Sassy Resources; “Lively & Bold…” But Does It Have Gold?

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Sassy Resources (CSE: SASY) is a newly-listed, high-grade, gold-silver play with two Canadian projects. The crown jewel is in the world famous Eskay Camp of B.C.’s Golden Triangle (“GT“). Its 100%-controlled Foremore project is 45 km north of the legendary Eskay Creek Mine. Sassy has just 29.1M shares outstanding, (49M fully-diluted), with 15.1M currently free-to-trade.

Foremore covers 146 sq. km (14,585 ha) and contains a number of high-grade, gold-silver targets with select, strong showings of zinc, lead & copper. Regional neighbors are — Newmont’s/Teck’s Galore Creek to the NW, Copper Fox’s/Teck’s Schaft Creek to the North, Enduro Metals’ Newmont Lake to the SW and Skeena Resources (Eskay Creek, Snip), Garibaldi (E&L, Casper), Metallis, Eskay Mining ~30 km to the South.

Sassy initiated its first drill program on July 20th. The first of two phases was recently completed. Management will release results as received & analyzed.

Sassy Resources is a spinout from Crystal Lake Mining (now called Enduro Metals). Crystal Lake negotiated the option for the Foremore project 15-16 months ago in an entirely different market. As such, management is benefitting from attractive terms (1.25M shares of Sassy + $300k in cash over four years). The property is subject to a 3% NSR of which 2.5% can be clawed-back by Sassy for a total of $3M.

Critical takeaways from my initial review of Sassy; 1) flagship asset is an attractive, sizable property in the heart of the Eskay Camp, (and center of the GT), with ample historical exploration incl. 71 drill holes, 2) management, board & advisors are outstanding, especially for a company with an Enterprise Value (“EV“) {market cap + (0) debt – (~$2M) cash} of just $14M, and 3) valuation + airtight capital structure is quite compelling.

(Click on image to enlarge)

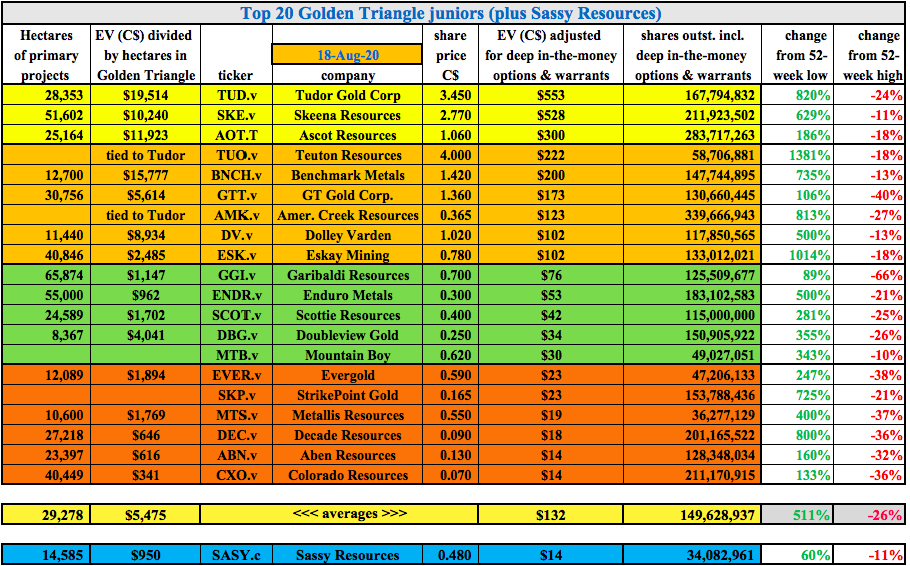

I’m tracking 475 gold-heavy juniors with market caps between $3M & $999M. Incl. Sassy, thirty-four have significant properties in the GT. The average gain of the top 20 GT juniors is +511% (from 52-week lows). The top 5 are up an average of +966%, the top 10, +792%. Compare that to Sassy at $0.47, up +57% from its last capital raise at $0.30.

Of course, this comparison is not apples to apples because Sassy did not suffer through the COVID-19-induced March selloff. On the other hand, it hasn’t benefited from the precious metal frenzy that has driven peers to all-time highs. Few know this story, it started trading two days ago!

The chart above depicts the top 20 pre-construction GT companies. Sixteen are pre-maiden resource. Notice that the average # of outstanding shares = 149.6M. Sassy has 34.1M. (Note: I add deep in-the-money options + warrants to company share counts, Sassy has 5M warrants struck at $0.10).

I don’t mean to suggest that Sassy’s stock will necessarily move a lot higher, but I see plenty of room to grow without running into peer valuation concerns. There are relatively few precious metal juniors, with great management teams & projects, in safe, prolific high-grade jurisdictions — with substantial near-term discovery potential & ultra-low share counts — that haven’t already soared.

The GT is one of the best performing gold districts on the planet. Yet, giant returns in gold-silver juniors are widespread. Of my 480 names, 236 (49.2%) have been (at least) 4-baggers (+300%) off their lows. Ok, enough about how hot the market is. What makes Sassy so interesting?

(Click on image to enlarge)

Sassy Resources, high-grade project, high-grade team

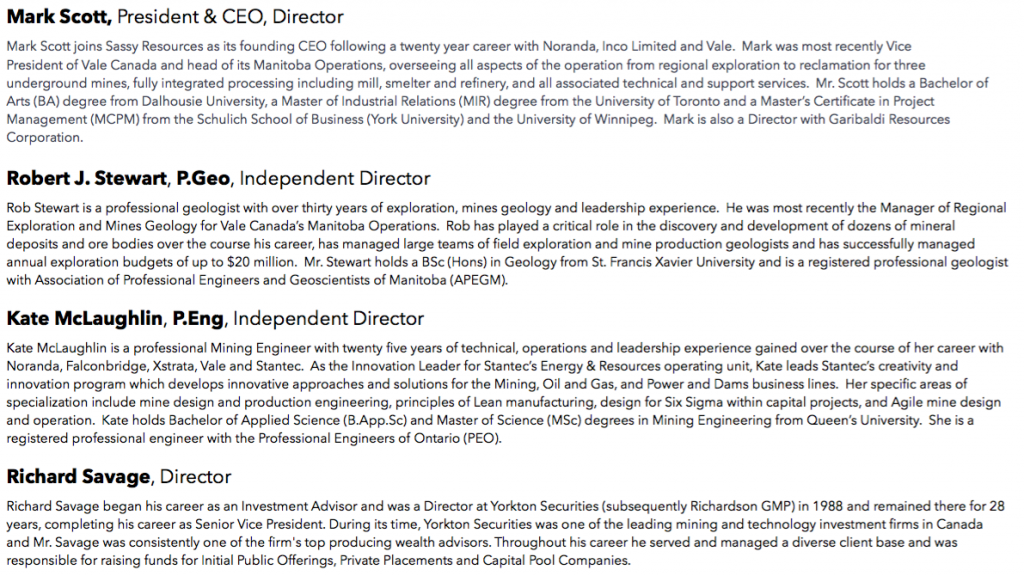

First, as mentioned, a tremendous mgmt. team, board & technical advisors. President, CEO & Director Mark Scott is a mining rockstar with 20 years’ experience at Noranda, Inco Ltd. & Vale.

He has run large operations, overseeing everything from exploration to reclamation for three underground mines and fully-integrated processing, incl. mill, smelter & refinery. Mr. Scott brings a wealth of experience in mining, processing & exploration operations, strategic planning, business & organizational development.

Many mining / metals juniors of similar size & exploration stage have 3, 4, maybe 5 senior-level, highly experienced mining professionals (incl. advisors) involved. Sassy has at least eight. Instead of me describing each of them, their bios can be seen above & below.

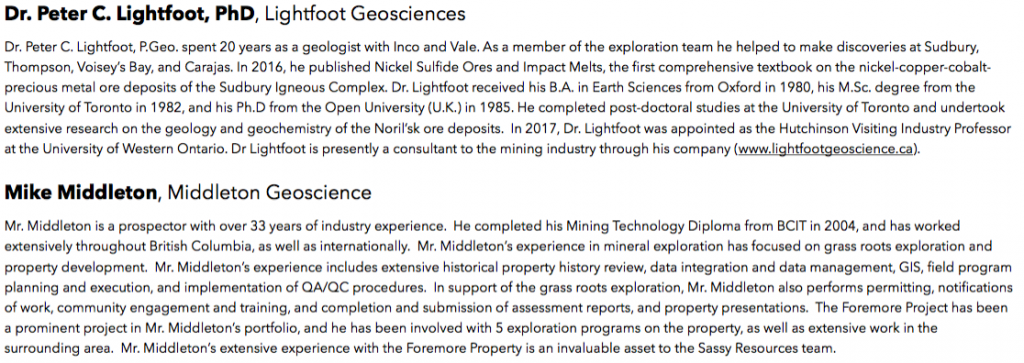

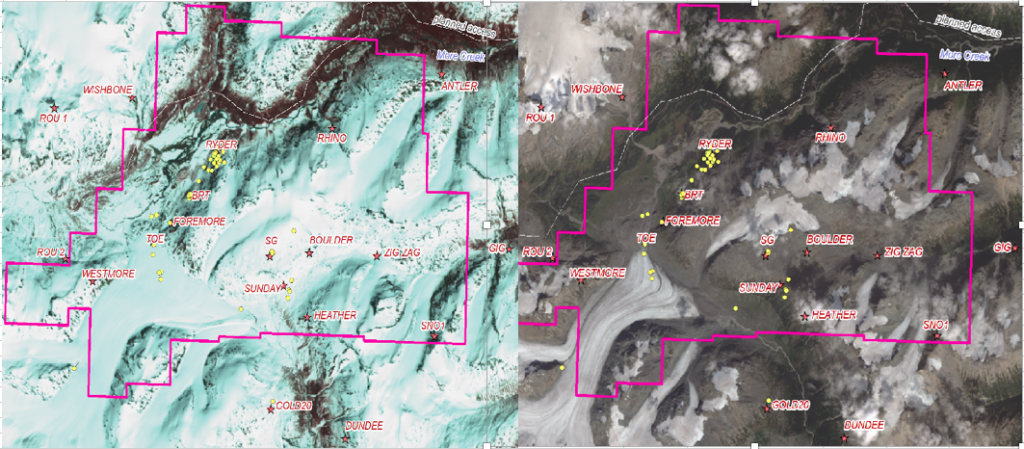

How good is the Foremore prospect? It’s of decent size and is vastly underexplored. A big reason why is that 35 years ago snowpack & glaciers covered > 90% of the project area. Look below at the very dramatic before & after pictures, 1985 vs. 2019.

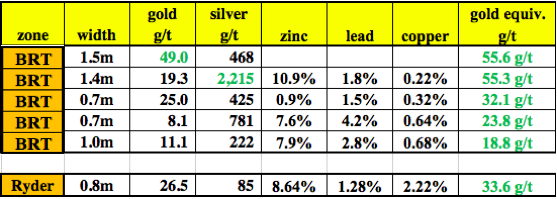

The best historical drill intercepts from a total of 71 holes:

Notice that these highlights are from just 2 of 12 named mineral occurrences. In addition to following up on these great historical assays, a lot more work is going to be directed at the Westmore / Toe / SG / Boulder / Zigzag / Sunday & Heather zones. Note: {in a follow up article I will describe exploration results and future plans in greater detail}.

Exploration in the area of the Foremore property dates back > 30 years. It includes prospecting, mapping, sampling, airborne & ground geophysical surveys & 71 diamond drill holes. Nearly an estimated $15M has been invested over the decades, probably > $20M in today’s dollars.

That’s well more than the current EV. I believe the considerable value of the historical exploration is increasing along with the price of gold & silver.

(Click on image to enlarge)

The most significant work was completed by Cominco Ltd. from 1987 to 1996, followed by Roca Mines Inc., mostly from 2002 through 2008. No diamond drilling has occurred at Foremore since 2008, because Roca went bankrupt due to an ill-timed molybdenum transaction.

From July 25 to September 20, 2019, a surface prospecting, local geological mapping & geochemical sampling program was undertaken. Sassy collected 573 samples and received some noteworthy results.

At spot prices, the best 16 samples range in gold equiv. grade from ~16 g/t to ~150 g/t and averaged ~44 g/t. Although dominated by impressive gold & silver values, there were some significant contributions from zinc, lead & copper as well.

** Snowpack / glacier cover of Foremore property: 1985 vs. 2019 **

(Click on image to enlarge)

Tight share structures make a big difference in junior mining

Management stated that 15.1M of 29.1M shares are currently free-trading. Two private placements done in May (5.7M) & July (6.5M) become free-to-trade on September 22nd & November 29th. There are 17.2M warrants outstanding at an average strike of ~$0.36 vs. today’s share price of $0.47.

Some of the very best junior stock performances come from companies with under 60M shares outstanding. Perhaps you’ve heard of Great Bear Resources? 50M shares outstanding, it’s up > 7,000% from its low in 2018. How about GT superstar Teuton Resources? Also 50M shares outstanding, up > 4,000%. I could go on….

I realize I sound promotional with all these peer performance references, but we are smack in the middle of an epic precious metals bull market. Gold is up +70% from its 2018 low. Silver is up +131% from March of this year!

(Click on image to enlarge)

I believe precious metal prices will remain strong, and perhaps even continue climbing. The U.S. presidential election and ongoing uncertainty surrounding COVID-19 will be with us for at least the next nine months.

Management plans high impact, high-grade N. American acquisition(s)

Management plans to make meaningful acquisition(s) of high-grade properties / projects in N. America. The stated goal is to pursue trending metals such as gold & silver, but also battery metals like nickel & copper. Having multiple projects diversifies exploration risk and allows for year round exploration. A material acquisition seems reasonably likely in the next few months.

Acquisitions of high-grade projects make a lot of sense in both bull & bear markets. Higher grade provides a margin for error & increased mine plan flexibility. Management believes juniors should explore & make discoveries, not spend giant sums (relative to market caps) to drill. Find it, demonstrate blue-sky potential, then step aside and let the deep pockets take over. I wholeheartedly agree. This strategy helps ensure that a tight capital structure remains tight.

(Click on image to enlarge)

CONCLUSION

Investors in precious metal juniors can chase hot stocks, many up 500%+, or take a closer look at Sassy Resources. If the Company reports strong drill results, it might not take much trading volume to send the stock up a lot higher. Only 15M free-floating shares until September 22nd, when 5.6M more hit the market.

As good as this mgmt. team is, I’m very interested in seeing the new properties / projects that potentially come into the Company. CEO Scott promised to remain vigilant about protecting Sassy’s capital structure.

No one can predict the future. I can’t tell readers that gold & silver prices will continue to march higher. However, I can say with confidence that high-grade assets are incredibly robust & valuable in bull markets. Sassy Resources (CSE: SASY) is in the right place at the right time with the right project, people & strategy.

Disclosure: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, ...

more