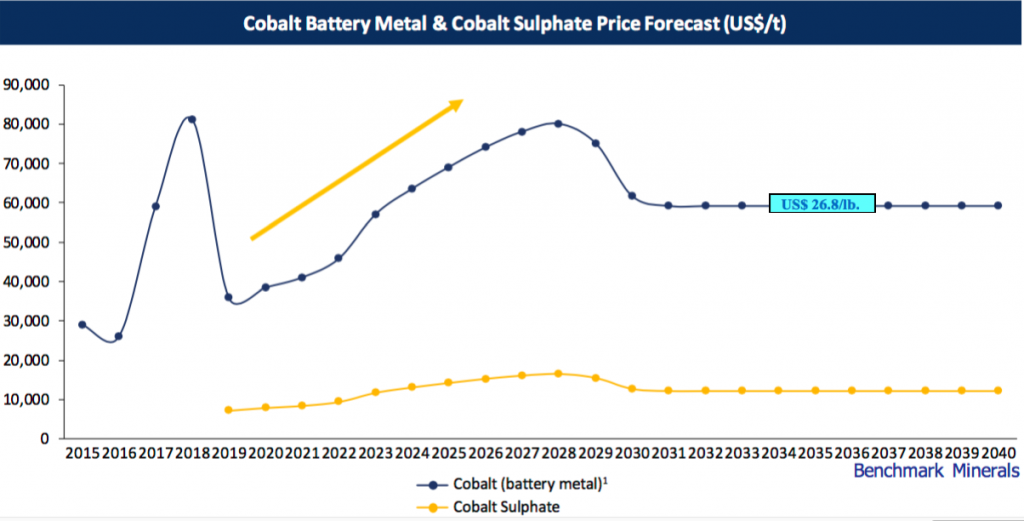

Will lithium, vanadium & nickel prices rise again? I don’t know. This article is about cobalt, which briefly traded at $44/lb. in 2Q 2018, but now changes hands at about $16/lb. I believe a rebound to $25/lb. is reasonable within 2-3 years.

(Click on image to enlarge)

Outlook for EVs & energy storage remains strong, good for cobalt

Even as some predict cobalt’s demise, several factors make me bullish. First and foremost, despite a global pandemic, long-term trends in the EV market look as strong as ever. Look no further than Tesla’sEnterprise Value (“EV“) of $400 billion. If one is bullish on EVs, cobalt remains a great way to play that thematic.

In North America, there are surprisingly few pure-play cobalt juniors to choose from. Even fewer that are anywhere near positive cash flow. A name I’ve been following for years, First Cobalt Corp. (TSX-V: FCC) / (OTCQB: FTSSF), hopes to be profitable in 2022.

Management expects a very healthy $41M of pre-tax cash flow at the refinery level (economics to be split between First Cobalt & Glencore) in its first full year of toll-milling operations.

First Cobalt owns 100% of a permitted Ontario, Canada cobalt refinery that mining giant Glencore is backing with debt financing (terms yet to be determined) to restart operations. This refinery has a Feasibility Study on it delineating a $139M after-tax NPV(8%) and 53% IRR at a $25/lb. cobalt price assumption.

Refurbishing & expanding First Cobalt’s refinery is underway and is expected to cost $60M, a meaningful portion in the form of loans from Glencore. Some of the remaining capital needed could come from Canadian government agencies, possibly including grants. First Cobalt and Glencore will share in the refinery’s economics (terms to be determined) until loans are repaid.

Why is the outlook for cobalt, especially from N. America, bright?

COVID-19 has spurred several countries, most notably China, to stimulate weak economies with EV subsidies, rebates, tax breaks, etc. The global economy is in recession, so new car markets are not doing so great. However, EV sales have held up remarkably well.

Signs of global warming have become increasingly prominent across the globe, making it impossible to deny or ignore. This can be seen in intense forest fires in places including; the U.S., Australia, the Amazon, Canada, Europe & Siberia, as well as more powerful & frequent hurricanes (among other phenomena).

This trend is driving the world towards even more rapid adoption of EVs and renewable energy. Wind & solar power require battery storage systems (mostly large, non-portable Li-ion batteries), that use cobalt.

Li-ion batteries will be the dominant EV and energy storage battery architecture for at least the next 10-15 years. Expert consultants like Benchmark Mineral Intelligence, CRU and Roskill agree. Roskill recently stated,

“…. the cobalt market is entering a new phase of consolidation & rejuvenation. Medium-term demand is expected to grow steadily once battery & aerospace sectors recover from recent setbacks with the assistance of government subsidy/rescue schemes in China & Europe. As market participants re-focus on supply chain security & sustainability, a more resilient and diverse cobalt value chain could be built. As such, cobalt should continue to play an essential role in the global transition towards clean energy technologies.“

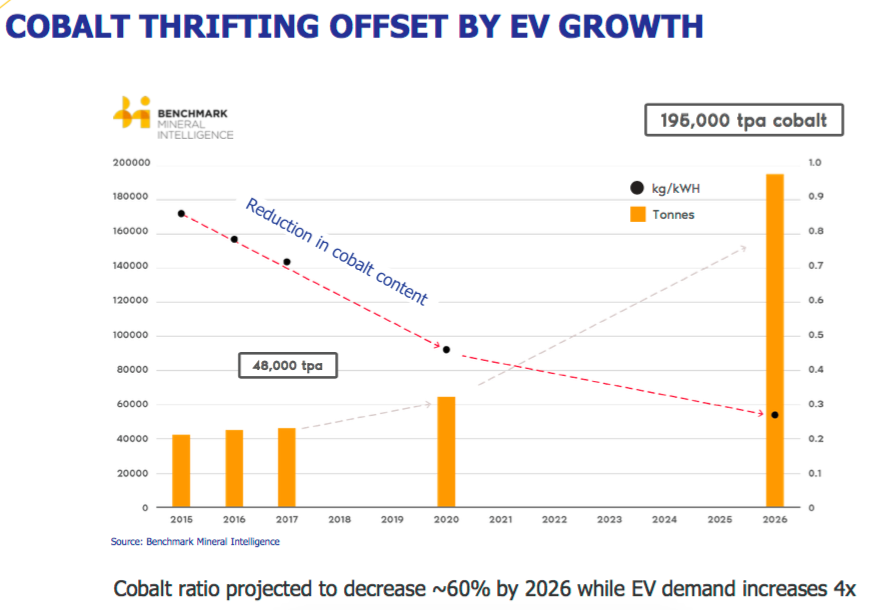

(Click on image to enlarge)

Although I’m bullish on EVs, energy storage and cobalt demand, some readers might be concerned about recent headlines that Tesla is using batteries that contain no cobalt. These will only be in a minority of Tesla’s vehicles, some low-end Chinese models. Make no mistake, most global EV makers are sticking with cobalt.

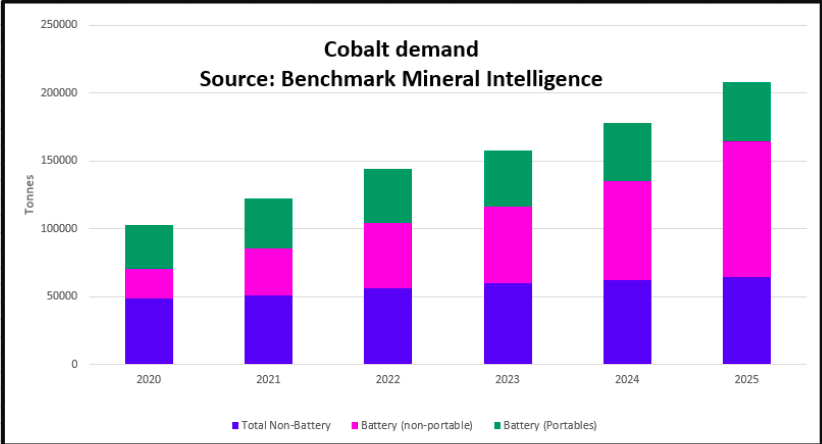

Benchmark Mineral Intelligence expects 15%/yr. growth in cobalt demand

Granted, due to sourcing challenges & cost considerations, the percentage of cobalt used in Li-ion batteries for EVs is declining. From 20+% (on average) cobalt content today, it could fall to ~10%, but probably not lower. Why? Cobalt plays a crucial part in stabilizing the battery structure, which in turn enhances energy density and safety.

Even as cobalt use per EV battery declines, the soaring number of EV batteries mitigates the decline, such that total cobalt consumed (in EVs) will continue increasing, albeit modestly.

In the chart below from Benchmark Mineral Intelligence, cobalt demand for Li-ion batteries (in non-portable applications, like grid-scale energy storage systems) is forecast to grow much faster than cobalt demand for EV batteries. Overall, Benchmark forecasts cobalt demand from all end uses to rise a robust ~15%/yr. from 2020-2025.

New applications that require Li-ion batteries are growing by leaps and bounds. This recent Reuters article explains that the rollout of 5G telecom networks will require a significant amount of cobalt. Quote,

“The need for larger rechargeable batteries & more energy storage for 5G technology will significantly boost demand for cobalt…. Larger batteries using lithium, cobalt oxide chemistry (“LCO“), are needed in 5G phones as the antenna, used to transmit & receive radio waves, needs more power than antennas in 4G phones. Base stations for 5G need more power, necessitating widespread use of energy storage systems. In China, the fastest growing 5G market, base stations use LCO batteries.“

Refinery op-ex estimate cut by 13.2%, after-tax IRR rises to 55%

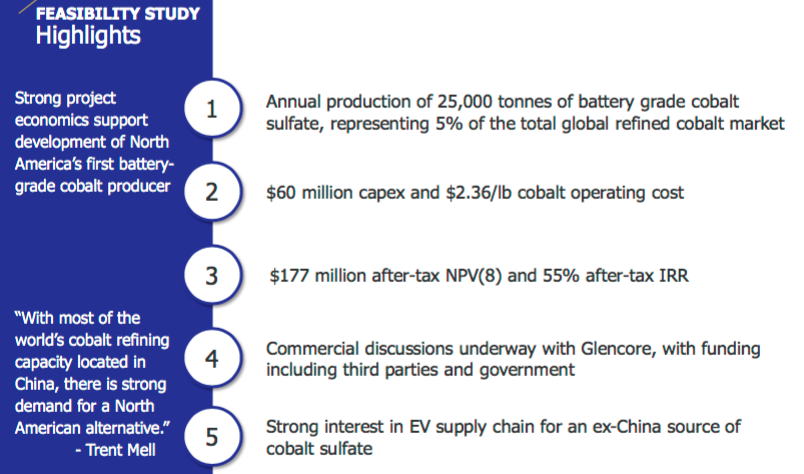

Returning to First Cobalt, management recently revealed a 13.2% decline in anticipated op-ex in its refinery Feasibility Study’s flow sheet. Due to these savings, and two additional years of mine life, the after-tax NPV(8%) from the Feasibility Study increases by ~$38M to $177M, and the IRR rises to 55%. The ratio of NPV to upfront cap-ex improved from an already strong 2.5x to 3.0x.

Importantly, a number of other initiatives are being carefully studied that could potentially cut op-ex a further 5%-10%. Having Glencore on one’s technical team helps a lot in this regard! If further op-ex reductions are forthcoming, the after-tax NPV(8%) could rise above $200M. Compare that to First Cobalt’s market cap of $41M.

The refinery alone could be worth 4x-5x the current market cap in a few years. Yet, that does not even take into consideration a portfolio of silver assets that management is trying to monetize or its cobalt assets in Idaho (USA). The U.S. cobalt resources are probably not worth much at current cobalt prices, but could become valuable again if the price rebounds.

First Cobalt’s refinery has tailings capacity of 26 years, yet the refinery life outlined in the enhanced Feasibility Study is just 13 years. Instead of 13 years at 25,000 tonnes/yr., imagine the economics for an 18-yr. refinery life at 35,000 tonnes/yr. output.

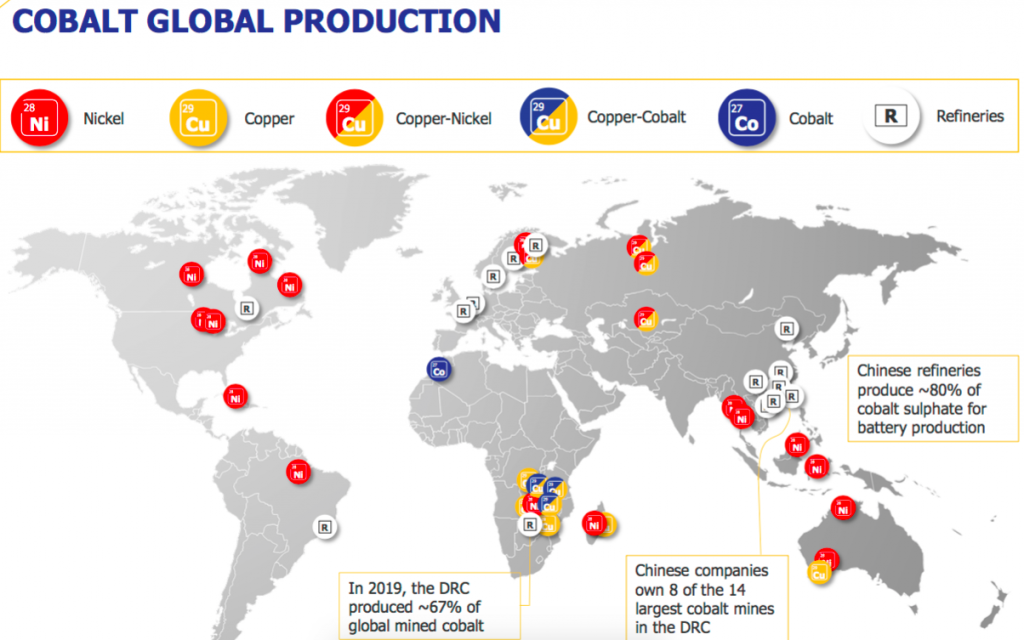

N. America desperate for conflict-free, non-Chinese battery-grade cobalt

Two-thirds of mined cobalt production comes from the DRC in Africa, and over 3/4’s of that production gets refined in China. For the security of supply reasons, automakers would greatly benefit from cobalt that, although sourced from a mine in the DRC, is guaranteed by Glencore to be conflict-free.

(Click on image to enlarge)

Glencore’s conflict-free feedstock, fed into First Cobalt’s refinery in Ontario, would circumvent the need to deal with China, generating considerable cost, time & logistical savings. Not to mention, far less pollution from not having to ship feedstock to China and refined cobalt products back to N. America.

Given challenging U.S. – Chinese relations, U.S. auto plants would benefit from the security of supply from Ontario. Instead of relying on China, refined battery-grade cobalt from Ontario could be delivered to Canada, the U.S., Mexico and even Europe.

Last week Ford announced plans to invest C$1.8 billion to produce, “fully battery electric vehicles” in Canada. Not just anywhere in Canada, but in Ontario, ~500 km from First Cobalt’s refinery. This is a big deal for the Canadian EV industry.

Conclusion

As compelling as First Cobalt is, there remains a high level of risk. In the next two years, First Cobalt expects to amass ~$50-$60M in debt (primarily from Glencore). If the refinery does not approach nameplate capacity by 2022-23, or cobalt remains around $16-$18/lb., the Company could be in trouble.

However, the flip-side of a heavily indebted company with Glencore breathing down its neck is First Cobalt’s share of cash flow from operations paying off debt in 3-5 years. This debt payment outcome is the base case, not an aggressive upside scenario.

Once First Cobalt reaches free cash flow positive, with line of sight towards being able to pay down loans, the true value of its hard to replicate operating cobalt refinery — feeding battery-grade cobalt to U.S., Canadian & Mexican auto markets — will become a lot clearer.

Upon that substantial de-risking, and the cobalt price hopefully being stronger, First Cobalt Corp.’s(TSX-V: FCC) / (OTCQB: FTSSF) share price could be a lot higher than today’s C$0.135. Lithium prices remain depressed, but several lithium juniors have recently started rallying hard. Could cobalt names be next?

Disclosure: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of more